Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

Here at Skai, we have decades of combined experience in key digital advertising channels across our client, product, sales, and marketing teams. Every year around this time, we check in with our internal experts to hear how they think these channels will evolve. So follow along this week as we share what we believe the future holds for paid search, paid social, retail media, app marketing, and measurement.

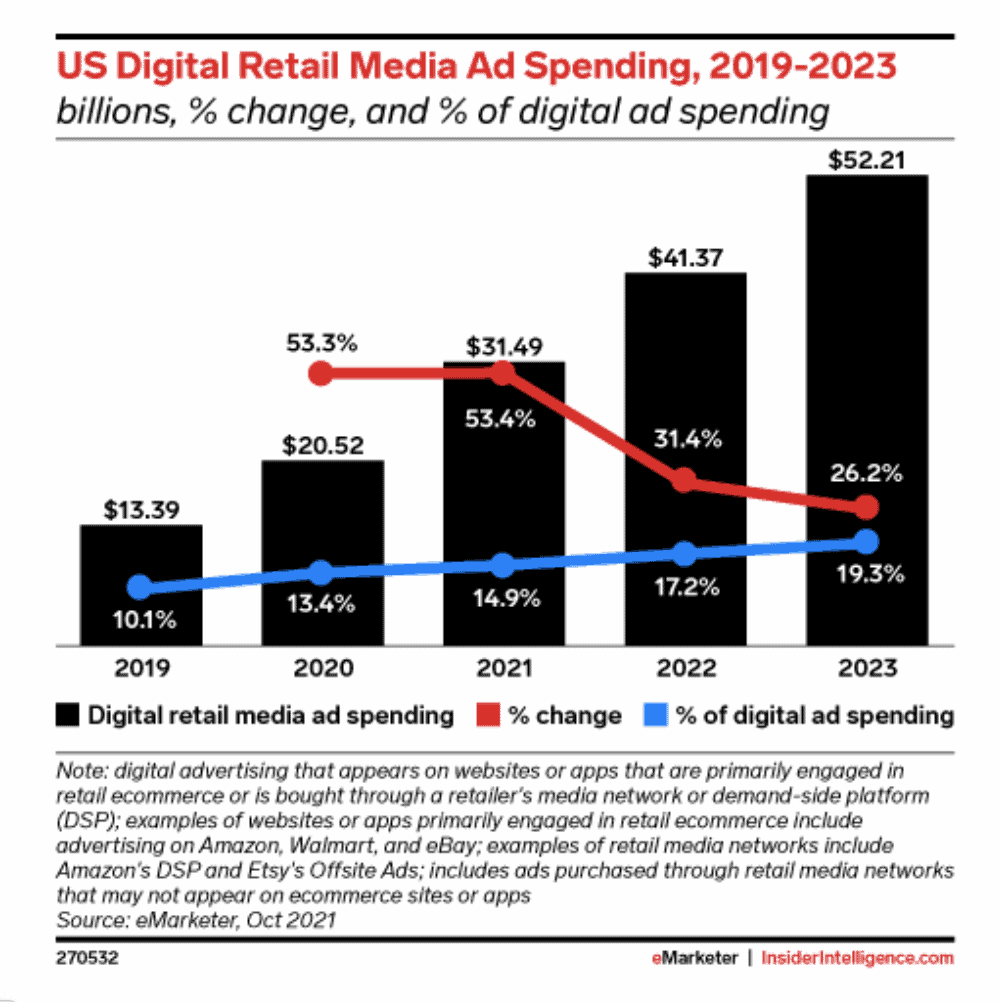

Now the third-largest digital channel, retail media is predicted to end 2021 at 53.4% year-over-year (YoY) growth. Compared to the 14.9% overall YoY growth in digital ad spending, retail media is the hottest niche in one of the hottest industries. Consumer goods companies are “all in” with this channel, and 81% of them plan to grow their investments in retail media networks within the next 12 months.

