Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

This month’s question for our panel of retail media experts comes from our recent research, The State of Retail Media 2022. To get a better understanding of the trends driving this channel, Skai and BWG Strategy surveyed mid-level and senior-level decision-makers who spend a key portion of their week involved in retail media.

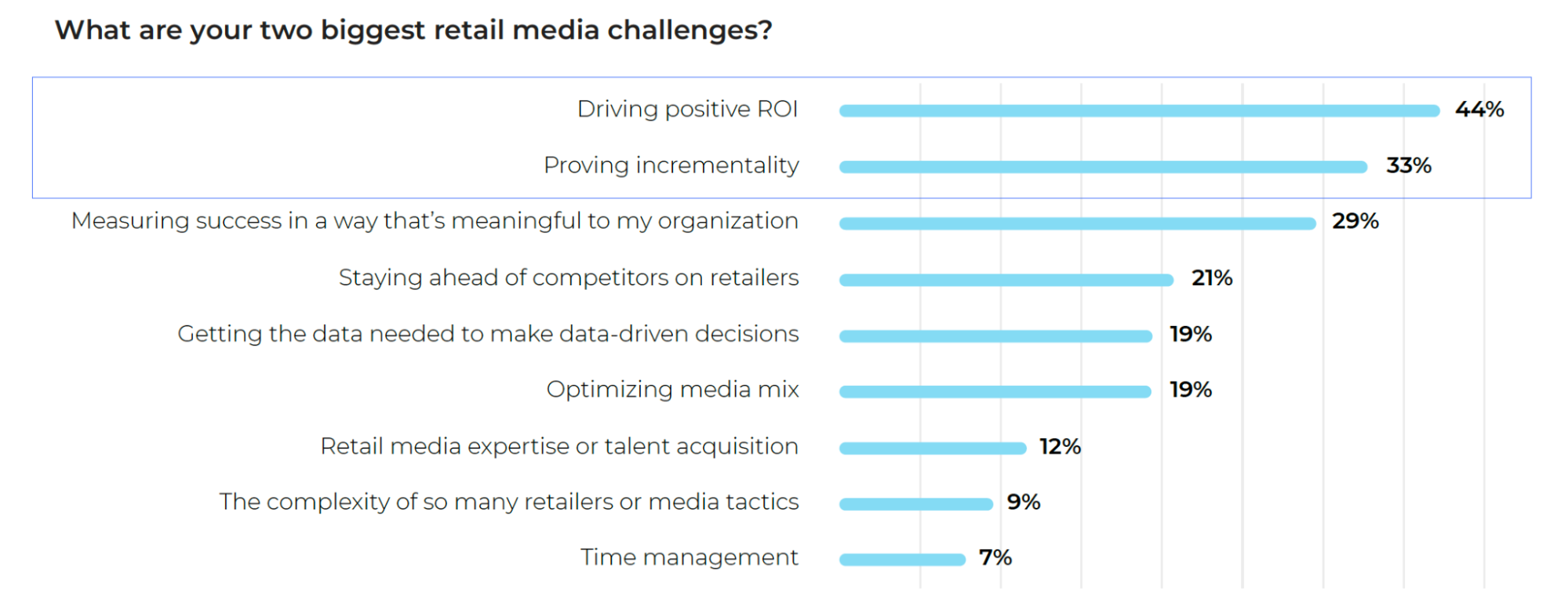

One of the questions we posed to respondents was: “What are your two biggest retail media challenges?.” It may not surprise you that the top two issues cited were measurement-related? (“Driving positive ROI” and “Proving Incrementality”)

Today, we ask our expert panelists their thoughts on this matter and how retail marketers are addressing the measurement problem.

Do you have any burning questions you’d like to ask our expert panel? Would you like to contribute to this series? If so, please reach out to our content director, Josh Dreller, at joshua.dreller@skai.io.

– Michelle Urwin (Senior Director, Strategic Marketing @ Skai)

from The State of Retail Media 2022. Download your complimentary copy today.

As advertisers, it’s our goal to identify the effect an ad has on a business’s top-line revenue goal and focus investment on the channel, campaign, or ad that’s driving incremental revenue.

