As Amazon continues its rise in advertising dominance — just behind Google and Facebook as the third largest online advertising platform, according to Statista — Amazon Ads now come at an increasingly steep cost.

Some industry reports about Amazon Ads show that CPCs are rising quickly, as much as 50% year over year. Even more challenging, these price increases negatively impact Amazon advertisers’ most watched metric, advertising cost of sales (ACoS), which is the percentage of Amazon revenue spent on advertising. In 2020, the average ACoS was 22%. It rose to 25% at the beginning of 2021 and 30% by mid-year.

We’ve seen this before as paid search and paid social channels matured — as a channel grows, more competition drives up auction prices.

Read more in Skai’s white paper, Amazon Ads Inflation.

What happens as the cost of Amazon Ads rise?

Amazon Ads inflation not only means that ads will become more expensive over time but also the Amazon Ads strategies that worked in a less crowded marketplace might no longer be as effective. So understanding why prices are rising is vital to understanding how to remain competitive in a changing marketplace. Part of that understanding comes from knowing who the newcomers to the Amazon Ads marketplace are.

Here are the top four types of marketers driving up Amazon Ads costs.

1) Late Adopters

Just a few short years ago, Amazon was more of a “good to have” ad channel, but now it has become a “must-have” tactic.

Early adopters had the advantage of claiming a lion’s share of voice on the platform for a relatively low cost. However, now that 74% of Americans begin their product research on Amazon, regardless of where they end up making their final purchase, Amazon has become essential for full-funnel marketing.

As a result, we’re probably passing over from the early majority to the late majority phase of Amazon Ads, which means Amazon Ads inflation will continue until the auction hits a saturation point.

2) Amazon Aggregators

These are highly aggressive, venture capital-backed companies that buy small, successful Amazon sellers and help them accelerate sales. One of the critical areas for aggregators to drive growth is advertising. Using cutting-edge technology and deep retail analytics, Amazon aggregators hope to generate more revenue than initial sellers.

In early 2022, there were at least 89 Amazon brand aggregators and counting, raising over $13 billion. While some experts predict that these aggregators’ rapid rise and success are not necessarily sustainable, their presence means that Amazon advertisers who aren’t backed by millions of dollars of venture capital will have to get a bit savvier to compete.

3) Startups and D2C Brands

While Amazon has traditionally been considered a marketplace where small mom-and-pop shops could compete with the big guys, the platform’s boom in popularity with startups and direct-to-consumer (D2C) outlets means that Amazon is increasingly more about building brands than simply selling products. That’s because as more and more consumers use Amazon for research, startups and D2C companies can build awareness and sales with retail media, giving their businesses a much-needed push out of the gate.

The plan is that new customers will buy again, tell their friends, promote their purchases on social media, and leave positive ratings and reviews, which help drive the next wave of sales. Thus, the strategy is that those initial sales drive another, more significant wave of sales. Then it’s just rinse and repeat.

These advertisers drive up the cost of Amazon ads because they’re willing to pay a premium for that critical brand-building stage rather than simply focusing on profits from sales.

4) Non-Endemics

Amazon sellers are classified as “endemic advertisers,” meaning they use Amazon ads to push their retail products on Amazon. But non-endemics, or advertisers who are not necessarily selling a material product on Amazon, are coming.

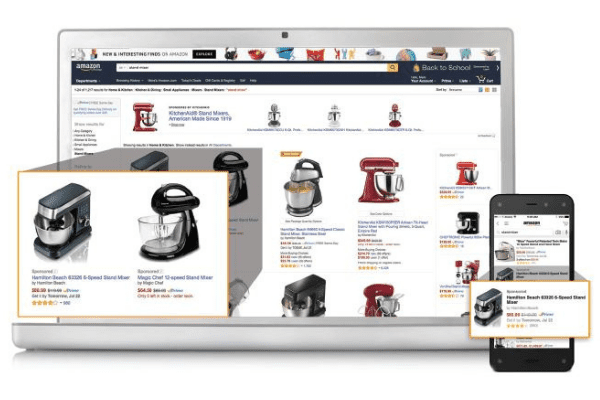

Amazon’s demand-side platform (DSP) allows advertisers to programmatically buy display, video, and audio ads on and off Amazon using the platform’s first-party data. Non-endemic advertisers will pay to advertise products and services related to Amazon searches or purchase history.

For example, a customer who searches for hearing aids might also be served ads for local hearing centers through Amazon’s DSP platform. While these advertisers will likely not compete for Sponsored Product or Brands ads, they ultimately help drive Amazon Ads inflation by driving up costs for Amazon DSP and Display ads, which might also make competition for the remaining ad types more competitive as well.

Get more savvy and sophisticated with your Amazon Ads programs. Download the Skai Marketing Guide to Mastering Amazon Ad Types.

What’s your plan to beat the rising competition on Amazon?

The addition of these newcomers to the Amazon advertising landscape was inevitable as the platform grew. But that doesn’t mean existing Amazon advertisers should jump ship. Instead, retail media marketers should shift their strategies to account for these changes.

To find out more about how retail media marketers can remain profitable as costs continue to rise, download Skai’s white paper “Amazon Ads Inflation” here.

If you are looking for a strong retail media platform, Skai’s intelligent Retail Media solution empowers brands and agencies to plan, execute, and measure campaigns on 30+ retailers in one unified platform with best-in-class automation and optimization capabilities.