Joshua Dreller

Sr. Director, Content Marketing @ Skai

Joshua Dreller

Sr. Director, Content Marketing @ Skai

Here at Skai, we have decades of combined experience in key digital advertising channels across our client, product, sales, and marketing teams. Every year around this time, we check in with our internal experts to hear how they think these channels will evolve. So follow along this week as we share what we believe the future holds for paid search, paid social, retail media, app marketing, and measurement.

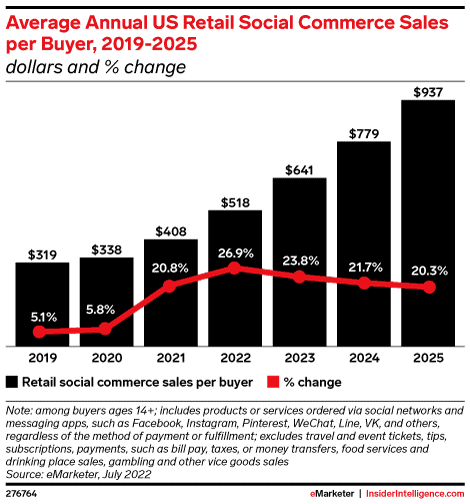

It is an incredibly versatile and diverse channel with multiple publishers, a variety of ad types & formats, and a highly engaged user base that spends over 70 minutes on average each day with their favorite social networks. In 2024, US social consumers are expected to spend 21.7% more than 2023, doing so on Facebook, Instagram, and increasingly, TikTok.

According to the Skai Q3 2023 Quarterly Trends Report, paid social was up 28% quarter-over-quarter in Q3 2023. Despite a year-over-year contraction of about 3%, we expect headwinds from headwinds in the second half of 2023 to fuel paid social spending growth in 2024.

A walled garden ecosystem offers users an all-in-one experience in which audiences can consume content, shop, and communicate with other users. In many social media apps, for instance, users can post their own content, direct message friends and businesses, and shop sponsored content without ever leaving the app.

For advertisers, walled garden ecosystems offer the advantage of targeting users based on their behaviors within the platform, and because content is so highly prioritized in these platforms, their users are highly engaged. Studies show that TikTok has an engagement rate of 4.25% from audiences who use the platform for an average of about 95 minutes a day.

This year, this small group of publishers account for 81% of total spending, and only 12% of marketers from our survey said they would be spending less next year on walled gardens.

In the wake of Apple’s big change to iOS in 2021 which dramatically affected advertisers’ ability to track users across mobile devices, Facebook initially offered some solution ideas for marketers, but there has yet to be any significant fixes to this challenge. One reason may be that it’s not just Facebook that was affected, but all mobile-first publishers. So, while many marketers are concerned about this visibility issue, reallocating budgets doesn’t solve anything.

Many experts predicted that the publishers most impacted would experience drops in ad spending, but with digital advertising up big this year, it’s been hard to determine if the tracking woes have dissuaded investments. Anecdotally, Skai’s client services team has reported that most of our social clients are focused more on how to make the best of the new circumstances rather than big shifts in Meta spend next year.

We believe that the social advertising train will keep on its meteoric course up and to the right and Meta won’t experience any giant drops in marketer spending.

