Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

Retail media has rapidly become the third-largest digital advertising channel behind paid search and social advertising. Forecasts predict it will reach $160 billion by 2027, making up 18% of global digital advertising and 11% of total advertising. Digital’s newest channel allows marketers to influence shoppers within online stores and closer to the point of purchase, expanding the customer journey and driving higher conversion rates.

For our annual State of Retail Media survey, we asked 167 retail media brand/seller marketers more than 35 questions about their retail media strategies, success rates, and plans for the future.

The State of Retail Media 2023 provides a valuable snapshot of the current thinking and challenges that are on the minds of today’s marketing decision-makers.

Download your copy today!

We found is that as brands feel more confident in the retail media landscape, their approaches to retail media are becoming more sophisticated. These findings indicate that, soon, all advertisers will need to level up their retail media strategies to stay competitive.

Here are some results from our survey that illuminate how retail media is maturing – and what marketers are planning to keep up.

Amazon launched its first retail network in 2012, and in just over a decade, the rise of retail media has been meteoric. While Amazon, Walmart, and Instacart remain the top three places brands spend their retail media advertising dollars, the possibilities for using retail media to reach shoppers seem infinite as companies from Best Buy to Walgreens and beyond race to claim their share of the retail media market.

And though there are a growing number of new places to invest retail media dollars, marketers are ready to embrace these new opportunities. Our survey found that 89% of marketers say their retail media programs are average, above average, or excellent in maturity.

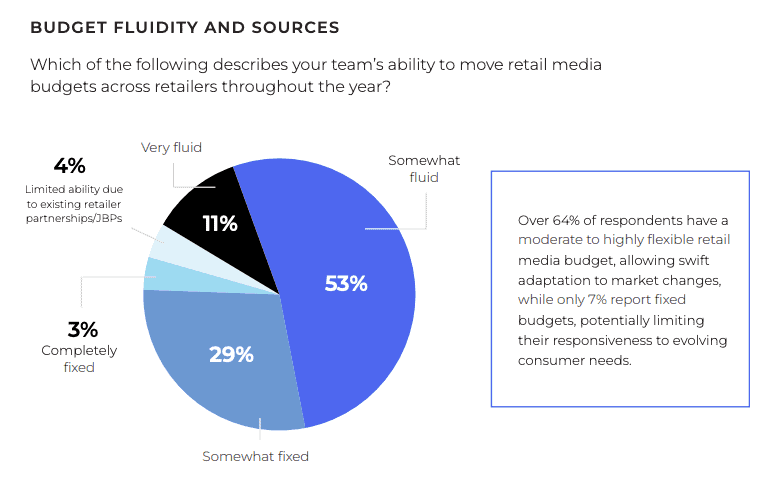

Marketers increasingly keep their retail media budgets flexible to adapt to market changes quickly. 64% of respondents have moderate to highly flexible budgets, while only 7% have fixed budgets, which may limit their responsiveness to consumers.

This omnichannel approach indicates that brands feel confident enough in their retail media strategies to accurately measure and predict success and then adjust on the fly to achieve their overall campaign goals.

Another important predictor of retail media’s growing importance to overall strategy is that there is no one source of retail media investment. While retail media budgets pose the greatest threat to existing paid search (e.g., Google Search) investment, with 33% indicating that search is a source of spend, brands are looking at many different sources for retail media investment. Nearly as many respondents (31%) indicated that retail media budgets are new and not disruptive to any existing channel, and 29% indicated they are coming from paid social (e.g., Facebook).

The fact that investment in retail media comes from search, social, and additional sources suggests that retail media is approaching parity with more established forms of marketing in terms of importance.

Like all retail media maturing channels, retail media has experienced some growing pains. Here are the top challenges marketers are facing.

By loading the video, you agree to YouTube’s privacy policy.

Learn more

ROI: As the space grows more crowded, marketers are seeing different returns than they did when retail media was relatively new.

Measurement: Proving the incrementality of investment is difficult since measuring the impact of retail media campaigns on shopper behavior can be difficult.

Selling more direct-to-consumer (D2C): As costs rise, it’s possible that brands may choose to focus more on D2C channels. This change calls for a sophisticated retail media strategy to gain ROI

When we asked experts to name their top three activation challenges, it was no surprise that they were all measurement related – ROI, measuring success, and incrementally – are all major obstacles to laughing and maintaining successful retail media advertising programs.

Of course, these challenges are not endemic to retail media. Marketers across all channels have difficulty measuring success both within a channel and holistically across channels. True omnichannel marketing remains elusive until brands adopt methods to answer these measurement channels.

Though marketers report the same difficulties measuring retail media success that they face on other channels, retail media advertising offers some solutions for solving the measurement puzzle.

For example, omnichannel retailers like Walmart and Target offer brands the opportunity for closed-loop measurement, providing a better understanding of how offline shopper marketing and online retail media complement each other to unlock the next era of growth for CPGs.

Additionally, as brands strive for profitability in 2023, retailers will likely be pressured to make more data available to optimize programs. Some retailers are already exploring clean rooms, such as Amazon Marketing Cloud, to co-mingle proprietary back-end data with highly granular insights safely.

As retail media matures, so too do the possibilities for using the channel to measure brand performance across every stage of the buyer’s journey, both online and off. Even though retail media has quickly risen to become a mainstay of most marketing strategies, the relative youth of most retail media platforms means that possibilities are endless – And incredibly exciting!

To read more about how retail media marketers plan ahead, download our full State of Retail Media 2023 report.

As part of Skai’s omnichannel marketing platform, our Retail Media solution empowers brands to plan, execute, and measure digital campaigns that meet consumers when and where they shop. Built with best-in-class automation and optimization capabilities, our unified platform allows you to manage campaigns on 1000+ retailers, including Sam’s Club MAP but also Amazon, Walmart, Target, and Instacart, all in one place.

For more information on Skai’s integration with Sam’s Club MAP or to see our platform in action, please schedule a quick demo.

We use cookies on our website. Some of them are essential, while others help us to improve this website and your experience.

Here you will find an overview of all cookies used. You can give your consent to whole categories or display further information and select certain cookies.