It’s only logical that if the biggest buzz in paid search for the first half of this year was about the adoption of Enhanced Campaigns (EC), then the biggest topic for the second half would be about how it continues to impact paid search advertisers following the forced migration date of July 22nd (a.k.a. “EC-Day”).

Enhanced Campaigns was the biggest modification to the Google platform “in the last ten years,” as its Head of Mobile Solutions for North America, Bon Mercado, told us in a Skai webinar on August 22nd in which we discussed the initial industry reaction one month after this historic event.

After almost three months since EC-day, I have received literally dozens of request from clients, colleagues, trade publications, and financial analysts asking about how EC has affected search spend, conversions, etc. Are cost-per-clicks (CPCs) higher? Lower? The same? Is this a boon for Google? Is this a win for its competitors? Will more money flow to paid search due to this change?

Before sharing what we’ve seen, let’s take a step back for a moment. The general consensus leading up to EC-Day at conferences and the SEM blogosphere was that either: 1) advertisers would pull back spend and wait to see how the changeover affected things before putting money back in or that 2) advertisers would see higher CPCs during this time so they might have to spend more in order to keep driving the same number of conversions they were generating before the switch.

Based on the numbers, however, neither of these scenarios matches what actually happened.

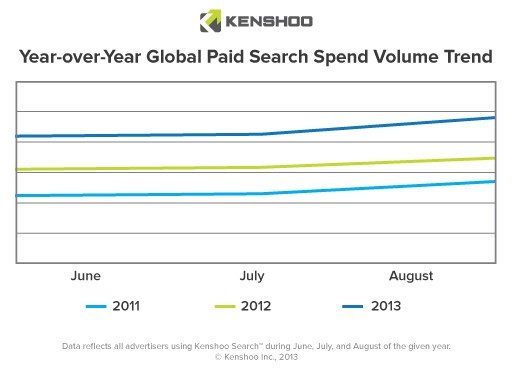

At the beginning of September, I analyzed paid search spend in aggregate across our clients for June, July, and August and compared it to the same three month period during 2012 and 2011.

This is what I found:

Even though paid search is growing year-over-year, the general curve of 2013’s ratio of spend during this time matches pretty closely to previous years. This indicates that paid search advertisers continued to spend at levels we expected based on recent trends and did not dramatically increase or decrease spend during the Enhanced Campaigns period.

“Things seem to be doing fine. So much for all the doomsday talk!” commented WordStream’s Larry Kim on an recent Enhanced Campaign blogpost by Brendan Buhmann, Sr. Product Manager for Skai Search™.

But, what about click costs?

Under EC, paid search marketers had to trade in the fine, granular-level control of the bid at the keyword level across devices for mobile bid adjustments at the campaign or ad group level based on the core, desktop/tablet bid.

During the migration period, when I asked practitioners about how they would approach their bidding strategy under this new structure, some said that they would try hard to maintain the pre-EC bid levels as best they could while knowing in certain specific instances that their new bids would be higher or lower than they were previously.

However, others focused on keeping their desktop bids the same and set a global mobile bid adjustment knowing that they would start tinkering with that setting after the rollover. There actually seemed to be many different schools of thought in this area.

So what did the numbers say?

Earlier this month, we released our Q3 2013 global search trend data which showed that CPCs were up just 4% quarter-over-quarter.

On the surface, 4% doesn’t imply that EC had very much of an impact on click costs. However, this is an aggregate metric across all of our clients and sometimes a top-line number doesn’t tell the full story.

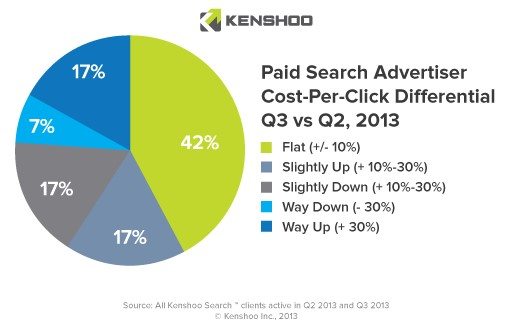

Below is a pie chart in which I mapped out QoQ CPC changes by client across our platform.

Almost half (42%) of all Skai Search clients had relatively flat (+/- 10%) CPCs from Q2 to Q3. For example, if an advertiser ended Q2 with a $0.50 average CPC, then Q3 was somewhere between $0.45 and $0.55.

However, more than half of advertisers saw their CPCs go up or down by at least 10%.

Now let’s put this into context. Just because an advertiser pays more per click does not always mean that the efficacy of their paid search efforts decreases. Paying more for higher quality clicks that convert better can be actually improve the return on investment (ROI).

For instance, $2.00 clicks that generate a 3% conversion rate are more valuable than $1.00 clicks at a 1% conversion rate. In this simple example:

- $1000 spent on $1.00 clicks would generate 10 conversions ($1000 @ $1 per click = 1,000 clicks X 1% conversion rate)

- $1000 spent on $2.00 clicks would generate 15 conversions ($1000 @ $2 = 500 clicks x 3% conversion rate)

This example illustrates that, even though some advertisers saw CPCs rise, it’s not clear whether or not it was on purpose or a byproduct of Enhanced Campaigns. Only time will tell…

So, what can we learn about the impact of Enhanced Campaigns from Q3’s spend and CPC numbers?

Ultimately, advertisers vote with their wallets. Our quarterly trends infographic showed global paid search spend was up 10% year-over-year and 3% quarter-over-quarter. And, per the first chart above, the trajectory of spend in 2013 was very similar to recent years in terms of trending across June, July, and August.

Furthermore, the fact that that almost half of advertiser CPCs stayed flat indicates that EC didn’t disrupt things as much as many predicted in the first half of the year. So far, there seem to be more positive post-EC stories being shared by marketers than negative ones.

The Era of Mobile is upon us. Google’s changeover to Enhanced Campaigns follows consumers to the multi-device world and better aligns with the future of digital marketing and not the past.

Although there will always be some fear of the unknown with changes such as these, it seems that the anxiety was largely unjustified and the hard work that search marketers, agencies, and technology partners put in preparing for EC paid off.

Let’s all remember the lesson here as new curveballs are thrown at us in the future.