In our Skai 5 series, we discuss digital advertising tips, tricks & trends to keep you one step ahead of the consumers, the market trends and your competition. For this portion of the series, we highlight five growth drivers your organization can use for retail media spending.

The last two years have seen retail media growth in advertising, and it is predicted that U.S. retail media ad spend will pass the $50 billion mark by 2023.

eMarketer’s recent “Retail Media Advertising 2021” report helps to shine a light on the rapid evolution of retail media in the past few years, indicating that not only has retail media advertising transitioned from a bottom-of-funnel tool to an effective top-of-funnel strategy, but that advertising with third-party platforms like Amazon, Walmart, and Home Depot, among others, is one of the best ways to connect with consumers who are becoming increasingly frustrated with more intrusive forms of digital advertising.

In today’s Skai 5, we examine five of the growth drivers for retail media spending:

1) Great performance brings in more investment

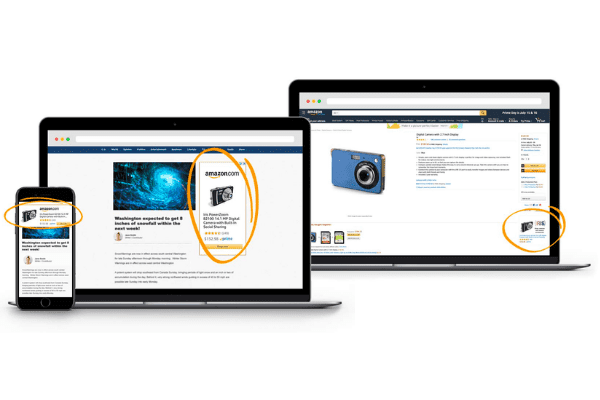

While most people do not necessarily love ads, many consumers do not mind native advertisements that do not interfere with their shopping or reading experience. It’s the ads that take over the screen when trying to read text or waiting through an ad before a video plays that consumers report the strongest adverse reactions,

According to the eMarketer report, that is actually great news for retail media since the consumers also report feeling mostly positive about ads on third-party sites—like Amazon Advertising—which are intended to aid in the shopping process rather than distract from reading or other activities.

In fact, according to eMarketer, when consumers notice ads on Amazon, “they were more likely to characterize these ads as useful, helpful, or aligned with their shopping habits than as distracting or untrustworthy,” which suggests that ads designed to assist shoppers are the future of retail media spend.

2) Online shopping continues to strengthen

During the pandemic, many consumers who were unfamiliar primarily with ecommerce became adept at everything from ordering groceries from their phone to using tools on home improvement retail sites to redesign their gardens.

As retail slowly moves back in-store, those newfound preferences for ecommerce do not seem to be subsiding. According to Insider Intelligence, U.S. ecommerce sales will reach $1 trillion in 2022, a figure they had not projected until 2024 pre-pandemic. And even as consumers move back in-store to make their final purchases, they are still researching products online well before stepping foot in a store, making retail media spending more important than ever.

3) The proliferation of retail publishers

The number of retailers offering retail media is growing, so there are more places to spend efficiently. Just a few short years ago, there were only a few options to consider when making decisions about retail media spending, like Amazon and Walmart.

According to a September report from Merkle, every one to two months, a new retail media network is born. Whether that’s building their own operations like Amazon and Walmart or going through aggregator platforms like CitrusAd or Criteo, every online retailer with significant audience reach sees the retail media channel as a potential for high-margin revenue and a way to better engage their manufacturer clients. There are Instacart, Target, GoPuff, and scores of others.

4) Data depreciation pushes marketers to closed ecosystems

As privacy regulations become the new normal for most advertisers, marketers should consider closed ecosystems, such as retail media publishers and retailers who can target, measure, and optimize within the parameters of their platforms.

Studies have shown that consumers do not necessarily mind giving up privacy for personalization, and retail media ads targeted to their search queries are generally viewed as helpful rather than intrusive.

5) Connected Commerce offers even more performance opportunities

Marketers continue to get more adept at integrating other channels, such as search and social, into their retail marketing strategies. The next stage of this process is connecting retail marketing strategies by taking advantage of the myriad new possibilities that have emerged as retail media has grown.

For example, Kroger and Roku have recently announced a new partnership that will make data available to target and measure TV advertisements. Other opportunities include the platforms that emerged as important new players in the retail media landscape during the pandemic, such as Instacart and GoPuff.

Integrating cross-channel opportunities holistically is one of the best ways to get the most from your retail media spend.

Scale your retail media programs without losing performance with Skai

One of the biggest lessons to take from the retail media boom is that when it comes to retail media advertising in an age where consumers seem to have wholeheartedly embraced ecommerce, the best seems yet to come.

As part of Skai’s intelligent marketing platform, our Retail Media solution empowers brands to plan, execute, and measure digital campaigns that meet consumers when and where they shop. Built with best-in-class automation and optimization capabilities, our unified platform allows you to manage campaigns on 30+ retailers including Amazon, Walmart, Target, and Instacart all in one place.

For more information on how to take advantage of the growth drivers for retail media presented in this article, please reach out to Skai today.