As the country begins to open back up, how is the world of paid advertising responding? The answer varies by vertical. Here’s what’s happening this week.

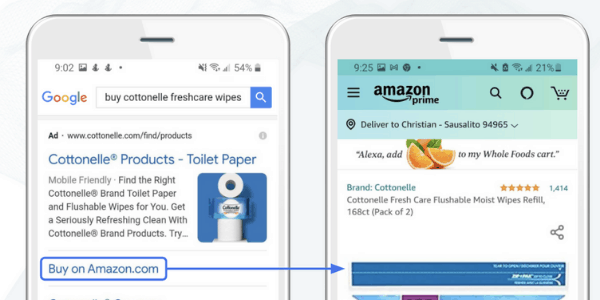

The data to follow comes from weekly vertical snapshots of our robust dataset in the Skai COVID-19 Marketing Resource Center. Visit the page to find weekly updated data, as well as marketing tips, response toolkits (deeper analysis and recommendations by channel), and replays of webinars and our Ask the Experts Live series.

The Skai COVID-19 Marketing Resource Center

Advertising Patterns and Insights by Industry: Week ending June 6th, 2020

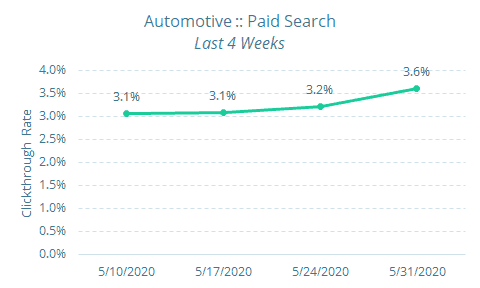

Automotive

With most auto shoppers taking more than a few months to research a purchase, there could be a wave of activity in this category fairly soon.

We have highlighted paid search spending growth in the Automotive category in recent weeks, but engagement with those ads has also increased. Clickthrough rate (CTR) is up 18% over the last four weeks.

Clickthrough rate is considered by search marketers to be somewhat correlated with consumer interest in their ads. To see CTR trending upwards should be interpreted as a sign that consumers are considering vehicle purchases again.

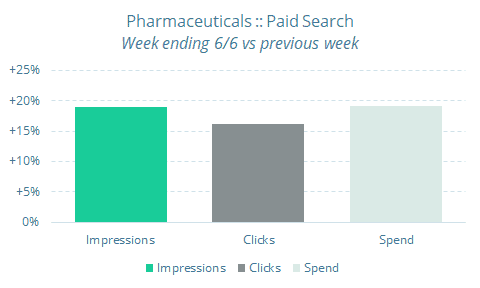

Health: Pharmaceuticals

Not all pharmaceutical products are considered “essentials”, so the sector has taken an overall hit during the pandemic along with so many other categories. However, with nearly a 20% week-over-week jump in spend and impressions, pharmaceutical marketing seems to be jumpstarting as some regions around the country begin to open.

Pharma advertisers saw double-digit increases in impressions, clicks, and spending on paid search ads last week, when compared to the previous week.

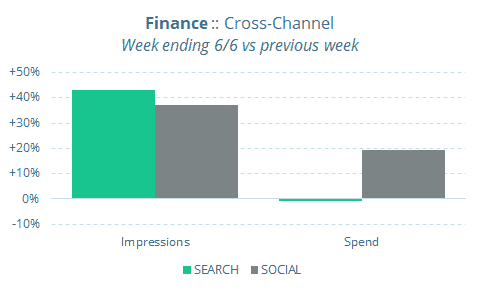

Finance

In this case, financial advertisers are finding ways to maintain traffic levels with the same budget. Impressions for financial ads were up sharply week-over-week in both the Search and Social channels, but that only translated to increased spending for Social.

For auction-based advertising channels such as Search and Social, an increase in ad impressions with minimal impact on spending generally means that marketers are optimizing for efficiency.

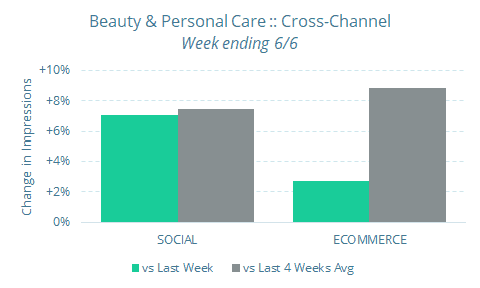

CPG: Beauty & Personal Care

While makeup sales are shrinking, other categories of products are starting to boom such as lotions, skincare, and self-grooming. Consumers saw more ads for Beauty & Personal Care products last week in the Social and Ecommerce channels compared to both the previous week and the average for the last four weeks.

The Forbes.com article, The Pandemic Has Changed Consumer Preferences – It’s All About Health And Comfort Now, goes deeper into how this industry is transforming.

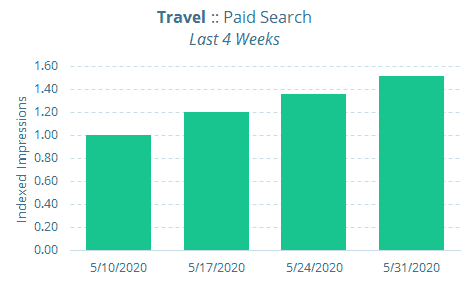

Travel

Travel has been hit hard by the pandemic, but as restrictions loosen, things are on the upswing. This industry continues to be the most consistent growth category across paid search. This week, we focus on impressions, which have increased by 52% in just four weeks.

There might be some relief coming in the form of a stimulus measure being considered in Congress. If approved, the “Explore America” Tax Credit could cover up to $4,000 of vacation expenses spent in the U.S. at hotels, theme parks, restaurants, and other tourism-related businesses.

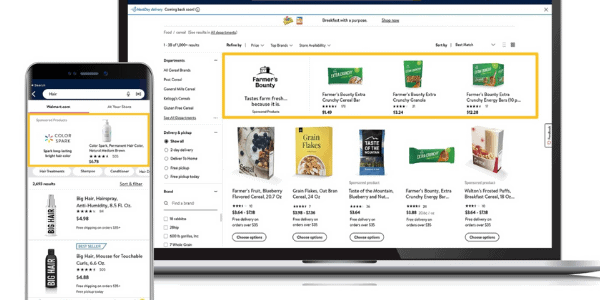

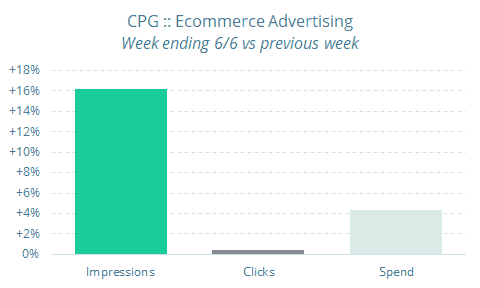

CPG: General

Activity in the Ecommerce channel was relatively unaffected by changes in online behavior stemming from the protest movement, and CPG was a good example of that. Impressions and Spending were both up over the prior week, while Clicks were mostly flat.

In a search-triggered ad medium such as Ecommerce Advertising, impressions up significantly with minimal impact on clicks or spend can be interpreted as more consumers are researching product purchases. Online grocery for CPG products is still a bit of a new shift in shopping behavior for many Americans, so the lift in impressions may simply be the result of consumers searching and then refining their searches multiple times to zero in on the products they want.

Check back every week for updated data

For more COVID-19 tools and resources, check out the Skai COVID-19 Marketing Resource Center and visit the Skai.com/blog/ regularly for articles like these.