Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

In 2008, the share of US digital advertising spending to walled garden publishers was 52%. Just two years later, in 2010, the percentage of walled garden spending jumped up to 64%.

A decade later, in 2018, the share of US digital advertising spending on walled gardens was 78%. Just two years later, by the end of 2020, walled gardens spending represented more than 82% of US digital advertising.

What was the one thing these two periods had in common that dramatically increased spending on the walled garden publishers? Both happened during historic economic downturns. The Great Recession occurred from 2007 to 2009 after the bursting of the U.S. housing bubble and a global financial crisis. And, of course, 2020 was the year of COVID that created disruptions to the economy that are still being felt today.

What this data confirms is something that most digital advertisers already know. When marketers are under tremendous pressure to drive growth while facing historic market challenges and budget cuts, they prioritize budgets to walled gardens in an economic downturn.

If indeed the old adage is true that marketers vote with their wallets then this is a major vote in confidence in walled garden media.

We know that marketers tend to allocate a higher percentage of their media plans to walled garden advertising when times get tough.

The answer is straightforward—walled garden ads perform better than other forms of marketing. But why? Performance is key, but what are the underlying benefits of these digital ecosystems that make them perform so well, even in challenging times?

The following are just a few of the reasons why marketers put their trust in walled gardens during economic downturns.

One of the main reasons why most digital advertising spending goes to a short list of walled garden publishers when times are tough is that marketers can reach nearly everyone on the planet without having to spread their efforts too thin. A marketer must place ads across hundreds or thousands of open-web publishers to access the same audience size as just a handful of walled gardens.

And “cutting back” isn’t just restricted to media costs. When budgets get cut, marketers are expected to “do more with less” which includes dropping the extra help they’re used to with agencies, freelancers, etc. They may even have to deal with laying off part of their existing teams or hiring freezes where they can’t fill open roles.

In an economic downturn, teams are running thin out so marketers want to work with as few partners as possible to reduce complexity, time, and costs. For most advertisers other than the biggest brands in the world, the handful of walled garden publishers offers an extremely efficient way to spend budgets.

With the recent limitations on third-party cookies and other common identifiers, brands know that properly using their first-party datasets is key to adapting to the future. It’s comprised of users that are already customers or web visitors and offers a competitive advantage because it’s a unique dataset your rivals don’t have. And, even better, once the (relatively low) cost to collect it is factored out, it’s free to use again and again without having to pay for each round like third-party segments.

Over the last two decades, these publishers have built native tools for marketers to upload first-party data to target and personalize advertising to their existing customers.

And this goes beyond “retargeting cookie” functionality that the demand-side platforms (DSPs) on the open-web use. The problem is that when a user jumps to a different device or wipes their browser cookies/cache, the open-web publisher tracking can fail. But, with walled gardens, because users are generally logged in on their devices, that retargeting can still work.

Targeting the right ads to the right people online requires the right data. Sure, third-party audience vendors offer segments to target users on the open-web, but it can be rather expensive. And there is always some healthy skepticism about where third-party audience segments come from and how they are defined.

Conversely, walled garden publishers offer trusted audience segments which marketers can use for free when targeting ads. Native segments are rich and robust based on users’ expressed or implicit preferences, behaviors, and characteristics. They can also be combined into infinite combinations with each other as well as with first-party and third-party data segments.

The data walled garden publishers like Google and Meta on each of their users is staggering. Consider this example from Google’s online Search Ads training about how it can determine if a user has young children in the home by their interactions with Google properties:

Each of the walled gardens has similar audience capabilities for advertisers to target by just about any demographic, interest, or location.

Walled garden ads are inherently better suited to performance because of how well they work within each publisher’s unique environment. For example, Meta (Facebook and Instagram) carousel ads offer users an expandable format to dive deeper into multiple brand messages without having to leave the page. Pinterest Promoted Pins, Snapchat Collection Ads, Apple Search Ads, etc., tend to have much higher response rates than the standard rectangles seen on most (non-walled garden) websites and apps.

Another benefit here is how native ads blend into the page on walled garden sites, and in some cases, they don’t even realize the content they are clicking are ads. This is in stark contrast to bland, open-web advertising that relies on standard “IAB” ad formats that are primarily just different-sized rectangles on a page. For example, the search-triggered ads of Google and Amazon look and feel like standard search results listings.

In a recent survey by Skai, 1000 consumers were asked if they noticed ads on walled garden destinations over the last 30 days. Even though any marketer knows these sites have ads on almost every page, 42% of consumers reported not seeing an ad on Amazon, 39% on TikTok, 32% on Google, and 25% on Facebook/Instagram.

