Before the pandemic, Amazon was a website many of us used when we were too lazy to lug a giant bag of dog food from the car to the front door or to get free shipping on our 2 A.M. impulse buys. However, when the pandemic started, Amazon became a lifeline where people could stock up on essentials while avoiding brick and mortar retailers.

During this period many small 3P (third-party) sellers found themselves helming booming businesses—whether it was selling home goods for those who spent the pandemic renovating their homes or arts and crafts shops answering America’s newfound interest in oil painting. Post-pandemic, many of those popular sellers are suddenly fielding offers from Amazon brand aggregators looking to invest in popular sellers.

What Are Amazon Aggregators?

Amazon aggregators are businesses that have a goal to acquire multiple Amazon brands with the purpose of integrating them with other brands.

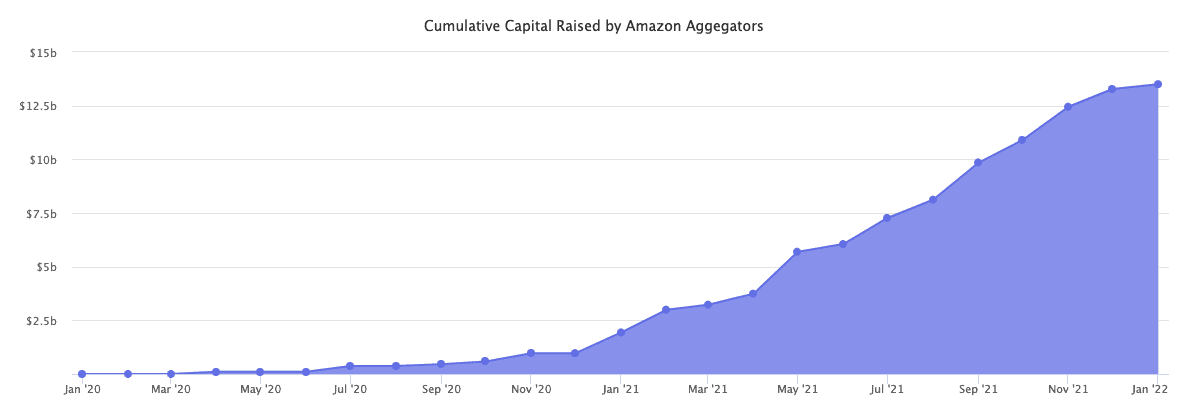

These aggregators are aggressively looking to roll up any Amazon brands that have growth potential. So far, more than $13 billion has been raised—at last count, there are 89 active Amazon aggregators of which 29 raised at least $100 million.

So what are Amazon brand aggregators anyway?

Amazon brand aggregators are larger companies with the funds to acquire successful, small Amazon sellers. These aggregators are betting on their business acumen and budgets to grow them faster than those individual sellers could have grown by themselves.

When we think of Amazon’s marketplace, most of us imagine a bit of a mixed bag, where giant companies sell goods right alongside little mom-and-pop shops. But as Amazon very quickly becomes the world’s one-stop shop for pretty much every good under the sun and the company tightens up its recommendation algorithms, bigger companies have taken an interest in smaller 3P sellers as prime investment opportunities.

“I think there was a confluence of Amazon’s marketplace becoming more mature and kind of hardening, if you will, around the edges to make it more trusted,” Chris Bell, who founded Amazon brand aggregator Perch in 2019, recently told CNBC. “And then the pandemic and I think just a lot of people noticing that this was possible, and coming after it.”

Brand aggregators routinely scout out successful, smaller third-party Amazon sellers for growth opportunities. These aggregators can help small 3P sellers with the potential to overcome common logistical problems, such as shipping costs, advertising strategies, and understanding Amazon’s SEO hurdles. These areas of expertise help Amazon brand aggregators to increase the profits of small businesses much faster than small sellers are often able to achieve on their own.

The math makes sense. Each Amazon seller needs infrastructure (customer service, stock inventory, warehouses, shipping, legal, design, marketing, etc). If they’re not properly investing in these areas right now, they’re probably not growing as fast as they could. Aggregators can invest in an efficient, cutting-edge infrastructure that can be leveraged across all of these sellers. At least, that’s the plan.

