Throughout the COVID-19 pandemic, we have been leveraging our unique dataset to monitor and report on trends for key industry verticals as a way to support marketers to better understand what is happening in their category.

The data to follow comes from weekly vertical snapshots of our robust dataset in the Skai COVID-19 Marketing Resource Center. Visit the page to find weekly updated data, as well as marketing tips, response toolkits (deeper analysis and recommendations by channel), and replays of webinars and our Ask the Experts Live series.

The Skai COVID-19 Marketing Resource Center

Advertising Patterns and Insights by Industry: Week ending May 30th, 2020

Retail: General

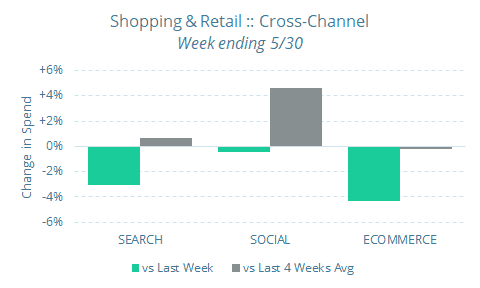

In a week shortened on one end by the Memorial Day holiday and on the other by demonstrations across the U.S., ad spending in the Shopping & Retail saw single-digit declines across channels. Social advertising, which had been steadily recovering, was down less than 1% versus the previous week but still was up over 4% across the previous 4-week average.

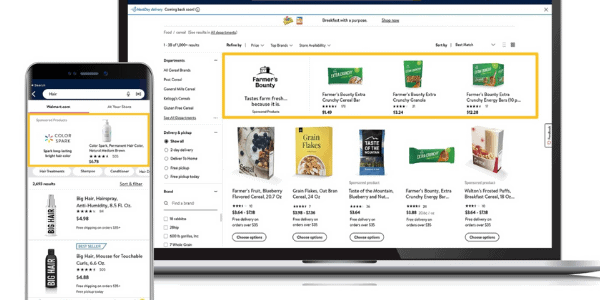

Retail marketers looking for ways to drive performance may want to explore Google Shopping which is now offering free listings for brands to promote their products.

Retail: Computers & Electronics

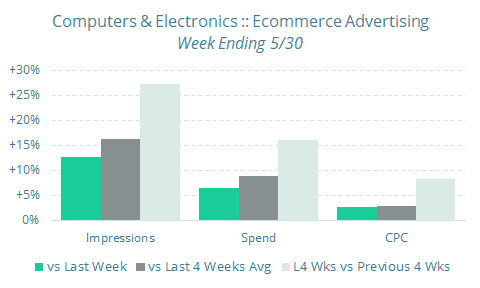

Computers & Electronics continued to show steady growth in the Ecommerce advertising channel, posting increases in impressions, spend and CPC in the short-, medium- and long-term.

As you can see from the chart, ad impressions have been steadily increasing for the last few months. Signs point to the fact that Americans have started to spend beyond just the essentials as they settle into the “new normal” of more time spent working while living at home.

CPG: General

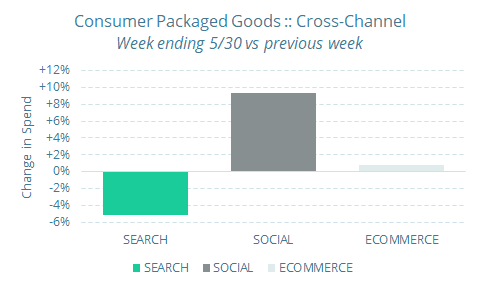

Search spending was down in most categories as a result of the short week, and CPG was no exception. Social spending was up and Ecommerce was mostly flat.

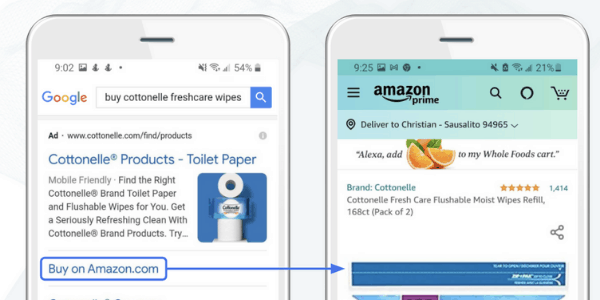

While both paid search ads and ecommerce ads are triggered by consumer searches, social advertising can be pushed to people on social media. Facebook allows marketers to drive ads directly to their Amazon product pages and may account for why Ecommerce wasn’t down for CPG marketers last week. Social ads can be a really good option to drive awareness and demand when consumer interest is focused on other areas.