Behind the scenes, walled garden publisher ad systems are working on behalf of each of their advertisers to improve ad matching. With their giant user bases and deep datasets, walled gardens excel at optimizing ad performance because they can get the right message in front of the right person at the right time better than any other publishers. Consider that every time an ad gets served, it could potentially be chosen from a bank of millions of ads—and properly matching advertisers to ad inventory is a critical contributing factor to campaign performance success.

The publisher algorithms apply their rich datasets—that could never be shared with marketers due to privacy constraints—to detect unseen correlations between audience characteristics and clicks/conversions to help them find the needle in the haystack, e.g., the brand/ad with the highest forecasted response rate.

For example, ten people may search for the same keyword on Google simultaneously and receive ten completely different ad experiences. Based on what Google knows about the searcher (previous searches, recent YouTube videos, keywords in Gmail, etc.), it will assign a unique context to the search user’s search, and thus, serve the most relevant ads.

In the recent Skai report, Why Walled Gardens Are a Marketer’s Best Bet, we

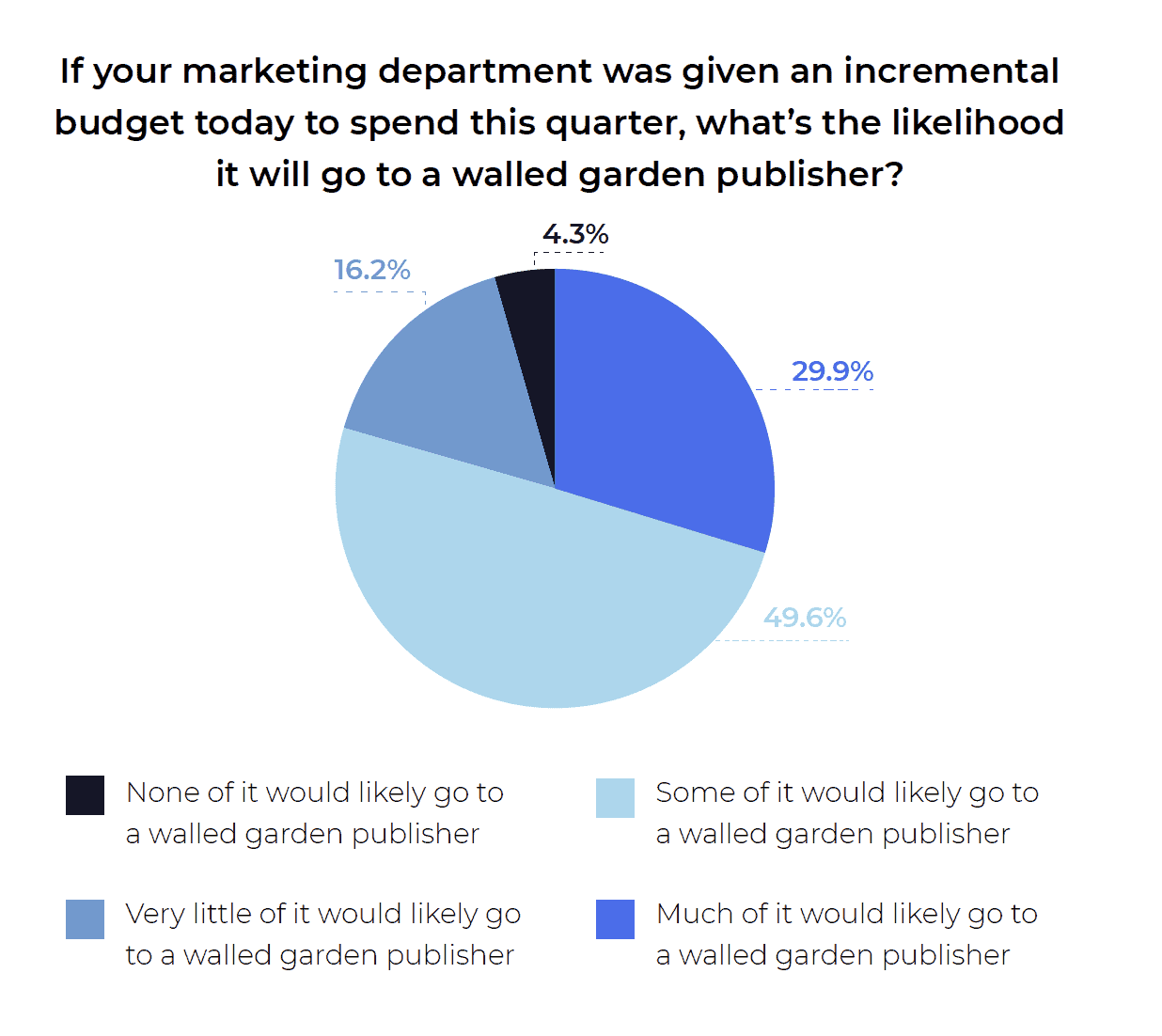

The following are three charts that demonstrate the confidence that marketers have in walled gardens and why nearly 4 out of 5 US digital ad dollars are spent with them.

