A strong holiday shopping season for digital marketers is typically a leading indicator of solid results in Q1 and subsequent quarters throughout the year. The good news is that, based on preliminary data, 2019 looks to be a strong year for retail. Register for the upcoming Q4 2018 Quarterly Trends Report webinar to get the full download on last quarter.

Q4 2018 was the biggest quarter ever for Search, Social, and Ecommerce advertising. Marketers upped their game for the holiday shopping season as they do every year. 2018’s solid U.S. economy helped retailers to end the year strong and all of the early signs indicate that it was a very prosperous one for merchants.

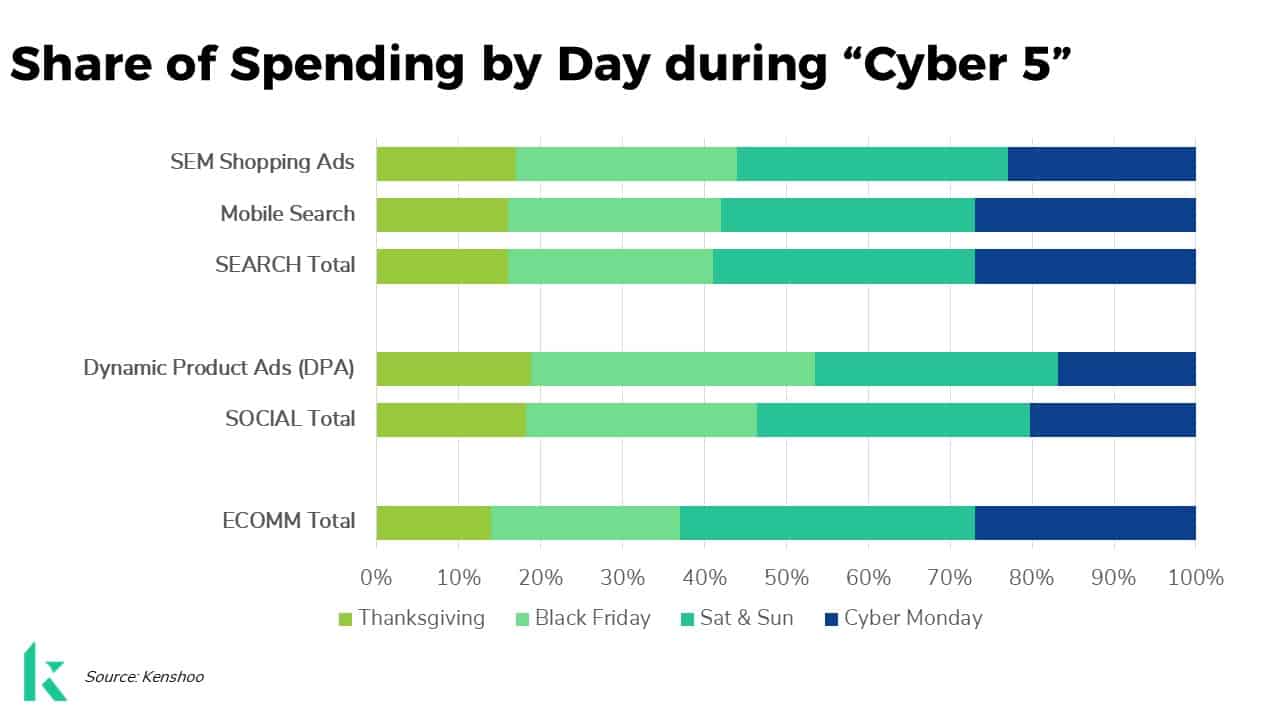

As is common during the holiday season, all three channels experienced an increased spend for the entire period, with premium pricing for the Cyber 5 (Thanksgiving Day, Black Friday, the weekend, and Cyber Monday).

Note: For the purpose of this analysis, the “holiday shopping season” is defined as November 1st through December 25th.

Search Marketing: Mobile and shopping campaigns drove incredible efficiency for the 2018 holiday shopping season

Not only was overall search marketing spend up a healthy 9% over 2017’s holiday shopping season, but advertisers were able to squeeze 49% more impressions from the same spend by dropping the average cost-per-click (CPC) 18% from $0.40 to $0.33. That kind of operational efficiency is exactly what marketers hope to find as high budgets and cheaper clicks equal a lot more eyeballs and traffic to their online stores.

