Since the beginning of COVID-19, marketers have had to deal with countless shifts in consumer behavior. While the pandemic continues, rapid changes will be the norm, and marketers will have to find ways to plan programs months away with the reality that no one truly knows what will happen next.

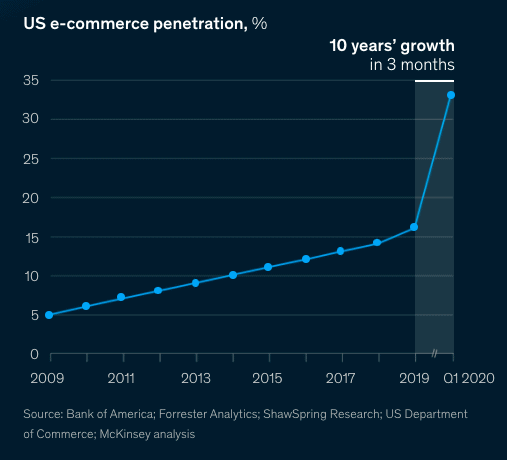

However, one shift that marketers know will persist in 2021—and can plan for—is that consumers will be buying online at a higher rate than anyone ever expected just a year ago.

A popular McKinsey chart around the industry shows that ecommerce as a percentage of total retail sales have nearly doubled in 2020.

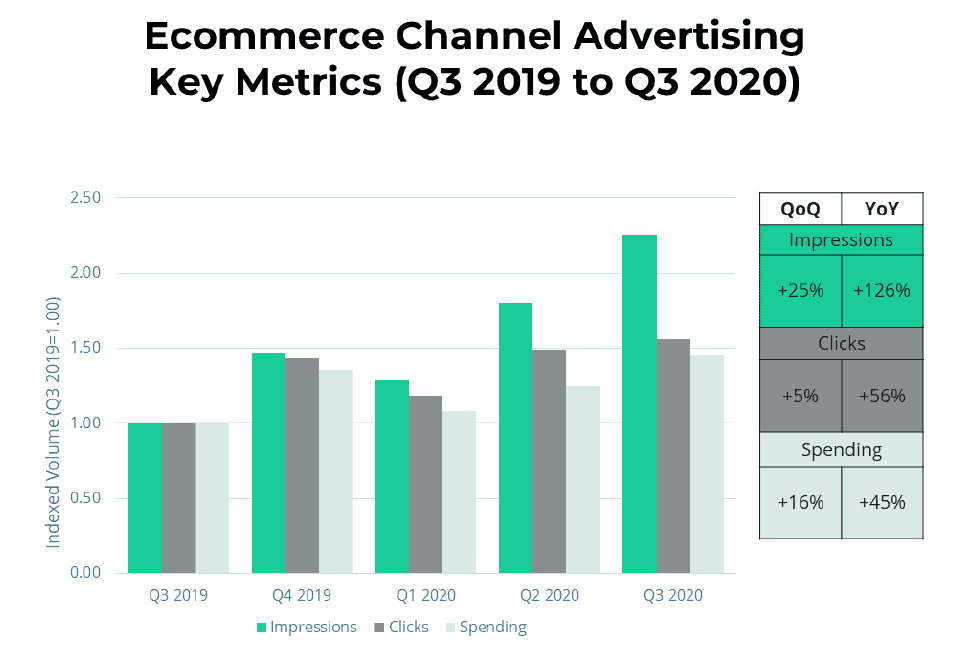

And the rise of ecommerce has driven up marketing investments in Ecommerce Channel Ads (ECA) from online retailers such as Amazon, Walmart, Target, Instacart, and more. As we reported in our Skai Q3 2020 Quarterly Trends Report, ECA grew 45% year-over-year last quarter—that’s in the middle of a pandemic and faster growth than any other major digital ad channel.

Five Ecommerce Channel Advertising (ECA) Predictions for 2021

ECA Prediction #1 – The further publisher diversification of the channel

While Amazon Advertising is still the leading ECA publisher, other retailers are bolstering their offerings to compete. With the increase in consumers buying online and the success that the channel had in 2020, marketers will be interested in not just expanding their budgets, but also the retailers they will look to use.

“The two big up-and-coming retail media platforms after Amazon are Walmart and Instacart. The next tier includes large digital marketplaces eBay and Etsy, along with multichannel retailers Kroger and Target. Retailers have a key advantage over Facebook and Google as media sellers. Their platforms are powered by the combination of high-intent keyword searches and shopper data, giving them an even better ability than their duopoly counterparts to target the right customers with ads.”

The way that this channel is shaping up is that each Ecommerce Channel Advertising publisher brings a different environment and variables to the table. This gives marketers ways to develop unique strategies for each partner and see where their product ads work the best.

For example, if you examine the way that Walmart presents its ECA offering, it emphasizes the offline footprint its stores represent in the US, and how advertisers can benefit from combined online/offline measurement. Instacart and Kroger lean heavily into grocery items. Target has its upscaled, big-box brand to offer, and sites like eBay and Etsy present unique, auction marketplaces.

