Chris "Coz" Costello

Senior Director of Marketing Research @ Skai

Chris "Coz" Costello

Senior Director of Marketing Research @ Skai

October marks the beginning of the biggest quarter for many marketers as they gear up for the all-important holiday shopping season. As long-planned campaigns and creative assets are deployed in the final stretch of the year, what is their impact on digital advertising budgets? On ad prices?

According to the Skai Q3 2020 Quarterly Trends Report, the third quarter of 2020 saw some strong signs of recovery in Paid Search and Social Advertising as brands who paused or limited their ad spending at the onset of the pandemic were coming back, setting themselves up for Q4. Meanwhile, Ecommerce Channel Advertising continued its 2020 growth in a year where the online penetration of total U.S. retail sales has doubled in growth versus the previous ten years.

Heading into the fourth quarter, we would expect both spending and pricing for digital advertising to increase across channels as a whole. And that is largely what happened, but we want to take this opportunity to look more closely at how those changes are distributed. Read on to see how much those metrics changed from September to October, and for how many Skai advertisers.

This is our third month of this new benchmarking series. As with any benchmark, your mileage may vary, but we hope this provides a bit more context for you as a marketer as you navigate the ups and downs of your program’s performance.

Methodology note. For the purpose of these monthly benchmarks, only Skai accounts with spend above a minimum threshold for the previous three months are included in this analysis.

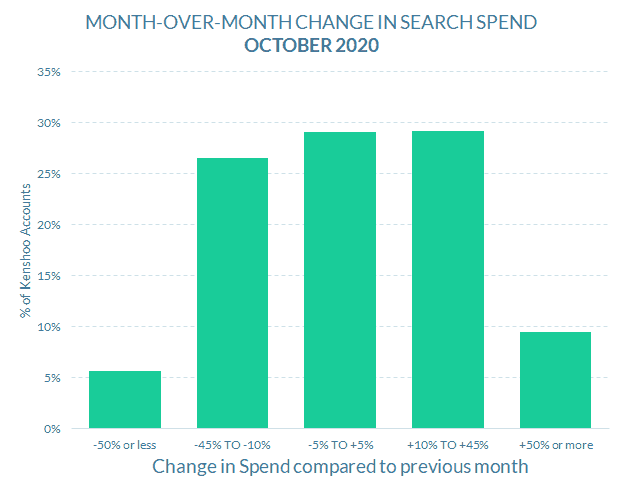

Paid Search spending

Search budgets, on balance, did not change much from September to October, although they trended slightly positive.

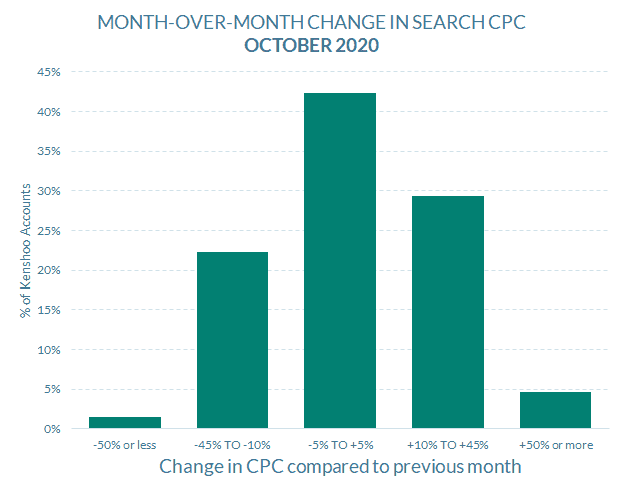

Paid Search CPCs

Paid Search CPCsSearch click prices also mostly held steady in October, with a slightly more positive lean than spending.

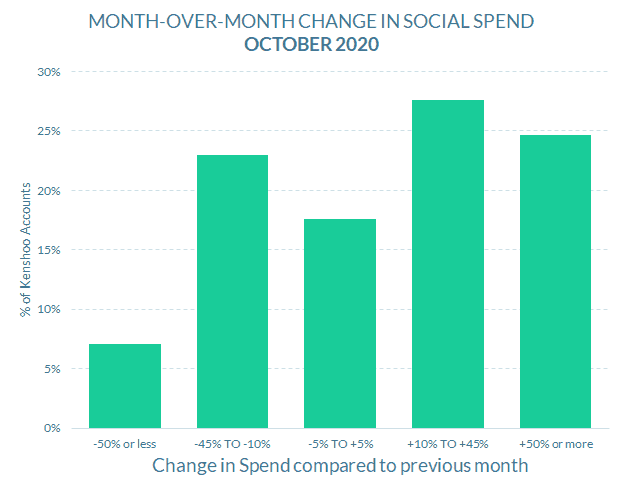

Over half of social advertisers increased budgets by more than ten percent in October, signaling continued growth in the channel.

