Summary

Retail media marketers must embrace social commerce as it transforms shopping behaviors. Platforms like TikTok and Instagram blend discovery and purchasing, offering new opportunities to drive growth and deepen consumer connections. By focusing on shoppable media, omnichannel measurement, and cross-channel insights, marketers can create seamless, high-impact campaigns. Social commerce is no fad—it’s essential for modern retail strategies.

Last updated: December 22, 2025

In the buzzword-heavy world of marketing, “social commerce” has taken center stage. Yet, despite all the headlines, confusion still surrounds what it truly means and why it’s here to stay. For retail media marketers, this confusion often leads to complacency. Many assume, “It’s just another trend that will fizzle out.” Spoiler alert: It won’t.

The past year has made it abundantly clear that retail media and social commerce are becoming increasingly intertwined. Ignore that, and you’ll miss out on a big opportunity.

Micro-answer: Social discovery that converts to commerce.

What is social commerce?

- Social commerce now includes in app checkout plus off platform influence.

- Two models drive social commerce today.

- Retail media teams should treat social commerce as both a transaction channel and a demand driver. It can close sales inside social experiences or generate high intent traffic to retailer and brand destinations, creating measurable signals that improve targeting, creative, and full funnel performance.

To understand social commerce, it’s important to understand that it’s not just a singular concept but a blend of two interrelated dynamics:

- Platform-integrated shopping. This includes ad formats or organic posts that lead to checkout options within the respective social platforms. Currently, this is dominated by TikTok Shops and Instagram Shops, but increasingly, retailers such as Amazon and Walmart are collaborating with social publishers to allow consumers to buy products from those stores directly from within the social apps.

- Broader commerce journey. Social media’s role extends beyond just hosting transactions. It shapes and impacts the entire consumer journey, whether through social publisher-owned shops or by driving traffic to established retailers. Social commerce blurs, and often erases, the lines between content consumption and shopping, creating immensely sticky media experiences.

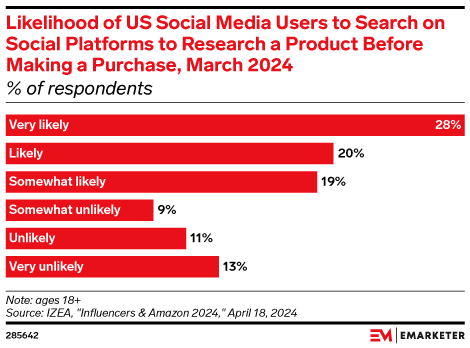

According to eMarketer 2024, product research on social is mainstream, which raises the value of social commerce signals for retail media measurement and optimization.

Why should retail media marketers care?

- Retail media teams must treat social commerce as performance critical.

- It is becoming central to retail media results.

- Social commerce changes how consumers discover products, how budgets get allocated, and how full funnel retail performance is proven. When teams connect social signals to retail outcomes, they improve audience quality, creative learning, and incrementality insights across retailer and brand destinations.

At first glance, social commerce might seem like someone else’s challenge – likely managed by brand teams focused on metrics like reach, impressions, and view-through rates. Meanwhile, retail media teams are laser-focused on driving growth, profitability, and market share, with ecommerce leaders demanding tangible results.

So, what’s changed? Social commerce is no longer optional – it’s becoming central to the retail media ecosystem. According to eMarketer 2024, that social research behavior is widespread, which makes social commerce a practical upstream lever for retail media outcomes rather than just a branding tactic

Here’s why:

- Consumer behavior has shifted. Consumers increasingly turn to social platforms for discovery and inspiration. For example, 67% of US social media users are at least somewhat likely to search on social platforms to research a product before making a purchase, per eMarketer. TikTok, in particular, is no longer just an entertainment app — it has evolved into a powerful search engine and marketplace in one. In fact, according to eMarketer, in 2024, for the first time, TikTok will have a higher percentage of US users (43.8%) who are buyers than any other social media platform. The #TikTokMadeMeBuyIt phenomenon illustrates this seismic shift in how people shop.

- Social commerce is growing fast. Platforms like TikTok, Meta, and Pinterest are rapidly launching commerce-first features. TikTok now offers Product Catalog campaigns, while Meta refines its shopping experiences across Instagram and Facebook. During Black Friday Cyber Monday (BFCM) 2024, 62% of social ad spend targeted commerce outcomes, with spending up 96% compared to November averages. Looking ahead, eMarketer projects that US social commerce sales will crack the $100 billion mark in 2026.

- It deepens consumer connections. Retail media marketers must recognize the immense value social commerce brings to building brand loyalty and advocacy. Social platforms’ ability to generate first-party data and strengthen share of voice offers an unparalleled opportunity to connect with consumers in meaningful ways. To operationalize those signals at scale, many teams align social outcomes with their broader paid social platform workflows so creative learnings and audience insights can be activated consistently across campaigns.

- Marketers are investing accordingly. Preliminary results from our State of Retail Media 2025 report reveal that 83% of US consumer goods marketers say that advertising on social media is important to them, a 69% increase from last year. Over half (55%) already incorporate social commerce in their retail media strategies, and 68% plan to increase their social commerce budgets in 2025. No channel other than on-site search ads has as big an increase projected for the year ahead.

- Social helps retail media go upper funnel. Retail giants like Amazon and Walmart are doubling down on full-funnel strategies. At Amazon’s unBoxed 2024 conference, upper-funnel solutions like Streaming TV were front and center. And both Amazon and Walmart are enabling seamless social-to-retail experiences via partnerships with TikTok, for example. Retail media investment is also expanding overall WARC 2024 forecasts continued retail media growth, which makes integrating social commerce signals more valuable as spend scales across onsite and offsite touchpoints.