In 2021, we predict that not only will ECA keep growing at its meteoric pace, but the maturing channel will garner a diversified market share across a roster of publishers.

ECA Prediction #2 – “Seller roll-ups” will bring savvy, super-aggregator advertisers to the channel

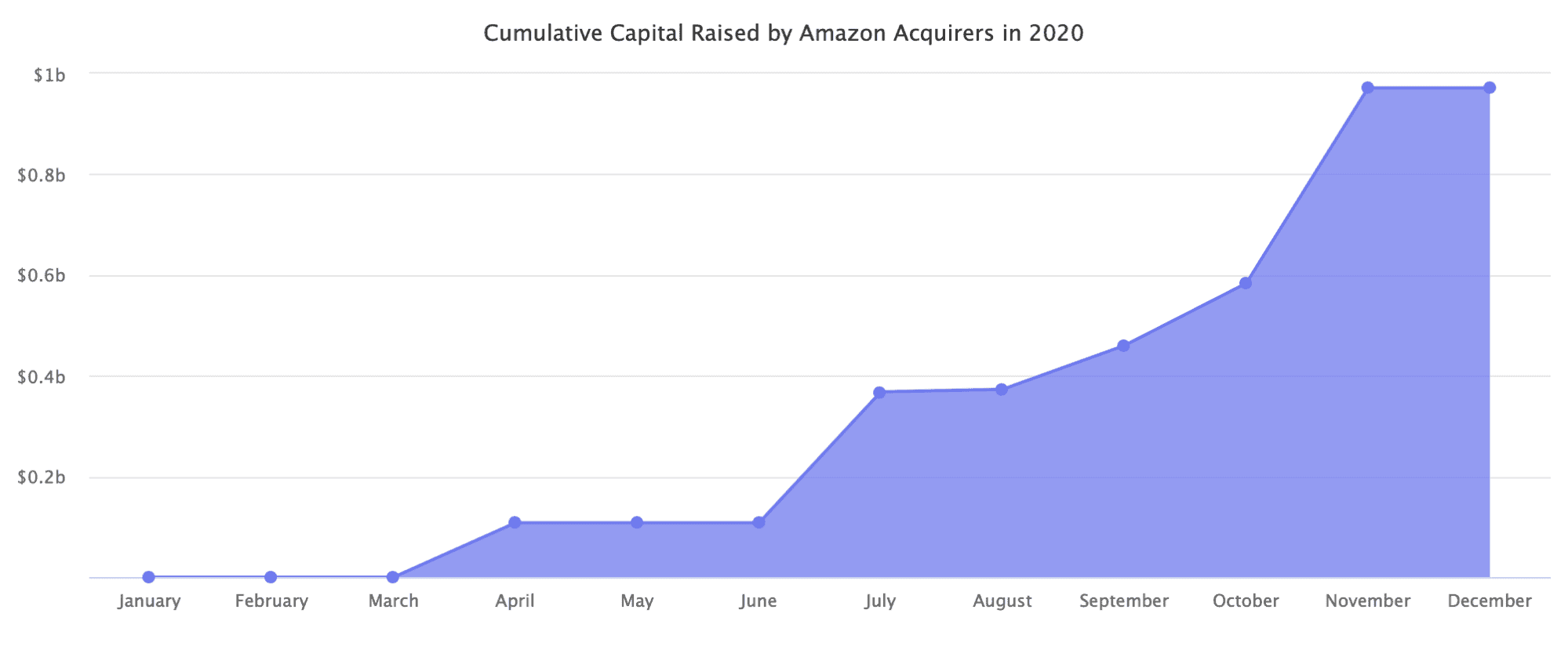

The migration of more consumer shopping online has not just caught the attention of marketers. Investors have seen the potential and are making moves.

One such market push is coming in the form of “seller roll-ups”. These companies are looking to acquire successful private-label Amazon sellers—betting that operational efficiencies can grow those companies even faster than they would on their own. It’s estimated that there are 30,000 sellers of these attractive potential acquisitions—each exceeding $1 million in sales in 2019.

A December 2020 article on MarketPulse.com called Amazon Seller Acquisition Market tracks these players as they raise cash and estimates that nearly $1 billion in fresh capital was raised in 2020 to firms looking to acquire Amazon sellers and brands.

As these aggregators acquire sellers, they will need to rely on more than just logistical efficiency to be successful. A logical component to their investment ROI is Ecommerce Channel Advertising—and not just doing it with loaded budgets, and doing it really, really well. That means increased competition in a channel that is already pretty competitive.

ECA Prediction #3 – The impact of cookie limitations will be a boon for retailers offering ECA

With some of the defacto marketing tracking mechanisms becoming more limited in 2021—namely third-party cookies and mobile identifiers—ECA publishers will become an even more attractive advertising option next year. After all, it’s upper-funnel exposure that marketers have the most trouble tracking, and one of the strengths of Ecommerce Channel Ads is that it reaches shoppers near the bottom-of-the-funnel. It can be used as an upper- or mid-funnel tactic to drive awareness and consideration—but reaching in-market consumers as they’re ready to buy is where it really hums.

