Yoav Izhar-Prato

CEO @ Skai

Yoav Izhar-Prato

CEO @ Skai

Note – this article originally appeared in Retail-Today.com’s The State of Retail Media 2023 feature, with industry leaders sharing their thoughts on what 2023 holds for the retail space.

Now the third largest digital advertising channel behind just paid search & social advertising, retail media is forecasted to reach $160 billion by 2027 — representing 18% of global digital advertising and 11% of total advertising.

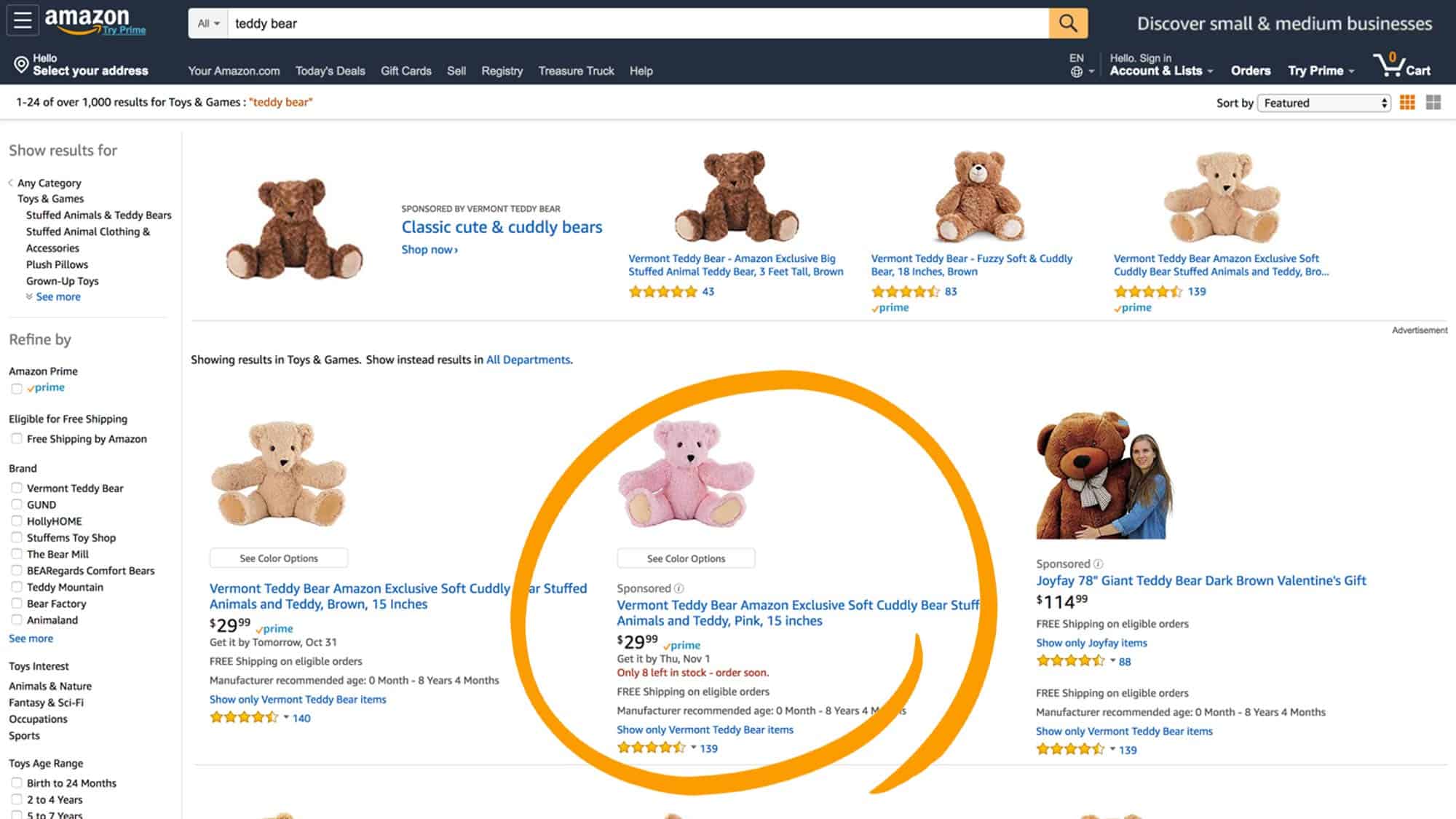

Before retail media, brands could only address 99% of the digital path to purchase with existing channels. It was that last 1% — the essential part of the customer journey at the very bottom of the funnel within online stores — where marketing exposure ended. But now, with retail media, marketers can influence shoppers within the online store and closer to the point of purchase.

