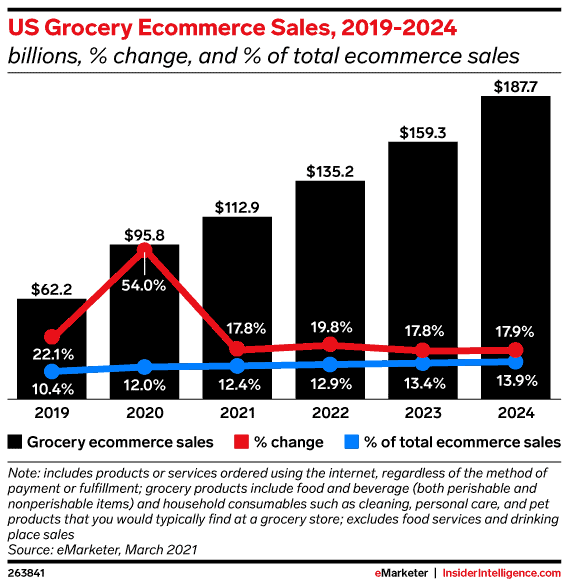

The U.S. online grocery market was estimated to generate about 95.8 billion U.S. dollars in 2020, with sales forecast to reach 187.7 billion U.S. dollars by 2024

And, remember, this market was only at $62.2 billion just a few short years ago. It’s expected to grow to almost $200 billion by the end of 2024.

While the rise of online grocery due to the pandemic has been widely publicized, the question now as the country opens up and is vaccinated is will consumers still keep up this behavior?

The general consensus among industry pundits is that while some shoppers will curb back their online grocery deliveries, this shift in behavior is permanent and will persist long after the pandemic is over.

“Many low-propensity buyers will return to their pre-pandemic purchase behaviors once the threat is sufficiently mitigated through vaccines,” says Andrew Lipsman, eMarketer principal analyst at Insider Intelligence. “Other consumers, now acclimated to the process of buying groceries online, will do so on an occasional basis. And many who developed a regular habit around buying groceries online will carry the behavior forward. Continued growth in digital grocery will now depend more on purchase frequency than new buyers entering the category.”

This is an important question for marketers involved in Retail Media, the digital advertising channel that enables brands to reach shoppers on major ecommerce sites such as Amazon, Walmart, and Target. After all, this channel has fast-forwarded tremendously over the last 12 months, and many investments have been made to follow consumers to the online world.

If the online grocery trend is going to continue at the same meteoric pace, there’s no doubt that this advertising channel — already the third biggest digital channel in the U.S. — will be a major force in the years to come.

What is Instacart Advertising?

