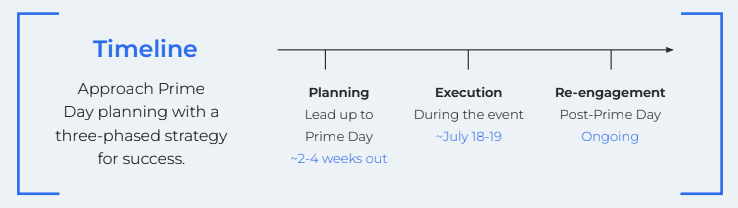

With your Prime Day plans likely already in motion, Skai’s Expert Services team would like to offer some final advice to help you make sure those programs are set to drive the maximum value for your investment. There are just so many things to say about this critical shopping event that we couldn’t contain them in a single article. This post is part of a week-long Final Prep for Prime Day 2022 series.

Thank you for joining us this week as our Expert Service team shared its recommendations for retail advertisers to maximize Prime Day sales at all three phases of the event:

In your final plans, we wanted to make sure that you don’t miss out on cashing in with the other retailers in your portfolio—such as Walmart and Target—during this time.

You see, since Prime Day began, it’s been well-documented that the extra buzz around shopping has stimulated commerce even off of Amazon.com, and 47% of consumers expect other retailers to offer deals due to Prime Day. So, make sure you’re ready for the extra attention your products will likely garner during the Amazon event.

“As Prime Day becomes increasingly popular, especially in Europe, brands and retailers are beginning to follow the retail holiday trend with sales of their own, and they’re really seeing the pay-off,” said one industry exec according to FashionNetwork.com. “Consumers are very much open to shopping in places other than Amazon. They shop at a combination of Amazon and other brands/retailers during Prime Day and prioritize those that have the most attractive sales.”

2021 Research on the Halo Effect of Prime Day

Here’s some research from our partner, Criteo, about last year in its blog post, Amazon Prime Day Halo Effect Retains its Glow in 2021.

To investigate the Amazon Prime Day halo effect, we used data from 300 million transactions globally in June 2021, coming from 8,000 retailers. In particular, we took a closer look at the sales generated by “participating retailers” (those likely to be running their own promotions at the same time, based on having a sales increase of at least 20% during the event) versus “non-participating retailers” (those with less than a 20% increase in sales during the event).

-

- Globally, participating retailers saw +19% traffic, +45% sales, and +23% conversion rate. Non-participating retailers saw -9% traffic, -14% sales, and -6% conversion rate. (Globally, about one quarter of retailers were considered as “participating.”)

- In the US, participating retailers enjoyed +48% sales on June 21 and +38% sales on June 22. Conversion rates were up more than 40%.

- In Australia, participating retailers recorded a sales increase of 51% on June 21.

- In Europe, participating retailers generated a sales increase of respectively +45% and +24% on June 21 and June 22. Conversion rates increased 14%.

- Around the world, product categories that saw the biggest sales increases included sporting goods, apparel, consumer electronics, home goods, and mass merchants.

