Just over a decade ago, only 5 percent of total U.S. retail sales happened online. The entirety of the buyer’s journey generally consisted of going to a store, checking out that store’s inventory, making a purchase, and calling it a day. Now, buyers are inundated with products, and standing out among the endless aisles of the ecommerce landscape has increasingly become a challenge for marketers.

The “digital shelf” is a term that describes how and where a brand’s products are displayed online along with the ways that shoppers discover products online, whether that discovery is through search, social, or third-party marketplaces, like Amazon and Walmart.

Think of the ways in which a product can be displayed within a store. Stock is limited, so there is less to choose from. In order to make a choice, a shopper might browse the aisle, compare prices and styles, then choose the product that is most to their liking.

However, as more and more consumers’ shopping moves online, the online market has created a “shelf” that is nearly limitless, giving shoppers more inventory to choose from than ever before. In order to succeed in this new, digital landscape, it is important for retailers to claim their share of voice (SOV) in order to standout among competitors. Claiming share of voice on the digital shelf requires careful SOV analysis of how, where, and how often customers are discovering (or not discovering) your brand.

The digital shelf has also been called “the endless aisle” which hits home just how important it is to be visible within online retailers

How does share-of-voice apply to ecommerce?

In an era where 74 percent of shoppers begin their product searches on Amazon, it is more critical than ever before to understand share of voice. When it comes to ecommerce, share of voice analysis describes the measurement of of much advertising inventory or organic search results your brand claims versus how much of that space competitors claim.

Share of voice can encompass other areas, like social media, but share of voice analysis primarily means understanding exactly how discoverable one brand is versus another. Capturing a larger share of voice within the endless aisles of the ecommerce marketplaces involves unlocking and analyzing data from many different sources, including looking at market trends, analyzing competitors’ strategies, and compiling all of your share of voice data in one place.

Here are a few tips for using SOV analysis to win the digital shelf:

SOV analysis: Pick your battles

When it comes to claiming share of voice within ecommerce platforms, your ROI may look different than it has in the past. Traditionally, the goal of pushing products on platforms like Amazon or Walmart has, understandably, been to sell more products. But increasing market or category share often requires different strategy, and your brand may need to sacrifice immediate sales in order to push trials or initial orders of a new item in order to become discoverable to new audiences, thus claiming more share of voice. In this instance, it’s important to remember that each product or category of product is a different battleground, and keeping an eye on how much share of voice competitors claim across platforms in each category is critical for winning these small battles.

And that battleground can absolutely change from platform to platform. For example, if one of your chief rivals is investing heavily on Walmart.com, you may have to spend much higher than you planned there to remain competitive. Or maybe you’re strong on Amazon but barely visible on Instacart? Meanwhile, at Target.com, you are dominating the share-of-voice and can be less aggressive with your ad dollars as your organic listings drive success.

SOV analysis: Analyze market trends

However, share of voice isn’t just about understanding where your competitors stand across ecommerce platforms in different categories. Looking at market trends by analyzing the performance of your content, as well as that of your competitors, across digital channels can be an important way to market your products in a way that will capture audiences in the discovery phase of the buyers’ journey. There are early warning detection datasets available to help marketers better track impactful market trends that go beyond just ad performance data, including:

- Social media posts

- Consumer product reviews

- Key Opinion Leader (KOL) posts

- Product descriptions

- Publicly available patents

What would it mean if your food brand knew the next hot ingredient—you already use in some of your products—before your rivals?

How would you market your apparel brand differently if you knew the next big color in fashion?

Focusing on ads and keyword search terms using this data could be the move that nudges your product to the forefront of the digital shelf. As part of the evolution of retail media, practitioners need to access market trend data to stay ahead of competitors and take advantage of new consumer behaviors before others realize they are happening.

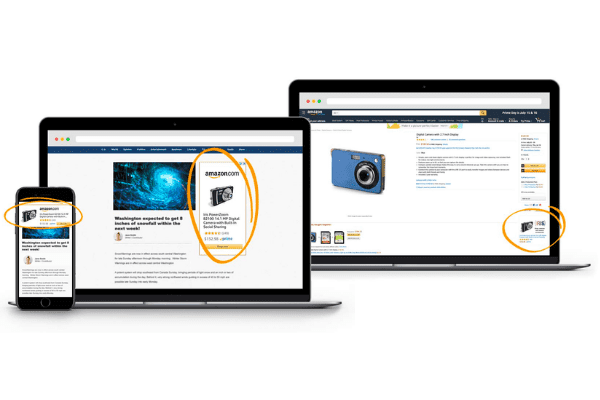

Connect Commerce Channels

One platform for the three most important digital advertising channels—paid search, social advertising, and retail media—is a step in the right direction. These three channels already represent nearly 70% of all digital marketing spend and, when planned and managed together, enable a level of clarity and agility that opens up a world of possibilities for consumer goods brands. From a single interface, marketers use SOV analysis to gain insight and take action to improve each channel’s impact and influence on overall product sales.

Winning the digital shelf may be a bit more challenging than winning a traditional retail shelf, but careful SOV analysis and compiling all your SOV data in one place is a great first step towards carving out a space for your brand across ecommerce platforms.

Skai’s Retail Media solution has SOV analysis and more

Skai empowers the world’s leading brands and agencies across industries to manage omnichannel digital marketing campaigns. Our intelligent marketing platform includes solutions for retail media, paid search, paid social, and app marketing. We’ll keep you at the forefront of the digital evolution with data and insights, marketing execution, and measurement tools that work together to drive powerful brand growth.

Most importantly, we integrate some of the most powerful retail analytics you need to make great retail media decision-making right in the platform.

For more information or to see our cutting-edge data and campaign management functionality for yourself, please reach out to schedule a brief demo.