In terms of understanding success at the campaign or ad level, campaign structure is paramount. When auditing campaigns for advertisers, a common issue I find is that keywords or targeting options that reach users at different stages of the funnel are managed within the same campaign.

For example, non-brand and competitor keywords are typically searched for by users who are not brand-aware; revenue from those keyword types adds to incremental revenue. Brand keywords are searched for by users whose intent is likely to purchase from the brand. Because non-brand keyword traffic is driving incremental revenue, it’s essential to manage those keywords in separate campaigns and hold them to different KPI goals.

When measuring success, include all metrics that help to prove incrementality; for example, Amazon’s “New-to-Brand” metric. Additionally, including top-line revenue (advertising + organic) in advertising reporting will help to demonstrate how advertising investment impacts top-line revenue.

At a higher level, understanding how channels drive incrementality is a greater challenge. The most effective way to get an accurate answer is a Market Mix Model (MMM) analysis.

An MMM measures the impact of media, but also goes beyond that, with the ability to factor in competition, price changes, seasonality, and more. An MMM also establishes a baseline level of sales a brand can expect if media is turned off.

A digital marketer’s main job is improving accounts based on goals. Our secondary job is measuring success and reporting it in a meaningful way to clients. There are often more challenges in measuring and reporting than there are in actually achieving the goals.

At beBold we have taken the time to really educate our clients on what any given metric might mean and we use those metrics to explain how any project might have impacted the account. For example, understanding how an increase in click-through rate might mean different things than an increase in conversion rate helps us isolate variables and report success in a meaningful way. If we just updated product detail pages and conversion rate grew while click-through rate dropped, we may need to revisit our titles and main image while celebrating the changes made to bullet points or A+ content.

Knowing why you improved allows replication of the process. At beBold we hyper-focus on education for ourselves and our clients so that we can avoid failed experiments and replicate successful ones.

There are several reasons why marketers are challenged with measurement and proving out incrementally within the retail media space. First, the channels are prioritizing network and ad format expansion versus providing the measurement capabilities that marketers have been accustomed to having. When looking at platforms like Google and Facebook which have had years to build measurement tools and resources, newer networks like Walmart and CitrusAds are still just trying to get off the ground.

A second challenge has been retail media networks’ choice to standardize attribution based on last-touch attribution. This specifically affects measuring incrementality because it doesn’t provide marketers with a way to evaluate the value of additional touch points within the consumer journey. While Amazon has provided a solution within its network through its Amazon Marketing Cloud platform, it solely evaluates Amazon and requires expertise to be able to analyze the data that many brands don’t have. A solution for measuring incrementality is to construct pre/post testing plans that give marketers a method of evaluating the changes that occur. For example, when an advertiser invests more in a channel, utilizes new ad formats, or possibly changes strategies within a channel.

A third reason that measurement is challenging within retail media, particularly sponsored ads, is how ads serve within the various networks. Unlike paid search through Google or Microsoft which have provided ways to evenly rotate creative variations, there is no such capability currently through the retail media networks. The focus has been on relevancy to dictate the serving of ads but provides little ability to test one product against another.

Retail media measurement is challenging for a few reasons. First is data leakage: while Retail Media Networks increasingly offer more precise targeting and measurement, they aren’t yet fully integrated with other touch points on the shopper journey. Once a consumer moves off platform or offline, it’s harder to assess a measurable impact, so retail marketers need a strategy for gathering and analyzing data more holistically across digital and physical ecosystems. Second, each network offers slightly different ad and measurement products, making it difficult to establish consistent KPIs. Third is siloed reporting, as RMNs are walled gardens and measurement is typically limited to that platform. Individual reports aren’t deduped [deduplicated], making attribution and incrementality tough.

Retail media measurement is challenging for a few reasons. First is data leakage: while Retail Media Networks increasingly offer more precise targeting and measurement, they aren’t yet fully integrated with other touch points on the shopper journey. Once a consumer moves off platform or offline, it’s harder to assess a measurable impact, so retail marketers need a strategy for gathering and analyzing data more holistically across digital and physical ecosystems. Second, each network offers slightly different ad and measurement products, making it difficult to establish consistent KPIs. Third is siloed reporting, as RMNs are walled gardens and measurement is typically limited to that platform. Individual reports aren’t deduped [deduplicated], making attribution and incrementality tough.

