Prime Day is one of the biggest ecommerce events of the year, inviting thousands of consumers and sellers to participate in some of the biggest deals and savings individuals can expect to see annually. Skai is here to help your business exceed revenue expectations and prepare you for each Prime Day. In this piece, we give you the data, insights, and results you need to stay ahead of the curve for Prime Day and beyond. Feel free to start at the beginning or jump to specific years or results with our Table of Contents.

Amazon Prime Day has been an event that always attracts both shoppers and advertisers in large numbers for years. As a singular event, once a year, it typically yields advertiser spending at three to four times the daily average for the month running up to the two-day online sale.

TABLE OF CONTENTS

- What Is Prime Day?

- How to Prepare for Prime Day

- How to Prep for Prime Day 2023

- Prime Day 2023 Results

- Prime Day 2022 Results

- Prime Day Early Access Results

- Prime Day 2021

- Prime Day 2020

- Prime Day 2019

What Is Prime Day?

Every year Amazon hosts Prime Day that entails 48 hours of exclusive deals throughout each department. Prime Day brings a massive amount of engaged consumers to Amazon who are in a feeding frenzy looking for deals. What makes Prime Day even more of a strategic win for Amazon is that it uses the event to get more Prime subscribers who generally outspend non-Prime members on the site by two or three times.

For product companies, Prime Day has become one of the most important shopping holidays of the year. It’s estimated that last year’s Prime Day generated $10.4 billion globally over the two-day event, up 45.2% from $7.16 billion in 2019. Due to last year’s pandemic, Amazon shifted the event to October, but Prime Day is once again back in the summer.

While marketers are able to optimize their Amazon Advertising programs throughout the three months of Q4’s end-of-the-year holiday shopping season, Prime Day represents a unique challenge because of how short it is. Marketers have to put their best foot forward because there isn’t much time to make any changes. That doesn’t mean practitioners aren’t going to be glued to their hourly results to make changes throughout the event. They will be.

But, it’s important to show up with the best Amazon Advertising plan possible to maximize sales and revenue. And that’s not always easy to do.

How to Prepare for Prime Day

The three phases of Prime Day. Marketers should be diligent through the Prime Day season as the pre-and post-periods of the event are critical times to fully maximize your Prime Day success.

Prepare well in advance. Start ramping up spending and progressively increasing keyword bids starting a couple of weeks before Prime Day. This will allow for optimizations before the deadline and translate into a more efficient performance during the event.

Be intentional with your Prime Day strategy. Following the Pareto principle — focusing on the 20% that impacts 80% of your business — ensure your top products get enough support across the priority keywords throughout the event, especially when running on a limited budget.

During Prime Day, look out for opportunities such as targeting competitor products or pivoting from specific components of the strategy that aren’t working as expected.

After Prime Day, take your time to study performance at the brand, campaign, and product level. Look at your main metrics, as well as more complex metrics to get a holistic view of the actual value of your advertising spend, not only throughout the event but the effect it will have on the following months.

https://www.youtube.com/watch?v=HRvY2NtXkm4

How to Prep for Prime Day 2023

It’s important to take historical market data into account when finalizing your Prime Day strategy to ensure you’re maximizing your return. We’ve put together insights and key takeaways to help you ensure the visibility of your products and boost sales on Prime Day. Download our Prime Day Prep guide today.

Product Availability

To see increased sales, you will need enough stock to satisfy the increased demand, especially if there are plans to run a promotion or discount on any products.

Our recommendation is to align with Amazon beforehand (especially if enrolled in the SVS program), on your expectations as a vendor, as well as Amazon’s forecast for the event. Sometimes, Amazon will agree to raise manual orders to minimize the risk of fast-moving products being out of stock. Alternatively, you can also raise Born To Run orders for a quick top-up if you think Amazon stock holding doesn’t align with your plans for the event.

On the other hand, marketplace sellers are encouraged to send stock in advance to avoid last-minute warehouse capacity restrictions and delays in stock acceptance. Features such as our Brand Analytics integration help clients create a clear view of inventory and units on hand leading up to the event.

