The Skai Q3 2019 Quarterly Trends Report (QTR) is now available with the latest channel-level industry trends for Search, Social, and Ecommerce advertising. You can download the report or explore the insights yourself via the interactive infographic.

In many ways, the third quarter is the calm before the storm during which marketers put their media budgets on tried-and-true channels as they work diligently to prep for Q4.

While Q1 and Q2 are the testing grounds for new tactics that were earmarked to try out this year, poor-performing channels and campaign elements have been weeded out by this time and the media mix is highly indicative of where marketers are most confident. So, Q3 is the quarter that generally reflects how the year has come together for a marketing organization, and thus, a good period to analyze for industry benchmarks. Skai’s Q3 2019 Quarterly Trends Report represents the analysis of over $5.5 billion in annualized marketer spend and continues to be one of the most well-respected datasets by those who follow advertising performance closely. With over 500 billion impressions and 13 billion clicks analyzed, it includes many proprietary insights about what’s happening in the digital advertising industry on a macro level.

In this report, learn quarter-over-quarter and year-over-year digital advertising campaign performance trends from Q3 2019, including:

- Ad spending velocity of the largest publishers in the world

- Key performance indicators across Search, Social, and Ecommerce advertising

- Insight into how marketers may interpret these market dynamics and how they may shift their plans to take advantage of new opportunities

Highlights of the Skai Q3 2019 Quarterly Trends Report:

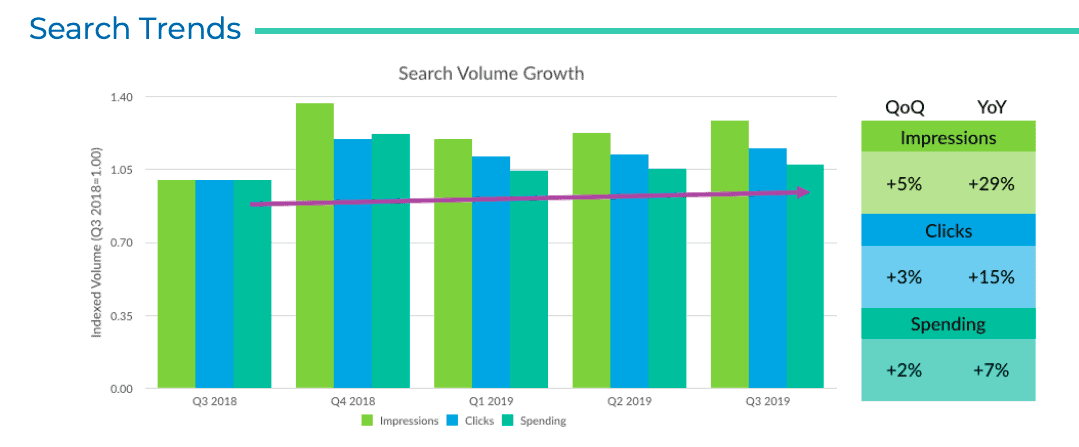

Paid search

SEM has grown steadily over the last five quarters, with a solid 7% year-over-year spend increase in Q3. 54% of spending was on mobile devices which firmly plants SEM—digital marketing’s largest channel—as a mobile-first experience. The largest segment of search ads in Q3 were mobile keywords at 42%, and these ads saw a 13% increase in investment year-over-year. Shopping campaigns were a driver of overall search growth.

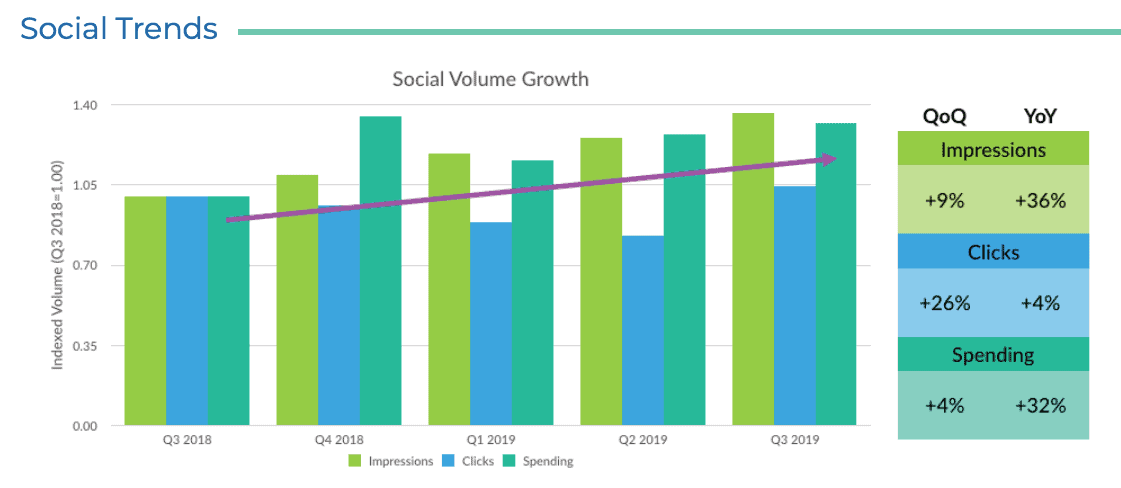

Social advertising

Spend continued its upwards trajectory with a 32% year-over-year increase from Q3 2018. With CPMs staying relatively flat, social advertisers are still finding value with their investment in the channel and there still seems to be plenty of room to grow efficiently, according to the Skai Q3 2019 Quarterly Trends Report.

Impressions grew faster than spending, indicating that the volume of social ad activity is still increasing steadily.

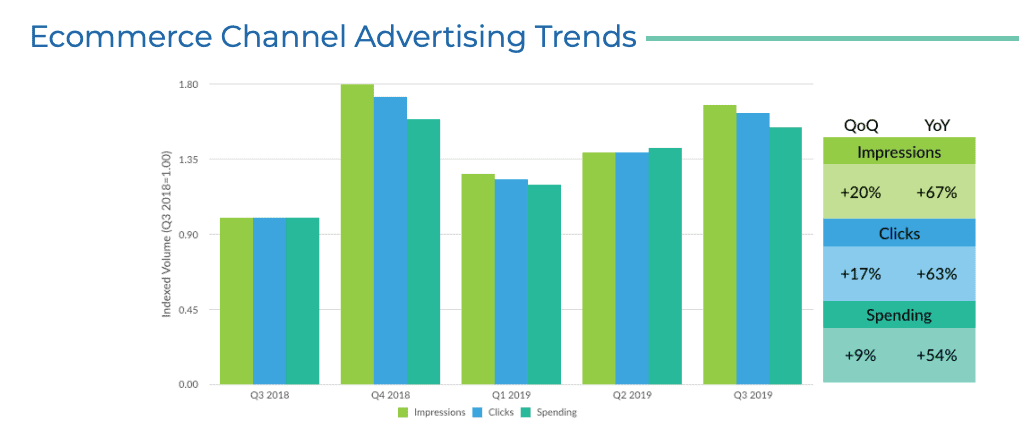

Ecommerce Channel Advertising (ECA)

The Skai Q3 2019 Quarterly Trends Report shows that ECA was up big in Q3 with a 54% year-over-year increase in marketer spending. This channel is still relatively new and traces a path of strong growth that is comparable during the first few years of growth in paid search and social advertising.