When asked if their marketing department was given more budget within the quarter, nearly four out of five marketers (79.5%) said that some or much of it would likely go to a walled garden publisher.

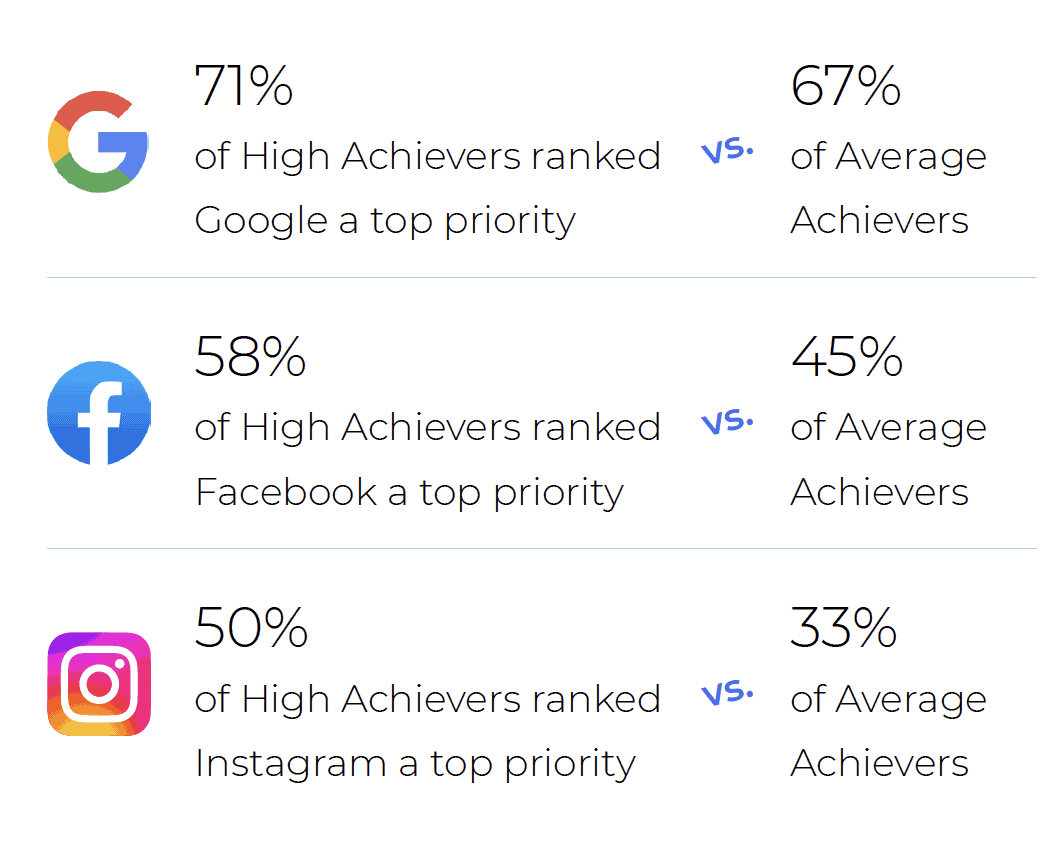

When asked to rank walled garden publishers in terms of importance to their media programs this year, ‘High Achievers’ ranked these companies as a top priority (priority level 5 out of 5) more often than ‘Average Achievers’.

