Financial services marketing can be challenging on social media. People are on these apps to connect with friends and family, engage the greater online community, and consume entertaining content. It’s can be hard to get social media users to stop what they’re doing and pay attention to ads—what financial promotions can compete with celebrities and cute baby/pet pics?

But, with 247 million U.S. social media users as of 2019, the opportunity is just too big to ignore regardless of the complexity level.

Five Effective Social Advertising Strategies for Financial Services Marketing

Financial services advertising includes ads from commercial banks, credit agencies, personal credit institutions, consumer finance companies, loan companies, insurance agencies, business credit institutions, and credit card agencies.

The following are five ways that financial services brands can leverage social advertising to best reach and engage consumers:

Use videos to convey complex concepts

While there are many different social advertising formats, each has its pros and cons and marketers should choose wisely when picking which ad types to use.

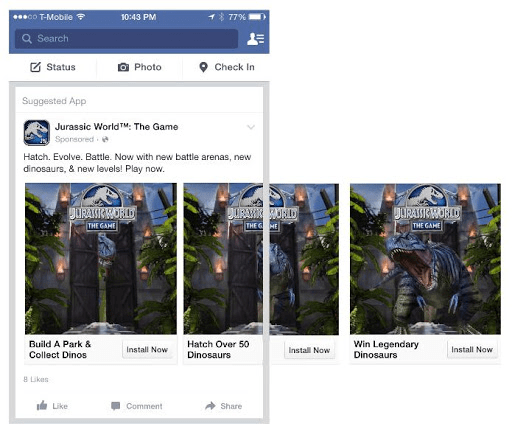

For example, standard feed ads can be very inexpensive and reach many social media users for a tight budget. And carousel ads are great at showing different angles of a product or providing a step-by-step walkthrough of multiple products.

So, remember, the old adage that a picture is worth 1000 words.

If your financial services ads aren’t getting very high click-through rates (CTR), it might just be that the general public doesn’t understand enough about retirement plans, investing, mortgages, etc. to be compelled to click. But, if you can explain your offering in a well-made, thought-provoking video, it will give social users more context into what you do and why your financial services marketing promotions might benefit them.

Split campaigns by existing customers and non-customers

One of the areas where social advertising excels compared to other marketing channels is in audience targeting. The social pubs know so much about each and every one of their users that they offer some of the most powerful and granular segmentation engines available to practitioners.

While there are many ways to build audience targets, focusing social advertising campaigns by existing customers and the rest of the world might be the most effective tactics for financial services marketing.

Existing customers already know who you are and your ads to them could skip the brand building and go right into upselling and cross-selling promotions. And you don’t just have to create one big segment of existing customers. Further segmenting them using your first-party CRM data by how long they’ve been a customer, how much they’ve spent with you, and by which financial services products they’re already using can help you to break this group down into smaller targets.

Non-customers are going to be your biggest bucket. You can use the native targeting options from the social publishers to group them by location, age, gender, household income, education level, and more. For example, maybe your retirement promotions need different messaging if the viewer is less than 30 years old and just starting their careers versus people over 50 who might be looking to invest in some additional coverage as they near the end of their working lives.

Garner trust through influencers

Trust is an incredibly important aspect of financial services marketing. After all, these cus relationships often involve how best to utilize a consumer’s savings. The trust requirement they need to have with you is a lot higher than with a brand from which they’re just buying a $20 item.

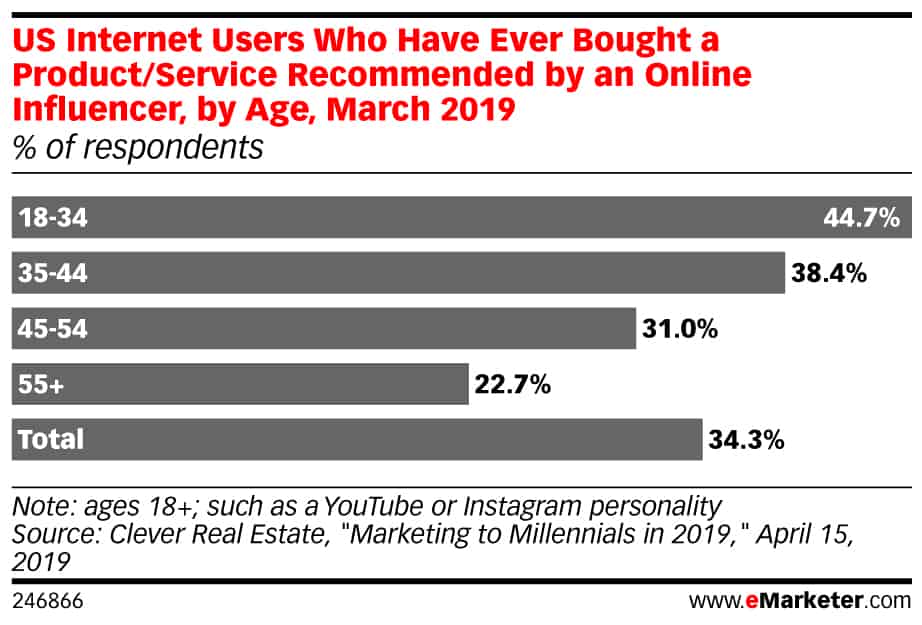

For newer brands, you can get instant credibility by aligning with trusted influencers. While social media users know that influencers get paid to promote brands, there’s a bit of an assumption that there’s a filter in place and that these mavens wouldn’t align themselves with a brand that they thought would be detrimental to their audience.