Product Prioritization and Diversification

In recent years, Amazon has extended its Prime Day to more of a full-week event. Although the highest amount of conversions is commonly seen on Prime Day itself, it’s important to not underestimate the opportunities available across the wider event dates.

With Prime Day being an excellent opportunity to present your brand to thousands of new customers, placing your top-selling products on a deal with high perceived value and visibility on Prime Day itself is wise. However, the week of Prime Day is a great opportunity to grant visibility to slower-moving lines or other strategic product choices.

Consider promoting lower price point products that showcase your brand and serve as a sample to customers. Even if margins aren’t large enough to make a profit, you can use these audiences for remarketing purposes once the event has finished upselling your more profitable, top-selling products.

Advertising Optimization and Planning

A solid campaign structure that addresses different touchpoints in the customer journey tends to outperform less diversified structures. Ensure you have a healthy mix of Sponsored Products, Sponsored Brands, Brands Video, and Display, as well as DSP if this is part of your strategy. Diversification will allow your brand to interact with consumers in different ways, as well as improve CPC efficiency and brand memorability, among other factors.

Give yourself enough time for campaign building, as well as for the campaigns to run for some time before the event. Our recommended live date is a minimum average of two to three weeks before the event, with those campaigns that have a larger budget ideally in the three to four weeks bracket. Additionally, as DSP tends to need longer turnaround times than Sponsored Ads, schedule your campaigns to be live at least four weeks prior to Prime Day.

According to our research, CPCs were 40% higher on the first day of Prime Day 2021 and 50% higher on day two versus the daily average in June leading up to the event. Thus, It is best practice to progressively increase your bids to be between 10-20% higher during Prime Day when compared to your average CPCs. This will help your campaigns get impressions with the increased demand for existing inventory that brands are likely to experience during the event.

In terms of keyword match, we recommend that 60% of your budget goes toward exact match keywords, as these allow for tighter control and higher quality of optimization. Also, make sure to include placement modifiers in favor of Top of Search to improve discoverability, as audiences’ searches change every year. Therefore, even if you’re leveraging last year’s Prime Day data, increase your Automatic campaign’s budget for the event to capture new and event-specific placements that your keyword research may have overlooked.

Remove low-performing keywords before the event to avoid creating a hole in your budget caused by non-converting keywords. With Skai’s Search Term Analysis you can seamlessly add negative search terms from a list of suggestions to the relevant ad groups in an easy-to-use UI, allowing you to spend more time optimizing your campaigns.

Product prioritization is also going to play a role in advertising. If you do not have a large enough budget to properly cover everything, consider shortening the list of products being advertised to maximize coverage where it matters most so you can strategize an out-of-budget plan.

Budget and Bid Planning

To achieve top results, it’s a best practice to progressively start increasing spending a week or two prior to Prime Day. As for historical context, average daily spending increased 3.7x on Prime Day 2021 compared to the daily June average. So, begin to increase your bids across your priority keywords to increase both paid and organic visibility. By doing this you will give a competitive advantage to your products for the event, where CPCs are expected to increase 2-4x depending on the category and the time of day.

With the large influx of customers and sellers that Amazon attracts during Prime Day, some vendors and sellers aren’t necessarily prepared from a budget perspective for the increased costs this brings. Don’t let that be you! Be sure to set aside extra budget for the weeks leading up to and the two days of the event.

It is quite frequent for brands to run out of budget early in the day and not be able to extend their campaigns’ budgets. And, as last year’s sales revenue jumped 4.2x on average, you want to ensure you’re not missing out on a large opportunity to drive sales. To avoid this, allocate enough budget (based on previous events and/or speaking to your advertising representative), as well as allow for some contingency budget in case there’s a need to increase budget caps even further.

Skai’s Automated Actions monitors campaign budget pacing in real-time and increases budgets on campaigns that have capped throughout the day. As Amazon lags on real-time data, we recommend Automated Actions as your main tool for optimizations and manual managing of bids for best results. In turn, be sure to pause any Portfolios running through Budget Navigator that might conflict with your Prime Day strategy given the fluctuations and delayed data during the event.

