Summary

Evaluating SEM platforms for financial services is critical for maximizing paid search investments in this high-stakes, compliance-driven industry. With nearly half of digital ad budgets in financial services dedicated to SEM, selecting a platform that supports compliance workflows, advanced targeting, and dynamic budget management is essential. Follow a structured evaluation process, including prioritizing must-have capabilities like AI-powered automation and cross-channel integration, to ensure the platform aligns with your needs and delivers measurable ROI.

Last updated: December 22, 2025

Are you a financial services marketer maximizing your paid search investments? We’re not just talking about maintaining ROI levels year after year but truly unlocking your full potential in this channel. Paid search performance depends on many factors—strategic keyword targeting, competitive bidding, high-intent audience segmentation, and flawless campaign execution. But there’s one foundational piece that can make or break your success: the platform you use to manage it all.

What if it’s your tool that’s holding you back? Maybe you’re using Google’s native platform because it seems like the obvious choice, or you’ve stuck with a third-party tool that your team likes. Yet, familiarity doesn’t always equal effectiveness. In fact, most marketers are advised to evaluate their marketing technology stack at least once a year to ensure their tools align with their goals and keep up with the latest industry advancements.

Are you overdue for a reassessment?

For teams juggling strict governance and expensive keywords, a paid search platform can centralize controls, pacing, and visibility without forcing daily manual work.

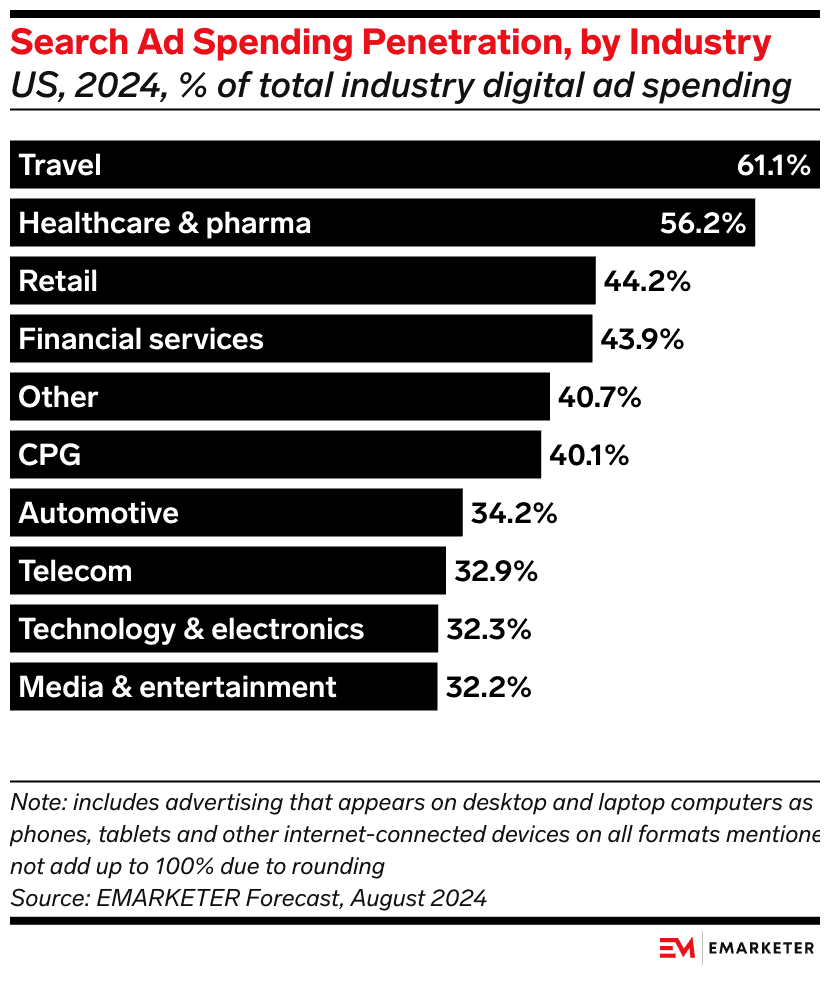

Paid search is one of the most important drivers of success, especially for financial services marketers like you. Nearly half (43.9%) of digital advertising budgets in this sector go to paid search, emphasizing its critical role in reaching intent-driven customers. Given this reliance, using the best platform is non-negotiable—especially one that excels in the areas required for a high-performing financial services SEM program.

