Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

Stay-at-home restrictions and safety concerns during the pandemic meant that shopping increasingly involved scrolling through the search results on an app rather than browsing the aisles of a store. As a result, online shopping brands soared.

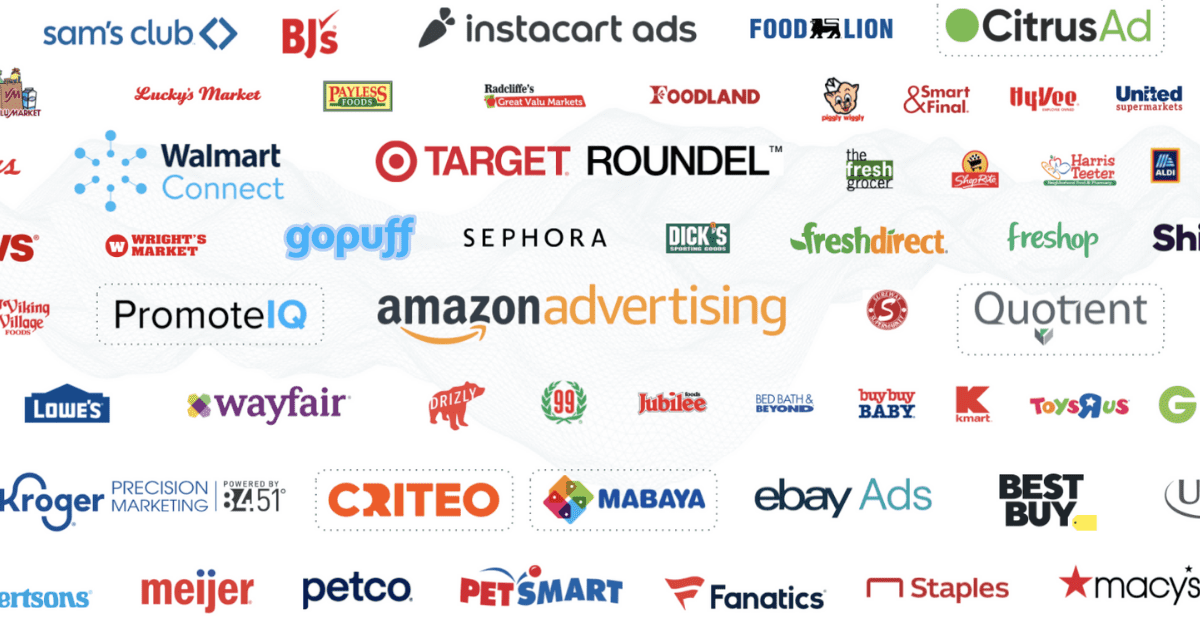

With that increased online shopping came the rise of the retail media network, which allows brands to boost their products to the top of search results or offer special promotions across thousands of different platforms, from Amazon Ads, Walmart Connect, Instacart Advertising, and scores more. Wherever a brand sells products online, there’s likely a retail media marketing option for earning more attention and boosting sales.

Retail media refers to a specific type of marketing targeted toward consumers who are nearing the end of their buying stage.

Retail media is the marketing at, or in proximity to, a customer’s decision point for making a purchase and can include in-store advertising, online shopping, rewards programs, and coupons. These forms of advertisement could be located on a retailer website or within their apps.

A Merkle report recently stated that “every one to two months a new retail media network is born”, so this is something marketers should be paying very close attention to for the next few years.

Here’s everything you need to know about getting started advertising on retail media networks.

To understand how retail media networks operate on the most basic level, think about the product placement, in-store signage, and special promotions in circulars retail outlets have always offered brands in their physical locations. As more and more retailers also offer their customers an online shopping experience, those advertising opportunities have moved online via digital ad space to feature sponsored products on websites and apps.

A Merkle report recently stated that “every one to two months a new retail media network is born,” so this is something marketers should be paying very close attention to for the next few years.

Here’s everything you need to know about getting started advertising on retail media networks.

During the pandemic, many consumers who were unfamiliar with ecommerce became adept at everything from ordering groceries from their phone to buying tools on home improvement retail sites to redesign their gardens.

As retail slowly moves back in-store, those newfound preferences for ecommerce do not seem to be subsiding. According to Insider Intelligence, U.S. ecommerce sales will reach $1 trillion in 2022, a figure pre-pandemic that was not expected until 2024. Even as consumers move back in-store to make their final purchases, they are still researching products online well before stepping foot in a store, making retail media advertising more important than ever.