We work with our clients to identify all data sources, define KPIs, and then stitch together the varied metrics into a unified reporting dashboard for a more holistic view of marketing performance data. Incrementality requires access to a broad and varied data set; by being purposeful in the data points we choose to collect and ensuring the media buy supports a control/exposed test methodology, we can begin to understand program/placement-level impact. Advertisers must be willing to constantly adjust as new metrics and data sources and information become available. This methodology has proven to drive meaningful and measurable results by prompting fluidity in planning across the retail media universe to align with where the consumer is buying and what ad product, optimization capabilities, and performance metrics are available by platform.

Let’s start out by answering the question of why practitioners can be challenged. Sometimes, brands are not on the same page with how to define these topics, how to measure them or where to find the resources to track them.

Let’s start out by answering the question of why practitioners can be challenged. Sometimes, brands are not on the same page with how to define these topics, how to measure them or where to find the resources to track them.

For instance, screenshotting your ad on Amazon is a useful visual to understand how you’re placed in that exact moment for a query. However, a tool like Skai’s Brand Insights share of voice will actually be a more objective approach to understanding your ad appearances over time against your competitors. This concept now opens the door for strategizing around your retail presence and using SOV as a measure of success for advertising alongside other key indicators like ROAS.

Proving incrementality is similar. Not only do some teams speak to this differently, but there isn’t always a clear-cut way to measure it. Does a brand consider advertising revenue incremental to their organic revenue? Should new-to-brand metrics be tracked? From our perspective, both can play a role in measuring incrementality depending on the situation.

The theme here is, to get on the same page across all teams so everyone is speaking the same language. Determine if you have the right measurement tools and get a good grasp on where you currently stand with your key performance indicators. Advertising teams then have a better view of where the gaps are and can create strategies to make impactful optimizations towards your goals.

Advertisers are always looking for ways to prove the incrementality and success of advertising efforts. Within eCommerce, as each category gets more saturated with vendors and sellers alike, advertisers have to find new measurement tools to track KPIs and the overall success of a brand.

Advertisers are always looking for ways to prove the incrementality and success of advertising efforts. Within eCommerce, as each category gets more saturated with vendors and sellers alike, advertisers have to find new measurement tools to track KPIs and the overall success of a brand.

Focusing Sponsored Ads (PPC) advertising strategy on a rank-based approach, moves away from the short-term goal of ROAS (Return on Ad Spend) and focuses instead on the long-term goal of improvement of Best Seller Rankings. This strategy aims to advertise on high opportunity keywords with a product category that has high search frequency and isn’t featured within page one or even in the top 5 listings organically. Investing heavily in these keywords will improve Best Seller Rankings over time and result in lifts in organic sales. Tools to measure success for this strategy are Share of Voice or Impression Share metrics, to ensure consistent and high visibility.

Amazon Marketing Cloud (AMC) continues to be a valuable solution to advertisers running Amazon Sponsored Ads and DSP. Through this measurement tool, attribution can be tracked across both Amazon platforms. This is essential in driving insights for brands focused on upper-funnel tactics and understanding how their brand is impacted by their advertising investments. By integrating a brand’s data in Amazon’s clean room, advertisers can gather full-funnel and cross-channel insights on their customer’s journey. Using this solution, advertisers are able to showcase that Streaming TV (STV/OTT) investments when paired with Static DSP and Sponsored Ads result in an increase in new-to-brand conversions.

Skai’s Impact Navigator solution measures the effectiveness, or incrementality, of a marketing tactic in the only place that matters: the real world. We’ll help you design and monitor testing for any channel in your marketing mix to measure results and optimize ad spend. Impact Navigator surfaces intelligent insights in real time, so you can make data-driven decisions, boost productivity, and drive powerful brand growth.

Want to see Impact Navigator for yourself?

Reach out today and schedule a brief demo.

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information