The largest of these is Thrasio, who has raised $3.4 billion to date. Their mission as stated on their website:

At Thrasio, we’re reimagining how to make the world’s most-loved products accessible to everyone. So we work with successful sellers, using a deep understanding of rankings, ratings, and reviews – plus supply chain and marketing smarts – to transform the art and science of commerce.

What kinds of sellers are Amazon brand aggregators looking for?

When it comes to the types of small businesses Amazon brand aggregators are looking for, buzzy doesn’t necessarily mean better. There are quite a few factors for becoming a small seller with major aggregator appeal.

First off, aggregators are generally looking for companies that have a registered brand. Additionally, the Prime badge is vital to a big company, so sellers who have already adopted Amazon’s fulfillment (FBA) are especially appealing.

Most of all, Amazon brand aggregators are looking for brands that have already earned popularity in smaller markets. That means they’re banking on loyal customers who are vocal about their good experiences with a 3P seller in the reviews and across social. And though these companies are referred to as Amazon brand aggregators, Amazon isn’t the only place where popularity counts. The most appealing sellers are those who also have a strong presence on sites like eBay, Shopify, and Etsy. Even so, Amazon is still the name of the game, and an online seller’s strongest presence should be there.

It’s also helpful to know that Amazon brand aggregators aren’t looking for a few types of sellers, such as seasonal goods, perishable items, and fashion; any seller with an evergreen product, like arts and crafts, home and kitchen, or baby supplies, for example, is in an excellent position for a savvy aggregator to turn its Amazon popularity into rapid, exponential business growth.

Should you consider selling to an Amazon brand aggregator?

Though there are a lot of wild stories out there of Amazon brand aggregators luring mom-and-pop shops to sell with gifts of Teslas and other over-the-top tactics, the truth is that Amazon brand aggregators (many of whom are former sellers and Amazon employees) are simply looking to invest in businesses with potential.

The ideal partnership between aggregators and sellers is based on that growth. Sellers who are both passionate about their business but also lack the tools and resources to streamline shipping, focus on branding, and navigate Amazon’s SEO while still delivering the reliable customer service and product quality that their loyal fans loved in the first place.

While many smaller 3P sellers saw their business boom during the pandemic, that growth is not necessarily guaranteed post-pandemic. So partnering with Amazon veterans who understand the industry is one way to ensure that currently thriving Amazon businesses stay competitive.

One word of caution from most experts: Amazon brand aggregators themselves have grown rapidly, perhaps too quickly for their own good. Like any business decision, partnerships with Amazon brand aggregators could turn out to be a business trend that falls by the wayside as quickly as it becomes topical. But still, if a reputable aggregation agency turns up in your inbox offering a Tesla, it might be wise to hear them out.

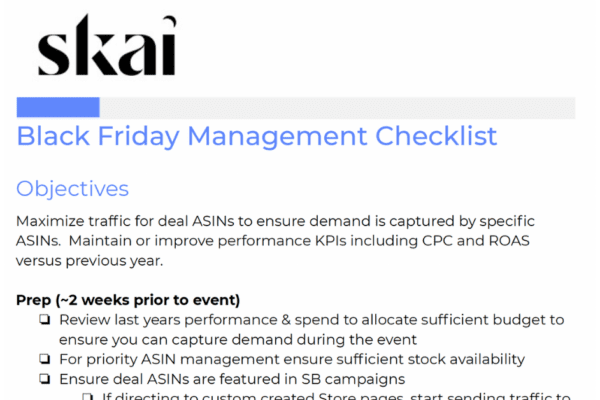

You might have to get a bit savvier on Amazon Ads if you’re going to beat these aggregators

As an industry-leading campaign management platform for over 16 years, Skai’s retail media solutions enable your team to master your Amazon, Walmart, Instacart, Target.com, and dozens of other retailer advertising programs.

Find out why the world’s best brands and agencies rely on Skai. Let us show you in a brief demo how our retail media solution can help your team increase sales, save time, reduce errors, and be the tech foundation for your best-in-class retail media program.