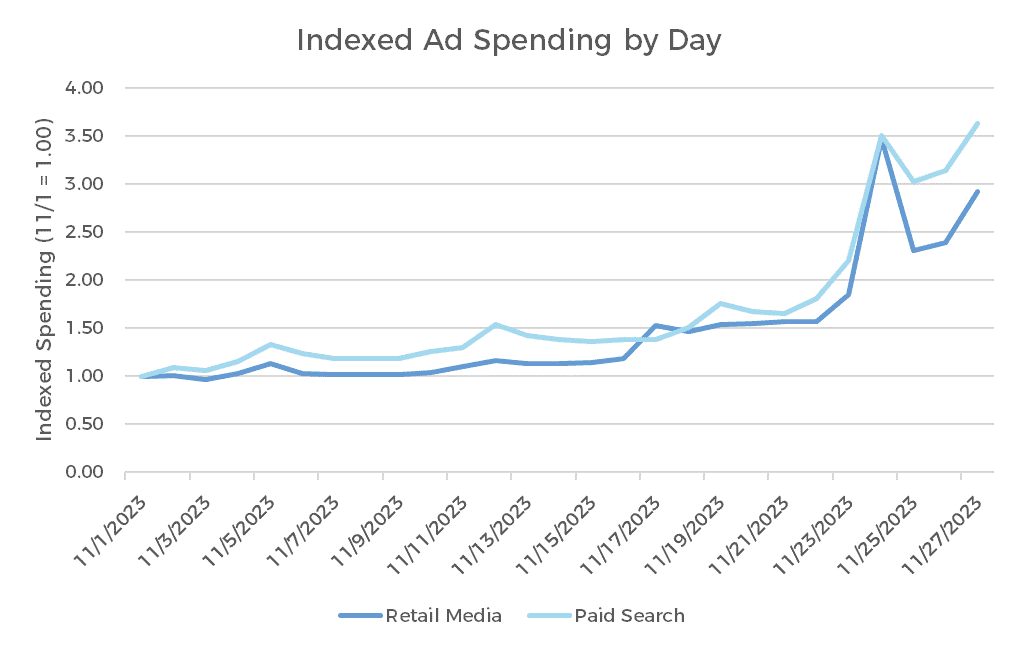

With the big holiday weekend behind us, we can now look more closely at how digital advertising performed for the five days between Thanksgiving and Cyber Monday, also known as the “Cyber 5.” Overall, the intense shopping period lived up to its potential in at least the short term, with spending increasing as more ads were shown at higher ad prices, which were then balanced by similar increase in sales. Compared to last year, the weekend grew in overall size for Retail Media and Paid Social, while the story in Paid Search is a bit more complicated.

The following analysis looks at the online advertising programs of commerce advertisers across Retail Media, Paid Search and Paid Social. “Pre-Thanksgiving” refers to average daily performance from November 1 through November 22, the day before Thanksgiving. Commerce advertisers are defined as advertisers who produce and/or sell consumer goods. This analysis includes all qualifying accounts on the Skai platform, except where noted.