Seamlessly customize the pauses and campaign management for Prime Day by leveraging revert bids. Set the pause date, update budget allocation manually, exclude Prime Day dates so that the algorithm will skip the abnormal activity performance on these days, and then turn it back on once the event is over.

Additionally, make sure you have done your due diligence and have solid keyword research and harvesting strategies well before the event, including event-related keywords. Skai’s keyword harvesting tool enables you to set a large array of if/then rules that will help you identify what customers are looking for and capture that traffic much faster than in a more manual, traditional way.

Competitor Activity

Taking into consideration that early budget capping is a frequent issue brands come across, use this to your advantage and intensify your activity during the afternoon and evening, when competitors’ advertising activity may be losing some steam. For this purpose, a dayparting tool allows you to schedule bid increases throughout the day across specific campaigns and ad groups, as well as pause campaigns in strategic moments of the day in which we see drops in consumer activity to prioritize early morning, lunch, and evening time.

Additionally, depending on the nature of your brand or category, if some of your campaigns begin to run out of budget, you may want to focus on undecided customers versus brand traffic. Although more expensive, this will expand the pool of customers that interact with and learn about your product, and you can use in the future to drive brand loyalty.

Keep an eye out for competitors that aren’t participating in Prime Day deals, as you could include aggressive product targeting via Sponsored Products and Sponsored Display to go after these products. Take this as an opportunity to increase your category market share throughout and after Prime Day.

To understand who your competition is and the spread between your share of search and theirs, leverage share of voice data via Skai’s Brand Insights.

Brand Store

Creating a deals subpage on your brand store to drive traffic to via Sponsored Brand ads can prove to be a great strategy, especially for brands with larger catalogs. Just as with a D2C website, personalizing your brand store for the event will improve relevancy and translate in more conversions.

Prime Day 2023 Results

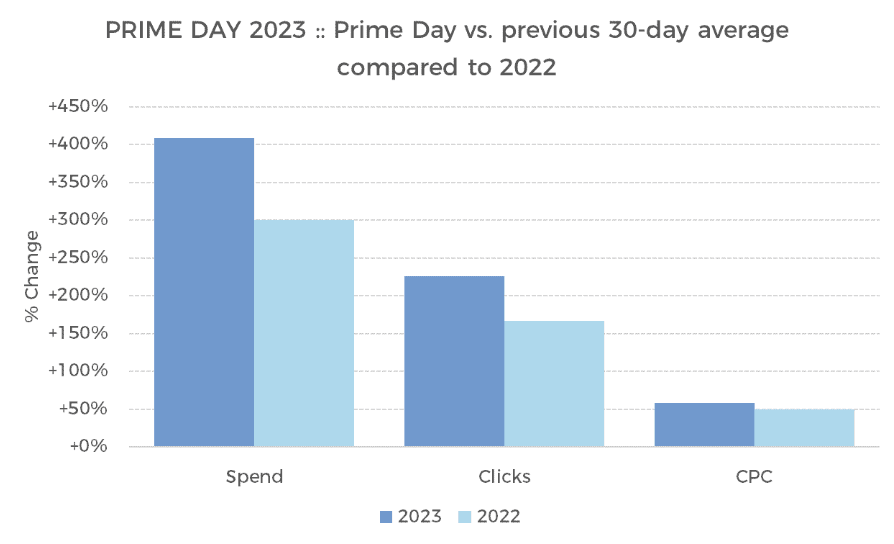

During the two-day Prime Day 2023 event on July 11 and July 12, advertising expenditures skyrocketed by a remarkable 409% (5.1 times) compared to the average of the previous 30 days. This is a significant increase compared to last year’s growth of 300% (4.0 times).

Spending rises are typically influenced by two factors: an increase in ad engagement from shoppers or an increase in ad costs for advertisers. In the case of Prime Day, both factors played a role. Clicks on ads surged by 226% (3.3 times), and the cost per click (CPC) rose by 58% (1.6 times). These growth rates surpassed the increases seen last year, which were 167% and 50% respectively.

