In modern marketing, retail media advertising has become an increasingly important tool for businesses looking to reach their target audience and drive sales. As more consumers turn to online shopping, retailers leverage their platforms to offer brands unique advertising opportunities.

In the sections to come, we will delve into the concept of retail media advertising, its benefits, and what you need to know to get started.

An Overview of Retail Media Advertising

Retail media advertising refers to retailers offering advertising opportunities to brands within their digital properties, such as their website, mobile app, or email marketing campaigns. This allows brands to reach consumers directly at the point of purchase, increasing the likelihood of conversion.

Key characteristics of retail media advertising include:

- Advertising placements within a retailer’s owned digital properties

- Targeted advertising based on consumer data and shopping behavior

- Direct access to consumers actively engaged in the shopping process

Unlike traditional advertising methods, such as television or print ads, retail media advertising allows brands to reach consumers who are already interested in making a purchase, leading to higher conversion rates and better return on investment (ROI).

Benefits of Retail Media Advertising

Retail media advertising offers numerous benefits for retailers, brands, and consumers alike.

For retailers, the advantages include:

- Additional revenue stream through advertising sales

- Enhanced relationships with brand partners

- Improved customer experience through relevant and targeted advertising

Brands benefit from retail media advertising in the following ways:

- Increased visibility at the point of purchase

- Access to valuable consumer data and insights

- Higher conversion rates and better ROI compared to traditional advertising methods

Consumers also benefit from retail media advertising, as they are exposed to relevant products and offers based on their interests and shopping behaviors, leading to a more personalized and efficient shopping experience.

How Has Retail Media Advertising Changed in the Past Few Years?

According to eMarketer’s recent report, “Retail Media 2021.” retail media advertising has been typified by the bottom-funnel search ads on retailer’s websites. The years following represented a sea change in how most advertisers think about the possibilities for retail media advertising. The advent of advertising tools such as video and demand-side platforms that can deliver ads on the open web has led advertisers to consider retail media advertising for attracting upper-funnel customers.

Additionally, as privacy concerns grow, the first-party data that retailers have access to has led advertisers to consider the personalization potential of retail media advertising. Better tools and potential for targeting based on customer searches and purchase history stand to make right now an even bigger year for retail media advertising.

During the pandemic, more shoppers moved to online shopping than ever before. eMarketer estimates that the US share of online sales has jumped from 11% in 2019 to 14% in 2021. How shoppers research their purchases has forever changed.

Recently, Forbes reported that 74% of US shoppers begin their searches on Amazon. Whether they purchase from a third-party seller online or not, online product listings, reviews, and retail media help consumers make their final purchase decisions.

Ready to learn more? Explore digital retail media and its impact.

Key Players in the Retail Media Advertising Space

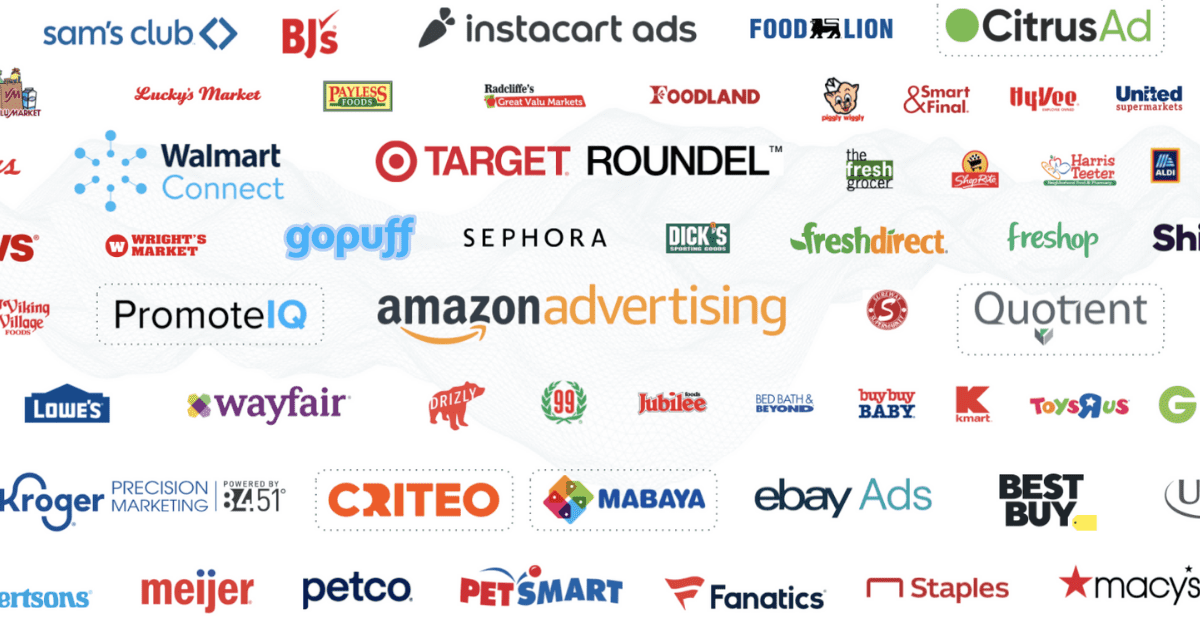

The recent boom in retail media advertising is good news for retailers looking for ways to maximize their retail media ad spend. While Amazon has become a bit crowded by competition, all looking to grab consumers’ attention in those critical searches, there are many platforms where early adopters can stand out.

Grocery delivery apps, like Instacart and GoPuff, are excellent places to experiment with sponsored search results and seasonal promotions to build a strong retail media advertising presence and claim a share of voice.

Other popular retail media networks include:

- Walmart Connect

- Target Media Network

- Kroger Precision Marketing

As more retailers recognize the potential of retail media advertising, the industry is expected to grow significantly in the coming years, providing brands with even more opportunities to drive sales.