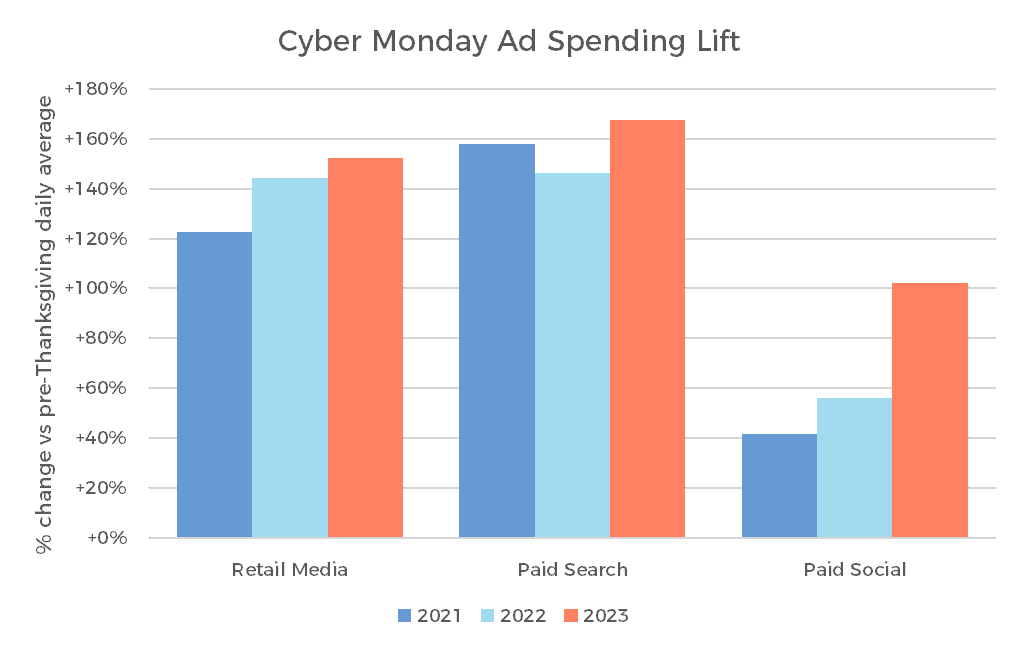

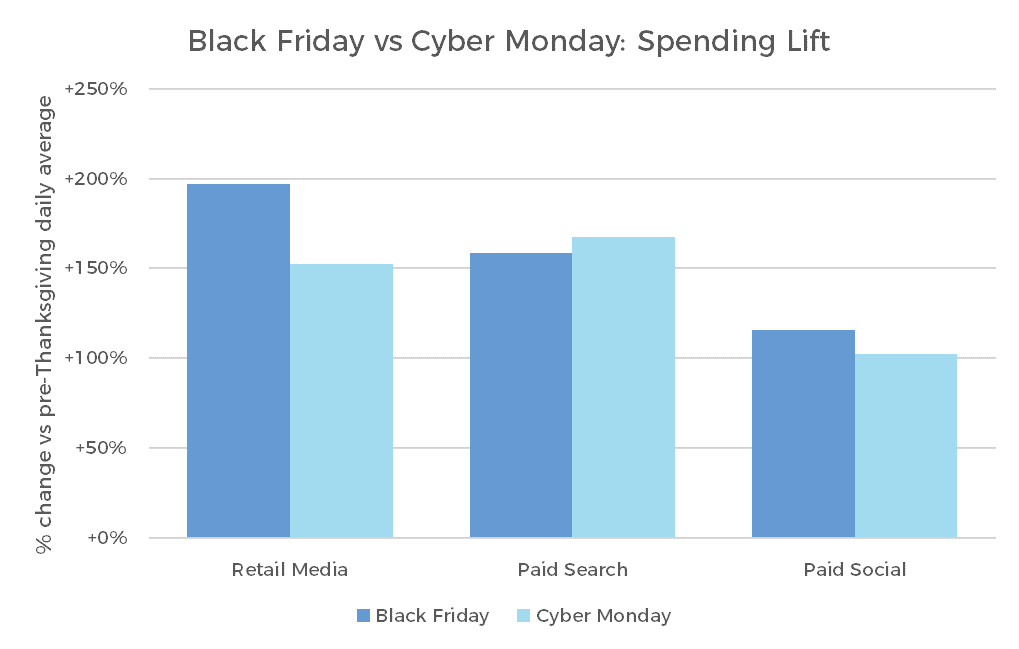

The short-term lift in ad spending on Cyber Monday when compared to the pre-holiday daily average was bigger in each of our three primary digital ad channels than it was in both 2022 and 2021. Paid search saw the largest bump with spending up 168%, or 2.7X an “average” day in November.

When we compare this to the lift on Black Friday, Retail Media stands out as having much less of a spike on Monday as it had on Friday. Paid Search came in just a little bit hotter on Monday and Paid Social came in just a little bit colder, but those numbers were broadly consistent between the two key days of the weekend.

That dropoff in spending lift for Retail Media also means that Cyber Monday was a clear second place to Black Friday in terms of overall spend. Paid Search saw a slight spending edge on Cyber Monday, but even that varied by keyword search (Black Friday was higher), standard shopping campaigns (Cyber Monday) or Performance Max (about even).