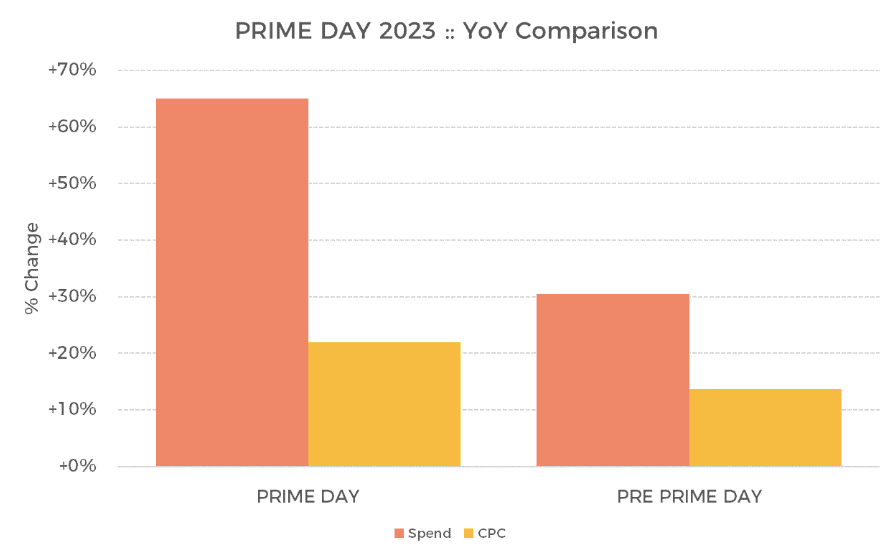

Compared to the levels in 2022, spending during Prime Day witnessed a remarkable 65% increase year-over-year (YoY). However, it is important to mention that the 30 days preceding Prime Day this year already experienced a 30% increase compared to the same period last year. Hence, it would be more accurate to attribute just over half of the YoY spending growth to Prime Day.

The average cost per click (CPC) for 2023 displayed a YoY increase of 22% during the two-day event and a 14% increase during the 30 days leading up to it. It is worth noting that last year saw a YoY decrease in CPC, which, in retrospect, seems to reflect the economic uncertainty related to factors such as gas prices and inflation.

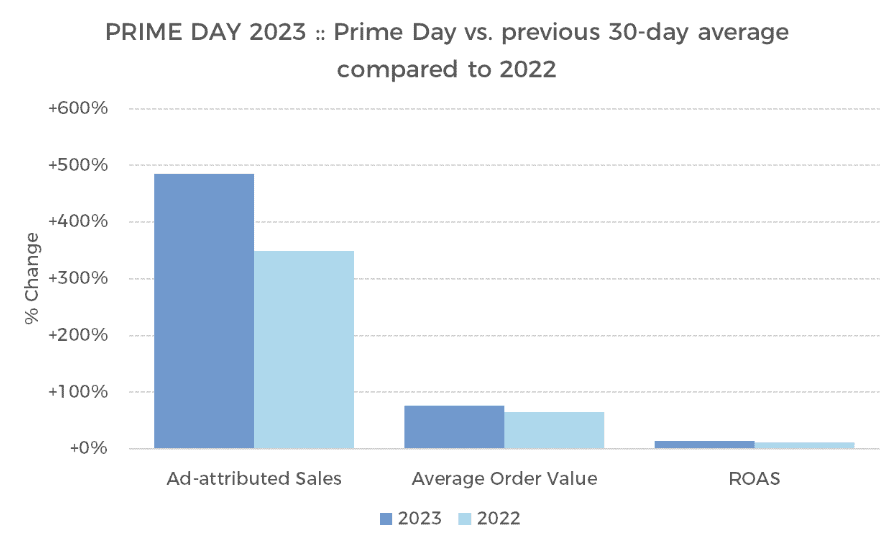

Compared to last year, the sales resulting from the increased ad spending show a more considerable growth. In simple terms, consumers made more purchases.

The average value of a shopping cart increased by an impressive 76%, from an average of $36 during the 30 days prior to Prime Day to $61. As a result, ad-attributed sales revenue soared by a staggering 486% (5.9 times) in comparison to the previous 30 days. With revenue growing at a faster pace than ad spending, this indicates a 14% growth in Return on Ad Spend (ROAS), even with the added volume.

