With economic winds picking up throughout the year, expectations were high for the kickoff of the holiday season on the day after Thanksgiving in the United States, also known as Black Friday. The numbers are in, so let us look at performance for this key retail event through the lens of digital advertising across the channels containing major “walled garden” publishers Google, Meta and Amazon.

The following analysis looks at the online advertising programs of commerce advertisers across Retail Media, Paid Search and Paid Social. “Pre-Thanksgiving” refers to average daily performance from November 1 through November 22, the day before Thanksgiving. Commerce advertisers are defined as advertisers who produce and/or sell consumer goods. This analysis includes all qualifying accounts on the Skai platform.

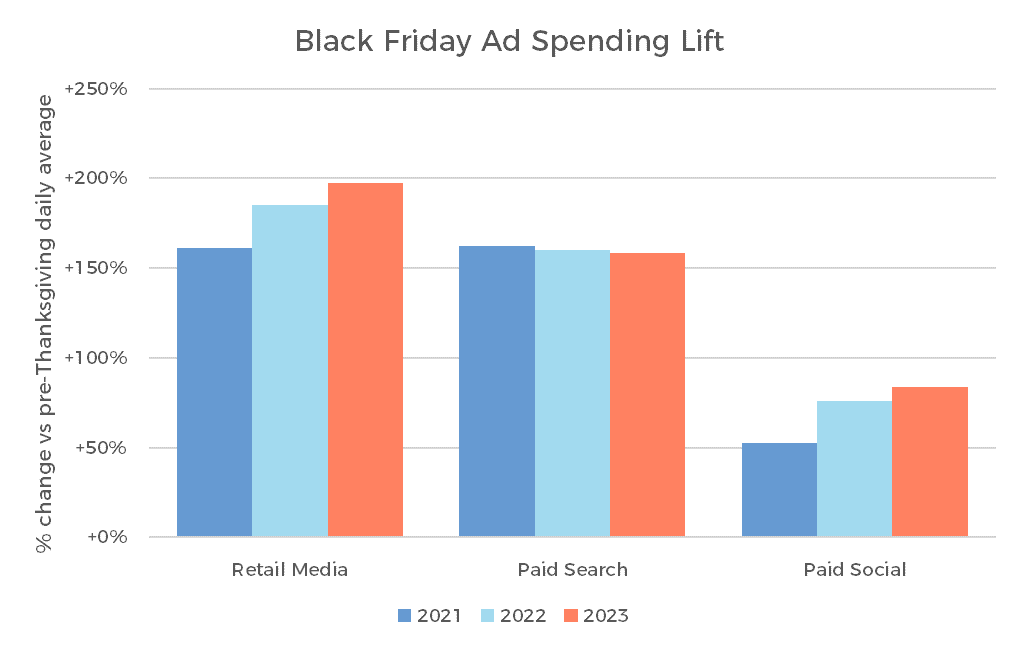

Our baseline expectation is that Black Friday would see increases in both ad prices and overall ad volume. This means more clicks in paid search and retail media campaigns, and more impressions for paid social advertising. We have seen this behavior over and over across many years, and 2023 proved to be no exception.

