Summary

Skai’s “State of Retail Media 2024 Report” underscores the critical role of omnichannel strategies in retail success, emphasizing seamless integration across channels for customer engagement and adaptation in the evolving landscape. Insights from the survey reveal key takeaways for retailers aiming to harness these strategies for growth. Read the blog post, then download the full report for comprehensive coverage.

Unless you’ve been living under a rock for the past 12 months, avoiding the buzz around retail media has been impossible. However, it wasn’t all a tale of optimism. Critics claimed that retail media was just having its moment and that it wouldn’t last. Others believe unaddressed data and competition challenges could hamper its growth — and that a lack of standardization is standing in the way of its ability to fulfill growth projections. In a notable move, Insider Intelligence even downgraded its 2024 spend forecast from $61 billion to $55 billion in June of 2023.

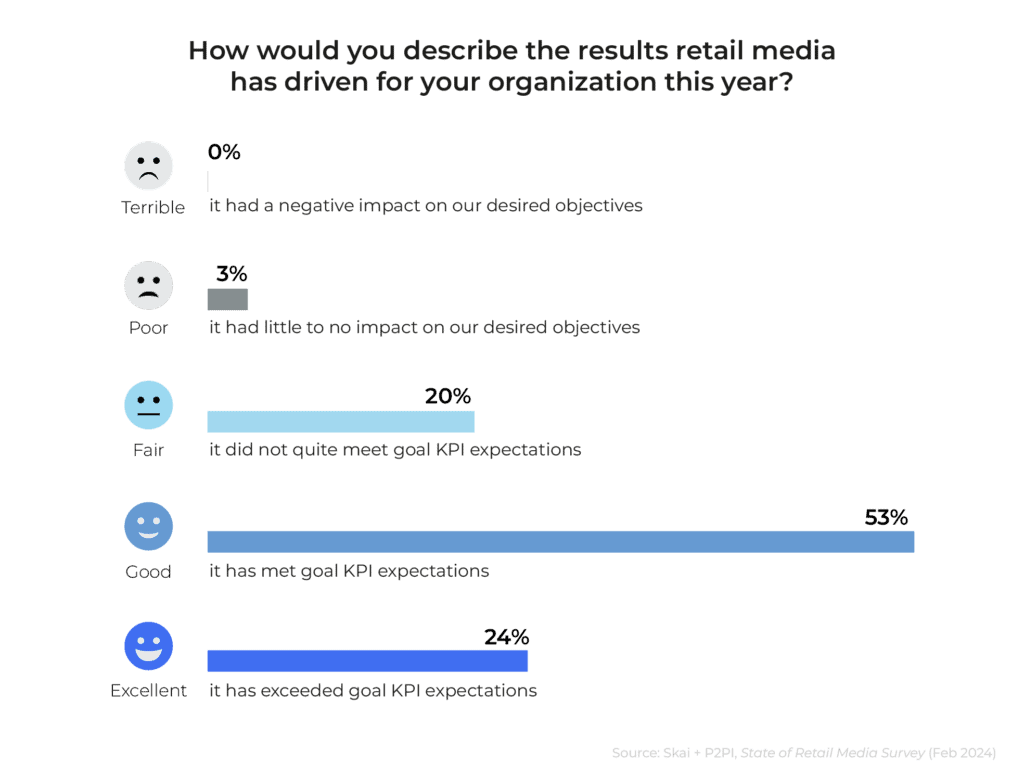

The good news is that we can take the negativity with a pinch of salt. Every emerging channel experiences growing pains, and retail media is no exception. The outlook, however, remains incredibly positive. It claims the top spot on the list of the most important marketing channels, with 81% in our survey considering it very important or extremely important in 2024, and 77% of respondents attest to retail media driving good or excellent results for their businesses in 2023. Notably, Insider Intelligence actually revised its spend forecast back up to $59.6 billion for 2024, signaling a bright future ahead.

As retail media investments grow, so will the opportunities. To date, the majority of retail media spending has been on bottom-funnel search ads, with some mid- and upper-funnel ad options offered by channel leaders such as Amazon Ads and Walmart Connect. This year, retail media networks (RMNs) will push the omnichannel envelope and innovate up the funnel with new ad formats, placements, partnerships, and ways to leverage commerce data outside their walls.