When examining year-over-year (YoY) changes, we observe a minimum increase (“floor”) of +19% for the pre-Prime Day period, followed by an additional 20% growth during Prime Day itself. This totals to a YoY growth of +39% over the two-day period.

In conclusion, Prime Day continues to showcase significant value for brands as they expand their customer base and increase product sales at a faster pace. This often translates to a higher return on investment for their advertising efforts. The data also indicates that, in a year marked by a general improvement in the economy, overall shopping behavior has seen an accelerated growth, building upon its momentum.

Shoppers have resumed their shopping habits

Shoppers have resumed their shopping activities, indicating a positive rebound in the economy. Prime Day 2023 experienced a greater surge in both ad spending and consumer purchases compared to last year’s event within the previous 30 days. Notably, conversion rates in retail media rose by 8% and search conversion rates increased by 10% in Q2 2023, reflecting an upswing in consumer buying behavior.

Return on ad investments is yielding positive results

Moreover, the investments made in advertising have proven to be worthwhile. Typically, ad prices escalate during high-demand shopping events such as Prime Day, Black Friday, and Cyber Monday. However, despite the increase in ad expenditure, the return on ad spend (ROAS) for Amazon Prime Day 2023 grew by 14% across all product categories. This can be attributed to surges in conversion rates and order value, offsetting the higher cost per click (CPC) during these periods.

Prime Day 2022 Results

According to an Amazon press release:

Prime members purchased more than 300 million items worldwide during Prime Day 2022, making this year’s event the biggest Prime Day event in Amazon’s history. And, more shopping means more savings: Prime members saved over $1.7 billion, more than any previous Prime Day event.

News outlets reported that “total U.S. online spending across retailers reached $11.9 billion (including $6 billion on day one and $5.9 billion on day two), representing 8.5% growth compared to $11 billion in Prime Day’s total online revenue in 2021.”

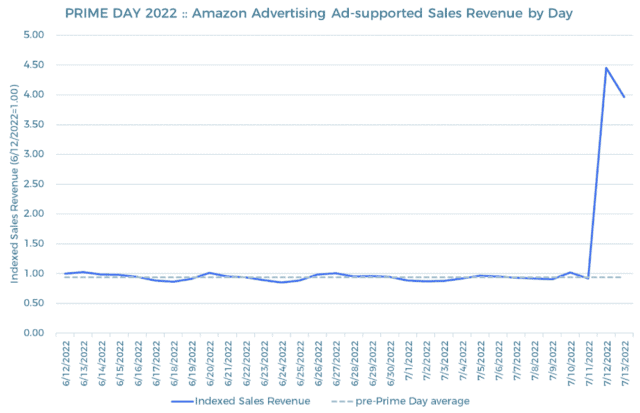

Advertisers spent 4x as much as the days leading up to Prime Day. Daily ad spending on Amazon for the two days of Prime Day was up 4 from the daily average for the previous 30 days.

Ad-supported sales revenue on Amazon for the two days of Prime Day was up 4.5x from the daily average for the previous 30 days.

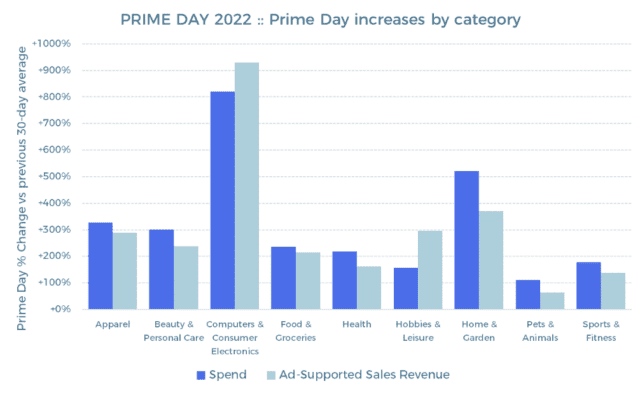

Prime Day continues to be perhaps the biggest boon for the Computers & Consumer Electronics category, which saw spending increase 820% (or 9.2x) over the previous 30 days and ad-supported sales revenue increase by more than a factor of 10. As a result, the technology-heavy category is one of very few that see an increase in ROAS over Prime Day. Other categories, particularly CPG categories with lower price points, make large gains in volume over the two-day period but at a cost of lower return.