Spending

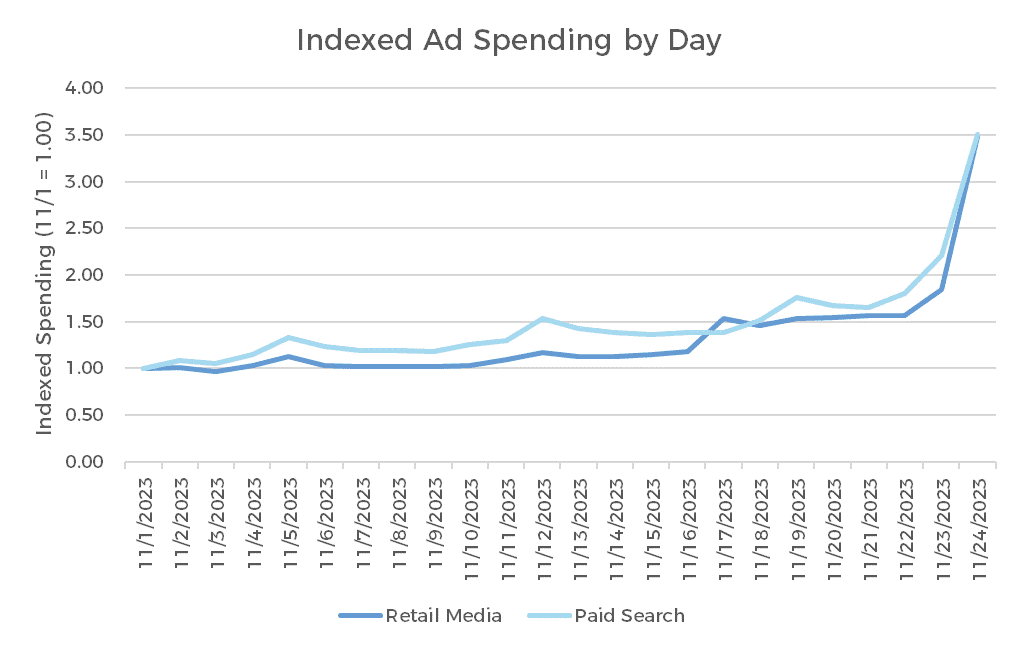

- Retail Media ad spend on Black Friday was nearly triple that of an average pre-Thanksgiving day (+198%), the biggest margin over the last three years.

- In Paid Search, Black Friday ad spending was 2.6X the pre-Thanksgiving average, which was largely consistent with previous years.

- Paid Social spending was 84% higher than the pre-Thanksgiving average.

While Retail Media posted a bigger increase over the average than Paid Search, in both channels, the spending level on Black Friday was roughly 3.5X of what it was on November 1st. The difference was that search spending grew more gradually throughout the month, which drove the average higher, while retail media didn’t spike until about a week before the big holiday weekend.

Ad prices

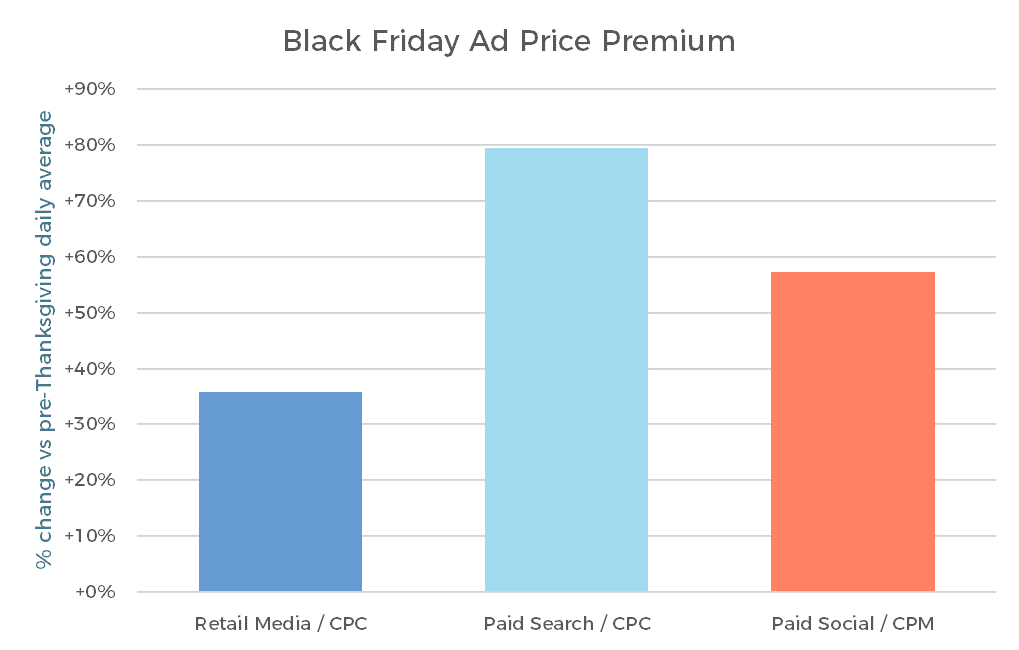

- Retail Media CPC was up 36% on Black Friday compared to the pre-holiday period, implying that the vast majority of ad spending growth came from increased clicks.