What Kinds of Retail Media Do Consumers Respond To?

Strong evidence supports the fact that consumers respond more positively to retail media advertising than other forms of digital advertising.

As eMarketer notes, consumers most frequently report dissatisfaction with disruptive content that pops up when they are trying to read or play before a video. However, “native” advertising, as it applies to retail media advertising in the form of sponsored search results or recommendations, is often viewed more favorably.

In 2020, for example, most Amazon Prime members reported having had no negative experiences with Amazon advertising. The eMarketer report concedes that in prior research, Amazon customers “relatively rarely said they notice ads on the site, even after being exposed to significant ad loads in search results. When they did notice ads, they were more likely to characterize these ads as useful, helpful, or aligned with their shopping habits than as distracting or untrustworthy.”

Types of Retail Media with Positive Consumer Responses

- Sponsored Product Listings: Products receive prominent placement in search results or category pages in exchange for payment from brands. This helps shoppers discover relevant products during their search.

- Recommendation Engines: These systems suggest products to shoppers based on interests, purchase history, and other factors. They provide a personalized experience appealing to customers looking for related or complementary items.

These advertising formats allow brands to create a comprehensive retail media strategy that effectively reaches and engages their relevant audiences at multiple touchpoints throughout the shopping experience. As retail media advertising continues to grow, there’s never been a better time to get started!

How to Get Started with Retail Media Advertising

Diving into retail media advertising may seem daunting initially, especially if you’re new to the concept or haven’t explored this avenue before. However, with the right guidance and a clear strategy, you can quickly begin leveraging the power of retail media to reach your target audience and drive sales.

Here are some digital marketing strategies for retail media success:

Identify your target audience and the retailers they frequently shop with

- Take the time to research your ideal customer and understand their shopping habits and preferences. This will help you determine which retailers to focus on for your advertising efforts.

Research the advertising opportunities available through each retailer’s media network

- Once you’ve identified the key retailers, explore their media networks and the various advertising formats they offer. This will give you a better understanding of how to reach your target audience within each platform best.

Develop a clear advertising strategy, including budget, ad formats, and targeting criteria

- Create a well-defined advertising strategy that outlines your budget, the ad formats you’ll use, and the targeting criteria for each campaign. This will serve as a roadmap for your retail media advertising efforts and help you focus on your goals.

Create compelling ad content that showcases your products and resonates with your target audience

- Develop eye-catching and informative ad content highlighting your products’ unique features and benefits. Use high-quality visuals and clear, concise messaging to capture your audience’s attention and encourage them to take action.

Launch your campaigns and monitor their performance closely

- Once your ads are ready, launch your campaigns and closely monitor their performance. Regularly check your KPIs and make adjustments as needed to optimize your results.

Optimize your campaigns based on data and insights to improve ROI over time

- Use the data and insights from your campaigns to refine your approach continually. Test different ad formats, targeting criteria, and messaging to see what works best for your audience and product offerings. Over time, this iterative optimization process will help you improve your ROI and achieve better results from your retail media advertising efforts.

When creating your ads, focus on crafting content that grabs attention and clearly communicates your product’s value proposition. Use high-quality visuals that showcase your products in the best light, pair them with compelling, action-oriented copy encouraging users to click through and make a purchase.

Master Retail Media Advertising with Skai

Skai empowers modern marketers to overcome the challenges of fragmented data sources, complex campaign structures, and the constant pressure to deliver strong ROI. As part of our intelligent marketing platform, Skai’s Retail Media solution provides the tools and insights needed to master retail media advertising. With best-in-class automation and optimization capabilities, Skai enables brands to seamlessly plan, execute, and measure digital campaigns that reach consumers at the right time and place.

Key capabilities of Skai’s Retail Media solution include:

- Search Term Analysis to uncover keyword inefficiencies

- Automated Actions for rule-based campaign optimization

- Budget Navigator to find the optimal spend/ROI balance

- Experiments for scalable incrementality testing

- Custom reporting across brands, channels, and time periods

- Creative Center for central analytics and insights

- Scheduling, pacing, harvesting, automation, and more

By consolidating siloed data into integrated omnichannel insights, Skai empowers retail marketers to put the customer first, dominate digital shelves, and win in the ecommerce industry. As part of Skai’s intelligent marketing platform, our Retail Media solution empowers brands to plan, execute, and measure digital campaigns that meet consumers when and where they shop. Built with best-in-class automation and optimization capabilities, our unified platform allows you to manage campaigns on 30+ retailers, including Amazon, Walmart, Target, and Instacart, all in one place.

Client results include:

- 461% increase in Amazon Ads ROAS and 57% increase in page traffic for Bondi Sands

- 92% increase in share of voice on Amazon for a Fortune 500 CPG brand

- 72% increase in revenue for VTech

- 1,390% year-over-year sales growth for Kamado Joe

At Skai, we strive to be more than just a vendor; we aim to be a true marketing ally. Our unique combination of advanced technology, deep industry expertise, and forward-thinking creativity helps you break through barriers, optimize campaign performance, and achieve marketing goals across every channel.

Book a meeting with Skai today to learn how we can help you master retail media advertising and take your digital marketing strategies to the next level.

Frequently Asked Questions

How can ecommerce data enhance retail marketing strategies?

Ecommerce data provides valuable insights into consumer behavior, enabling retailers to optimize their marketing efforts across digital channels.

What is the digital shelf’s role in retail media advertising success?

The digital shelf’s product visibility and content directly impact consumer engagement and sales in retail media advertising.

How can brands manage retail media advertising campaigns across digital channels?

Brands should use a centralized platform with integrated data and automation to manage retail media advertising campaigns across channels effectively.