Note: When asked to describe their company’s 2021 marketing results:

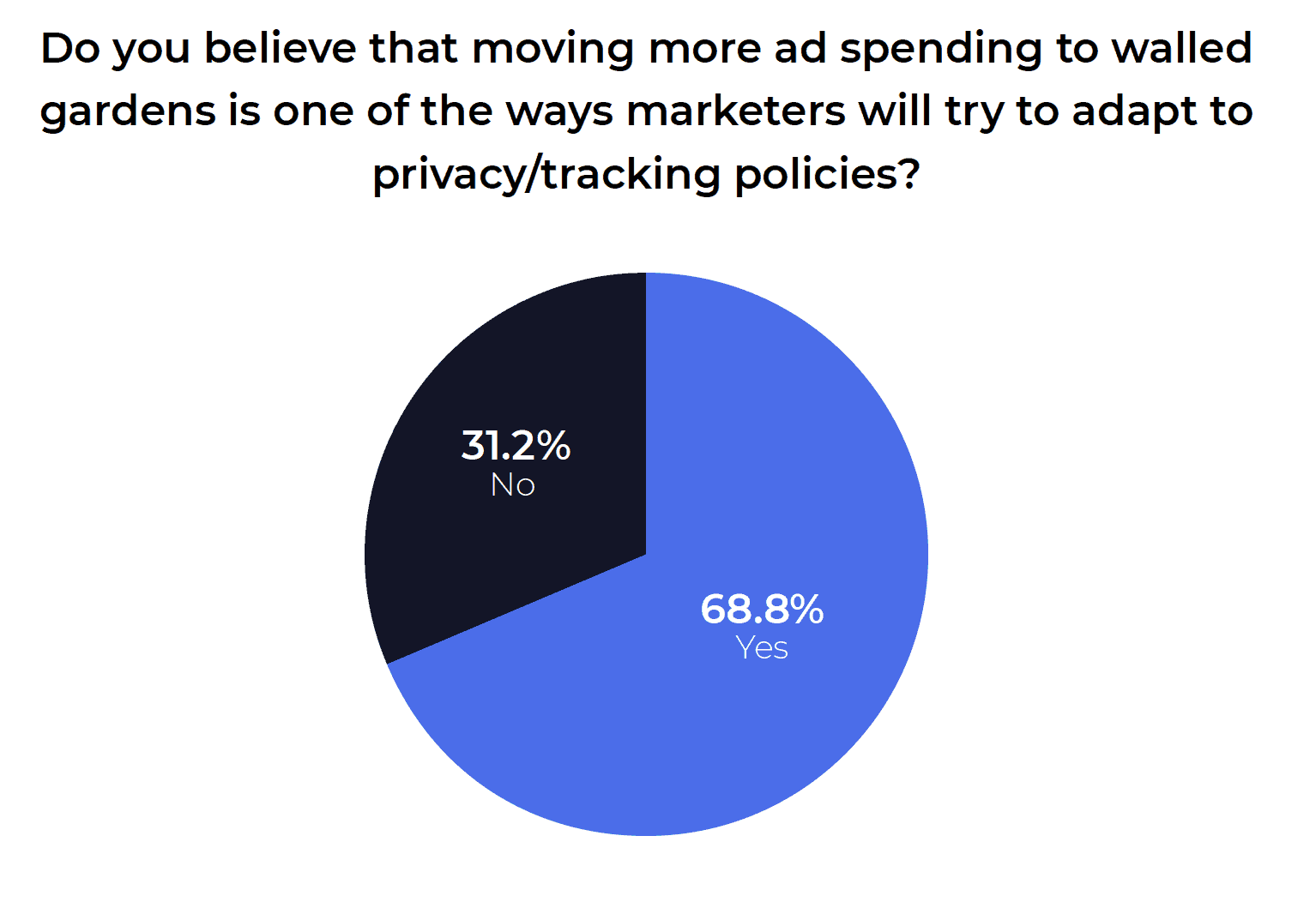

One of the biggest stories in advertising over the last two years would have likely been the shift in consumer data tracking. Marketers have been dealing with curveballs such as Apple’s ATT privacy policy and other limitations on tracking online users.

Walled garden publishers can target, personalize, and measure massive audiences of logged-in users. That’s why nearly 70% report that practitioners will spend more with these publishers as a way to hurdle these challenges.

Some open-web companies have articulated a fairly basic argument on why marketers should spend much more of their budgets there. Their opinion surmises that because consumers spend 60% of their time online on the open web, they recommend marketers spend 60% of their budgets there.

Objectively, that argument seems a bit thin and self-serving.

Should time spent be the single driving factor behind allocating marketing budgets? Of course not! Marketers have many other considerations for budget allocation rather than time spent, such as:

But, ultimately, if you ask any CMO how their teams should be allocating budgets across publishers, it’s always goal performance and return on investment (ROI). Whether it’s sales, profit, conversions, traffic, leads, registrations, or any other goal, marketing, at its core, is investing. A company invests its marketing budget to generate results.

And, that’s truly why marketers turn to walled gardens in an economic downturn. Because they know they will get the best return for their marketing investment which—while important every year—becomes essential in challenging times.

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information