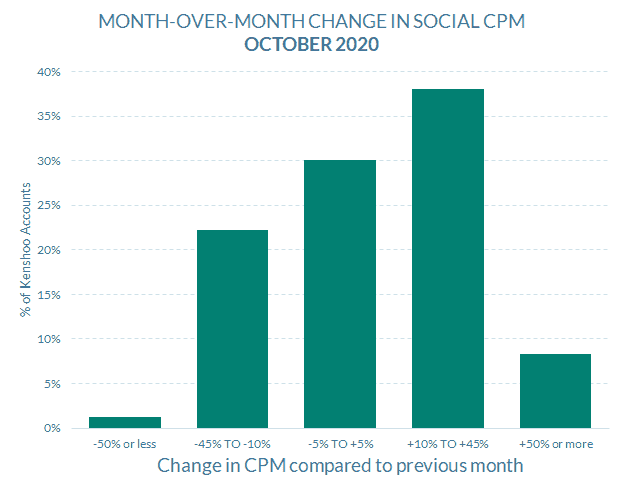

Social advertising CPMs

Social advertising CPMsSocial CPM has been climbing steadily since the onset of the pandemic, and October continued that trend.

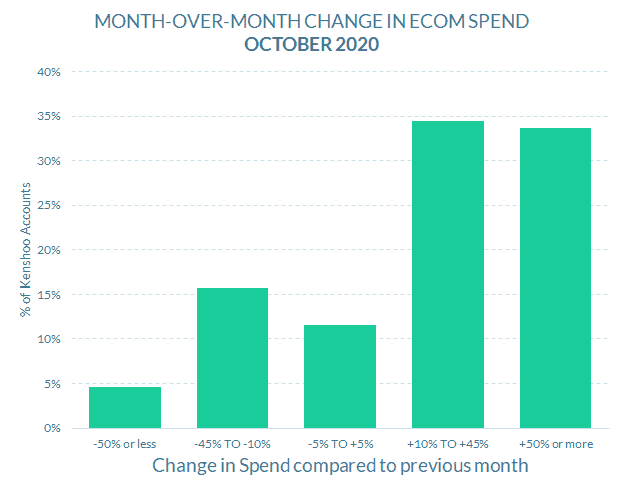

Ecommerce channel advertising spending

Ecommerce channel advertising spendingWith Amazon’s Prime Day in October and not the summer this year, the net result was two-thirds of advertisers increasing their Ecommerce advertising budgets for the month.

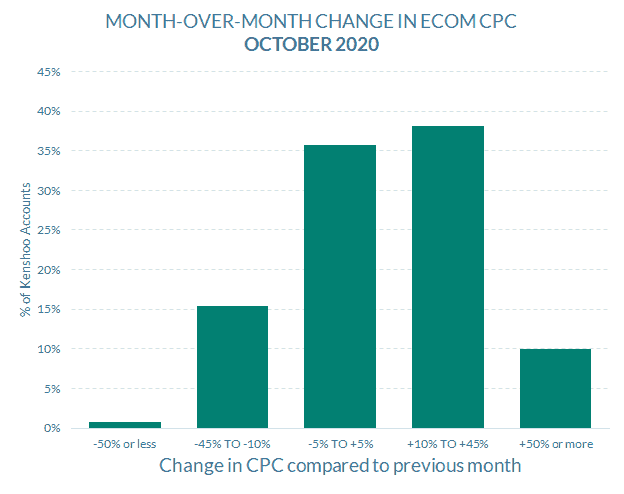

Ecommerce channel advertising CPCs

Ecommerce channel advertising CPCsThe Ecommerce channel has become more price-sensitive over time, as reflected by Prime Day also having more of an impact on click prices.

Come back in December for our next monthly trends post. Until then, you can dive into more of our research via our Quarterly Trends Reports hub and our COVID-19 Marketing Resource Center.

And please visit the Skai blog and Research & Reports page for ongoing insights, analysis, and interviews on all things related to digital advertising.

We use cookies on our website. Some of them are essential, while others help us to improve this website and your experience.

Here you will find an overview of all cookies used. You can give your consent to whole categories or display further information and select certain cookies.