In today’s post, we’ll share a sure-fire evaluation methodology for advertising technology. You’ll learn a basic approach on how to score competing platforms against your needs, ensuring an objective process that delivers results. We’ll also highlight the most critical areas of a platform for financial services marketers to focus on, helping you find the perfect fit for your SEM strategy.

Micro-answer: Evaluate compliance, pacing, targeting, insights, and AI.

How do you evaluate paid search platforms step by step?

- Financial services SEM platform selection hinges on repeatable evaluation, not gut feel.

- Score platforms against your must-have capabilities.

- A structured scorecard keeps demos objective by weighting the features that matter most, then converting vendor claims into comparable scores. This helps paid search, compliance, and analytics stakeholders align on tradeoffs and choose a platform that fits real workflows.

Evaluating SEM platforms doesn’t have to be complicated. With the right framework, you can confidently assess tools to find the best fit for your team. This process isn’t just for SEM; it’s a solid method for any technology evaluation.

Financial services marketers already know how important paid search is—digital ad spending in this sector surpassed $30 billion in 2023 and continues to grow at 11.6% annually. That level of investment makes it essential to use a platform that delivers on your most important needs.

Paid Search platform evaluation: high level

You will start by creating a spreadsheet with the capabilities you need in a paid search platform, prioritizing their importance to your SEM program. Next, schedule demos with your selected vendors and score each capability based on those discussions. Ultimately, you’ll have an objective, data-driven evaluation score for each vendor.

Paid Search platform evaluation: 6 easy steps

- List capabilities and assign priority levels. Create a list of all the features and tools you need in an SEM platform. Assign each capability a priority level from 1-3. For example, compliance workflows might be a top priority and get a 3, while creative automation might be less critical and get a 1. Add a notes field for each capability to capture questions you will ask each vendor.

- Research the space and shortlist vendors. Find the SEM platforms that align with your needs and narrow it down to up to five vendors (fewer is better). Schedule demos and include key stakeholders like paid search managers, compliance officers, and data leads. Have each participant take notes during the calls.

- Hold internal debriefs after each demo. After each demo, meet with your team to review and score the vendor. Assign a score of 1-5 for each capability and multiply it by the priority level. For example, if a priority 3 capability is rated a 4, it would score 12 points (3 x 4). Add up all the final capability points to calculate the vendor’s total score.

- Repeat for all vendors. Follow the same scoring and debriefing process for each vendor to ensure consistency.

- Hold a final review with stakeholders. Once all demos are complete, review the final scores and discuss insights with your team. After spending hours in these demos, you may frequently identify follow-up questions or discover new capabilities that weren’t on your initial list. Reach out to vendors for additional clarifications as needed.

- Finalize scores and make a decision. Share the final scores with stakeholders and gather feedback. While the highest-scoring platform may seem the best option, factors like team familiarity or reputation could influence the decision. Regardless, this process will give you the confidence of a thorough, data-backed evaluation.

What SEM platform capabilities are must-have for financial services?

- Financial services SEM programs require more than bidding and keywords.

- Prioritize compliance, pacing, targeting, insights, and automation.

- The right capabilities reduce regulatory risk, protect spend on high CPC terms, and improve decision speed across teams. A strong platform supports audit trails, budget pacing, granular segmentation, cross-channel coordination, and reporting that ties performance to CAC, LTV, and ROI.

While the evaluation process outlined in the previous section is a solid, universal method, each industry has unique needs that must be factored in. For financial services marketers, paid search plays a critical role in driving success, but it also comes with unique challenges like high CPCs, strict compliance requirements, and the need for advanced targeting and reporting.

The following capabilities are key areas to prioritize during your evaluation. For each, we’ll explain why it matters, what to look for, and the questions to ask during vendor demos. By focusing on these, you can ensure your SEM platform supports the demands of financial services marketing.

Compliance and regulatory support

Why it matters: Financial services marketers operate in one of the most highly regulated industries, where non-compliance can result in significant fines, legal challenges, and reputational risks. With the average data breach cost in financial services at $4.45 million, compliance isn’t just a regulatory checkbox—it’s a business imperative. Regulatory workflows must protect sensitive customer information while simplifying approval and documentation processes.

FinServ ad review workflows also need to map to how regulators classify and supervise customer communications across channels.

What to look for in a platform: Prioritize platforms that simplify regulatory workflows with tools like customizable ad approval pipelines, real-time flagging of non-compliant content, and comprehensive audit logs to document campaign compliance. Platforms that offer pre-built templates for industry-specific regulatory requirements or regional advertising laws can save significant time and effort.