There is already a relatively big group of retailers (retail media publishers) in the channel. And that’s not slowing down. According to a September report from Merkle, every one to two months, a new retail media network is born. Whether that’s building their own operations like Amazon and Walmart or going through aggregator platforms like CitrusAd or Criteo, every online retailer with significant audience reach sees the retail media channel as a potential for high-margin revenue and a way to better engage their manufacturer clients. There’s Instacart, Target, GoPuff, and scores of others.

In other big digital channels like paid search and paid social, there are only a few or just a handful of significant publishers, so this is a bit of a new challenge to face. And in programmatic display, where almost every website online can be a publisher, the ecosystem is rather neatly consolidated with SSPs and DSPs.

So how do retail media practitioners manage all of these programs in the face of this fragmentation? How do they allocate budgets across so many partners? Where should they send the next interested user—to Amazon? To Walmart? Best Buy? Target? The list goes on…and is growing.

In 2022, retail media marketers will have to figure these things out quickly. Whether using a 3rd party campaign management platform or getting great at spreadsheets (lol), the fragmentation issue is getting out of hand. Those unable to solve this complexity will quickly find themselves at a marked disadvantage against those who can figure it out.

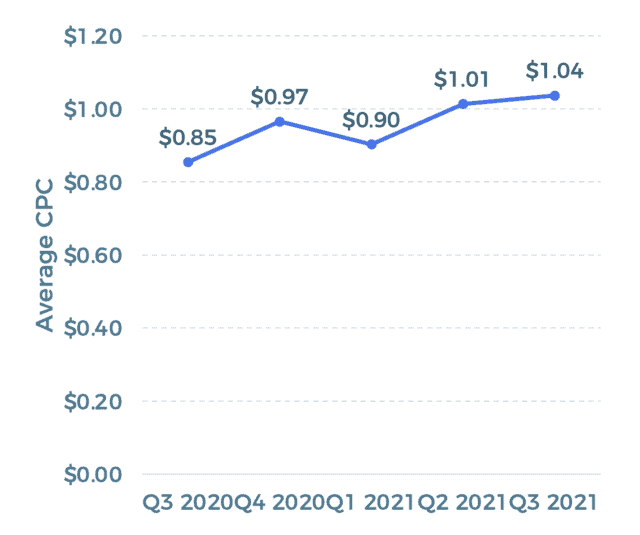

According to Skai data, the average cost-per-click of retail media grew from $0.85 in

The fact that retail media ad costs are rising is not surprising—it was expected. But now that we’re here, it’s what to do about it in 2022 that is the new challenge for retail media marketers. Simply put, ROI is calculated using two numbers: how much you made divided by how much it cost you to make it. So, ROI will take a hit because that denominator is going up. The only way to keep performance stable—or ideally to grow it—is to increase that numerator, in other words, make more money.

That’s easier said than done, but it’s what is facing retail media marketers next year. Early success brings in more competitors. More competition means higher ad costs. Higher ad costs mean it will be harder to succeed. But, marketers are up to the challenge. We will see in 2022 how they handle this issue and squeeze the most efficiency from their programs to remain successful.

2022 will be a big year for the channel as arguably the “first era” of retail media is over.

Retail media investments are growing, which will undoubtedly garner more attention from business leaders. When a channel is first emerging, and the budgets are small, the implications of low performance aren’t very risky. However, as retail media garners more share of the annual marketing spend, the impact on the bottom line will be a bit more considerable. The potential upside here is that more scrutiny from stakeholders could also open up more investments in expertise and technology to mitigate that risk.

In 2022, as retail media continues its meteoric growth, what was once an emerging channel with little oversight will have more eyes on it than ever—and hopefully some help and support are coming for marketers from above.