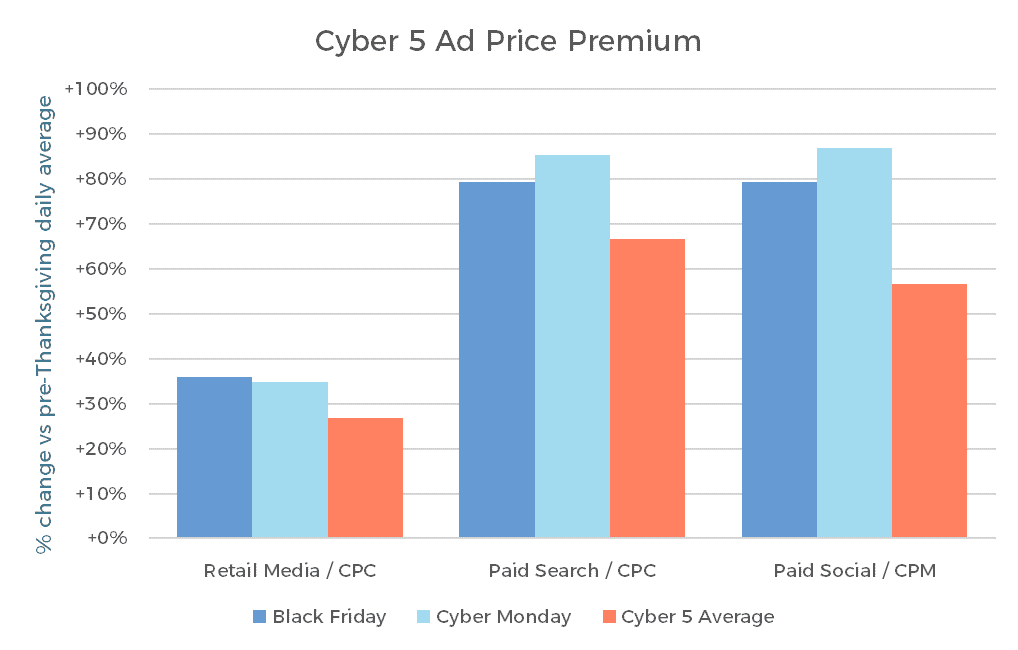

We can also now take a more holistic look at the pricing impact of the weekend. For Retail Media, the price “premium” for Black Friday was 36% higher than the pre-holiday period, and Cyber Monday was just one percentage point behind that, at 35%. Both Paid Search and Paid Social saw both higher premiums in general–at or above 80% across the two days–and a bigger jump on Cyber Monday. In all channels, the average premium across the five-day period was somewhat lower, as the “off” days had lower ad prices across the board.

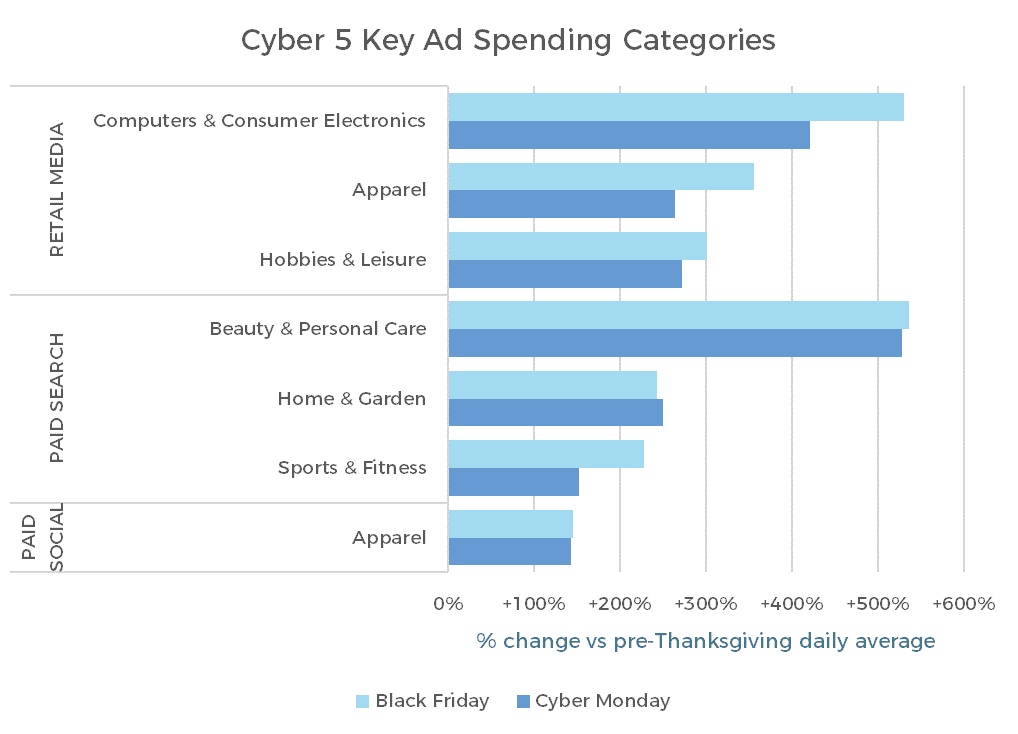

Refreshing our key categories in each channel shows mostly the same patterns. Spending across all of Retail Media was lower on Cyber Monday than Black Friday, so it follows that each of the breakout categories lost some of that momentum. The Sports & Fitness category in Paid Search is the only area where there was a more notable difference between the two days that could not be explained by the overall pattern for the channel.