Questions to ask during demos:

- How does the platform streamline compliance? Ask about tools specifically designed to ensure adherence to regulations for financial products like loans, credit cards, or mortgages.

- Can workflows be customized for different markets? Inquire whether the platform can handle variations in regional and international compliance requirements, such as GDPR.

- What reporting tools are available for audits? Verify whether the platform includes audit-ready reporting to streamline reviews by legal and compliance teams.

Budget control and pacing tools

Why it matters: Financial services SEM campaigns often target high-value customers and rely on expensive keywords like “mortgage rates” or “small business loans.”with a significant portion going toward high-CPC search campaigns. Managing these budgets effectively is essential for avoiding wasted spend and maximizing ROI.

What to look for in a platform: Look for platforms that allow real-time budget adjustments to avoid overspending on underperforming campaigns or keywords. Pacing controls that spread budgets evenly across campaign periods help ensure funds last through critical times, like month-end or quarter-end. Additionally, the ability to identify high-performing campaigns and reallocate budget dynamically can lead to better ROI.

Questions to ask during demos:

- Can the platform adjust pacing automatically? Check if it can prevent overspending early while maintaining performance goals.

- Does the platform reallocate budgets dynamically? Ask how it identifies high-performing campaigns and redistributes budget in real time.

- Are there tools to manage budgets across products or regions? Confirm whether the platform supports budget control across multiple financial service offerings or geographic locations.

Advanced targeting and segmentation

Why it matters: Financial services marketers need to connect with diverse audiences, from first-time homebuyers to seasoned investors. 61% of Gen Z and 54% of Millennials say they would switch financial institutions for better digital capabilities, emphasizing the need to reach these audiences with highly relevant and personalized messaging.

What to look for in a platform: Seek platforms with robust segmentation tools that allow for detailed audience filtering, custom intent signals, and dynamic retargeting. The ability to tailor campaigns to different financial products and customer profiles is critical for maximizing relevance and conversions.

Questions to ask during demos:

- How granular can audience segmentation get? Ensure the platform can support segmentation by product type (e.g., mortgages, loans) and demographics.

- Can it support custom intent signals? Ask if the platform uses signals like search behavior or past engagement to identify high-value prospects.

- Does it offer dynamic retargeting? Confirm whether the platform can automatically retarget users who interacted with your ads or website.

Cross-channel management

Why it matters: Paid search doesn’t operate in isolation—financial services marketers are investing heavily in multi-channel strategies, including social media and connected TV (CTV). As financial services digital ad spending grows at 11.6% annually, platforms that unify search and other ad channels are crucial for simplifying management and ensuring cohesive messaging.

What to look for in a platform: Platforms should offer seamless cross-channel management with the ability to execute and measure campaigns from one place. Integration with other ad channels, such as social media or retail media, is critical for building cohesive strategies and tracking the impact of multiple touchpoints.

Questions to ask during demos:

- Does the platform support integrated campaign management? Confirm whether it allows for unified planning and execution across search, social, and retail media.

- How does it ensure consistent messaging? Ask about features for maintaining consistent targeting and creative across channels.

- Are cross-channel performance insights available? Check whether it provides data to evaluate the contribution of each channel to overall performance.

Reporting and insights

Why it matters: Financial services marketers need to justify high budgets with clear ROI, especially when paid search accounts for nearly half of their digital ad spend. Reporting must deliver actionable insights to guide optimizations and make data understandable for stakeholders. In complex industries like financial services, KPIs such as customer acquisition cost (CAC), lifetime value (LTV), and ROI by product type are especially important.

What to look for in a platform: Platforms should offer customizable reporting dashboards that highlight KPIs relevant to financial services. Multi-touch attribution is essential to map the impact of campaigns on conversions, especially for complex customer journeys involving multiple products. Exportable reports that align with compliance requirements and are easily shareable with stakeholders are also crucial.

Questions to ask during demos:

- Can the platform deliver financial services-specific insights? Ask about capabilities for tracking ROI by product type or CAC by region.

- Are reports customizable and compliant? Confirm whether the platform allows tailored reporting to meet internal needs and regulatory standards.

- What attribution models does it support? Check if it offers models that reflect the complexity of financial services customer journeys, such as multi-product or cross-channel conversions.

- How easily can reports be shared? Ask if reports can be exported in a compliance-ready format for internal reviews or external audits.

