In our Skai 5 series, we discuss digital advertising tips, tricks, and trends to keep you one step ahead of consumers, the market trends, and your competition. For this portion of the series, we highlight 5 key takeaways from our State of Retail Media 2022 Report.

In our first report, we examined some of the key takeaways from the survey. But now, in our Complete Results version, we are releasing all of the results from that research.

It’s no secret to most retail media marketers that retail media is currently booming. Retail media is actually now the third-largest digital advertising channel in the U.S. It is forecasted to reach over $30 billion domestically this year, or one in eight digital ad dollars, and $100 billion worldwide by 2024.

But as retail media goes from a “nice to have” supplementary strategy to a necessary approach to online selling, retail media marketers face the challenge of connecting channels for a full-funnel strategy and measuring the success of those efforts. Skai’s State of Retail Media 2022 report found that while retail media is on the rise and retail media marketers have high hopes for future success, there are a few key roadblocks to that success.

Here are the five most important takeaways about the state of retail media 2022:

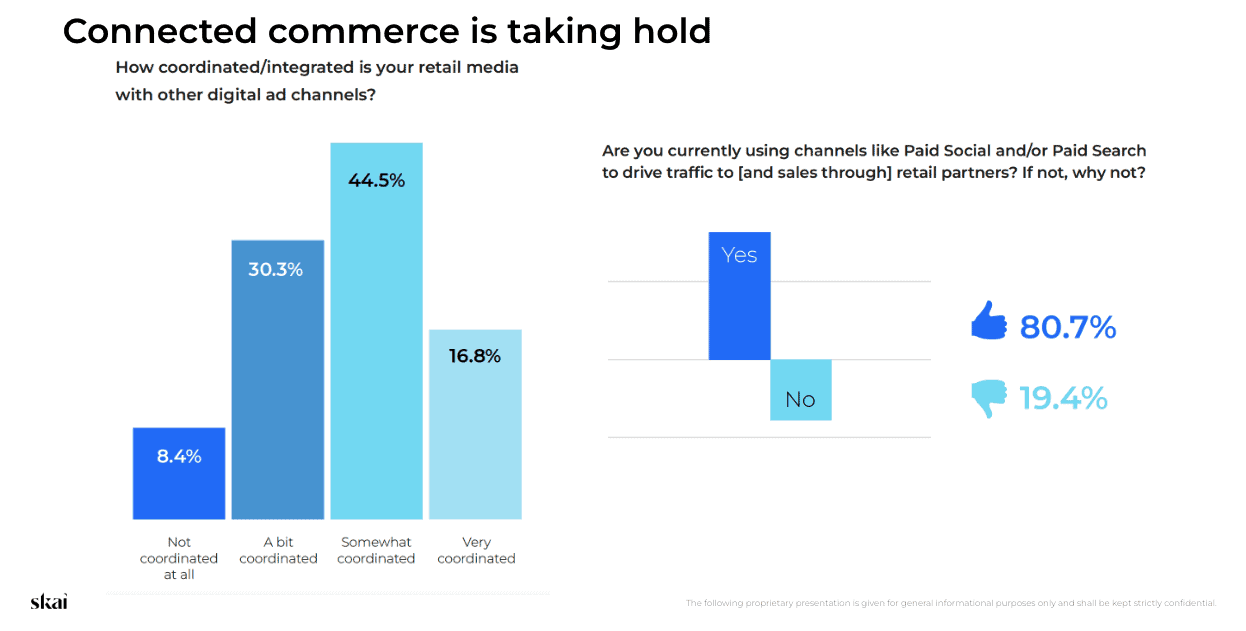

1) Connected commerce is on the rise

One of the State of Retail Media 2022 report’s biggest findings was that retail marketers are more focused than ever before on connecting their channels. Over 90% of respondents said that, on some level, they are focused on connecting their retail media with other channels. Among those connected channels, paid social and paid search seem to be the biggest draws, which makes sense, as the pair are two of digital advertising’s largest channels. More than eight out of 10 retail media marketers say that they are using paid social and/or paid search as part of their coordinated efforts.

Connecting channels is especially important as brick-and-mortar retailers get back to business following pandemic restrictions. At the height of the pandemic, more customers than ever before turned to online and mobile shopping for everything from groceries to home goods. Now, even as most businesses have fully reopened, many consumers say that they will continue to rely on digital channels, not just for shopping but for product recommendations and discovery.

2) Retail media is looking up

Another key takeaway from the “State of Retail Media 2022” report is that retail media specialists are feeling optimistic about the future. Over 70% of respondents believe that retail media will increase in priority over the next two years, with 27% saying that they believe retail media will “strongly” increase in priority.

