Summary

Skai’s Q4 2025 Digital Advertising Trends Report shows a strong finish to the year while revealing a major shift beneath the surface. Retail media surged, paid social efficiency rebounded, and paid search remained resilient, but AI-powered shopping and AI-led decision-making are reshaping how demand is discovered and how budgets perform. The report outlines what these shifts mean for planning 2026 and why marketers must rethink channel strategy, measurement, and AI readiness now.

Q4 2025 performance numbers were excellent across the board.

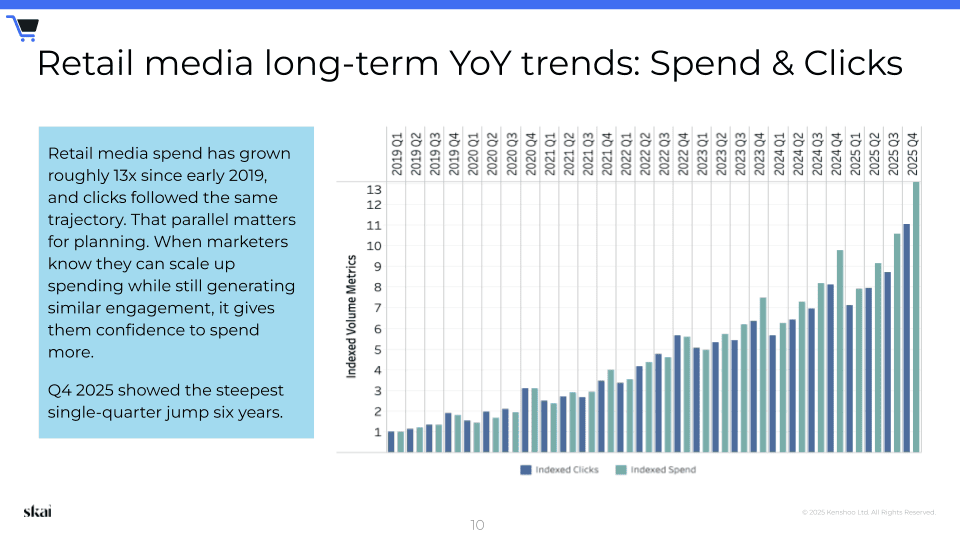

Retail media posted its biggest single-quarter jump in six years. Paid social delivered efficiency gains not seen since before iOS 14. Paid search, despite rising costs, showed that marketers are still willing to pay more where performance justifies it. By traditional measures, this was a great quarter.

But something else happened. AI-powered shopping went mainstream. Traffic from AI search channels like ChatGPT and Perplexity doubled year over year. Salesforce reported that AI-referred shoppers converted at nine times the rate of social media referrals, and retailers deploying AI agents saw 59% higher growth rates. Adobe found that traffic to U.S. retail sites from AI services jumped more than 800% on Black Friday alone. The consumer side of AI moved faster than most marketers expected.

Drawing from 972 billion impressions, 8.7 billion clicks, and $9.2 billion in spending across retail media, paid search, and paid social, this quarter’s analysis reveals the final shape of commerce media before AI reshapes it entirely.

