Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

In our Skai 5 series, we discuss digital advertising tips, tricks & trends to keep you one step ahead of the consumers, the market trends and your competition. For this portion of the series, we highlighted five reasons why Skai can help you expand your retail media portfolio to major retailers like Walmart.

In every major digital channel, there’s an 800-lb gorilla.

In paid search, it’s Google. Paid social? Facebook/Instagram.

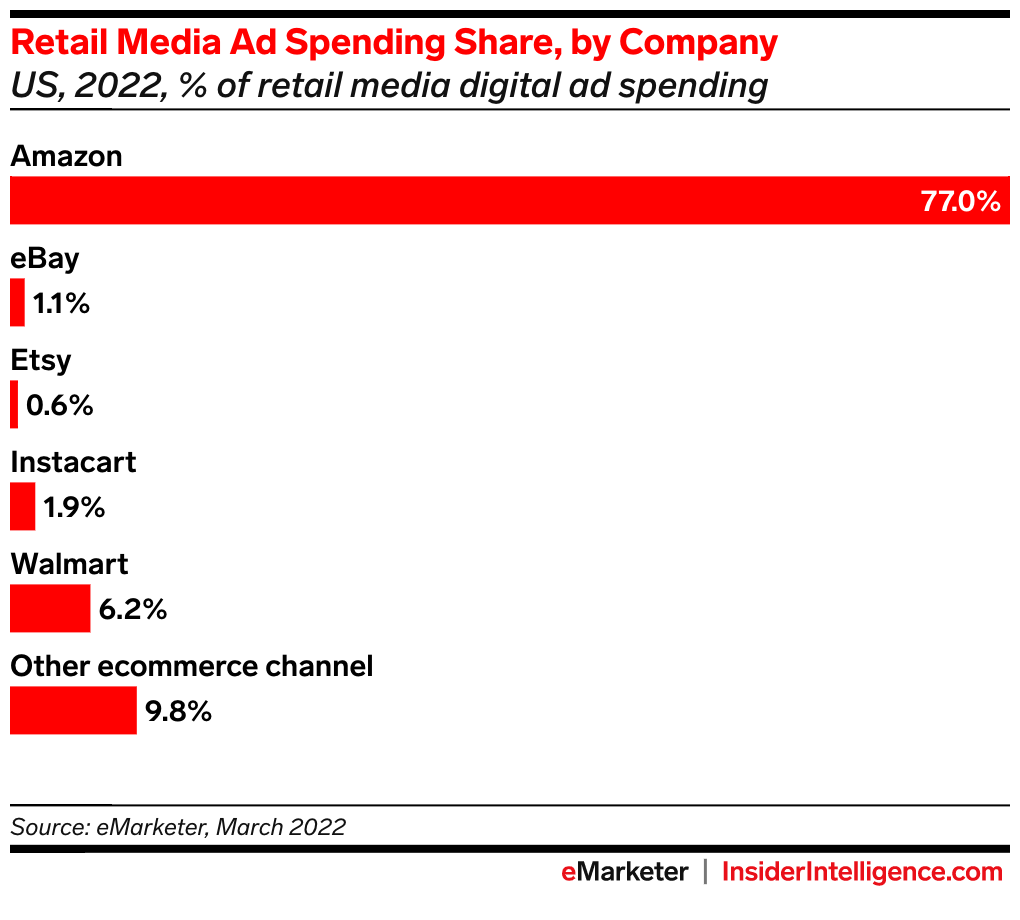

And with retail media advertising, it’s undoubtedly Amazon. This isn’t a secret. With 77% of this channel’s U.S. budget, it has a major lead right now.

Walmart is entrenched as the favorite behind Amazon, and eMarketer forecasts that it will reach 8% of the total U.S. retail media dollars in 2024.

For those of you who are exclusively focused on Amazon Ads, there’s certainly some logic behind that strategy. After all, Amazon’s share of the retail media market clearly makes it the first retailer to use.

But, there are some really good reasons why you should consider expanding to Walmart.

And, if you are going to take on this opportunity, there are some really helpful ways that Skai can make sure your new (or existing) Walmart Connect programs pay off the investment.

There’s a reason why paid search marketers go beyond Google to Microsoft Search Ads, Pinterest, and other publishers. And it’s the same in paid social beyond Facebook/Instagram to TikTok, Twitter, Snap, etc.

Here are just five of the many reasons why you should expand beyond Amazon Ads to Walmart Connect:

According to Skai aggregate customer data, during Q4 2021, Walmart Connect CPCs averaged just under a dollar ($0.99) while Amazon Ads hovered around $1.12—which means that Amazon click costs were 14.3% more expensive.

While thirteen cents may not sound like much, consider this math:

Now, of course, this is theoretical math. Amazon has the scale and order volume most brands need so it’s doubtful a brand would move all of their retail media investment to Walmart.

But, on the other hand, math is math. There is undoubtedly an opportunity here—even with a small portion of your budget—to find ad price breaks.

As more competition flocks to Walmart Connect, the price gap may start to close. Now is the time to jump in and see what kind of potential it has for your ecommerce program.

One of the primary reasons why marketers are excited about Walmart is because of its massive offline presence. Since the early 1960s, Walmart has been a mainstay of most American consumers’ shopping experience. In fact, with over 4,700 stores across the U.S. in addition to the brand’s ever-growing digital presence, it’s estimated that 90 percent of America shops at Walmart for everything from groceries to home goods.

Ninety percent of Americans live within 10 miles of a Walmart store. This has huge implications for brands to sell more than just next-day delivery. This offers consumers convenience options like same-day delivery, buy-online-pickup-in-store, and curbside service. For frozen items, this matters. For extremely heavy products that cost a lot to ship, this matters. There are a lot of products that can benefit from having a location within driving distance.