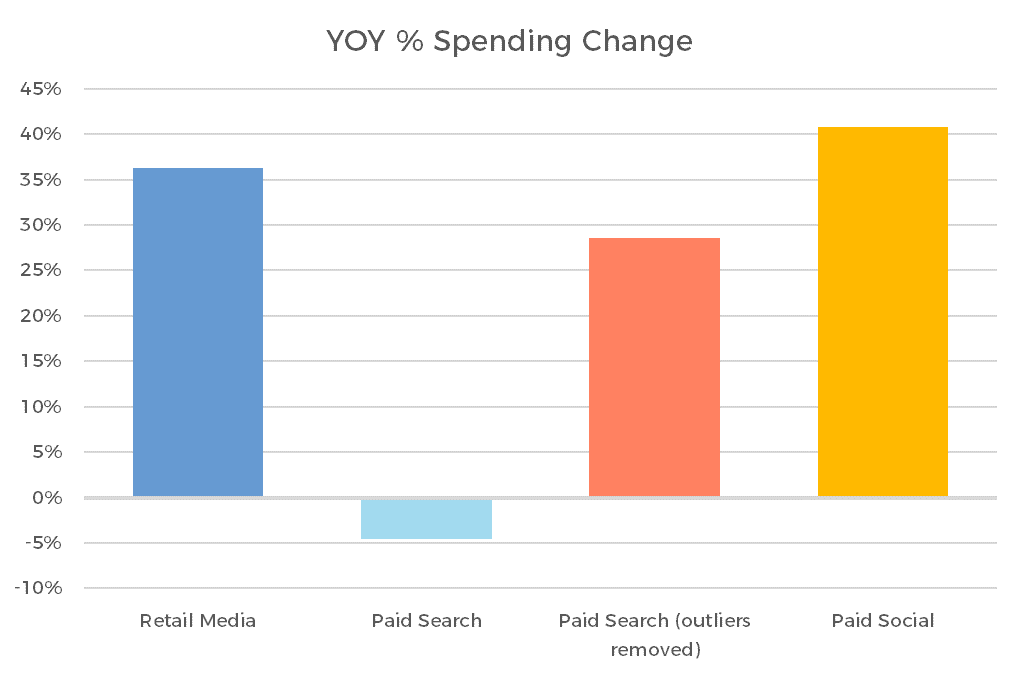

Compared to last year, we must look only at accounts with spending in both 2022 and 2023 to get a fair, “same store” analysis. When we do this, we see that both Retail Media and Paid Social showed fairly healthy year-over-year spending growth. Paid Search, however, saw a 5% decrease in spending. This was driven in large part by the two largest advertisers on the Skai platform, and if we were to exclude those two advertisers, we see a result more in line with the other channels.

Of course, simply removing outliers to fit a narrative is bad form, so now the relevant question is, what happened with those two big advertisers that led to a drop in spending?

Here, we can offer two possible explanations, one rooted in our performance data and one in overall market conditions. First, the data. One drag on spending growth, somewhat ironically, is a new paid search campaign type that has been a general hit among commerce advertisers, and that is Performance Max. These campaigns use a collection of ad components to dynamically serve customized ads based on audience and placement, which presumably tunes them more closely to the time, place and recipient.

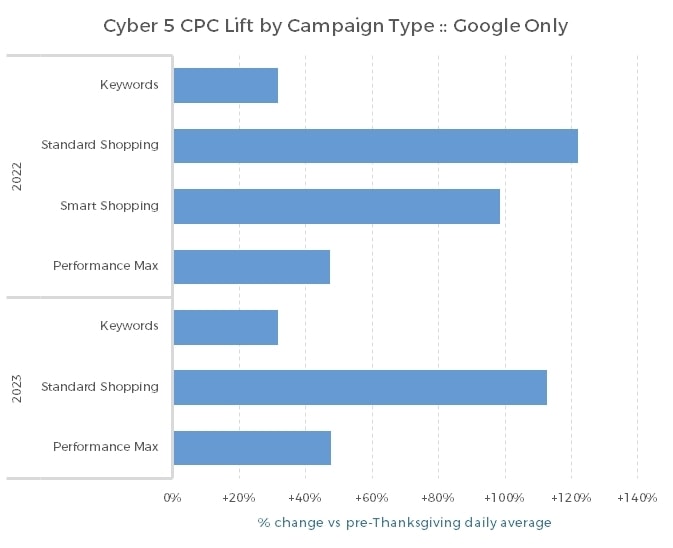

When we look at the Cyber 5 “lift” for CPC broken out by campaign type, what jumps out is that the CPC increase for Performance Max is much lower than that of standard shopping campaigns, and also lower than last year’s premium for smart shopping campaigns. It is more similar to keyword campaigns. As a result, there is much less growth potential for these campaigns in terms of raw advertising dollars, because the traditional formula for growth during the holiday is incremental volume from higher shopper intent, multiplied by higher prices.