Amazon Ads is perhaps the biggest example of a retail media network, giving sellers and brands quite a few ways to feature their products at companies in search results, banner ads, and even on competitors’ pages. However, in recent years many other businesses have entered the retail media network fold.

For example, Instacart, the grocery delivery app that saw unprecedented growth during the pandemic, is set to boost that growth even more with its retail media network, which, like Amazon, allows brands to place their products at the top of search results and offer in-app coupons to shoppers. The move is set to increase Instacart’s ad revenue by $700 million in 2022.

Retail media’s offline predecessor, shopper marketing, offers the closest analogy: reach consumers as they shop in stores. But, instead of being served in brick-and-mortar stores or on physical billboards, retail media advertising appears within the shopping experience of online retailers such as Amazon, Walmart.com, Target.com, and more.

Although certainly an individual ad channel, retail media advertising should be approached as more of a full-funnel advertising program for online stores. In this regard, it is more like paid social offering a mix of ad formats across the funnel within the walls of a closed ecosystem, e.g. Facebook, Instagram, Snap, Pinterest, etc.

Ads generally come in two varieties:

Each retailer offers its own flavor of retail media; some include email sponsorships or social media co-op buys.

Retail media measurement refers to the process of quantifying and analyzing the effectiveness and impact of advertising campaigns within the retail environment. In the realm of retail media, measurement is a crucial process that involves quantifying and analyzing the impact and effectiveness of advertising campaigns within the retail sphere. It entails the systematic tracking and evaluation of various metrics and key performance indicators (KPIs) to gain valuable insights into how well media initiatives are performing. These measurements encompass a range of aspects such as ad placement reach and frequency, consumer engagement and response, conversion rates, sales attribution, and return on investment (ROI).

To truly harness the power of retail media measurement, advertisers and retailers must leverage sophisticated data analysis techniques and tap into data from multiple sources, including online platforms and customer behavior tracking tools. This enables them to make well-informed, data-driven decisions, optimize marketing strategies, and effectively evaluate the impact of their advertising endeavors.

As the retail media channel continues its rapid growth, it becomes increasingly important for brands to elevate their measurement approaches. It is crucial to adopt advanced and sophisticated methodologies to generate sales, and secure and defend their rightful share of voice in the highly competitive retail landscape.

While it’s undeniable that retail media networks are great for retailers, what exactly is in it for advertisers?

Well, according to Amazon, retail media network ads are useful not just for brand discovery but also for sales. A recent study found that 68% of its shoppers had discovered a new brand on its platform. So it stands to reason that placing sponsored products directly in search results when shoppers are looking to discover is an effective means of getting noticed. Furthermore, Kantar analysis of mobile campaigns running on Amazon found a 450 percent increase in purchase intent compared to similar campaigns on other platforms.

The main purpose of advertising is ultimately to attract customers, and retail media networks offer consumer insights that other forms of advertising do not. As third-party data becomes more difficult to come by due to privacy regulations, retailers have begun to increasingly rely on first-party data or information that customers give voluntarily. All of those loyalty programs, email lists, and purchase histories to which online retailers now have access mean that advertisers can deliver more accurate product recommendations and special offers than ever before via retail media marketing.

Looking to stay up-to-date with the latest trends and insights in the retail media space? Look no further than Skai’s Retail Media Thursdays (RMT)! Each episode introduces a new thought leader in the industry, bringing their expertise and innovative ideas to the forefront. From discussions on the future of retail media to in-depth analysis of consumer behavior, these thought-provoking conversations are a must-watch for anyone in the retail industry.

Don’t miss out on the opportunity to gain valuable knowledge and inspiration from these experts. Join Skai’s Retail Media Thursdays by checking out the blog and discovering the wealth of insights waiting for you.

While most third-party sellers on Amazon understand the importance of retail media advertising, other traditionally brick-and-mortar brands may not necessarily understand how crucial retail media advertising has become to markets that traditionally relied on print, social, and other forms of digital advertising.

Online grocery shopping, for example, boomed during the pandemic–a boom that shows no sign of ending. eMarketer reports that 2021 was the first year that the majority of consumers purchased groceries via ecommerce, forecasting that 142.9 million people ages 14 and older would make at least one digital grocery order or 51.5 percent of the population in the age range.