CPG: Beauty & Personal Care

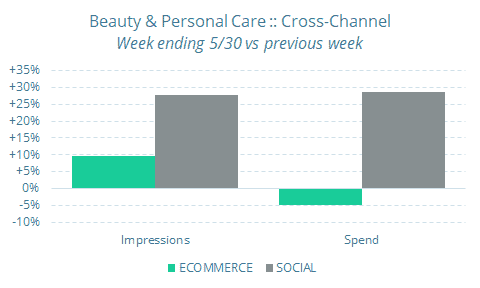

Impressions in the Beauty & Personal Care category were up week-over-week in both the Social and Ecommerce channels, leading to increased spending in Social.

To see social advertising impressions and spend up over 25% versus the previous week are a really great sign for this category. While a portion of this sub-vertical certainly falls into the “essentials” category, there are many “non-essential” products for which Beauty & Personal Care advertisers reduced ad spend on at the beginning of the pandemic. The recent uptick in marketing activity may be a strong sign of recovery.

CPG: Food & Beverage

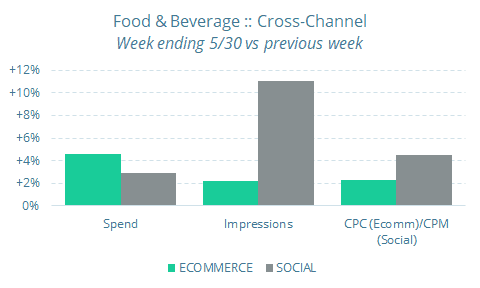

The Food & Beverage continued to show growth in both Social and Ecommerce channels, with increases in spending, impressions, and ad pricing.

Impressions were up 11% in social advertising and with CPMs up just over 4%, there still seems to be an opportunity with the channel for marketers to take advantage of the lower ad costs that we have been reporting on for the last few months.

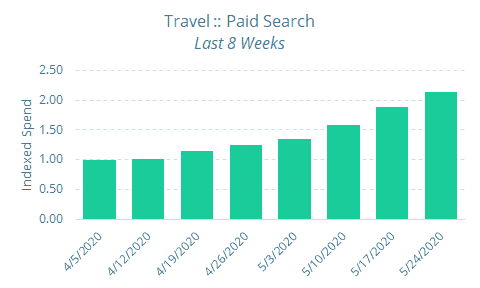

Travel

Search spending in the Travel category has grown since early April, but the pace of that growth accelerated in May. This was one of the few categories that bucked the overall search trend of lower short-term spending due to the short week.

Certainly, Travel is one of the categories that has been hit the hardest by the pandemic, but consumers are looking forward to traveling again. In a recent report, one-third of Americans have a desire to travel within the first three months after restrictions are lifted.

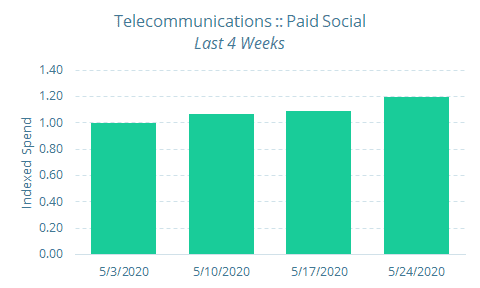

Telecommunications

Can you hear me now? Telecommunications spending in the Social channel has shown slow but steady growth over the last four weeks. The fact that the last week of May was up 20% over the first week of May is an indication that the telecom industry is starting to build up steam again. Paid social advertising can help marketers build demand with targeted ads to drive offline performance.

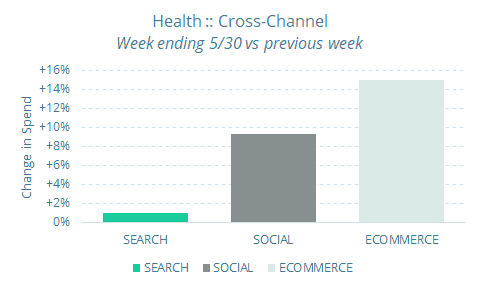

Health

Across a wide range of health and wellness advertisers, total ad spending was up in all channels compared to last week. Specifically, ecommerce advertising for the health category was up 15% over the previous week.

As consumers embrace online grocery shopping during this pandemic, the scope of what is and isn’t “grocery” has widened. Pre-pandemic, online grocery generally meant pantry items, but now consumers see the opportunity to buy everything they would in the store, including laundry soap, fresh fruits and vegetables, and many health and OTC products.

For more information on the online grocery trend, check out a recent episode of our Ask the Expert Live series on the topic of commerce advertising.

Check back every week for updated data

For more COVID-19 tools and resources, check out the Skai COVID-19 Marketing Resource Center and visit the Skai.com/blog/ regularly for articles like these.