One of our two outliers is in fact heavily invested in Performance Max this year, and not only did the CPC of those ads not grow as much for the Cyber 5, it was lower than the smart shopping campaigns from last year.

So this gives us insight into one factor that could be tamping down search spend this year, and if you consider the talking points around Performance Max, it can even be seen as a net positive for advertisers themselves, as these ads are touted as having better targeting and better engagement. One could look at this dynamic and say that some advertisers aren’t explicitly lowering spend as much as they are eliminating wasteful spending that was not finding the right audience.

A second potential factor is something that both Google and Meta have called out on earnings calls over the last couple of quarters, and that is the impact of new, big retailers like Temu and Shein. Broadly speaking, these retailers have been spending a lot of money in online ads, and one effect of this profligate spending is that all of these new ads could be disruptive to what more traditional advertisers are used to seeing during the holidays, effectively limited how many of those competing ads win their auctions and get shown to users. This is, admittedly, harder to quantify, but the frequency with which these new kids on the block are mentioned means we can’t rule it out.

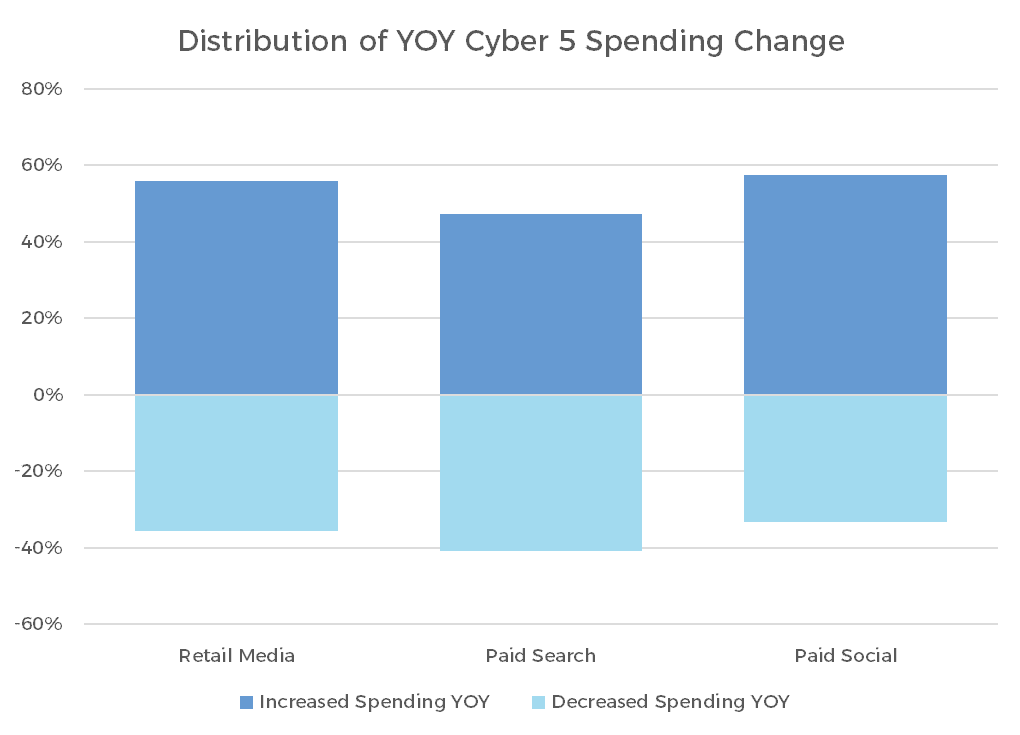

At the end of the day, another way we can compare the season to last year is by just looking at how many advertisers spend at least 5% more this vs. how many spent at least 5% less. Here we see a more consistent picture, as a larger share of advertisers increased spending over the Cyber 5 this year than last year in all channels.

Overall, the Cyber 5 behaved mostly as expected, particularly against the backdrop of growing ad revenues and improving consumer confidence. Short term prices and spending volumes spiked, with sales growing in tandem to absorb the additional costs. For the most part, we saw growth over the same period last year and where we didn’t, we were able to better understand what is different this year in the paid search channel. All of which gives us the tools we need to see out the rest of the holiday season.