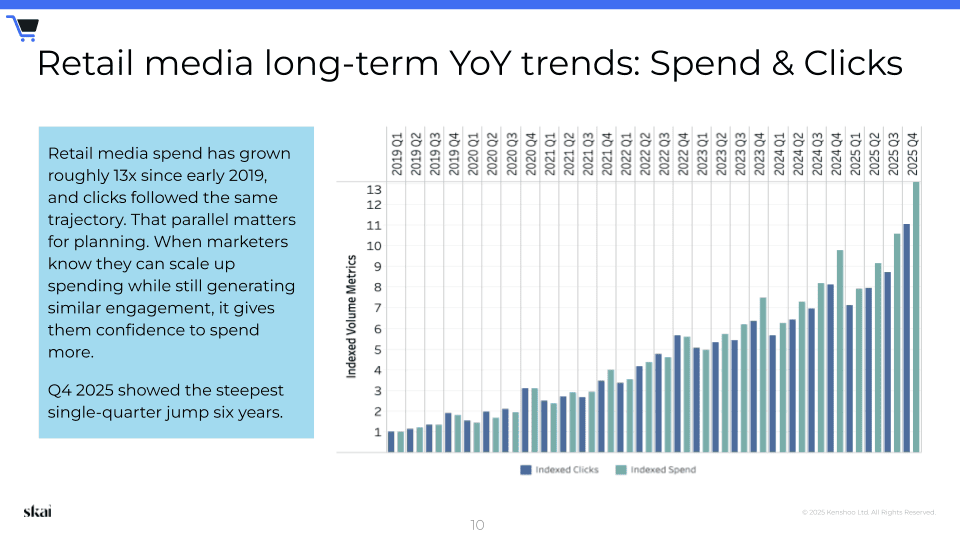

Retail media’s biggest quarter in six years, and it wasn’t even close

Spend rose 33% year over year, the largest single-quarter increase since 2019, with clicks climbing 34%. Engagement kept pace with investment even during the most competitive shopping period of the year. And costs actually declined. CPCs dropped 1% while click-through rates increased 9%.

The real story is where the money went.

Upper-funnel DSP investment grew 72% year over year while costs fell 24%. Half of Amazon advertisers now run DSP campaigns, and DSP’s share of total Amazon spend rose from 17.7% to 23.4%. This isn’t testing anymore. Brands are scaling full-funnel retail media aggressively, building connected customer journeys that reach people earlier and move them through to purchase.

Both Amazon and Walmart grew share of wallet, but the bigger development was what happened elsewhere. Smaller retail media networks grew faster than the big two during Q4, a reversal from earlier in the year. During the holiday season, marketers found real value in the expanded reach and often lower costs from secondary networks. A portfolio approach in which smaller RMNs command meaningful spend would be a healthy sign for the industry, and it looks like we’re heading there.

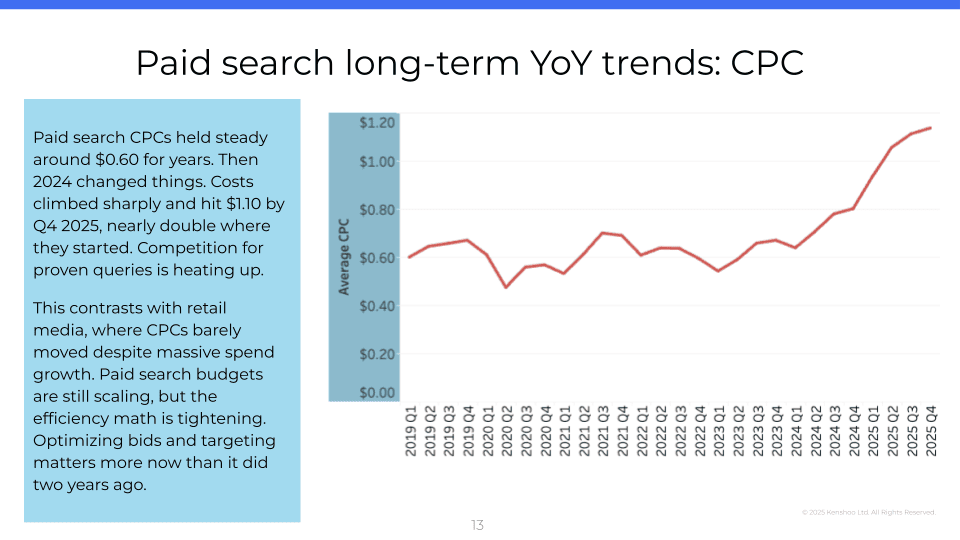

Paid search costs are climbing as AI captures demand earlier

Spend climbed 7% year over year, but the underlying dynamics reveal mounting pressure. CPCs increased 16% while impressions and clicks both declined. Marketers are paying more for less volume.

This is happening at the exact moment AI-driven discovery is capturing demand earlier in the funnel. Adobe reported that traffic to U.S. retail sites from AI services jumped more than 800% on Black Friday. The channel isn’t broken, but the efficiency math is tightening. Advertisers are getting more selective, concentrating budgets on placements that deliver measurable results rather than chasing broad reach.