Amazon, Walmart, Target, Instacart, and other online retailers are individual ecosystems with tremendous consumer scale and the powerful first-party data required to target ads to the most interested shoppers. Certainly, for a full-funnel ECA marketer, there will be some negative side-effects from the limitations on tracking technology, but publishers in this channel will be more insulated from these challenges than other forms of advertising.

Count on ECA budgets getting a boost when the changes go into effect and marketers have to make some hard choices about if they should stay with their other, more impacted, ad channels.

ECA Prediction #4 – It will get harder: as the channel matures, so will advertisers

If you look back at where ECA is in its progression compared to its two closest channels—Paid Search and Social Advertising—it’s about at this point that marketers really start to push larger budgets.

The first handful of years for a digital channel seems to be testing and seeing if the opportunity is really there or if it’s just a shiny object that won’t deliver consistent ROI. In the next few years, early adopters come in and find tremendous success which signals the rest of the market to hop aboard.

ECA—which was already trending upwards before 2020—got a tremendous boost from the shift of online spending during the pandemic. With more publishers now onboard besides just Amazon and Walmart, the channel is entering it’s [early] maturation stage. If ECA follows the path of Paid Search and Social Advertising, we will see a 2021 influx of both larger budgets and channel laggards which will drive up competition and ad costs.

What this means is that early adopters will need to uplevel their programs and get even savvier than before in order to remain successful. New best practices, better technology, and smarter agencies will be highly sought after in 2021.

ECA Prediction #5 – Publishers will begin to widen their offerings to help brands even more

The value that Ecommerce Channel Advertising provides to brands doesn’t need to be contained within their stores. With strong customer engagement and deep first-party purchase data, the opportunity for ECA publishers to help marketers across the wider web is a compelling proposition. They could help large brands go beyond transactions and build their connections with consumers, reach new customers, and build long-term shopper loyalty. Using all of its media platforms, a company like Amazon could offer advertisers more than just media transactions.

While it may not happen in 2021, look for some of the more mature ECA publishers to begin exploring ways to build deeper relationships with brands and how they might leverage their assets in more ways across the funnel. This would grow ECA investments and start to encroach on budgets currently allocated to other channels.

When you consider some of the other trends on this list—i.e. increased online spending and the pending impact of tracking limitations—if brands continue to see success with the channel, it makes perfect sense that they would be open to finding ways how these publishers could help them in other areas of their business. This could be especially interesting in the realm of online/offline measurement where Walmart and other retailers with big physical store presences can help marketers to manage their programs holistically.

What you will see from Skai Ecommerce in 2021

Skai Ecommerce is the leading platform for marketers to create, manage, forecast, and optimize Ecommerce Channel Advertising campaigns at scale.

Some of the areas that the Skai Ecommerce team are working on for next year including:

Looking for more publishers. The meteoric success of Amazon Advertising and others has opened the eyes of every large online retailer to the ECA opportunity. There probably isn’t a major retailer who isn’t already offering ECA, will soon be offering ECA, or is planning on exploring their options for a near-term rollout. In order to offer marketers a true, best-in-class platform, the Skai Ecommerce team is always looking for the next big ECA opportunity to add to our list which already includes Amazon, Walmart, Target, and Instacart.

Adding meaningful data. In a 2020 Skai blog post, we shared that marketers need more retail analytics to truly maximize the ECA opportunity:

“In traditional retail, data is decades ahead of where it is for ecommerce. Established data powerhouses deliver terabytes of information to retail analysts to number crunch and extract the necessary insights to power product development, market strategy, and operations.

Online, it’s still a bit of the wild west. Ecommerce marketing teams are learning as they go, testing theories, and validating hunches by cobbling together retail analytics from different sources. Sometimes, it’s hard to even know what questions to ask, let alone find the answer. Where are the connections? By pulling here, does it affect things over there? What impacts ad pricing and performance? How can an ecommerce marketer best drive ROI?”

There are a host of powerful retail analytics companies that can help ECA marketers make better data-driven decisions about their programs. The Skai Ecommerce team has been vetting and partnering with some of these companies so that our clients not only have access to a world-class campaign management platform but also meaningful data that can make the difference. Some of our partners include Dataweave, Profitero—and Signals-Analytics, which we acquired in December 2020.

Are your Ecommerce Channel Advertising programs ready for 2021?

We’re now entering the next phase of ECA. There are more options, more settings, and more ways to run your campaigns than ever before. What worked last year may not work in 2021 with the increased budgets and number of advertisers than just a year ago.

As a leading Amazon API integrator with 1000+ campaigns alongside fourteen years as an enterprise-level paid search and social advertising platform, Skai is uniquely positioned to help marketers understand and master this unique and complex marketplace.

Reach out today to set up a brief demo to see this innovative platform for yourself.