Even without the shipping complications, there might be a lot of products that simply make more sense to be sold at Walmart than at Amazon. This convenience can directly impact your advertising ROI.

And then there are the unique measurement capabilities. Certainly, one of the biggest Walmart opportunities for brands is to finally understand the connection between online and offline advertising on both online and offline sales. That’s the omnichannel potential that can help brands leverage those insights across the rest of their media portfolio—beyond just retail media advertising.

From its Walmart Connect site:

Only Walmart can correlate online ads to purchases on our digital properties & at our 4,700+ stores, so you understand your campaign’s impact with unprecedented scale & accuracy. With on-demand access to your campaign performance dashboards, you can gauge audience response & adjust as needed.

And just because Walmart’s retail media business is smaller than Amazon’s, by no way is it a small operation. eMarketer forecasts Walmart’s US digital advertising revenues will hit $1.55 billion this year, a 53.5% increase for the year.

Recently, Rich Lehrfeld, SVP and General Manager, Walmart Connect explains some of this year’s vision in the post, Walmart Connect: Building Meaningful Shopping Experiences Between Suppliers & Our Customers.

Here are some of the highlights:

“First, we are continuing to improve and innovate new ways for suppliers and sellers to connect with customers throughout the shopper journey.”

Lehrfeld explains that the company is experimenting with new ad formats and omnichannel experiences “such as optimizing how brands can showcase themselves at self-checkout screens, TV Walls, in-store events, and sampling.”

“Second, we are unlocking growth for suppliers and sellers of all sizes through automation.”

For this point, he mentions new upgrades across Walmart Connect including expanding the partner program and the recent launch of Walmart DSP.

“Finally, we are committed to exceeding advertiser performance goals, by leaning into our core offerings through a combination of innovation and evolution.”

For some marketers that have been shy of Walmart due to its first-price auction, it will be good news to finally see the public announcement of Walmart Connect’s second-price auction which puts it on par with most other retail media offerings including Amazon Ads.

Measurement is also going to be a focus as Walmart is “expanding measurement capabilities for all our offerings – including in-store placements – to drive accountable results and a stronger end-to-end offering.”

Get onboard now!

If it took twice the time to manage Walmart and Amazon advertising versus just Amazon, then this might be a different story.

There’s a lot of parity between these two publishers. They both have Sponsored Products, Sponsored Brands, and DSP. They are both auction-based. They both have buy boxes.

If history repeats itself, just as with Google and Facebook, challengers to the category leaders know that it’s in their best interest to offer similar advertising options and experiences as a way to keep the friction down with regard to adoption.

A retail media marketer—especially ones using a third-party campaign management tool like Skai—can seamlessly manage both publishers in not much more time than it takes to manage one.

Ultimately, it would be hard for any Amazon Ads marketer to argue that they’ll never use Walmart. It doesn’t seem like it’s a question of “if” but rather of “when.”

With this being the case, then why not start now. Begin testing Walmart Connect and discover for yourself the similarities and differences. You might find some great gaps that your competitors aren’t filling yet and you could find some price and conversion low-hanging fruit.

Where should you start? The wrong way to think about your Amazon Ads budget is Well, my ROAS is pretty good, so why should I move any budget to another publisher. That’s not how optimization-minded marketers think. The ones who are obsessed with performance think How is the ‘last’ 10% of my Amazon Ads budget working and could I better invest it elsewhere? They think about their budget in 10% chunks. The ‘first’ chunk is the highest performing 10% of their budget. The second chunk is the next 10% performing part of their budget, and so on.

Take another look at your performance. How is the lowest-performing 10% of your Amazon Ads budget working? Even if it’s in positive ROI territory, it might be the place to start. What if your least-performing dollars on Amazon Ads could become invested in the best-performing products on Walmart Connect?

The audiences are slightly different. The intent is slightly different. You may find that products that aren’t performing very well on Amazon might sing on Walmart.

Get in, get started, and begin building your Walmart Connect expertise. As your retail media budget grows, you may start hitting diminishing returns and will need to move to Walmart and other publishers. Wouldn’t you rather have experience on these platforms before you are forced to use them? Of course, you do!

READ THE CASE STUDY: “Big Four” Agency Scales Walmart Sales For Multinational Toy Brand With Skai

Skai’s Retail Media solution helps you realize your brand’s growth potential to stand out, capture demand and drive sales on Walmart’s high-traffic properties while giving you insight into the customer mindset. Drive advertising growth with Skai’s advanced optimization, analytics & automation solutions.

“Skai brings together all of the retailers that matter most to us, in one place – helping our teams organize, analyze, and optimize how we engage shoppers across Amazon, Walmart, Target, Instacart and so many others.” – Krishna Patel, Ecommerce Operation Analyst, Chomps

Automatically harvest keywords to expand reach. Define custom rules, destinations, and alerts to control when and how keywords are auto-harvested.

Dayparting allows you to double down when it matters most. Automatically invest when ROAS peaks by turning on and off campaigns and ad groups according to a predefined schedule, down to the hour.

Be intelligent with every dollar invested with rules-based optimization. Eliminate all manual and time-consuming tasks by defining rules that provide precise command over which automated actions are taken, and when.

Monitor & optimize paid and organic share of voice (SOV). Analyze digital share growth relative to competition and identify fast-growing competitors to inform conquesting strategies.

Analyze product-level performance across campaigns. Inform investments by surfacing opportunities to improve your product assortment and identifying ways to maximize campaign results.

Test and learn with agile and real-time experiments. Make testing easy by launching experiments in just a few clicks, leveraging interactive dashboards and visualizations to distill information quickly, and sharing results with colleagues.

For more information, why not schedule a brief demo to see all of Skai’s cutting-edge features for yourself?

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information