For long-standing financial brands, you may already have strong market equity that you can bank on, but you might not have that same trust level with younger audiences. To reach those people, you can leverage social influencers to help you tell your story to Millennials and Generation Z. As you can see below, younger generations are more likely to buy based on an influencer’s recommendation than older ones.

Increase relevancy of your financial services marketing

One of the elements that tends to often lead to improved marketing results is relevancy. Reaching a consumer when they are already thinking about how to solve a financial problem that your brand solves can be just the right moment to engage them with your promotion.

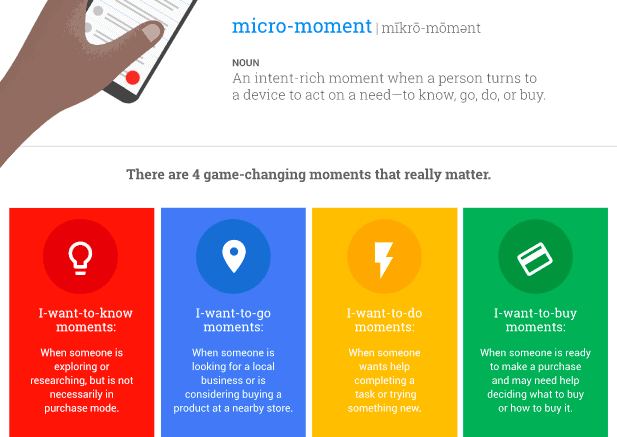

Google has pioneered the concept of micro-moments, which are various points throughout the day where people turn to the web to find answers or fix issues. If you can reach people during these micro-moments with a highly relevant message, you probably have a better chance for them to engage with you.

One of the ways you can make your social advertising more relevant is to use external signals to trigger your ads. For example, Skai Social clients can tie ads to weather signals such as rain, temperature, and even pollen count.

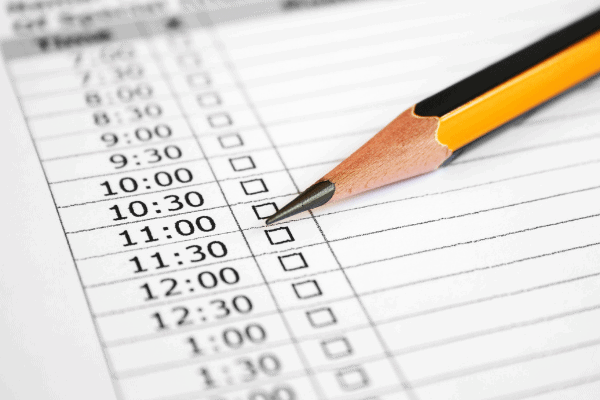

Another good tactic to increase relevancy might be the use of dayparting—to pause your ads during low conversion-rate times of the day and to activate them when your conversion-rates are the highest. For example, maybe your data shows that people are more interested in engaging with financial services ads at night, when they’re not distracted by their work day.

Pair social advertising with your television ads

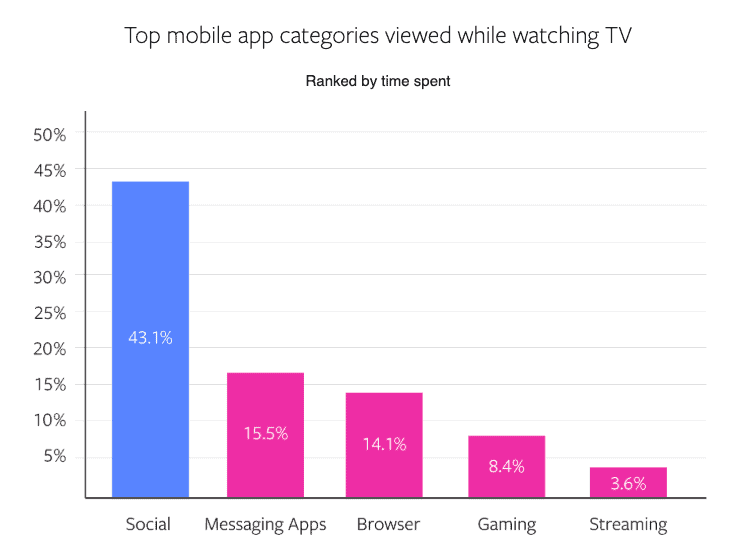

With today’s busy consumers, multitasking is the new normal and the most popular activity on mobile while second-screening is engaging in social media.

A few years ago, Facebook commissioned a study to better understand the multi-screen phenomenon:

“Mobile and TV are an increasingly irresistible combination. An in-home eye-tracking study Facebook IQ commissioned in the US revealed that 94% of participants kept a smartphone on hand while watching TV, making mobile nearly as common a TV companion as a remote control. The results also showed that viewers focused on the TV screen just 53% of the time, and one of the top reasons they looked away was to use their smartphones.”

Skai Social clients can activate—and take various automated actions on—their social ads based on real-time television signals.

For example, a retail brand whose commercial airs in Baltimore can leverage TV Signals for Social to run the same creative on Facebook or Instagram in the Baltimore DMA. Consumers who happen to be watching the channel at the time of the airing of a commercial might also be reached with a social ad. This activates the power of multi-channel messaging which has shown to increase advertising response rates.

Use Skai Social for best-in-class financial services marketing

Social media marketers need more than loose reporting on brand impressions and engagement. They need to mobilize their audience mix while connecting the dots to real business growth. They need to understand, at scale:

- The role of social in the broader marketing mix

- Which new platforms and ad formats are most effective

- How to navigate new privacy laws

- Creative and audience strategies

Skai Social delivers for enterprises with Total Social Intelligence. To learn more, schedule a brief demo to see Skai Social’s innovative features.