This increased pricing efficiency was chiefly driven by more investment into lower-cost SEM shopping campaigns ($0.27 average CPC) and mobile campaigns ($0.23 average CPC) which have continued to garner more attention and spend from search marketers for the last four quarters. In fact, shopping campaigns comprised 47% of holiday search budgets in 2018, up from 42% in 2017 and mobile campaigns (including mobile shopping) comprised 50% of holiday search budgets in 2018, up from 43% in 2017.

The Cyber 5 makes up just 9% of the days of the holiday shopping season, but marketers value this time so much that they devoted 19% of search spending to it in 2018. Predictably, Cyber 5 clicks come at a premium, with CPCs averaging 45% higher than the rest of the holiday shopping season (that’s up slightly from a 43% premium in 2017). Mobile campaign CPCs were also 57% higher during the Cyber 5 and click costs for shopping campaigns were a whopping 74% higher during this handful of days.

An interesting note here is that 2018’s Cyber 5 had the same share of spending from last year, which indicates that search marketers have somewhat solidified how they plan to support those key dates every year. This is also supported by the fact that the daily share of spend across the Cyber 5 was almost the same as last year, and CPC premiums for the five-day period were also flat year over year.

In short, the Cyber 5 is an important window for retailers and search marketers have seemed to have found a successful game plan to capture the opportunity.

Social Advertising: Up 29% over 2017 for online retailers with almost half of all spend going to Dynamic Product Ads (DPA)

Retail/e-commerce marketers spent almost 29% more during the 2018 holiday shopping period on social advertising than they did last year. They also paid a premium with the average CPM up 25% versus 2017 for the entire season ($4.95 to $6.22).

Retailers have come to rely on Dynamic Product Ads for key shopping dates throughout the year and that trend continued during the holiday shopping season: DPAs garnered almost half of the social spend (45%) for online retailers and represented 85% of all social clicks. That’s slightly up from 2017 where DPAs were 41% of spend and 81% of clicks. The average cost of DPAs rose dramatically in 2018 with CPMs up 41% for the entire season ($3.73 to $5.27) and up even more year-over-year (50%) during the Cyber 5 (from $5.96 to $8.92).

Just like with Search, the Cyber 5 represents just 9% of the holiday shopping season in terms of days but garnered 18% of social spend during the period (slightly down from 19% in 2017). As it was for all social spending by retailers during the period, CPMs were up 25% ($7.54 to $9.39) during the Cyber 5.

Ecommerce Advertising: Now firmly planted as an always-on channel; not just for key shopping dates

Marketers continue to embrace Ecommerce publishers such as Amazon for in-store ads that offer the valuable opportunity to reach consumers while they are shopping. What was interesting in 2018 was that marketers not only went big on Ecommerce advertising during the key days of the Cyber 5, but for the entire holiday shopping period (November 1st thru December 25th)

While more mature channels such as Search and Social saw spend spike heavily during the Cyber 5 compared to the growth of the rest of the season, Ecommerce advertising grew 82% year-over-year (YoY) for the entire season and 55% YoY for the Cyber 5. What this indicates is that marketers invested in the Cyber 5 last year but this year they wanted to have better coverage across the entire shopping period with an “always-on” approach.

Cyber Monday grew to capture 27% of Cyber 5 spending versus only 21% of spend during the Cyber 5 of the previous year. Marketers funded this shift by moving the budget priority away from the weekend, as 42% of the Cyber 5 spending in 2017 was for the Saturday & Sunday of the period while this year the same two days just garnered 36% of the Cyber 5 budget.

Clicks were up 70% for the Cyber 5 and 69% for the season while the average CPC was down 9% YOY for the Cyber 5 but up 8% for the season.

Join us for the full Q4 2018 Quarterly Trends webinar later this month

On Thursday, January 24th at 11am CST, join Skai’s Senior Director of Marketing Research, Chris ‘Coz’ Costello, as he recaps Q4 2018 Search, Social, and Ecommerce marketing performance data aggregated from over 3,000 advertiser and agency accounts across 20 vertical industries and over 60 countries. This dataset spans Skai’s publisher partners which include Google, Bing, Pinterest, Snapchat, Facebook, Instagram, and others.

In this webinar:

- Gain insight into Q4 2018 Search, Social, and Ecommerce performance via Skai’s client dataset

- See how Q4 compares to last year and last quarter as we explore the major trends

- Receive marketer tips and recommendations based on the data