While retail media has been a game-changer for brands, the impact on retailers may be more significant. This burgeoning channel represents a new, high-margin revenue stream that is helping them offset the loss of sales from the highly competitive and fragmented online shopping landscape.

Skai’s 30+ retailer advertising partners include Amazon, Walmart, Target, and Instacart, and I am in the fortunate position of hearing directly about how they plan to fuel growth.

Here are some of the strategies that I’ve heard:

The bulk of the first era of retail media has been keyword-triggered listings in the retailer search engine results pages. To grow ad revenue, retailers will support the adoption of display, video, and CTV, which can help brands reach consumers up the funnel.

And the treasure trove of first-party shopper data is no longer restricted to ads within the retailer’s website. Marketers can leverage the retailer’s rich browser/buyer-targeting data across the web to drive them back to retailer product pages. This will not just be limited to online ads but also extend to OOH (out-of-home ad formats) within physical stores.

Retailers are actively reaching out to brands that don’t even sell products. Endemic retail media are ads that drive users to product pages within those online stores. Non-endemic retail media are ads that drive users to destinations away from the online store. An example of a non-endemic retail media campaign would be an Italian restaurant that advertises a dinner promotion to someone searching a retailer for spaghetti sauce.

Within retail media publishers, there are those which are primarily digital such as Amazon or Instacart, and ones that are “omnichannel” such as Walmart or Target that have both large online and offline footprints. These omnichannel retailers offer brands the opportunity for closed-loop measurement. For CPGs, a better understanding of the online/offline relationship is absolutely necessary to unlock the next era of their growth.

Every penny comes under scrutiny in 2023 as brands strive for profitability. Retailers will be under pressure to make more data available so that their advertiser clients are equipped with the insights they need to optimize their programs. Today, advertisers rely on third-party scraping platforms such as Profitero and Analytic Index for digital shelf analytics like category share. Some retailers are exploring clean rooms — such as Amazon has with its Amazon’s Marketing Cloud — as a way for brands to safely co-mingle their proprietary back-end data with highly granular Amazon insights.

Gain a competitive edge by reading our complimentary report, The State of Retail Media 2023. This comprehensive snapshot of the industry offers valuable insights into how industry experts are approaching this rapidly growing channel. Don’t miss out on this opportunity to stay ahead of the curve!

Click here to download the report and uncover the strategies that will drive your success in retail media.

Globally, there are over a hundred retailers either offering advertising directly or through technology aggregators. This complexity has resulted in most of the spend being concentrated into a small group of major players. For the channel to truly grow, it will need to become more programmatic and easier to buy across platforms. This is especially true for the retailers outside of the market leaders — it will be difficult for them to accelerate budgets if they don’t make it easier for marketers to work with them.

The retail media channel is young, but its growth is off the charts, and it’s changing the face of ecommerce.

But, of course, an increase in investments is also bringing on an increase in competition. To truly become advertising publishers, retailers will have to spread their wings and innovate in 2023.

As part of Skai’s omnichannel marketing platform, our Retail Media solution empowers brands to plan, execute, and measure digital campaigns that meet consumers when and where they shop. Built with best-in-class automation and optimization capabilities, our unified platform allows you to manage campaigns on 30+ retailers including Amazon, Walmart, Target, and Instacart all in one place.

Client results include:

We invite you to schedule a quick demo to see all of our cutting-edge retail media innovation for yourself.

We use cookies on our website. Some of them are essential, while others help us to improve this website and your experience.

Here you will find an overview of all cookies used. You can give your consent to whole categories or display further information and select certain cookies.