So for brands that traditionally sell items in grocery or convenience stores, the recent retail media advertising space on popular apps like GoPuff or Instacart are critical spaces for connecting with local audiences.

At Skai, we firmly believe that retail media, at its core, is still media. As the industry undergoes constant change and evolution, we are dedicated to expanding the realm of AI optimization. Our unwavering focus on media activation and improved performance remains instrumental in driving tangible results for our clients. With a strong foundation in AI and a resolute commitment to leading the industry in AI optimization, we are poised to shape the future.

In a recent report titled “The Next Big Thing: Where Generative AI’s First Areas of Innovation Will Impact Marketing,” our Chief Product Officer, Guy Cohen, shares key insights. Cohen emphasizes that by harnessing the power of AI-driven technologies, marketing professionals can streamline their workflows, enabling them to invest more time in optimizing strategies and enhancing overall performance and return on investment.

This quote perfectly encapsulates Skai’s philosophy and dedication to AI. We are relentless in our pursuit of remaining at the forefront of the industry by continually advancing our AI capabilities, extending far beyond retail media, and providing increasingly sophisticated solutions.

The future of digital marketing is brimming with promise, and we are thrilled to lead the way. If you are ready to unlock the potential of AI and leverage its capabilities to achieve your marketing objectives, Skai’s unique AI Optimization capabilities are the definitive solution.

You need a technology platform that offers omnichannel insights, holistic measurement, actionable data, and comprehensive reporting.

Make smarter, predictive decisions at every turn with all the data you need and faster time-to-insight. Our rich data solutions provide AI-contextualized, actionable intelligence about consumer sentiment, market trends, competition and more.

Customer interactions happen everywhere. Maximize every touchpoint with the broadest reach, and gain the power to engage across all critical retailers, DTC channels, search engines, social media and more.

Discover the incremental impact of any marketing effort on sales lift and determine your optimal mix without cookies or other privacy-regulated identifiers. Our approach is unbiased, unlimited and based on real-time experiments and modeling, minus the data science learning curve.

Regardless of the channel, in just about every survey about measurement, marketers still cite it as one of the top challenges they face. Of course, other phases of the campaign lifecycle — research, planning, creative, targeting, optimization — may present their own hurdles, but all seem straightforward compared to the measurement conundrum.

And measurement is so critical to the success of marketing campaigns. We can only make the necessary changes to improve performance by understanding what is working and what isn’t.

How do expert marketers approach measurement for retail media?

At beBold we have taken the time to really educate our clients on what any given metric might mean, and we use those metrics to explain how any project might have impacted the account. — Max Schneider (Vice President of Advertising @ beBOLD Digital)

When measuring success, include all metrics that help to prove incrementality; for example, Amazon’s “New-to-Brand” metric. Additionally, including top-line revenue (advertising + organic) in advertising reporting will help to demonstrate how advertising investment impacts top-line revenue. — Matt Strietelmeier (Director, Marketplace Advertising @ Stella Rising)

As retail media networks become increasingly common, it can be difficult for brands to choose which ones to use. Everyone from Amazon to Instacart to CVS now offers ad space. Choosing wisely is about looking carefully at where products are the right fit, according to Tim Rogers, SVP and global general manager of omnichannel and CRM at media platform Criteo.

“Painting with a broad canvas, if 25% of my sales go through Amazon, I might put 25% of my investment there and 20% in Walmart and 15% and Target accordingly,” Rogers told AdWeek.

Download the whitepaper “Navigating the Retail Media Bang”

Another factor to consider is exactly how and where it’s possible to display ads.

Home Depot, which has also seen its business boom due to the popularity of home renovations during the pandemic, offers many different ways for its advertisers to connect with its customers. The retailer’s advertising branch, called Retail Media+, offers not only programmatic ads utilizing Home Depot’s first-party data, but also social via platforms like Pinterest and Facebook, and even Google Shopping options. These expanded offerings come in handy for seasonal advertisers whose sales increase during Home Depot sales events such as Spring Black Friday.

With so many options for retail media marketing, developing strategies for managing, optimizing and automating campaign creation and execution across thousands of retailer and marketplace websites is an ever-increasing challenge for most advertisers. That’s why Skai has partnered with a growing list of retailers in order to help advertisers create and measure retail media campaigns across channels using a single advertisement management software.

For more information on how Skai can help your brand grow your retail media marketing strategy, please contact us with questions or schedule a brief demo today.

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information