What are the four pillars of social commerce for retail media marketers?

- Social commerce requires storefront thinking plus measurement rigor.

- Four pillars guide scalable execution.

- Treat social commerce like a managed retail environment. Build shoppable destinations, use commerce enabled formats, measure cross channel impact, and apply shared insights across audiences, products, and creative. This turns social activity into repeatable retail media performance gains.

Just as retail media marketers invest in and methodically curate their presence on sites like Amazon and Walmart, social commerce demands similar meticulous attention. To capitalize, you must focus on these four areas:

- Social commerce as a new storefront. Social commerce isn’t just an advertising channel with particular ad formats; it’s a fully fledged storefront in its own right. Much like Amazon Brand Stores, platforms like TikTok Shop and Meta Shopping offer brands the opportunity to create immersive, shoppable experiences. Consequently, retail media marketers must think of social as a direct-to-consumer channel where discovery, engagement, and purchase occur in one seamless flow.

- Shoppable media and ad formats. To capitalize on platform-integrated shopping, marketers must embrace and optimize commerce-enabled ad formats. Features like TikTok’s Product Catalog campaigns and Meta’s shopping ads are designed to drive conversions directly within social feeds, creating new pathways to meet consumers where they are.

- Omnichannel measurement solutions. Social commerce influences purchases across the entire consumer journey, often leading to transactions on other platforms. Retail media marketers need tools that go beyond media mix modeling to help connect social activity to sales across channels and ensure that their campaigns drive tangible results. These solutions include:

- Incrementality testing across channels

- Data clean rooms

- Attribution solutions, such as Amazon Attribution

- Cross-channel insights to optimize commerce goals. Insights from social platforms can refine broader commerce strategies, allowing marketers to:

- Enhance audience targeting. Leverage unified data to uncover patterns in interests, purchase behaviors, and engagement across social and retail campaigns. You can use shared taxonomies to inform strategies, ensuring relevance and driving improved performance across channels.

- Fine-tune product strategies. Combine social commerce insights with retail media data to optimize product strategies and drive performance. From new launches to best-sellers, you can ensure the right items are promoted at the right time.

- Optimize creative. This requires data-driven insights to identify trends, refine creative elements, and optimize performance in real time. You can test multiple creative assets on platforms like TikTok, Meta, Snapchat, and Amazon and seamlessly align content with what drives sales. What’s already performing on social media can often be reused or adapted to enhance retail media campaigns, creating a more cohesive program.

By anchoring their approach in these four pillars, retail media marketers can bridge the gap between inspiration and purchase, creating a cohesive, omnichannel shopping experience. Social commerce isn’t a fad – it’s a transformative force that redefines how retail media interacts with consumers. And now it’s time to tap it.

To unify planning and activation across onsite and offsite commerce touchpoints, teams often align social commerce execution with enterprise retail media solutions so the same goals and measurement standards carry across retailers and social channels.

Related Reading

- Wild Fi boosts lead gen 33% and conversions up 258% across search and social for Personal shows how cross channel activation can improve conversion efficiency when social and performance goals are managed together.

- PepsiCo unlocks over 80% new-to-brand ROAS with Skai capabilities for Amazon DSP demonstrates how audience strategy and measurement can lift new customer outcomes in retail media programs.

- Inova Scales Facebook AdvertisingLeads by 600% with Skai highlights how automation and structured audience management can scale social performance while improving efficiency.

Frequently Asked Questions

What is social commerce for retail media marketers?

Social commerce is the discovery to purchase journey that starts on social platforms and results in either in app checkout or measurable traffic to retailer and brand destinations. For retail media marketers, it matters because it produces intent signals that can improve targeting, creative, and sales measurement across channels.

How do retail media marketers activate social commerce without losing measurement?

Start by defining one commerce goal set across social and retail media, then standardize tracking and naming so you can connect exposure to downstream outcomes. Use incrementality tests where possible and align clean room or attribution workflows to retail KPIs so social driven demand can be compared to other performance levers with confidence.

Why is my social commerce strategy not driving incremental sales?

Common issues include optimizing only for shallow platform events, sending traffic to weak product detail experiences, and failing to connect audiences and creative learnings to retail media activation. Tighten the signal chain by improving destination readiness, testing new versus existing demand, and using consistent taxonomies so insights can actually be reused across channels.

Social commerce vs retail media: Which is better?

They work best together. Retail media captures high intent shoppers close to purchase, while social commerce can create demand earlier and generate signals that improve who you reach and what you show. Use retail media for harvest and efficiency, and use social commerce to expand discovery and feed measurable audiences and creative learnings back into performance programs.

What is new with social commerce in 2025?

In 2025, more teams are planning for social commerce as a core revenue channel and not just a branding layer, with forecasts continuing to show strong growth toward the mid decade milestone. Coverage of recent market momentum highlights continued scale and investment, including projections tied to the 2026 threshold reported by EMARKETER and cited by major retail industry outlets.

Glossary

Social commerce: The commerce journey that starts on social platforms and results in either in app checkout or off platform purchases, closely related to shoppable media and retail media measurement.

Shoppable media: Commerce enabled creative that lets shoppers browse and buy with fewer steps, related to product catalogs, creator content, and performance retail outcomes.

Retail media network: A retailer owned advertising ecosystem that monetizes shopper data and onsite offsite inventory, related to full funnel commerce strategy and incrementality testing.

Omnichannel measurement: A set of methods that connect marketing exposure to outcomes across platforms and retailers, related to attribution, MMM, and privacy safe clean room workflows.