According to the National Retail Federation (NRF), this year’s Black Friday topped Cyber Monday as the busiest shopping day online for the first time, with 93.2 million shoppers compared with 83.3 million. With the traditional big shopping period between Thanksgiving and Christmas much shorter in 2019 than in recent years, consumers jumped on the deals early during the “Cyber 5” long weekend (Thanksgiving through Cyber Monday).

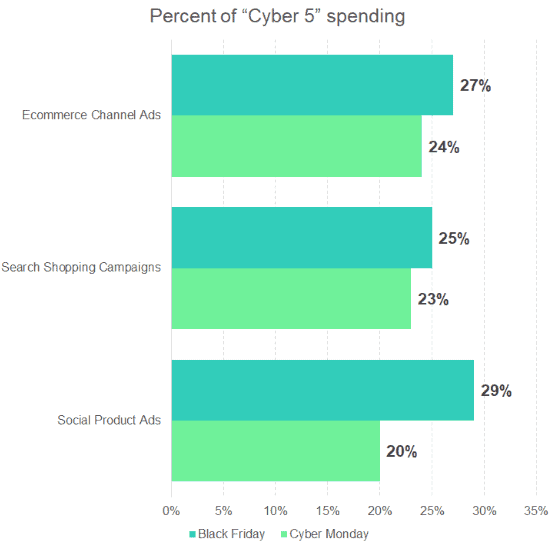

Retailers were ready for the shift in earlier consumer holiday shopping. Across the three most important digital ad channels—Search, Social, and Ecommerce advertising—Black Friday garnered a higher percentage of Cyber 5 spending than Cyber Monday. This was the continuation of a trend that first showed signs last year.

As reported by Skai on Monday, retailers spent more than 3X on Black Friday on these three channels versus the pre-Thanksgiving November daily average. Brands placed some big bets this year, and it seems like they were wise to do so.

“Americans continue to start their holiday shopping earlier in the year, and Thanksgiving is still a critical weekend for millions,” NRF President and CEO Matthew Shay said. “With the condensed holiday season, consumers are feeling the pressure to get their shopping done in time. Even those who typically wait until the last minute to purchase gifts turned out in record numbers all weekend long.”

Retailers relied heavily on social advertising this season

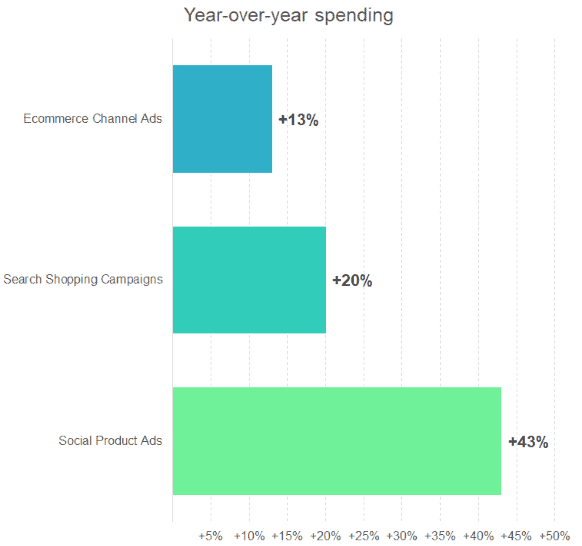

Year-over-year (YoY) spending increased 20% for Search Shopping Campaigns and 13% for Ecommerce Channel Ads for this year’s Cyber 5, but Social Product Ads experienced the biggest lift with an increase of 43% YoY.

Search and Ecommerce Channel Ads are valuable bottom-funnel tactics to convert shoppers when they have decided to make a purchase and are either in the final stages of selecting which brand to choose or are looking for the best price on the items they already want. However, Social’s combination of deep consumer data targeting and engaging ad formats enables retailers to push ads to people to drive awareness and interest. This makes the channel extremely valuable at the top and middle of the purchase funnel to reach people who may not even be thinking about a brand yet as a purchase option.

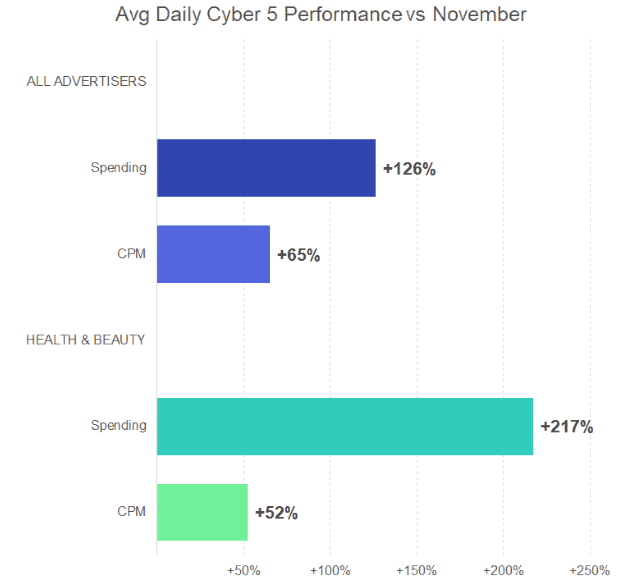

Retailers invested heavily in Social during the Cyber 5. Compared to the pre-Thanksgiving November daily average, spend across the Cyber 5 weekend for Social Product Ads was 126% higher, with the ad costs (CPMs) increasing 65%. The Health & Beauty category saw spending more than triple compared to the rest of the month.