Prime Day 2022 results across categories

Prime Day remains a tremendously beneficial event for the Computers & Consumer Electronics category, witnessing a substantial surge in spending by 820% (or 9.2 times) compared to the previous 30 days. Additionally, ad-supported sales revenue in this category has increased by more than 10 times.

Consequently, the technology-focused sector is one of the few categories that experience an improvement in return on ad spend (ROAS) during Prime Day. On the other hand, other categories, particularly those in the CPG (Consumer Packaged Goods) segment with lower price points, achieve significant volume gains during the two-day period but at the expense of reduced returns.

Prime Day 2021

As we reported last week, the first day of Amazon’s Prime Day 2021 shopping event was a very active one for marketers, with advertising spending on retail media up 3.7x compared to the daily average of June leading up to the event.

Retail media advertisers spent big but also had big results: Prime Day advertisers garnered 4.2x average daily sales revenue versus the daily average sales revenue in June during the days leading up to the event (June 1-20).

We share our full Prime Day 2021 results in ad spending, ad costs (CPC), and sales including some key categories that overperformed.

Retail media spending

Prime Day 2021 retail media average daily spending versus the daily June average leading up to the event:

- Day 1: Advertisers spent 3.7x

- Day 2: Advertisers spent 3.6x

- Computers & Electronics spent 7.9x on Day 1 and 9.1x on Day 2

Prime Day 2021 retail media average daily spending versus Prime Day 2020

- Day 1: Advertisers spent 1.4x what they did on Day 1 of Prime Day 2020

- Day 2: Advertisers spent 1.6x what they did on Day 2 of Prime Day 2020

- Non-U.S. advertisers spent 1.6x on Day 1 and 2x on Day 2 versus Prime Day 2020

Prime Day 2020

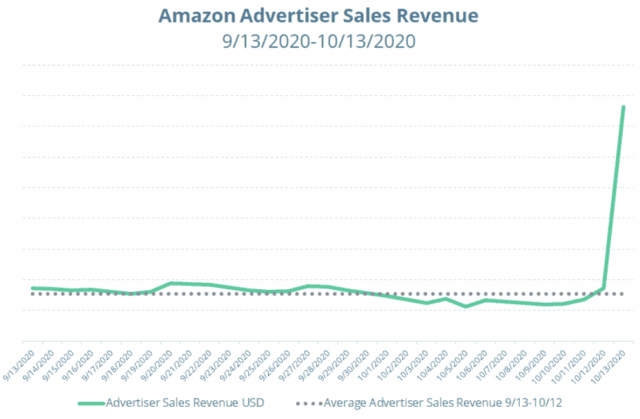

As has been the case every year since Amazon started the [now] two-day event in 2015, this Prime Day 2020 was the biggest ever. Days before, eMarketer forecasted global sales of the event would reach nearly $10 billion and that’s not even counting the “halo effect” that it has to help drive deal-seeking consumers to shop at other retailers.

Versus the average of the 30 days leading up to Prime Day 2020:

- Spending on Amazon Advertising was up 3.8x

- Advertising-driven conversions were up 2.6x

- Advertiser sales revenue was up 4.9x with average order size up 91%

In a press release, Amazon didn’t confirm total sales but did note that Prime members saved more than $1.4 billion. The online retailer did go into detail about how big Prime Day 2020 was for their SMB sellers, which have been severely impacted by COVID-19. “We are thrilled that Prime Day was a record-breaking event for small and medium businesses worldwide, with sales surpassing $3.5 billion, an increase of nearly 60% from last year,” said Jeff Wilke, CEO Worldwide Consumer.

Other notable Amazon Advertising KPIs for Prime Day 2020 (versus the previous 30-day average) included impressions up 3.6x and clicks were up 2.9x. While dramatically scaling up advertising spend can often drive a less efficient return, advertising revenue was up 4.9x versus the previous 30-day average.