Automation and AI

Why it matters: The financial services space is fast-paced, with competitive bidding and frequent market changes. AI-driven tools are transforming financial marketing by optimizing bids, forecasting performance, and automating routine tasks. Platforms must leverage these capabilities to ensure marketers can scale efficiently while staying competitive.

Responsible use of GenAI in marketing also requires risk management controls and documented governance.

What to look for in a platform: Platforms with AI-driven optimization, predictive analytics, and rules-based automation can help marketers scale campaigns efficiently while staying responsive to market dynamics.

Questions to ask during demos:

- How does the platform use AI to optimize bidding? Check if it can dynamically adjust bids for high-value financial keywords.

- Can it forecast campaign performance? Ask if the platform uses historical data to predict future performance trends.

- Does it offer rules-based automation? Confirm whether the platform can automate responses to performance changes or market fluctuations.

How does Skai deliver on critical fin-serv SEM capabilities?

- Skai focuses on the finserv realities that make SEM harder at scale.

- It supports governance, performance, and insight across core capability areas.

- From customizable compliance workflows to dynamic pacing, segmentation, and multi-touch reporting, Skai aligns platform functionality with the operational needs of financial services teams. The result is faster execution, clearer accountability, and optimization that can keep up with market volatility.

As a SEM vendor since 2006, we’ve worked with countless clients, including many in the financial services industry. We understand the unique challenges you face—whether it’s navigating strict compliance requirements, managing complex budgets, or tailoring campaigns to highly segmented audiences. Our product roadmap has been heavily influenced by the needs of our financial services clients, ensuring our platform is built to deliver results in this demanding industry.

We invite you to include Skai in your evaluation process to experience our full suite of capabilities. But for a preview, here’s how Skai stacks up in the six key areas outlined in the previous section, with real-world examples of how financial services clients have achieved success.

Compliance and regulatory support

Skai’s platform is designed to simplify compliance for financial services marketers. We offer customizable workflows to meet industry regulations, ensuring ad copy, campaign strategies, and targeting adhere to legal and regulatory requirements. Our audit-ready reporting tools streamline the review process, making it easier for legal teams to validate compliance for campaigns spanning multiple regions and products.

To scale automation without losing control, teams can apply AI-powered marketing to standardize optimizations, forecasting, and guardrails across portfolios.

Read more: Strocko Consulting Simplifies Campaign Management for Global Financial Services Clients. Strocko Consulting leveraged Skai to manage campaigns efficiently across regions, ensuring regulatory compliance and streamlining workflows.

Budget control and pacing tools

With Skai, financial services marketers can optimize budgets in real time to maximize ROI on high-CPC keywords. Our platform includes dynamic pacing controls to prevent overspending early in the campaign while ensuring funds are available for critical periods like quarter-end. Automated budget reallocation capabilities help move investments to top-performing campaigns, driving efficiency across your portfolio.

Read more: Lewis Media Partners Boosts Paid Search Efficiency for Financial Services Client. Lewis Media Partners used Skai’s tools to optimize campaigns, driving improved paid search efficiency.

Advanced targeting and segmentation

Skai provides financial services marketers with robust targeting capabilities to connect with highly segmented audiences. From first-time homebuyers to high-net-worth investors, our platform enables granular audience segmentation by intent, demographics, and product type. Dynamic retargeting ensures you stay engaged with prospects as they progress through the funnel.

Read more: Wild Fi Drives Growth in Financial Services with Advanced Targeting. Wild Fi achieved significant growth by leveraging Skai’s audience targeting tools to connect with the right financial services customers.

Cross-channel management

Skai offers a unified platform to manage campaigns across search, social, and retail media channels. This enables financial services marketers to deliver cohesive messaging while simplifying execution. With cross-channel performance insights, you can optimize budgets and creative strategies for maximum impact across all touchpoints.

Read more: Creditas MX Achieves Seamless Omnichannel Advertising. Creditas MX used Skai to streamline campaigns across multiple channels, ensuring consistency and improved performance.

Reporting and insights

Skai’s customizable dashboards and multi-touch attribution tools are built to meet the complex reporting needs of financial services marketers. Track KPIs like ROI by product type, customer acquisition cost (CAC), and lifetime value (LTV) with ease. Our exportable, audit-ready reports align with compliance requirements and make it simple to share performance insights with stakeholders.