The category dynamics tell a nuanced story. Jobs and Education led growth with double-digit spend increases. Finance pulled back despite the strong economy, likely reflecting brand safety concerns and cost pressures. Retail held steady, balancing search investment against growing retail media allocations.

Performance Max adoption reached 15% of accounts, but those accounts now direct 65% of their spend to the format. This concentration signals that early adopters are seeing results, or at least prefer Google’s automated approach to manual campaign management during high-stakes periods.

Paid social finally posted the numbers marketers have been waiting for

This was the best efficiency quarter since before iOS 14 disrupted the channel in 2021. Spend increased 9% year over year, clicks surged 23%, and CPMs dropped 6%. Platform algorithms have finally stabilized after years of volatility. Marketers are getting more engagement per dollar than at any point since 2020.

TikTok’s role in the mix continues to strengthen. Account adoption reached 50% in Q4, up from 44% a year ago, showing the platform has moved firmly into the mainstream for social advertisers. Spend share held steady in the 13-16% range throughout 2025, suggesting advertisers are still scaling rather than fully shifting budgets.

The category split reveals strategic priorities. Jobs and Education dominated with 15% spend growth while CPMs stayed flat – a rare efficiency play. Finance cut spend 20% despite absorbing 25% higher CPMs, signaling a strategic pullback. CPG found equilibrium, holding both spend and costs level as budgets likely shifted toward retail media where performance signals are stronger.

Marketers stopped using AI for ads and started using it for decisions

Nearly two-thirds of advertisers now use generative AI within retail media programs. But the way they’re using it has changed dramatically.

Analysis from Skai’s proprietary GenAI marketing agent, Celeste, found that strategy and planning queries accounted for 35.5% of prompts in Q4, while creative and messaging requests fell to just 3%. Marketers aren’t using AI to write ads anymore; they’re using it to figure out where to put their money.

INSERT CHART – AI Query Types by Category

This shift makes sense given what’s happening across channels. Budget allocation, channel prioritization, and cross-channel optimization are exactly the decisions that get harder when retail media is scaling 33%, paid search costs are climbing 16%, and paid social efficiency is finally stabilizing. The complexity demands better tools, and marketers are finding them.

Conclusion: The window to build AI capabilities is now

Q4 2025 delivered strong performance across all three channels. Retail media spend rose 33% with clicks up 34%. Paid social posted a triple win with spend up 9%, clicks up 23%, and CPMs down 6%. Paid search grew 7% despite rising costs. The fundamentals of performance marketing remain strong heading into 2026.

The bigger story is what happened around the edges. AI-powered shopping moved from experiment to reality. Traffic from AI search channels doubled. Retailers with AI agents dramatically outperformed those without. And marketers shifted their own AI usage from creative tasks to strategic planning. The teams that use Q1 to build AI capabilities, scale DSP programs, and establish always-on infrastructure will have structural advantages by Q3. The teams that wait will spend the year catching up.

Skai is the AI-powered commerce media platform for performance advertising. For nearly two decades, the world’s top brands and agencies have trusted our technology to bring retail media, paid search, and paid social together into a single, strategic commerce media program. With embedded AI, connected data, and automation throughout, Skai helps marketers move faster, make smarter decisions, and drive more meaningful growth.

Ready to see how the platform works? Schedule a quick demo.

And download the full report now

Frequently Asked Questions

The Q4 2025 Digital Advertising Trends Report shows retail media growth, paid social efficiency gains, and rising paid search costs. More importantly, it highlights AI-powered shopping going mainstream and changing how demand is discovered. These shifts directly impact how marketers should plan budgets for 2026.

AI-powered shopping captures demand earlier than traditional channels. Shoppers referred by AI convert at much higher rates than social traffic. This means marketers must plan for AI-driven discovery alongside retail media, paid search, and paid social to protect performance and ROI.

Marketers should use the Q4 2025 Digital Advertising Trends Report to rebalance budgets toward retail media, scale DSP, and invest in AI-driven planning tools. The data shows AI is now a strategic decision engine, not just a creative tool. Acting early creates a competitive advantage by mid-2026.