Driven by the mass adoption of online grocery shopping during the pandemic, Retail Media is surging!

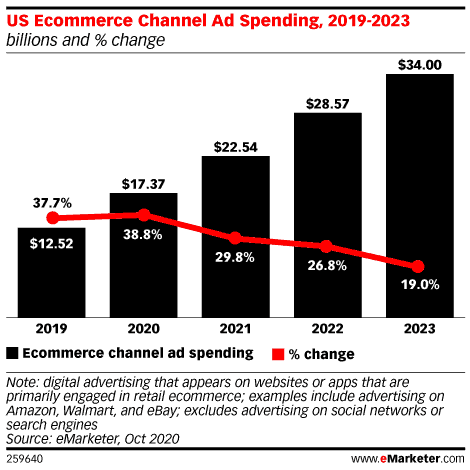

Already the fastest-growing channel is advertising, Retail Media (formerly Ecommerce Channel Advertising), is on track to garner nearly $23 billion in the U.S. alone this year and will grow to $34 billion by 2023. That puts it just behind Paid Search and Social Advertising as the third largest channel in digital advertising.

One of the leading players in the Retail Media space is Walmart. It was quick to adapt to the changing market of the pandemic in 2020 with 2-hour delivery, extended curbside pickup, and even added distribution centers with pickup & delivery capabilities during the holiday season.

But, the core of Walmart’s competitive edge with Retail Media is its massive online and offline footprint.

- Walmart is the largest retailer in the U.S.

- 90% of Americans shopped at Walmart in the past year

- 150 million customers visit Walmart or Walmart.com each week

- 90% of Americans live within 10 miles of a Walmart store

While some of Walmart’s Retail Media rivals are only online, Walmart is able to compete both online/offline. This plays right into Walmart’s strength as their customers are able to research online to check out things like product options, prices, and inventory which they can then drive and pick up locally. In fact, 35% of their in-store customers visit Walmart.com shortly before heading to their local Walmart store.