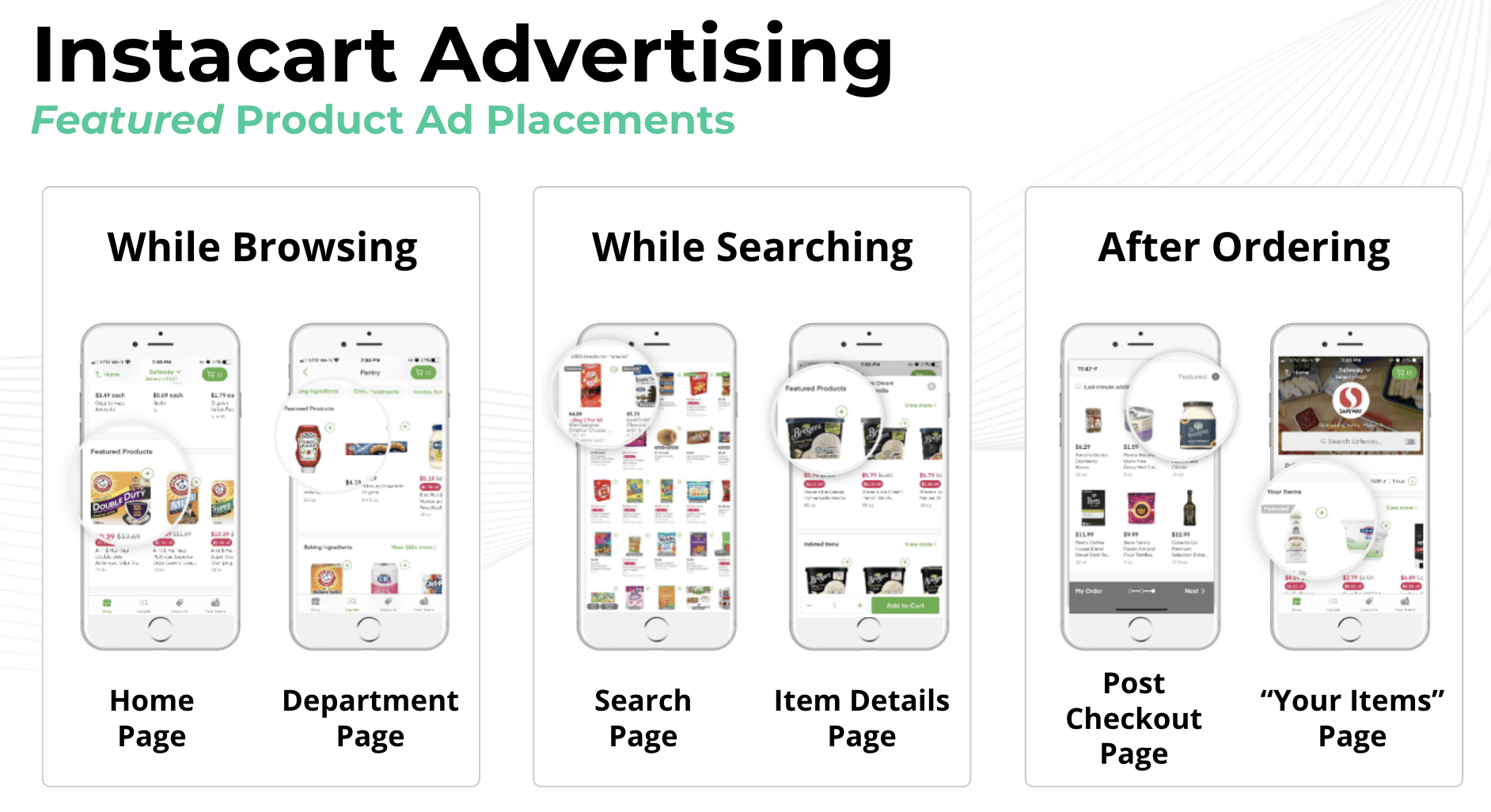

Instacart Advertising is a self-service platform where brands can grow by showcasing products on the digital platform, selling to millions of Instacart shoppers. The digital ad products include Featured Products, Sponsored Products, and Coupons. There is no minimum spend necessary to launch a campaign.

With the continued surge in demand for online grocery delivery, Instacart is working more closely than ever before with brands of all sizes to help them reach customers where they’re shopping via Instacart Advertising. The Instacart Ads self-service Ads Manager launched in May 2020. It’s a fairly straightforward offering with marketers choosing which of their products they want to feature in both the search results as well as in key placements throughout the app.

For many years before the pandemic, Instacart had been making its name as a same-day delivery service. Today, the company partners with nearly 600 national, regional and local retailers to offer delivery and pickup services from more than 45,000 stores across nearly 5,500 cities in the U.S. and Canada.

Today, Instacart Advertising is a part of the greater Retail Media channel, the fastest-growing sector in digital advertising. Recently, Instacart announced in a press release that it had raised new capital and identified its advertising business as one of the key areas that it will look to bolster with this investment.

Instacart and its bright future for agencies

Advertising agencies who have already rallied to build practices around Amazon Ads and other Retail Media examples such as Walmart Connect and Target’s Roundel, cannot ignore Instacart Advertising as a foundational player in this space.

For agency leaders and practitioners who certainly know about Instacart — and probably have already used it in the last year — if you aren’t already connecting your clients to Instacart Advertising, you may want to reconsider. The future is bright for this company, and brands are already looking for agencies who have experience and mastery on this platform to help continue their push into the online world.

Here are five things you should know about Instacart Advertising that will really make you want to prioritize your practice within your agency:

Instacart Advertising Facts

#1 – Very large footprint

Instacart partners with nearly 600 national, regional and local retailers, including unique brand names, to offer delivery and pickup services from more than 45,000 stores to over 85% of U.S. households and 70% of Canadian households.