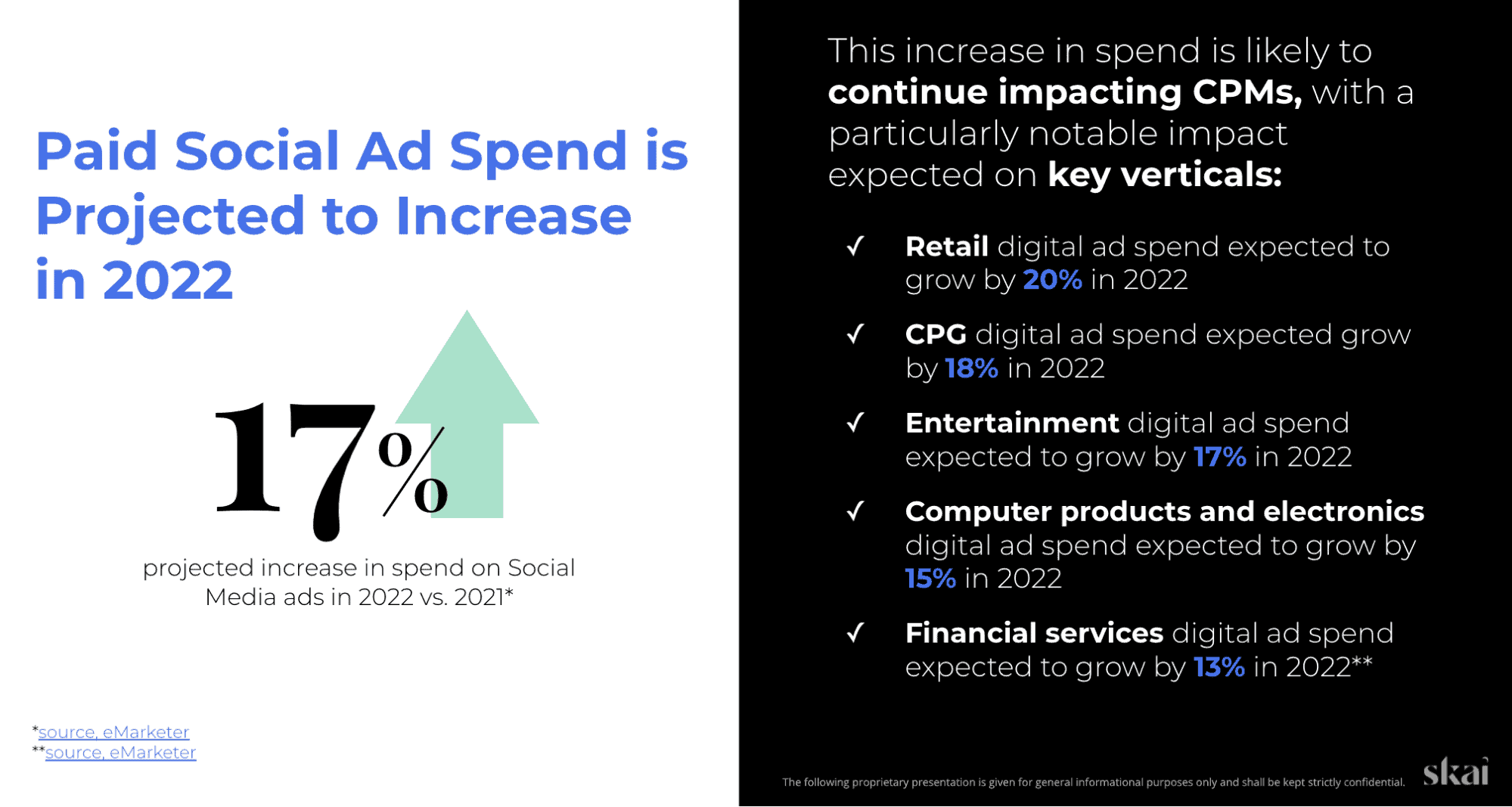

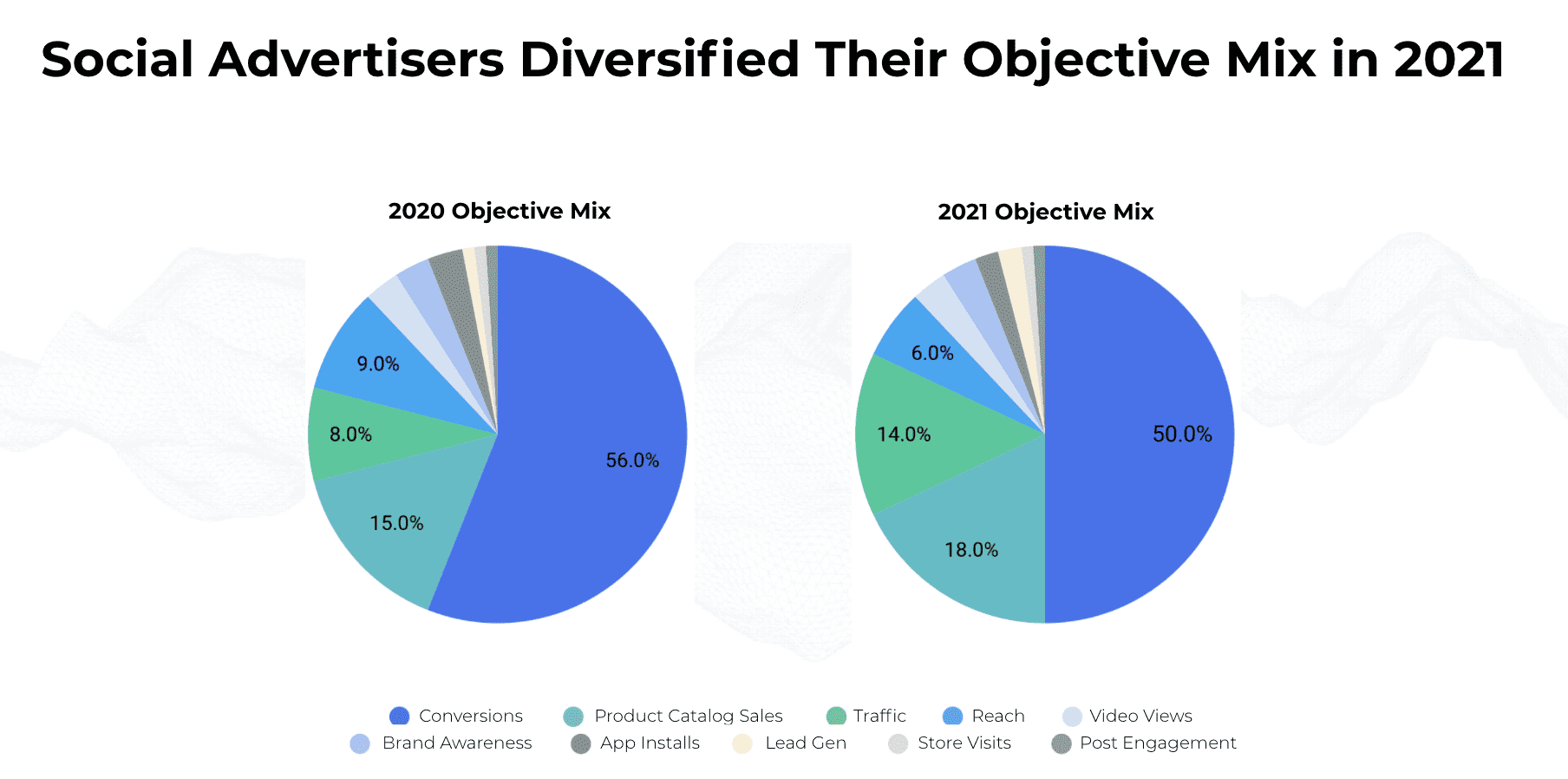

Social advertisers expanded their campaign types to include more Brand Awareness, Reach, and Traffic objectives this year. This was likely a reaction to the iOS14 change as advertisers tried to adapt their measurements of success in the shifting landscape. Based on the trends seen, we recommend marketers invest more in Placement Asset Customization (PAC) and Dynamic Product Ads (DPA) program types as an always-on tactic that allows for a more tailored and customized approach.

We expect this diversification to continue as marketers rely less on conversion-driven optimization and more focus on engaging customers better while on social platforms.

In 2021, spend on third-party audiences significantly increased year-over-year by 37%. Again, this is likely attributed to the iOS 14 tracking changes. Before Apple’s switch went into effect, it was the various ways that brands could leverage their first-party that were the gold standard of social targeting. For example, Facebook custom audiences—and subsequent look-alike audiences made from those seed groups — have been some of the most valuable types of targeting for most brands for years.

Data deprecation is a growing challenge — not just from iOS14 or cookie limitations — but from a variety of factors. As these issues have continued, look for brands to rely more heavily on the targeting options provided by social platforms and data providers nestled within their walls. Interest targeting, post/profile engagement, and other intra-social signals will become increasingly a part of the paid social marketers’ mix.

For some, Facebook’s rebranding to Meta was a bit of a head-scratcher and even a bit silly. Others explained the move as a conveniently planned distraction to divert attention away from the company’s other issues. However, Meta has been thinking about this for some time when it bought Virtual Reality headset maker Oculus back in 2014 for $2 billion. Anyone who has gone through a company rebranding knows that it takes a lot of planning and effort, which means this wasn’t a quick decision. This was most definitely a multi-year, deliberate plan.

