Hello! We’re continuing to review some of the insights from our Global Search Advertising Trends Q1 2013 report. In my first post on the report, I shared how quarter-over-quarter (QoQ) and year-over-year (YoY) Q1, search spend suggests a strong 2013 for paid search. Feel free to download that report or attend our webinar on Tuesday, April 30th – during which I will walk you through the entire report including spend data and provide some additional insights and best practices.

Today, let’s take a deeper look at Key Performance Indicators (KPIs) from the report such as clicks, click-through-rate (CTR), and ad impression volume. For more information regarding the approach that was used to render these numbers, please refer to the methodology section of the report.

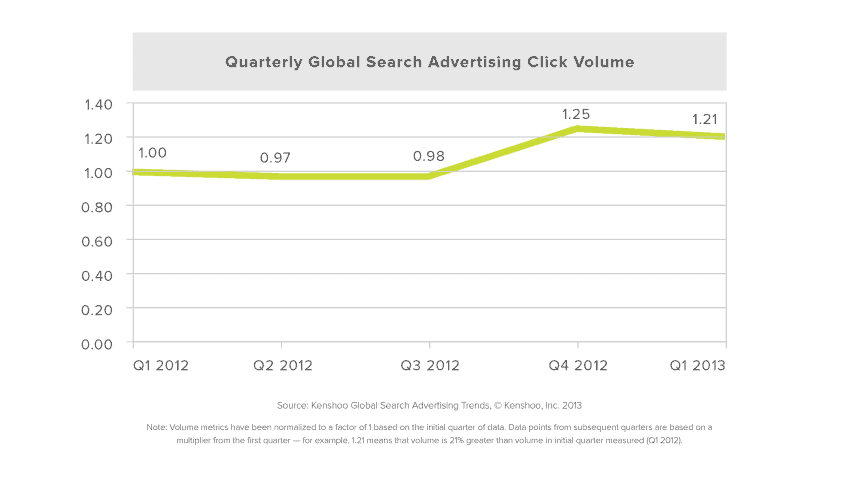

Spend was up YoY and so were clicks. Global search advertising budgets rose 15% YoY while clicks grew even faster with a 21% increase from the same quarter in 2012. In my next post, I will share some of the cost-per-click information that shows that advertisers were able to get more clicks for their SEM dollars, but for now, just know that this hike in clicks would seem to be a good sign of a healthy PPC economy.

In my next post, we’ll see how cost-per-click in Q1 compares to previous quarters as well some spend data broken out by region.