Instacart’s business model makes it incredibly easy to grow, with order volume up by as much as 500% since the start of the COVID-19 pandemic in the U.S. The company has also grown its community of Instacart shoppers, who pack and deliver orders, to more than 500,000 individuals, up from 200,000 in March of last year.

#2 – Instacart Advertising is now being compared to Amazon & Walmart

While most digital advertisers already know about the Retail Media businesses at Amazon and Walmart, a handful of other retail companies are hoping to be in that conversation. But, it looks as if Instacart Advertising has beaten those other players to the punch, gaining the attention of industry analysts.

In a recent report on 2021 trends:

“Although Google and Facebook will retain their relative dominance over the digital marketing industry, a trio of retail media firms—Amazon, Walmart, and Instacart—will impact the duopoly’s stranglehold on the US market in 2021.”

2021 was a big year for Retail Media and Instacart Advertising was right in the thick of things. According to the Instacart Advertising home page, it offers multiple benefits for brands including reaching customers directly at the point of sale, delivering unmatched scale with premium shelf space across nearly 600 retailers and more than 45,000 stores, as well as driving results across a range of business goals.

#3 – Its market value has grown to $39 billion

With the announcement of $265 million in new investment, Instacart now has a market valuation of $39 billion, effectively doubling its value since October 2020.

So, not only is Instacart not going anywhere, its investors are betting big that it is going to be a major force in online grocery for some time to come. Retail Media practitioners and ad agencies that service this channel should be extremely bullish about Instacart Advertising and ensure that their ecommerce teams are building best-in-class practices to offer their CPG clients.

#4 – It’s not just groceries, it’s household goods and more

First and foremost, Instacart is known as a grocery delivery service. At the height of the pandemic, it claimed over half (57%) of the online grocery market. One of the reasons cited for its immense popularity at the time was that it offered customers access to a wide range of products across hundreds of their favorite retailers.

With over 500 million products on the marketplace, Instacart is today one of the largest grocery catalogs in the world. Instacart remains focused on grocery but is also expanding beyond its core with partnerships with new retailers this year including Walmart, 7-Eleven, Sephora, Best Buy, Bed, Bath & Beyond, DICK’s Sporting Goods, and more. Same-day delivery can be a very difficult feat for individual chains, but for a specialist like Instacart, this is their model.

#5 – Unlimited growth potential

Because it can add more retail partners, Instacart can continue to expand its product footprint for customers.

This makes Instacart Advertising even more of a priority for advertising agencies. While online grocery is an emerging market for CPG brands to advertise, Instacart can offer brands outside of the CPG sector a place to market their goods. Consumer electronics, health & beauty, apparel, pet needs, home improvement…the list goes on and on.

It’s hard to imagine a major U.S. ad agency that doesn’t already have clients that could be advertising on Instacart.

Skai as a tech foundation for ad agencies to build a best-in-class Instacart Advertising practice

Expanding beyond the native user interface, marketers leveraging Skai to support Instacart Advertising campaigns enjoy a unified view of keywords, ad groups and campaigns on Instacart; the ability to measure performance across the marketplace; and different ways to structure and optimize these campaigns to boost results.

With rules-based alerts, advertisers managing Instacart campaigns with Skai can receive notifications to prompt bid, budget or other adjustments when various criteria are met: when campaigns outperform their target ROI or run out of budget, for example, or if sales from a high-performing keyword drop.

Skai’s dimensions and categories enable Instacart advertisers to apply custom labels (brand vs. non-brand, categorical, promotional, etc.) to ad groups, ads and keywords across Instacart and other ecommerce marketplaces that enable granular-to-aerial views of ad performance across channels. Also simplifying the otherwise complex task of comparing performance across channels, Skai’s True North Custom Metrics bridges the gap between differing attributions and auction models. Learn more about Skai’s support for Instacart Advertising.

Don’t miss out on the opportunity to achieve a granular-to-aerial view of your ad performance across multiple ecommerce marketplaces, including Instacart! Request a demo from Skai today and discover how our dimensions and categories can help you better label and analyze your ad groups, ads, and keywords.