And while retail media has long been viewed as a top-and-mid-funnel means of attracting audiences, that seems to be changing. As retail media has opened up the bottom of the funnel for CPG marketers and has kicked off a completely new way of thinking about how to go to market, brands are increasingly thinking about how to make retail media a full-funnel endeavor.

Download your complimentary copy of Skai’s State of Retail Media 2022 report.

3) Advertisers Are Investing Heavily

In order to achieve those full-funnel goals, advertisers are spending more than ever before on their retail media strategies. Nearly 80% of respondents reported that at least 11%+ of their total marketing budget is retail media.

A similar percentage say that they will be increasing their retail media spending next year. The “State of Retail Media” survey also found that those budgets are fairly fluid, with over 79% of respondents reporting that their retail media budgets were either somewhat or very fluid across retailers over the course of the year.

4) Multiple Datasets Are Critical

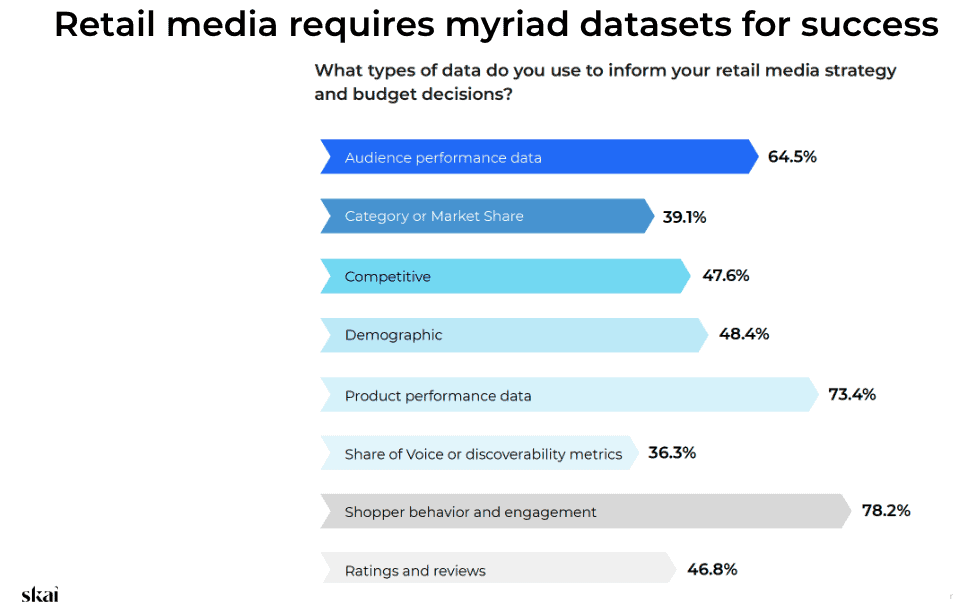

However, as budgets become more fluid, more information is needed about the best places to invest. Many respondents reported using at least eight different datasets to guide strategy and budget decisions. Among the most popular of those datasets was shopper behavior and engagement, with 78.2% of respondents naming it as a major source of information.

Another critical dataset was product performance data, which 73.4% said informed retail media strategy and budget. Audience performance data was also impactful to those decisions, as 64.5% said that they routinely rely on audience data to determine spend and strategy.

5) Measurement Remains a Challenge

But even though advertisers are analyzing myriad datasets, connecting channels, and investing heavily in retail media, measuring the success of those efforts continues to be a challenge. In fact, the biggest challenge reported by retail media marketers was driving positive ROI.

The “State of Retail Media 2022” report found that 44% of respondents said that driving positive ROI was their biggest retail media challenge. Part of that challenge is likely down to the fact that retail media marketers continue to struggle with incrementality and measure, which were the second and third biggest challenges, respectively.

As retail media continues to embrace connected channels and drive full-funnel action through that connected approach, adopting resources to help prove ROI and measure performance will likely be a crucial component of creating a successful retail media advertising strategy and effective budget spend.

For more information about the state of retail media 2022, download Skai’s full report here.

Skai’s Retail Media solution for the fastest-growing channel in marketing

As part of Skai’s intelligent marketing platform, our Retail Media solution empowers brands to plan, execute, and measure digital campaigns that meet consumers when and where they shop. Built with best-in-class automation and optimization capabilities, our unified platform allows you to manage campaigns on 30+ retailers including Amazon, Walmart, Target, and Instacart all in one place.

To learn more, schedule a brief demo to see all of our cutting-edge functionality for yourself!