Amazon Black Friday 2018 Recap

Computers & Electronics up 542%

Toys & Games up 305%

Black Friday’s tremendous advertiser spend volume and ROI success signals that Amazon Advertising is a true, established channel for marketers across all verticals to drive sales and build their brands.

Marketers will remember 2018 as the year that Amazon became the 3rd largest digital ad platform in the world and this year’s holiday season is proving that advertisers are truly in full support of this channel. Every industry category, from traditional Q4 winners like Toys & Games and Consumer Electronics to even CPG brands, saw an average increase in daily sales of 3X on Black Friday.

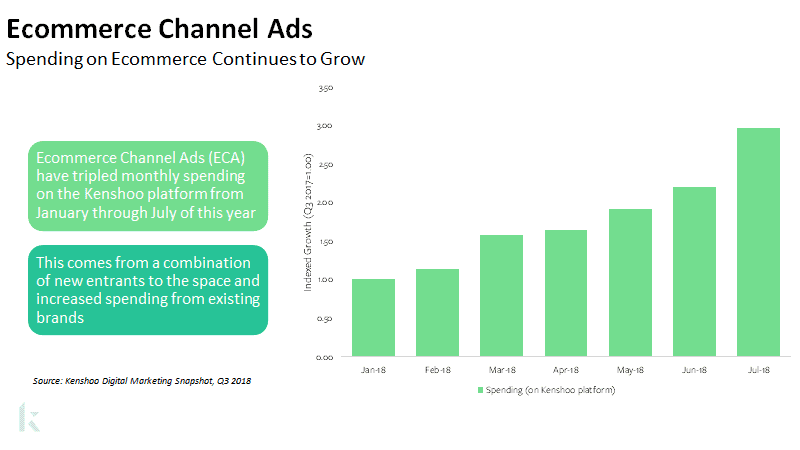

Amazon Black Friday was big and Cyber Monday is today. We’re already seeing tremendous activity. We knew this was going to be a big advertising week for ecommerce ad spending—led by Amazon—because of how fast it has been growing this year. Skai’s Q3 2018 Quarterly Trend Report showed that advertising in this channel tripled in marketer spend in the 7-month span between January and July of this year.

Amazon Black Friday 2018 Up 3X in Spend But Even Bigger in Return

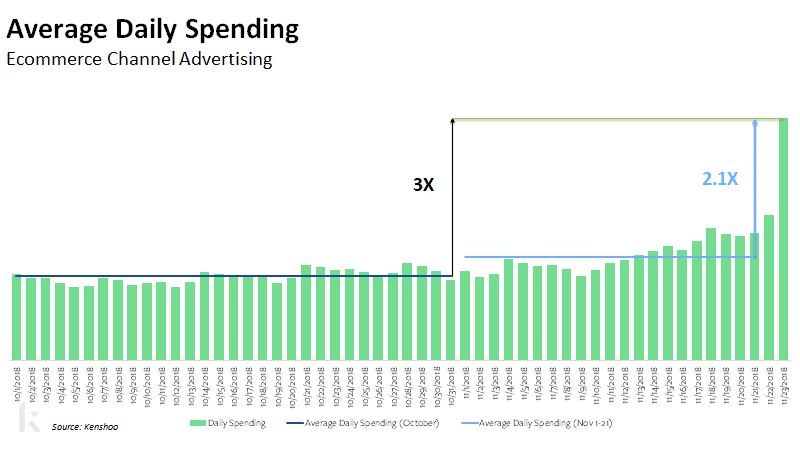

Every holiday season gets bigger and bigger each year for Amazon advertisers. This year’s Black Friday was 3X the average daily spend during the pre-holiday advertising month of October. Even when holiday spending had started to show growth, advertisers spent 134% (or 2.1X) more on Black Friday than the average daily spend in the three-week holiday ramp-up period (Nov 1 – 21) prior to Thanksgiving.

With Black Friday just the kickoff to the most critical dates of the shopping season, Amazon advertisers are expected to continue on their record-setting pace.

Amazon Black Friday – The Big Winners

Computers & Electronics. The latest tech gadgets are always big during the holidays. This year, these advertisers increased Black Friday spend to 331% over their average daily spend in the three weeks leading up to it. This category also saw an incredible increase of 542% in sales that day with a 49% increase in ROI.

Advertisers in the Toys & Games category spent 258% more on Black Friday than on the average daily spend in November with a 305% return on investment.

Advertisers in non-traditional holiday categories like Consumer Packaged Goods (CPG) and Food, Beverage, & Pharmaceuticals also ramped up on this shopping-focused day. CPG increasing their spend on Black Friday by 50% over the November average daily spend with a hike of 131% in average daily sales—a 55% increase in ROI.

| 2018 Black Friday Average-Daily-Increase in Amazon Key Metrics vs. November 1 through November 21, 2018 | |||

| Ad Spending | Daily Sales | ROI | |

| Computers & Electronics | +331% | +542% | +49% |

| Toys & Games | +258% | +305% | +13% |

| CPG | +50% | +131% | +55% |

| Food, Beverage & Pharmaceuticals | +48% | +73% | +17% |

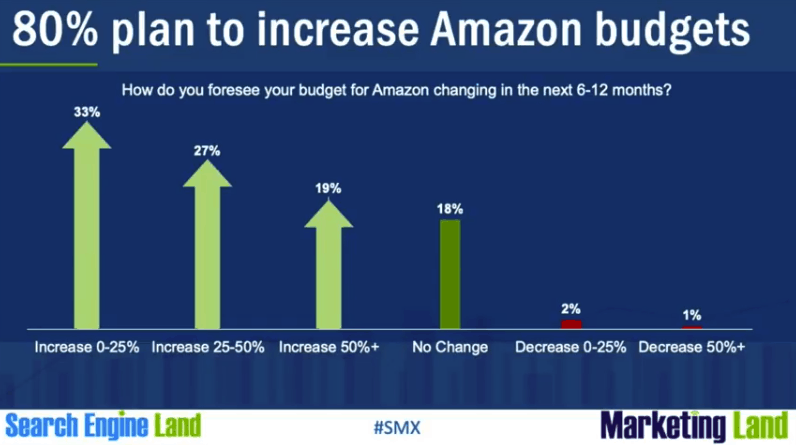

As big as this past weekend has been for ecommerce channel advertising, this seems to just be the tip of the iceberg. As reported recently by Third Door Media, 80% of Amazon advertisers plan to increase their spend to the publisher in 2019. And just over 10% are spending 50-100% of their budgets on Amazon, making it their primary advertising channel.

44% of Amazon advertisers report that they are looking for a marketing platform in 2019 to help them make the most of their budgets. As brands discount products and increase budgets to face competition to take advantage of this tremendous opportunity, marketers have a unique challenge in understanding all of the factors that drive Amazon Advertising success.

If you are interested in learning more about how Skai Ecommerce can help you manage your Amazon campaigns please reach out to us for a quick call to discuss how we can help!

Amazon Black Friday Research Methodology

Today’s analysis is based on the aggregate performance of brands managing Amazon Advertising campaigns on the Skai platform during October and November of 2018. Average daily metrics are calculated by taking the sum of all activity in the period across all advertisers divided by the number of days in that period.