Skai’s data also confirms the halo effect of Prime Day on other retailers

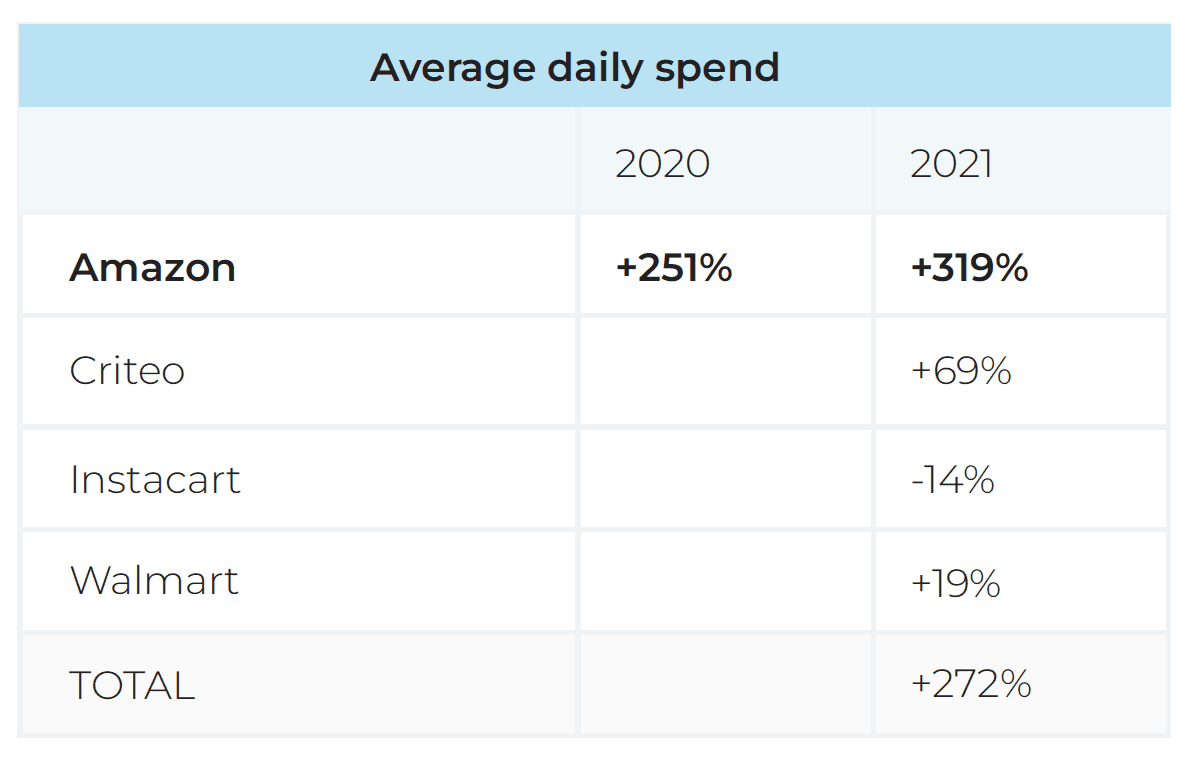

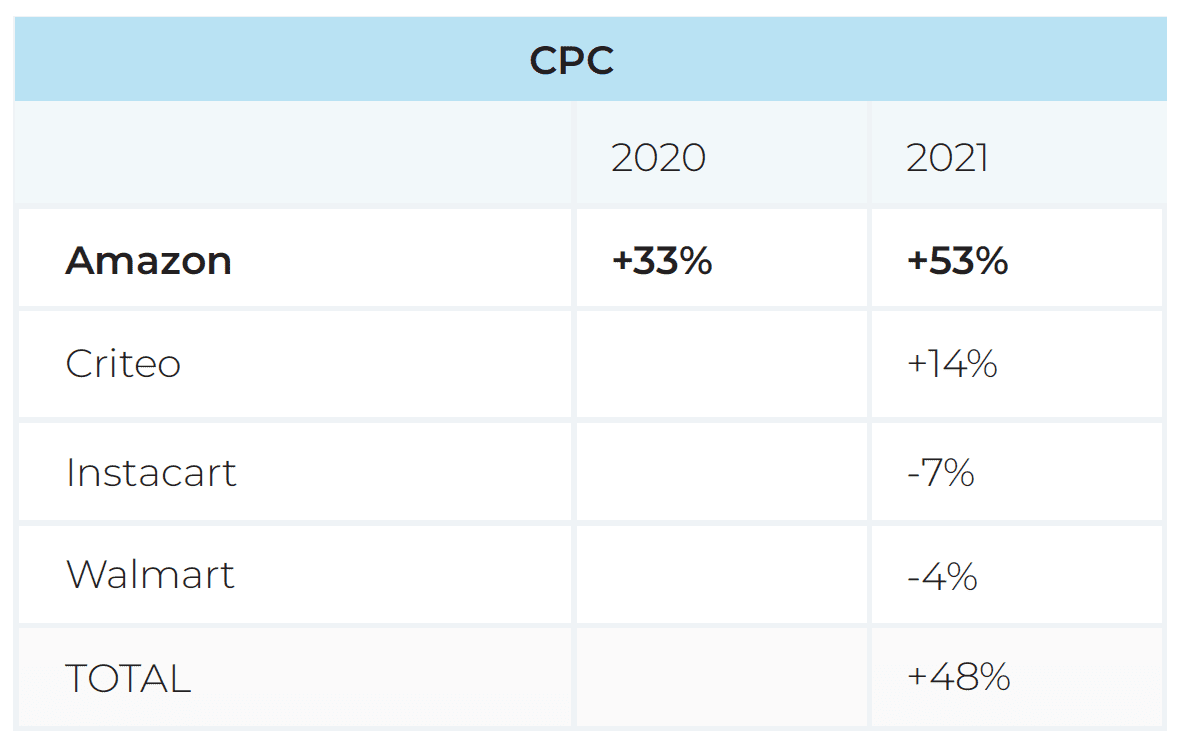

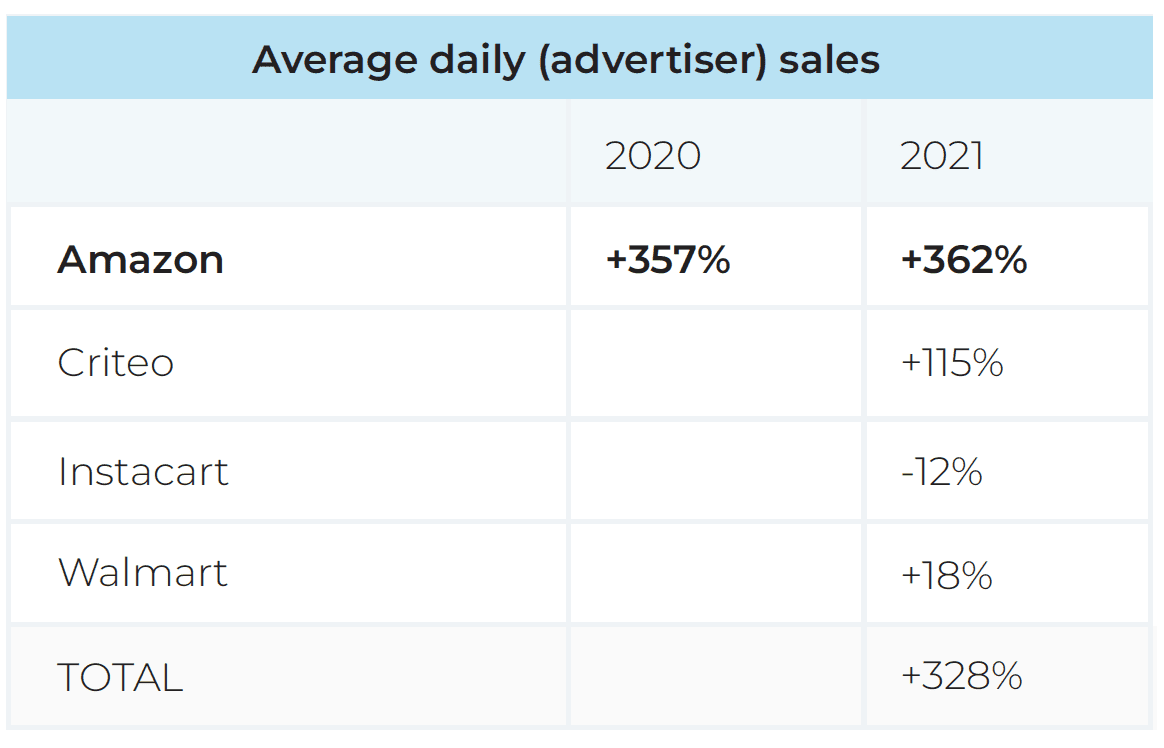

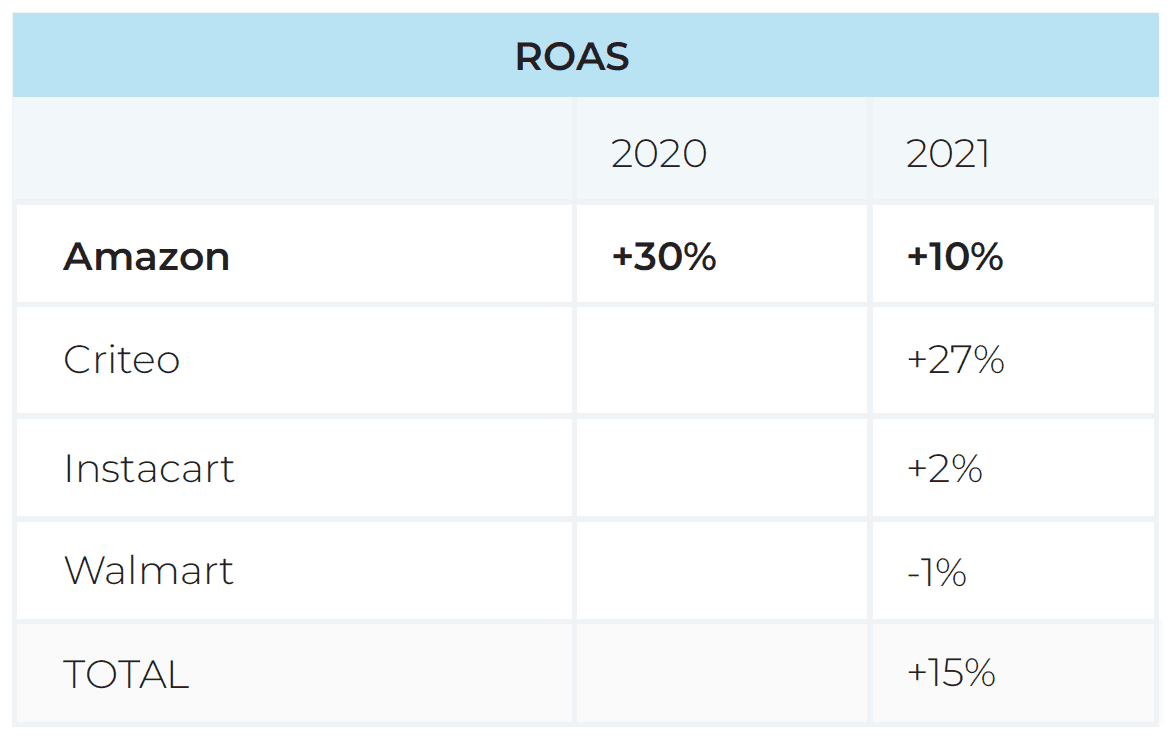

And, as you can see below, retail media advertisers also ramped up spending and bidding across these platforms to take advantage of this predictable impact.

Note: All values are average across two days of Prime Day vs. average for the previous 30 days

Skai’s Retail Media solution helps you master your Amazon (and 30+ other retailer publishers) programs

Skai empowers the world’s leading brands and agencies across industries to manage omnichannel digital marketing campaigns. Our intelligent marketing platform includes solutions for retail media, paid search, paid social, and app marketing. We’ll keep you at the forefront of the digital evolution with data and insights, marketing execution, and measurement tools that work together to drive powerful brand growth.

For more information or to schedule a brief demo to check out all of our cutting-edge innovation for yourself, please reach out today.