Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

The Omnichannel Forum is a monthly series that poses a single question to a panel of industry experts. August’s host is industry analyst Joanna O’Connell. This month’s contributors include:

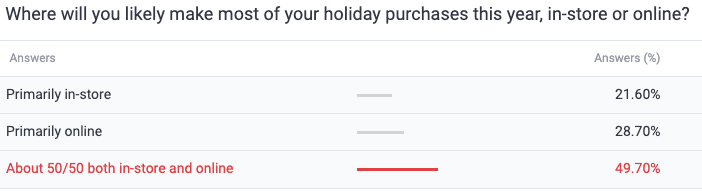

Skai’s ongoing thought leadership in omnichannel marketing led us to probe consumers on their primary shopping mode this year – online, offline, or a blend of both. Intriguingly, nearly half of the respondents indicated a balanced approach, spending about 50/50 online and offline. This insight marks a significant departure from shopping trends a decade ago, hinting that not just holiday shopping but the retail landscape as a whole may soon gravitate towards a 50/50 split or potentially lean more towards online shopping.

Recent data resonate with our findings. As of early 2023, around 43% of consumers in the United States expressed a preference for online shopping. Moreover, despite the rapid growth of e-commerce, with global e-commerce sales hitting $5.5 trillion in 2022, over half of the consumers still favor shopping in a physical store. Yet, it’s essential to note that online retail is far from plateauing. About 20% of all retail sales now occur online, with ecommerce sales growing at an annual rate of nearly 13% compared to the 4% growth rate for in-store sales.

A 2023 outlook by NielsenIQ emphasizes that “the digital and physical worlds of retail will merge in ways we’ve yet to see before”. This sentiment echoes the omnichannel shopping experience that consumers increasingly seek, blending the convenience of online shopping with the tactile and personalized experience of offline shopping.

As we step into 2024, it’s prudent to reflect on your media plans. Are they aligned with this evolving retail reality? The data hints at a genuinely omnichannel year for customers in 2024. It may be worthwhile to revisit your strategies to ensure they capture the essence of this retail transformation.

Let’s see what how our expert panelists had to say on this topic…

A true omnichannel shopping experience means a connected and seamless customer experience, regardless of where and how the consumer decides to buy. When applied to marketing, the same principles apply, and all messaging needs to not only be consistent but also a true and reasonable representation of the buying experience promoted in the advertising.

To deliver this, a brand’s sales and marketing departments must share plans, share data, and have open lines of communication. Basically, be completely in sync. Similarly, e-commerce teams need to be fully integrated. Any promotional activity must be consistent and offered simultaneously (or in-kind) across both in-store and online, such as price drops, percentage off, and multi-buy promotions (i.e. BOGOF). If certain SKUs are being promoted through trade marketing in-store, via a gondola end or FSDU, the same SKU should be focused on in any digital campaigns for the same retailer, using the same promotional messaging. Stock availability is key to the customer experience and a critical data point for more effective (and efficient) advertising campaigns.

Clearly, if a product is out-of-stock it should not be advertised. But similarly, if stock is running low in a particular location with no immediate replenishment due, then efforts should be made to exclude this geo-location from any campaigns for that SKU until stock is back at a sufficient level (provided online orders are fulfilled from that same store or local distribution centre).

Whilst there are many more examples, the key principle for marketers is to always think about whether any claim or offer suggested in a campaign can be fully realised by the consumer buying in-store or online. If the answer is no, it’s time to adjust.

The omnichannel strategy leading into 2024 shows marketers regaining focus to streamline online-to-offline experiences with buy online, pick up in-store, delivery, safety, and reliability of the products.

The omnichannel strategy leading into 2024 shows marketers regaining focus to streamline online-to-offline experiences with buy online, pick up in-store, delivery, safety, and reliability of the products.

Layering in personalized strategies and geotargeting to display proper inventory connects the right products to the right users to drive revenue. Concentrating on digital marketing O2O, Rakuten Advertising leans into seasonal campaign timing, A/B testing & performance-based initiatives to achieve success during this crucial time. We lean on our advertiser’s expertise in collecting customer feedback and sustainability measures to assist in our awareness initiatives of advertisers to instill confidence in a brand’s voice and image.

Creative is key. Whether online or in-store, shelf-space has never been more cluttered and brands need to work extra hard to stand out. Leverage consumer insights and first-party data to understand what messages are most likely to elicit action. Is it BOGO or FOMO?

Creative is key. Whether online or in-store, shelf-space has never been more cluttered and brands need to work extra hard to stand out. Leverage consumer insights and first-party data to understand what messages are most likely to elicit action. Is it BOGO or FOMO?

From there, make sure creative is not only consistent across channels but sequenced in a way that meets consumers where they are in the moment. Wherever possible, use Creative Ad Tech to automate workflow and go from DIY to ROI.

People: Investing in talent remains our priority. Key roles within our team are essential for effective management, requiring industry expertise to navigate Retail Media funds and foster strategic alignment across channels. We are dedicated to talent acquisition and development.

Data & Tools: Supporting these ecommerce efforts necessitates consistent investment in 3rd-party partners. These partnerships provide invaluable insights into market dynamics, competition, and keyword effectiveness across key platforms. Staying informed through data-driven decision-making is paramount.

By emphasizing People and Data/Tools, we are fortifying our foundation for successful e-commerce strategies in 2024 and beyond. Our focus remains on nurturing talent and harnessing data-driven insights to adapt to the evolving landscape.

In today’s rapidly evolving retail landscape, staying ahead of the curve is crucial for brand marketers. According to Skai’s recent holiday consumer survey, a significant shift is underway. Most consumers now plan to shop both online and in-store, adopting a balanced 50/50 approach. This shift in consumer behaviour offers a treasure trove of actionable insights for brands looking to excel in 2024.

Understanding consumer behaviour is key. Embrace the omnichannel shopping trend by crafting a cohesive connected commerce strategy that caters to both online and offline touchpoints, given that shoppers’ sales are increasingly influenced online, focusing on digital availability is paramount to ensuring your brands stand out from any shelf, beat the competition including the private label to drive brand growth. A dive deep into the consumer journey and mapping out how individuals move seamlessly between these channels during their shopping process is important, and this insight allows for the creation of tailored messaging and offerings that resonate with audiences at various stages of their decision-making journey.

Audience insights are paramount in this shifting landscape. Segment your audience based on their preferred shopping channels and behaviours, and leverage this to build out share-of-market and sizing information. Assess the potential market share and revenue growth achievable by optimizing your presence online and offline. Dive into market trends and growth rates, all while keeping a keen eye on your competitors’ strategies. Embrace search and retail media data to refine your content and advertising campaigns, reaching consumers effectively as they shop online. Furthermore, adopt a full-funnel approach, catering to every step of the customer journey, and consider retailers as media partners during joint business planning (JBP) negotiations.

We believe it is critical to tap into retail insights and intimacy signals and leverage location-based data to offer personalized promotions and experiences depending on consumers’ proximity to physical stores.

An omnichannel platform will be much more efficient than disparate point solutions in providing that view. Additionally, omnichannel buying behavior means that individual channel performance against traditional media KPIs like costs and ROAS won’t be nearly as meaningful as advertising’s impact on actual sales lift. So marketers should look for platforms that allow them to establish performance targets, optimization controls and reporting against business-level metrics.

Finally, marketers can no longer rely on segmenting audiences into predictable online or offline customer cohorts so they need to be leveraging more real-time intent signals in order to serve more effective advertising. Skai’s Intent Driven Messaging is a great example of how you can leverage the power of intent signals to sharpen your ad copy throughout the funnel.

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information