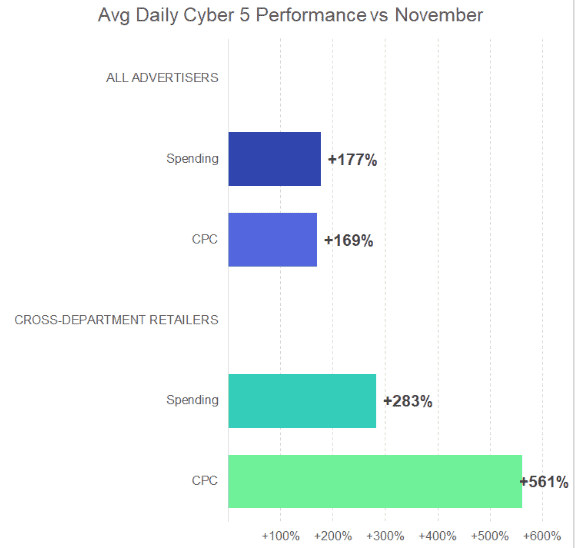

Cyber 5 search advertising spending up 177%

For the product-focused arm of digital advertising’s biggest channel, Search Shopping Campaign investment increased 177% during the Cyber 5 versus the pre-Thanksgiving November period. Most of this rise came from a 169% increase in cost per click (CPC), as advertisers were willing to bid higher to reach customers with greater purchase intent. For the category of Cross-Department Retailers (i.e., bigger stores that sell items spanning categories), CPCs increased more than 6X.

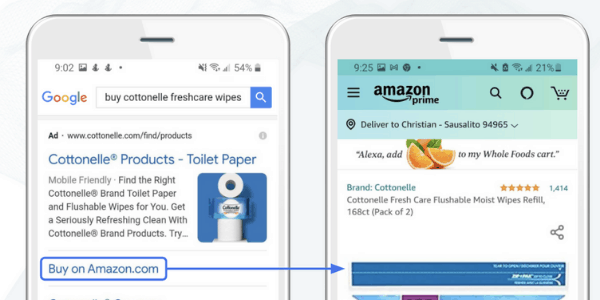

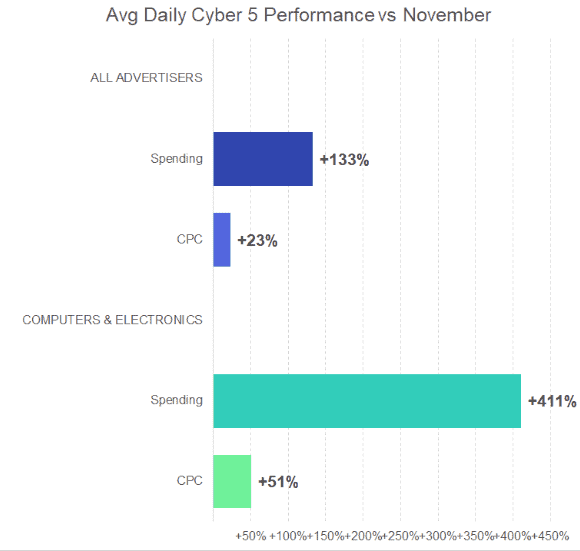

Cyber 5 ecommerce channel advertising (ECA) performance

Ecommerce Channel Advertising (ECA)—led primarily by Amazon Advertising—has the distinct advantage of reaching consumers as they shop in online marketplaces. With online shopping continuing to reach new heights this year, ECAs were always going to be a solid play for brands going into the Cyber 5 weekend.

Compared to an average day in the holiday shopping season ramp-up of pre-Thanksgiving November, the average daily spend across the Cyber 5 for Ecommerce Channel Ads increased 133%, with the average cost per click increasing by 23%. For the Computers & Electronics category, spending levels jumped over 5X and ad prices increased by just over 50%. That gap between CPC and spend increases shows that even with the introduction of higher seasonal prices in the channel, it was a higher volume of ads displayed and/or clicked that really moved the needle on the spending jump, much more so than for either Search or Social ads.

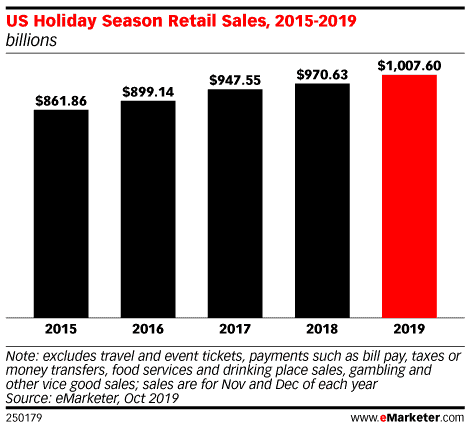

Will 2019 be the first trillion-dollar holiday shopping season?

Even with just 26 days between Thanksgiving and Christmas, industry experts predicted this year’s shopping season would break the trillion-dollar mark for the first time.

Based on the Cyber 5 data, it seems retailers brought out the big guns and made sure they invested heavily in key channels at the right time to ensure success. Stay tuned for Skai’s post-holiday coverage to see if 2019 lived up to expectations.