Today, Skai released our quarterly Global Search Advertising Trends report with data from the first quarter of 2013. You can download the report here and I’d like to personally welcome each of you to attend a webinar next week where I’ll review the report and provide additional insights from data we pulled during the first three months of this year.

The data found in this report is a subset of the paid search activity from advertisers and agencies on our platform. Our goal with these reports is to use the biggest data set possible while making sure to keep known anonomilies (such as recent, large advertisers coming aboard during the period of analysis) from skewing the figures. Thus, we only use aggreagate campaign data from clients who have been on our platform for the full 24-month date range we are examining. There’s still a ton of data here, but by using this approach, I feel confident that our results are much more stable and normalized than other, similar research.

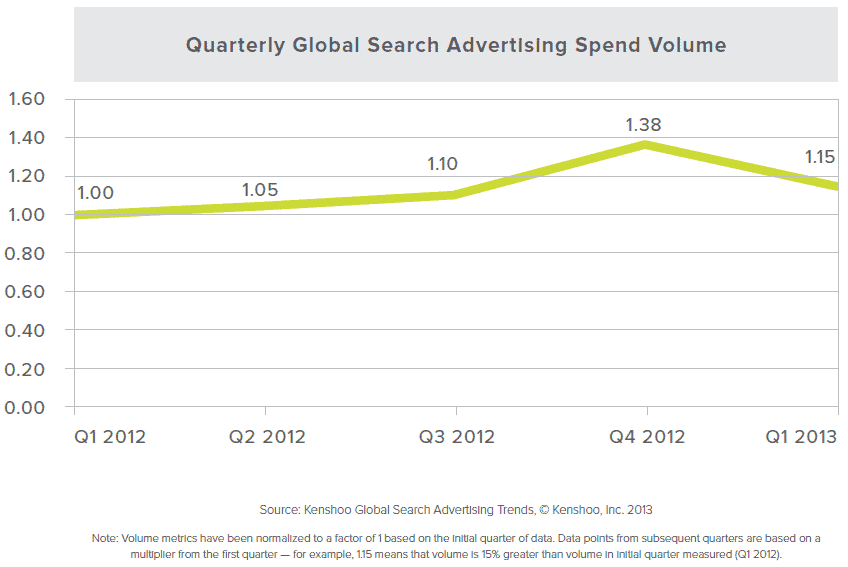

Let’s dive in! Search spend tends to be of most interest so let’s take a look at where we’re netting out so far.

Quarter-over-Quarter (QoQ) spend had an anticipated a 16% dip from the Q4 shopping season. However, Q1 of last year also showed a similar drop of 14% after Q4 2011 so this decline shouldn’t surprise anyone. Q4 traditionally has been the high budget season with budgets returning to normal after the new year.

2012 was a very healthy year for paid search with an increase of 32% Year-over-Year (YoY) from 2011. So, the fact that Q1 spend was up 15% over 2012 indicates a great start for paid search in 2013.

Below is an example of the volume metrics we use in many reports here at Skai — they are a very good way to highlight spikes and dips. In the chart below, for example, Q1 2012 is the starting quarter so it is divided into itself for a starting point of 1. So, 1.15 means that Q1 2013’s volume is 15% greater than volume in the initial quarter measured which was Q1 2012. As you can see, paid search spend has been growing steadily over the last five quarters with considerable spike in Q4 of 2012.

Please join me all week on this blog as I will be diving into various aspects of the report leading up to the webinar on April 30th.