Yes, 2024 is going to be a huge year for retail media!

Are you ready?

In response to marketer interest, retailers are figuring out new ways to capitalize on these high-margin advertising revenue streams.

Six key takeaways from Skai’s 2024 State of Retail Media report

This is our third annual State of Retail Media study, tracking the growth and trajectory of retail media as it twists, turns, and matures. We hope you will find some compelling insights to help navigate this ever-evolving space.

This year’s study topics:

- Spending. Drivers accelerating/decelerating investments.

- Success. KPIs, last year’s results, prioritization.

- Operationalization. Challenges, data sources.

- Omnichannel. Coordination with other channels.

- Measurement. Incrementality usage and proficiency.

- Technology. Usage & impact of AI and data clean rooms.

Retail media has a promising future.

While 77% reported good/excellent campaign results last year, the inverse is even more telling. Only 3% of marketers reported poor results with their retail media campaigns — and none said they had terrible results. Marketers will continue investing as long as retail media keeps delivering consistent value.

Evolution of channel coordination.

As retail media expands into other channels (social commerce, display, streaming TV, etc), we’ve seen a significant uptick in channel alignment in this year’s survey. In our 2023 State of Retail Media Study, only 17% reported good alignment between their different channels. This year, that number increased significantly to 47%. And it’s not just the advertisers aligning; in 2023, Amazon formed what, once upon a time, would have been unlikely partnerships with Snap and Meta.