The rise of retail media has opened up the opportunity for brands to finally do what they’ve done for decades offline—market to shoppers inside the physical store. This is driving new conversations and new thinking for how digital advertising should be best used in the post-pandemic commerce funnel. Up until now, channels like paid search and paid social have, for the most part, been utilized to drive users to owned properties like websites and apps. But now that brands can influence shoppers at the point of purchase with retail media, digital channels are quickly being redirected to transport interested users to online stores.

And with media changing, measurement needs to change as well. For example, web analytics and other tools can easily measure ad traffic to owned properties. But when that traffic is sent to retail partner sites, marketers have zero visibility into how it performs—which is essential to optimizing bids, budgets, and creative to maximize ROI. Amazon Attribution provides that visibility to brands. While consumer goods brands have been excited about how this measurement solution can help them grow their programs, we should see adoption pick up in 2022.

Note – Skai has a differentiated, automated solution for Amazon Attribution that saves marketers time and reduces errors.

Any CMO will tell you that they are a bit hesitant to invest in ads that drive users to a lackluster website or app—they’d much rather hold on to their budgets, fix the problems, and then buy media. In that same vein, retail media marketers know that the success of their channel is correlated to how good their product detail pages (PDP) are. In The Content Advantage in Amazon Advertising, Skai, Salsify, and Proftero studied Amazon Ad performance for advertising that led to great PDPs (“A-rated content”) and poor PDPs (“F-rated” content) with alarming results on just how vital product detail pages are to retail media success:

Better content leads to higher conversion: A-rated content on Amazon had 21 times more conversions than F-rated content, with a 53% more effective conversion rate. As your product content improves, your pages better support shoppers’ purchase decisions and also gain relevance with Amazon’s algorithm, together with winning more conversions.

Premium PDPs offer the best-in-class detail page experience with content such as video, image carousels, and enhanced comparative tables to tell a compelling brand story and showcase product information. In other channels—beyond simply the bidding strategy—the landing pages are key in converting users. In retail media, “the landing pages” are the PDPs. While the retail media practitioners and ecommerce content teams are often two separate groups, as investments grow in the channel next year, retail media marketers will expand outside of their lane and get more involved with PDP creation and optimization.

One of the hallmarks of a maturing advertising channel is the rise of standards. While the channel is nascent, each publisher tends to grow up in a bit of a vacuum, growing their offerings as they best see fit. However, as it garners more investment and attention, new publishers emerge, and they model their programs in congruence to the success of their predecessors. Metrics, ad formats, editorial guidelines, etc., all need to be figured out, so it makes sense for jargon and rules to be somewhat familiar as marketers move from one publisher to another. We saw this, for example, in the early days of the online video advertising space as publishers began to offer similar targeting and measurement features to enable a true industry to form.

While retail media is by no way a nascent channel (Amazon Ads is nearly a decade old), it’s undeniable that the bulk of its growth has come recently. With the channel predicted to reach $50 billion in a few short years, 2022 is the perfect time for some of these standardizations to crystallize better, reducing the friction for investment growth. Certainly, at this time, Amazon Ads is the gold standard of the channel, and we may see more retailers looking to tailor their offerings to mimic its programs a bit more.

As we’ve outlined already in this article, in 2022, retail media marketers will face new challenges to maintain the meteoric ROI that they’ve had for the last few years. More competition, more fragmentation, and rising costs will require new ways of thinking to adapt. One of the key areas where marketers have historically turned to increase performance and address complexities is technology.

Technology can help marketers in myriad ways. For example, it can automate recurring tasks to free up time for practitioners to work on more valuable projects. Computers are also best suited for Big Data analysis and to surface insights that marketers can use to make informed decisions. And for digital marketing specifically, technology has proven to help drive bid/budget/program optimization 24 hours a day, seven days a week.

Skai’s Retail Media solutions offer marketers a suite of intelligent functionality to help meet the new challenges of 2022. Features include:

2022 will be the most challenging year for retail media yet, so make sure you have the tech foundation you need to maintain the success of your programs! For more information or to see Skai’s retail media solutions firsthand, set up a quick demo.

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information