- Paid Search CPC jumped 79% vs the pre-holiday average.

- The cost per thousand impressions (CPM) for Paid Social advertising rose 57% over the November average leading up to the holiday.

Key categories

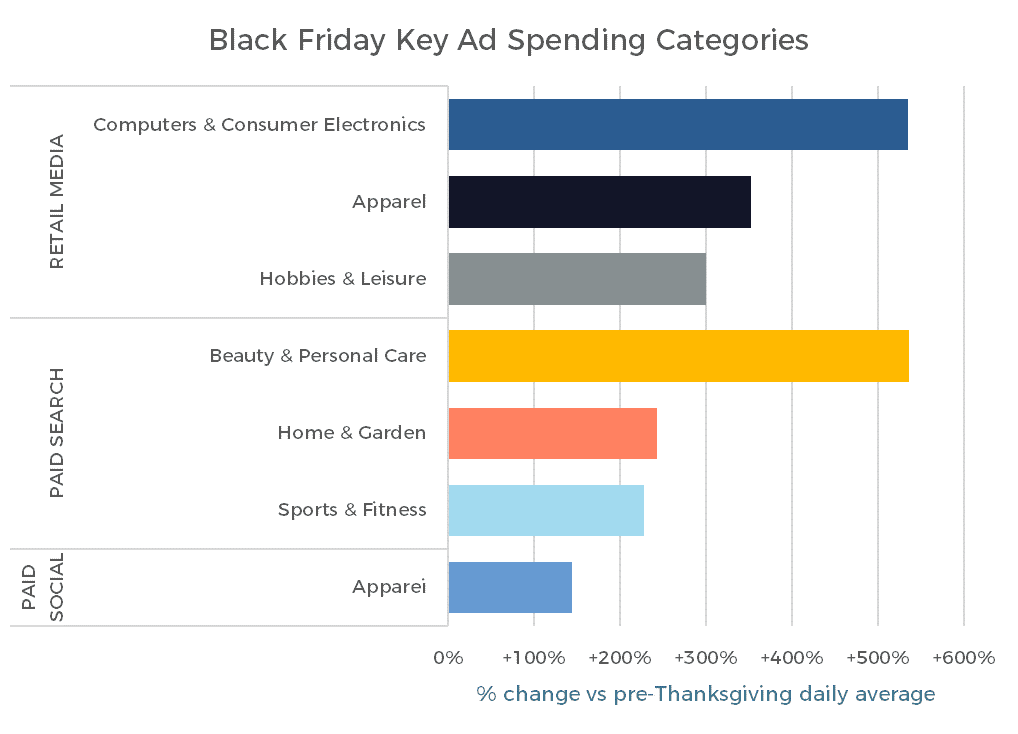

In Paid Search, Beauty & Personal Care saw the largest increase in ad spending by a wide margin, with total expenditures on Black Friday up more than 6X compared to the pre-holiday average. The Home & Garden and Sports & Fitness categories also stood out in the channel.

Apparel had a relatively strong showing in the paid social channel, as spending in this category grew 144% (2.4X) over the average leading up to Thanksgiving.

Retail Media saw the biggest ad spending spikes in Computers & Consumer Electronics (+535%), Apparel (+353%) and Hobbies & Leisure (+300%), all of which are traditionally strong categories for consumer sales events.

Consumer behavior

While our analysis focuses primarily on advertisers, we can also see the sales activity related to that advertising. In both Retail Media and Paid Search, the total dollar value of ad-driven sales tripled over the pre-holiday period. Which means that, in both of these channels, the increase in sales was such that neither channel saw any degradation of overall Return on Ad Spend (ROAS) and, in the case of paid search, even improved on that performance.

Later this week, we will look at the entire “Cyber 5” holiday weekend, from Thanksgiving to Cyber Monday, and also at year-over-year trends across online channels. Stay tuned!