Read more: Royal Bank of Canada Identifies Underperforming Search Ads Using Smart Tags. RBC uncovered underperforming ads with Skai’s reporting tools, improving CTR by 17.5% and optimizing campaigns with actionable insights.

Automation and AI

Skai’s AI-powered optimization tools are designed to help financial services marketers stay competitive in fast-moving markets. From bid adjustments to rules-based automation, our platform ensures campaigns respond in real time to market changes. Predictive analytics tools provide foresight into campaign performance, enabling smarter, data-driven decisions.

Read more: Royal Bank of Canada Makes Every Dollar Count with Skai’s Automation Tools. RBC maximized efficiency and ROI with Skai’s automation tools, ensuring every dollar spent delivered measurable results.

How do you choose the right tool for financial services SEM?

- The best SEM platform for finance balances performance with governance.

- Choose the tool that fits your workflows and stakeholders.

- A confident decision comes from matching platform capabilities to your operational reality: compliance reviews, pacing discipline, segmentation needs, and reporting expectations. When those pieces align, you reduce risk, spend more efficiently on high intent terms, and make optimizations that stand up to scrutiny.

For financial services marketers, having the right SEM platform is essential to driving success. With high stakes, competitive keywords, and complex compliance requirements, the right tool can make the difference between meeting goals and exceeding them. It’s not just about managing campaigns; it’s about optimizing every dollar spent and delivering measurable results.

Even if you think you’re already using the best tool, it’s important to evaluate the field every year. Technology evolves, and so do your needs. Plus, even confirming that you’re with the platform best suited to your business is a valuable insight that reinforces confidence in your strategy.

We certainly think Skai will knock it out of the park for your financial services marketing. When you’re ready, schedule a quick demo to see how we can support your SEM goals and help you achieve even greater success.

Related Reading

- Strocko Consulting Leverages the Power of Custom Metrics to Boost FinServ Client’s Conversion Rate by 67% Conversion focused optimization improves when you connect offline funding outcomes to search decisions.

- Wild Fi unlocks effective bottom-of-funnel audience optimization to lower CPA 46% Strong segmentation and conversion quality signals can materially reduce CPA in finance and insurance.

- Creditas Mexico use Bid Multipliers to reduce CPA by 16% and boost conversion volume by 16% in two weeks Bid controls and rapid testing help balance efficiency and volume in high pressure acquisition programs

Frequently Asked Questions

How should I evaluate SEM platforms for financial services?

Use a weighted scorecard and real workflows.

Start by listing required capabilities like compliance approvals, budget pacing, segmentation, and audit ready reporting. Assign priority weights, run consistent demos, and score each vendor against the same scenarios. Close with a stakeholder debrief to validate tradeoffs before selecting the best fit.

How do I build a compliance workflow for paid search in financial services?

Define required reviewers by product and region, then map approvals to campaign objects such as ads, extensions, and landing pages. Use standardized templates, required fields for disclosures, and time stamped audit logs. Add exception handling so urgent changes are still documented and reviewable.

Why isn’t my budget pacing working in high-CPC finance keywords?

Common issues include using static daily budgets while auction conditions shift, over funding broad match terms, or failing to isolate high intent segments by product and geography. Strong pacing requires real time controls, guardrails by portfolio, and fast reallocation from underperformers to proven converters.

SEM platforms for financial services vs native tools: Which is better?

Native tools can work for simpler programs, smaller portfolios, or teams with minimal compliance routing. A dedicated platform is usually better when you need audit trails, multi stakeholder approvals, advanced pacing, and reporting that ties spend to CAC and LTV across products, regions, and channels.

What’s new with SEM automation and AI in 2025?

More teams are applying automation to forecasting, pacing, and audience signals while adding governance to keep decisions explainable. The biggest shift is pairing faster optimization loops with guardrails for compliance and brand safety, so AI can scale impact without creating operational or regulatory risk.

Glossary

SEM platform: Software used to plan, manage, and measure paid search programs, often integrating budget pacing, compliance workflow, and reporting and insights so teams can scale campaigns with consistent governance.

Compliance workflow: The review and approval process that routes ads and landing changes through legal and brand stakeholders, supported by audit logs that complement reporting and insights needs in regulated environments.

Budget pacing: Controls that distribute spend across time to prevent early overspend and protect coverage during key periods, typically managed alongside SEM platform automation and reallocation logic.

Multi-touch attribution: Measurement that assigns conversion value across multiple interactions rather than one click, helping reporting and insights connect SEM activity to CAC and LTV outcomes.