Right now, the metaverse’s evolution is about where the internet was around 1998. It’s a “discovery of a new world,” and there’s about to be a giant bubble as companies and investors jump in to ensure they don’t miss the boat. For example, just like we saw domain squatters in the late 1990s buying up domain names, we’re seeing investors buying up land “parcels” in metaverse worlds like Decentraland and Sandbox for seemingly outrageous prices.

And because social media’s most prominent player is now leading the charge into the metaverse, it means that social marketers will most likely be the tip of the spear in terms of marketers leading the charge to use it as well. Next year, look for social marketers to get more interested and involved in how best to market in the metaverse.

It’s the fourth year where bespoke budgets are planned for the new publisher. That’s about where TikTok is for most brands. TikTok has been beefing up its retail/direct response focus and commerce capabilities such as TikTok’s live stream shopping that launched earlier this year. Next year will be another big year of TikTok advertising as bigger brands dedicate true line-item budgets on their annual media plans to allow the fledgling social network an opportunity to prove itself.

Digital media is in the midst of a transformative shift towards protecting consumer privacy. Marketers are faced with reduced access to the kinds of data many brands have become reliant on for ad personalization and targeting on Facebook.

Skai is the only platform purpose-built to help social marketers maximize data intelligence, connect with audiences and come out on top in a privacy-safe era.

Do you have 15 minutes to see how Skai’s Paid Social solution can optimize your programs? Set up a brief demo to see first hand how our innovative features can help make your paid social campaigns even more successful.

You are currently viewing a placeholder content from Instagram. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from Wistia. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationYou are currently viewing a placeholder content from X. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information