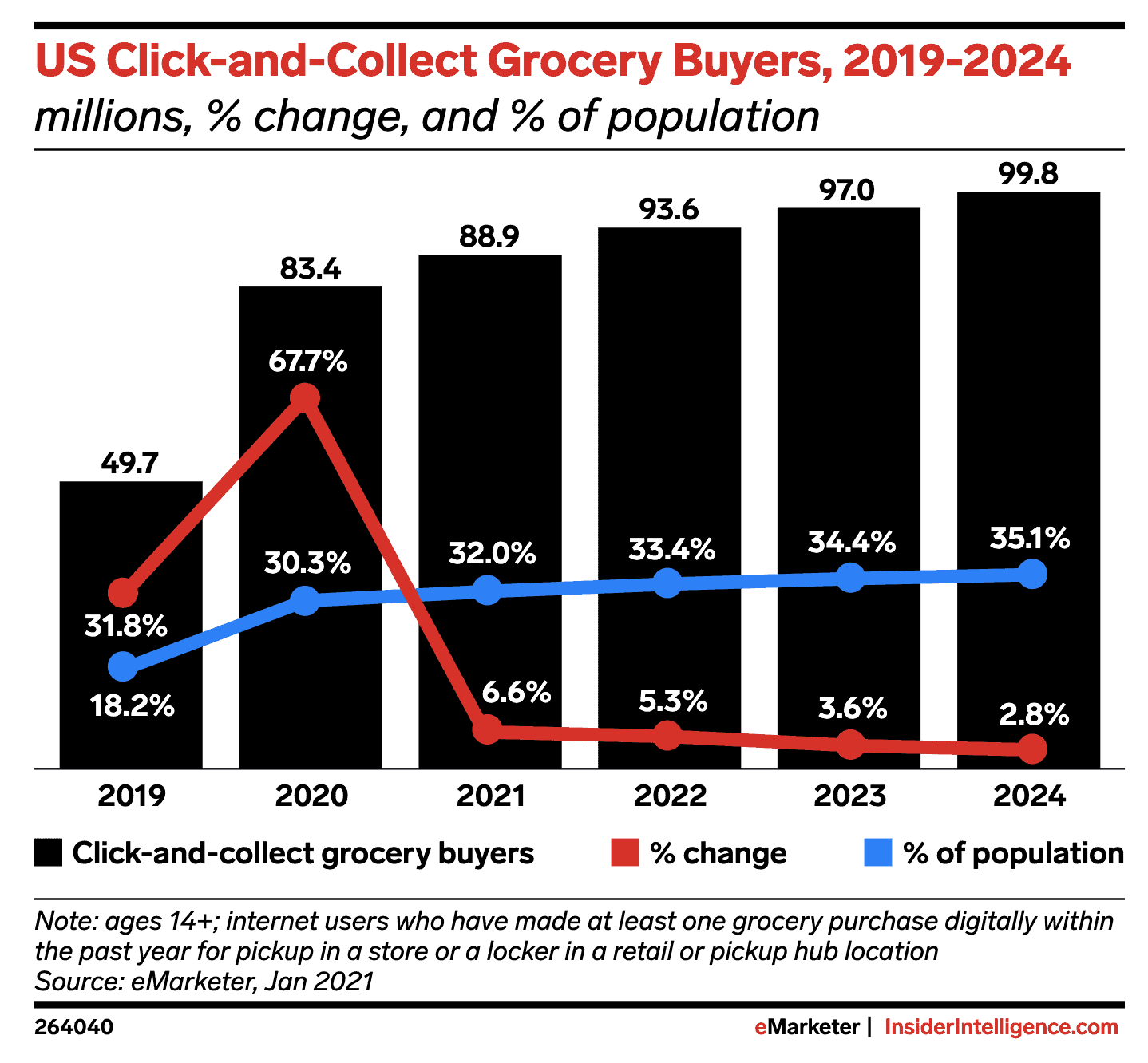

With the end of the pandemic in sight, industry pundits are wondering which consumer shopping behaviors will persist once stores are open and consumers are again able to feel safe to shop in person. One of those behaviors that many believe will remain is pickup and delivery, aka click & collect. Based on research from eMarketer, around a third of the US population will continue to shop via click-and-collect once stores are fully open. This is also a very favorable trend for Walmart because not only does it ship online orders from Walmart.com, but its retail footprint is perfectly suited to potentially dominate the pickup and delivery side of online shopping.

Walmart advertising makes it easy market products

Walmart’s advertising arm, Walmart Connect, offers an incredible opportunity for Retail Media marketers to reach the largest group of customers by any retailer. It’s been going strong for some time now, but a recent change opens up new opportunities for marketers to manage their Walmart advertising programs more efficiently while reaching more of Walmart’s valuable customers.

Previously separated, Walmart Connect has unified its Sponsored Product campaign program to include both Walmart.com and pickup and delivery. This helps advertisers manage a single, unified program versus multiple, especially when their catalogs may contain online-only shipping as well as pickup & delivery products.

For example, an advertiser promoting diapers could be sold both online and offline. But, what about ice cream? It’s not eligible to be shipped from Walmart.com, and conversely, there are online-only deals that can only be fulfilled via shipping.

With this change, advertisers can now run a single campaign to promote their products automatically to the most relevant places across Walmart’s properties. The technology is even smart enough to know that if SKUs are only available (or currently in stock) in certain geographies, ads will only be served for those products to those geographies.

Along with making campaign management much less time-consuming for their advertiser partners, the benefits of this change ease the burden of budget allocation and planning across the online and pickup & delivery options. Also, marketers will be able to access all ad placements of Walmart platforms from a single, unified campaign instead of having to pick and choose online or offline. So, instead of being focused on channels, Walmart Connect marketers can focus on their products.

Walmart Connect unified campaign best practices

Walmart Connect offers some tips on how to make the most of these new unified campaigns:

Keep a close eye on your unified campaigns for a while. Monitor bids and daily caps as the additional inventory will allow more efficient CPCs and clicks to exhaust your budget quicker. You may be able to test higher daily budget caps and investments as you get a sense of how your programs will perform under this new structure.

Unifying inventory could impact how and where your ads are served. Prioritize bids to achieve higher frequency in premium placements like Homepage, Search Ingrid, Stockup, and outbid the competition.

A mix of campaign strategies is still the right approach. Continue the best practice of running Automatic and Manual campaigns simultaneously, with a 30% higher budget on Manual to accommodate premium CPCs.

Stay on top of your metrics — especially with products across campaigns. Manage performance (ad impressions, spend, RoAS) of overlapping SKUs within multiple campaigns across demand channels.

Boost ecommerce success with sponsored advertising campaigns on Walmart using Skai

As the world’s largest retailer, Walmart stores, websites, and mobile apps reach over 90% of US households every week. Skai can help your brand or agency stand out and capture demand on Walmart’s high-traffic properties to reach your consumers across their purchase journeys. Drive growth with Walmart advertising using Skai’s renowned optimization, analytics & automation solutions.

To learn more about how Skai can become the foundational technology of your Walmart Connect program, schedule a brief demo to learn more.