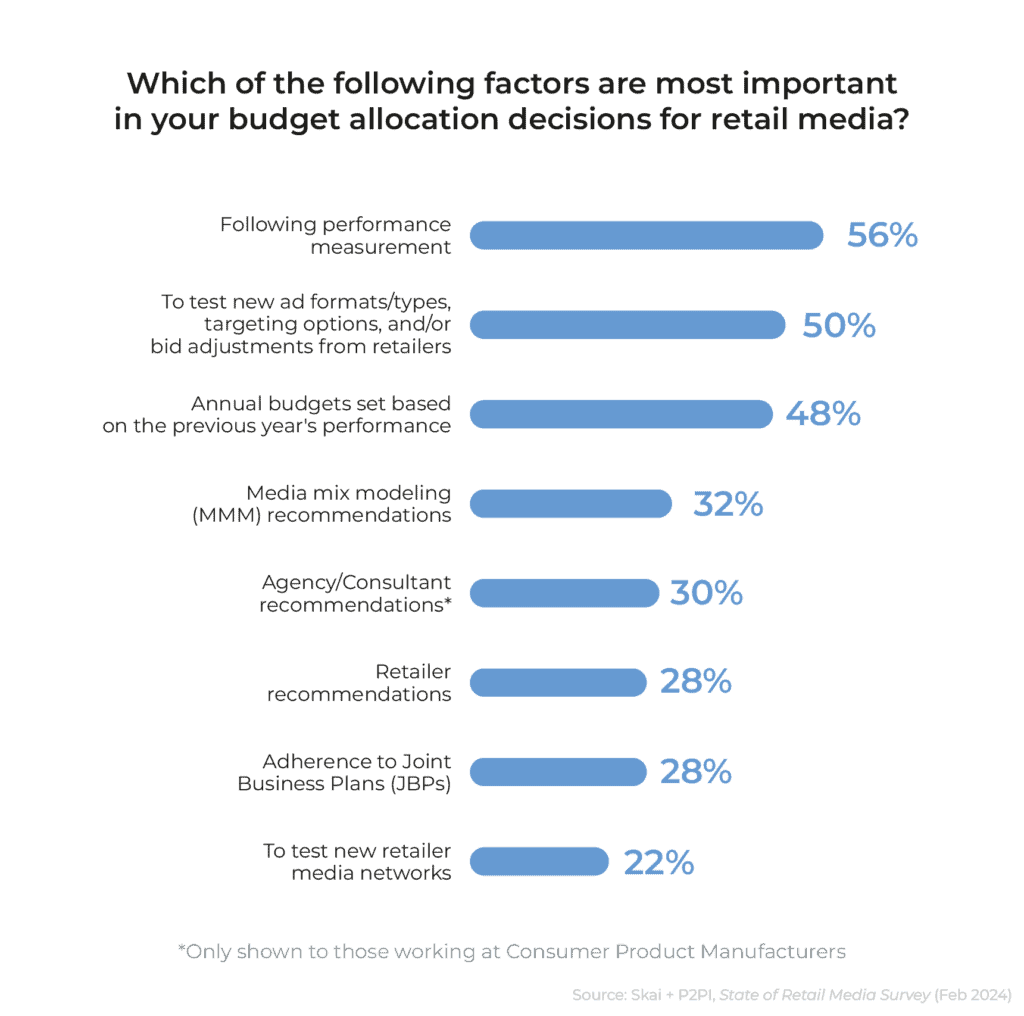

Investment is driven by performance.

Two of the top three factors in budget allocation decisions are results-driven: following measurement performance (56%) and setting annual budgets based on the previous year’s performance (48%). While less emphasized, 12% of respondents cite Google’s deprecation of third-party cookies as a driver accelerating the investment in retail media — a number we think is significantly underestimated given the value from retailers’ first-party data in a post-cookie era.

Technology is a critical component in the evolution of retail media.

The more prioritized retail media becomes, the more willing marketers are to invest in technology to protect and boost those investments. Tech is integral for managing the complexities of retail media, with 58% relying on business intelligence tools. The rise in retail media networks — now over 50 in the US alone — has increased the reliance on data & analytics platforms and third-party management tools. AI is expected to play a significant role in optimization and targeting strategies, but despite the hype around them, adoption of data clean rooms remains limited.

Misalignment between brands and agencies.

Discrepancies exist between brands — who see retail media as just part of broader retailer strategy — and agencies — who manage it as they would another channel in the media plan. For example, agencies prioritize campaign performance in retail media budget allocation (66%) more than brand advertisers (43%). Conversely, consumer product manufacturers place higher importance on retailer recommendations, with 45% considering them crucial, compared to only 16% of agencies.

Incrementality is still a significant challenge.