While the 2.6x lift in conversion rate over the previous 30-day average was a big contributor to advertiser success, the average order value of ad-driven sales was nearly double (91%) versus the same time period.

Prime Day 2019

- Advertisers spent 3.8x on Prime Day compared to what they spent in July leading up to Prime Day and generated 5.8x the revenue

- For Day 1 of Prime Day (July 15th), Skai advertisers that participated both years spent 2x what they did in Prime Day 2018

- Toys & Games spent 6.3x YoY

- Health & Beauty spent 3.1x YoY

- Computer & Electronics spent 2x YoY

- CPG (not known for promotions) spent 1.2x YoY

According to Skai performance data, advertisers spent an average of 3.8x more on the first day of Prime Day (July 15) versus the average July day leading up to the big event. And it was well worth it as these brands garnered 5.8x the revenue that day versus the average day this month.

According to the press release, Amazon said that Prime Day was once again the largest shopping event in its history with more than one million deals exclusively for Prime members. Amazon Prime Day 2019 (July 15 and 16) surpassed Black Friday and Cyber Monday combined with consumers worldwide purchasing more than 175 million items, from devices to groceries and more, throughout the event.

Prime Day Early Access Results

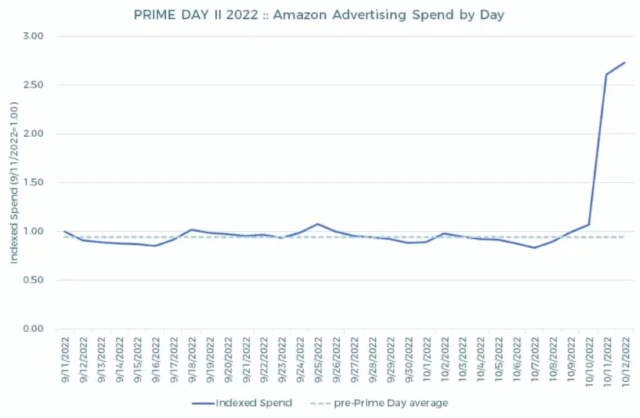

In 2022, we had a second Prime Day event for the first time, spanning October 11 and 12. Sandwiched between the first Prime Day — maybe call it Prime Day Prime? — and the holiday season, the nominal goal of the new event is to help jumpstart holiday spending well in advance of Thanksgiving weekend. To some extent, that was what happened in 2020 when the initial event was pushed back because of the COVID-19 pandemic.

With marquee events on either side of the Amazon Prime Day Early Access Sale, as it was officially called, advertisers and consumers could be forgiven if they didn’t respond quite as strongly. Compared to the 4x increase in advertiser spending for the first Prime Day in July, compared to the previous 30 days, the October version only saw an average spending increase of 2.8x.

This means that the spending difference resulted from a smaller increase in click volume this time around. While it would be easy to point at the macroeconomic environment, it should also be noted that consumers do not have an inexhaustible supply of dollars to spend even in the best of economies, so competing with a similar event just three months ago was always going to be a very high bar to clear. Overall volumes, whether spending, clicks, or sales revenue, were down compared to that event by 30-50% depending on the metric.

When we look at ad-driven sales revenue — how much Prime Day advertisers made in product sales — the increase over the previous 30 days was 2.9x.

Skai helps marketers during Prime Day and every other time of the year

Skai empowers the world’s leading brands and agencies across industries to manage omnichannel digital marketing campaigns. Our marketing platform includes solutions for retail media, paid search, paid social, and app marketing.

Utilize Skai’s available tools to improve campaign performance before and during Prime Day: Automated Actions, dayparting, Automated Keyword Harvesting, Categories and Dimensions, and Search Term Analysis; as well as our advanced Scheduled Reports tool to get an in-depth analysis of campaign performance.

We’ll keep you at the forefront of the digital evolution with data and insights, marketing execution, and measurement tools that work together to drive powerful brand growth.

For more information or to schedule a brief demo to check out all of our cutting-edge innovation for yourself, please reach out today.