Tablet Cost-per-Click Rises to Equal Computers while Phone Clicks Remain Discounted

London (April 23, 2013) – The role of mobile phones and tablets in U.K. paid search advertising has continued to increase and now accounts for roughly 25% of total spend and 28% of total clicks, according to the latest data from digital marketing technology leader, Skai (www.skai.io).

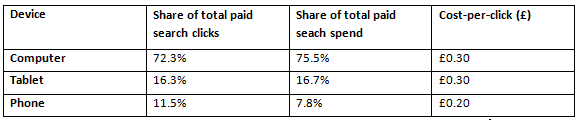

The findings come from the Skai Search Advertising Trends Q1 2013 report which indicates that increasing demand for both tablet and phone advertising in the U.K. has driven up Cost-per-Click (CPC) to £0.20 on phones and £0.30 for tablets (which is now equal to computers).

UK Paid Search Spend, Clicks and Cost-per-Click (Q1 2013)

Source: Skai Global Search Advertising Trends, © Skai, Inc. 2013

While U.K. advertisers’ share of total paid search spend on computers (72.3%) and tablets (16.7%) is closely aligned with the share of clicks they generate, phones lag behind with 11.5% of total clicks yet only 7.8% of the total spend (see table above).

The fact that mobile phone ads have a lower CPC than computers and tablets gives U.K. advertisers the opportunity to maximise clicks by reallocating spend to this device and using advanced key performance indicators (KPIs) to measure success, according to Aaron Goldman, chief marketing officer at Skai:

“Advertisers should be assessing the value of mobile clicks in alternative ways because you can’t expect a phone to deliver the same rate of direct online sales as devices with bigger screens that are typically used in the home. It’s imperative to track and optimise conversion events like phone calls, app downloads, check-ins, website registrations, store locators. These are KPIs we should be using to measure the effectiveness of phone clicks.”

The Skai Search Advertising Trends Q1 2013 report is based on a rolling data set covering several billion dollars in global paid search ad spend by advertisers and agencies which have been active on the Skai platform during the previous 24 months.

Other notable findings include:

Global PPC spend, clicks and click-through-rates (CTR) are up as advertisers are getting better at paid search optimisation

Globally, the report shows Year-on-Year (YoY) Q1 ad spend was up 15% with clicks up 21% indicating that 2013 is off to a good start. Click-through-rate (CTR) also improved from 1.04% in Q1 2012 to 1.68% in Q1 2013 — a dramatic YoY increase of 62%.

“The fact that clicks and CTRs are rising faster than spend indicates that Skai clients are getting better at their execution of paid search advertising – in other words, they’re getting more efficient by generating more clicks from fewer impressions,” explained Goldman.

Regional analysis shows U.S. Paid Search Budgets up with E.U. Relatively Flat and U.K. Down

In the U.S. and the U.K., ad spend was predictably down quarter-on-quarter (QoQ) following the strong Q4 Christmas shopping season. However, whereas U.S. Q1 spend followed the global trend of YoY growth (24%), ad spend in the U.K. dropped by 11% in Q1 compared to the same quarter in 2012. In the E.U., Q1 budgets actually rose by 4% but were down 4% YoY.

The average CPC in the U.S. and U.K. dipped slightly in Q1 and the U.K. remained higher than the U.S. at $0.44 and $0.38 USD respectively. CPC for continental Europe has been relatively flat for the last five quarters and stood at $0.36 in Q1.

About Skai

Skai is a digital marketing technology company that engineers premium solutions for search marketing, social media and online advertising. Brands, agencies and developers use Skai Enterprise, Skai Social, Skai Local and Skai SmartPath to direct more than £16 billion in annual client sales revenue . The Skai platform delivers Infinite OptimizationTM through closed-loop targeting, universal integration, and dynamic attribution. Skai’s adaptive technology, proven algorithms, and unmatched scale power campaigns in more than 190 countries for nearly half of the Fortune 50 and all 10 top global ad agency networks. Skai’s UK clients include Accor, Burberry, GroupM, Havas, John Lewis, Omnicom and Tesco. Skai has 16 international locations and is backed by Sequoia Capital, Arts Alliance and Tenaya Capital. Please visit www.Kenshoo.com for more information.

Skai brand and product names are trademarks of Skai Ltd. Other company and brand names may be trademarks of their respective owners.