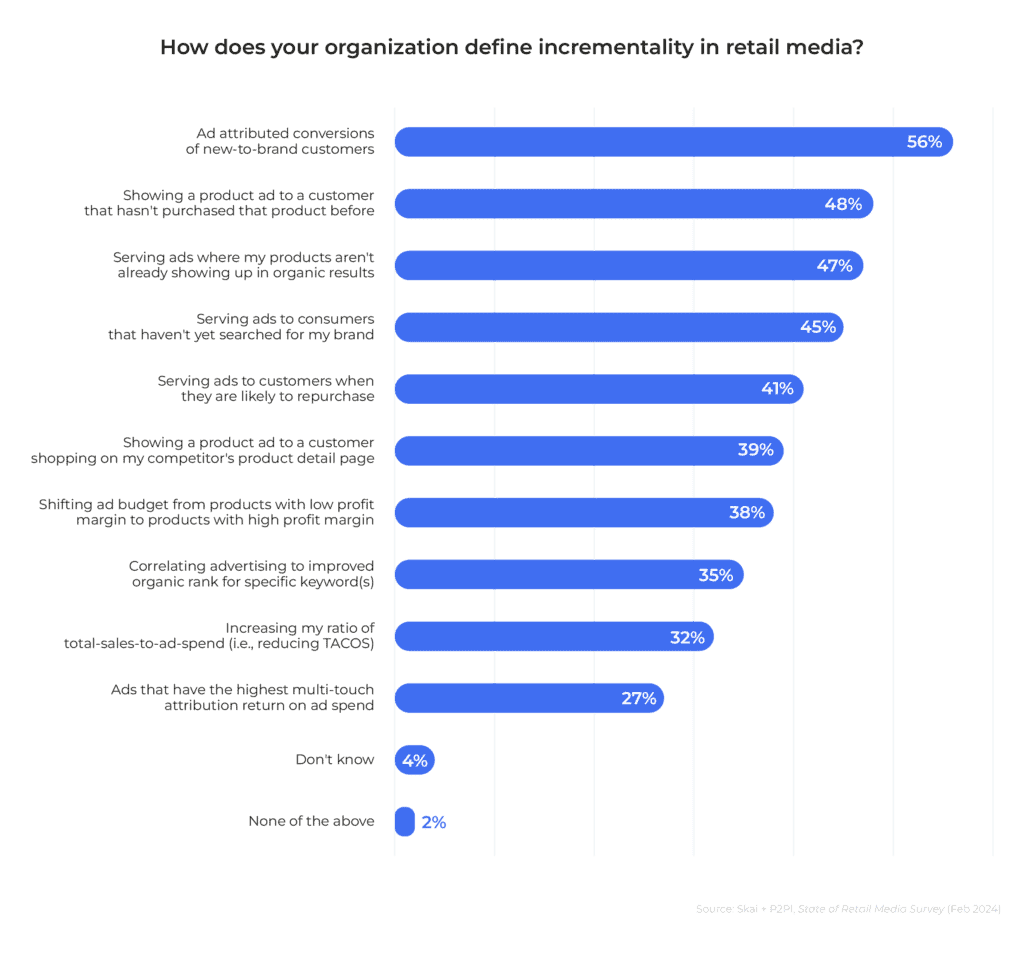

While advertisers have gotten more sophisticated with using non-advertising metrics and data sources, one pressing area of need remains: figuring out the right approach for measuring incrementality. Common tenets of incrementality include evaluating new-to-brand conversions (56%), targeting customers who haven’t purchased before (48%), and serving ads where products don’t appear in organic results (47%). Without an industry-wide approach, marketers must continue educating themselves on what incrementality means to each stakeholder and conduct tests with as much scientific rigor as possible.

What does this all mean for me?

Let’s quickly review our key takeaways:

- Investments continue to flow into retail media based on outstanding return

- Retail media marketers are seizing the opportunity to leverage other digital channels

- Measurement that can prove performance is a key driver of growth

- Technology is a critical component in the evolution of retail media

- There’s a noticeable difference in how brands and agencies approach retail media

- Incrementality is still a significant challenge that needs to be addressed

Retail media is expanding rapidly, driving advertising innovation. This growth encourages brands to use omnichannel strategies, advanced analytics, and targeted marketing to better engage with customers at all points of contact. The push to integrate new technologies and align various digital channels is critical to providing a seamless consumer experience that connects online and offline interactions. As retail media evolves, marketers are being pushed to reconsider traditional methods and adopt more unified, data-driven approaches.

What can I do in 2024 to align my retail media approach with what’s happening in the industry?

First, fostering an omnichannel strategy is critical. If commerce is your business, center your marketing plan on retail media as the foundation and build outward. Marketers should ensure that various channels are explored and effectively integrated to provide a consistent consumer experience across all platforms. Most importantly, understand your retail media performance’s demand drivers and demand-capture mechanisms. Stop thinking in channels (i.e., retail media is just for the bottom funnel) and start thinking about the best media mix to drive total performance across your commerce investments.

And given that this year’s report uncovered some evidence of brand-agency misalignment, brands must actively engage and educate their agencies about the complexities of retail media. And your unique brand ecosystem will always seem complex when looking from the outside in. This shared understanding will allow agencies to manage retail media campaigns more effectively and in line with brands’ overall strategies and objectives.

Technology, particularly analytics and AI, is another area critical for improving campaign performance and understanding consumer trends. The challenges of measurement and incrementality must be addressed. Marketers must invest in tools and methodologies that provide more accurate information about the incremental impact of their retail media campaigns. Those who successfully navigate these complexities will gain a competitive edge, driving meaningful growth and connections with their audience in 2024.

Finally, with third-party cookie deprecation on everyone’s mind, the good news is that walled gardens like retail media networks are highly trackable and measurable. If you’re worried about signal loss and the negative impact on your campaign investments, moving money to walled gardens — even in the short term — would seem to be a wise strategy.

Read the report and demo our commerce innovation firsthand

Download your complimentary copy of Skai’s 2024 State of Retail Media report — you can even just download the charts to use in your presentations.

And check out our Retail Media solution, which empowers marketers to plan, execute, and measure digital campaigns that meet consumers when and where they shop. As part of our omnichannel platform, we connect the walled gardens, enabling you to manage campaigns on 100+ retailers, including Amazon, Walmart, Target, and Instacart, alongside major publishers across paid search, paid social, and apps.

For more information, schedule a brief demo to see how our Skai can help boost your commerce media strategy.