The country continues to open up in various phases for different regions. What has been the impact on advertising by key industries? Here’s what happened last week.

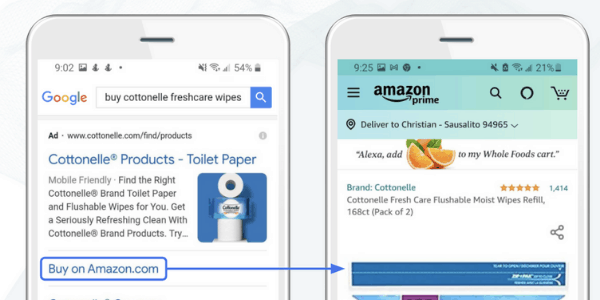

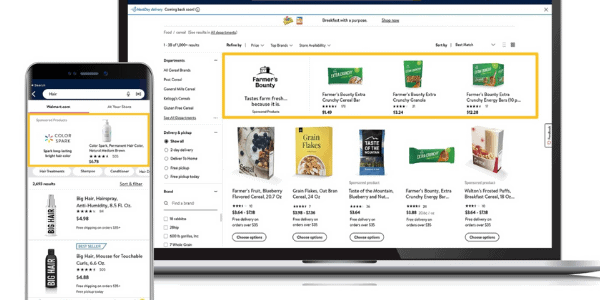

The data to follow comes from weekly vertical snapshots of our robust dataset in the Skai COVID-19 Marketing Resource Center. Visit the page to find weekly updated data, as well as marketing tips, response toolkits (deeper analysis and recommendations by channel), and replays of webinars and our Ask the Experts Live series.

The Skai COVID-19 Marketing Resource Center

Advertising Patterns and Insights by Industry: Week ending July 4th, 2020

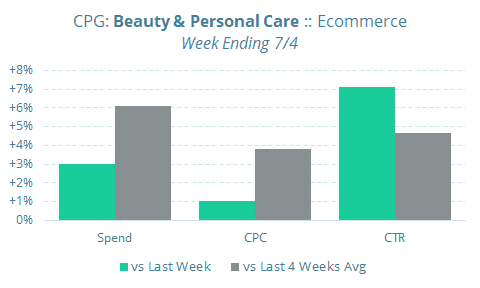

CPG: Beauty & Personal Care

The Beauty industry—which pre-pandemic relied on in-store demos and consumer testing to drive sales for decades—is evolving right now and relying almost exclusively on the online channel to build customers. Some beauty retailers are innovating with apps that can show shoppers how they look with virtual makeup apps and are sending more samples out so that customers can try products at home.

“Digital disruption has brought huge changes to the beauty industry, and with Covid-19 changing the retail landscape even further, nothing prepared beauty brands and retailers for an unprecedented metamorphosis of consumer habits,” according to Stellar founder Anna Brettle.

Last week, an increase in engagement at elevated prices resulted in higher levels of advertising spending on Beauty & Personal Care ads in the Ecommerce channel versus the previous four-week average.

Retail: Apparel

One of the big issues that the global pandemic has created in the Apparel industry is that because it is so globally-connected, apparel manufacturers in countries coming out of the crisis are still struggling as the countries they ship to might still be in the middle of it. One innovation being explored is on-demand clothing creation to ensure that stock doesn’t sit idle in warehouses.

“Change requires patience. When on-demand first came to the book publishing industry, the publishers initially resisted the model. Now they have adopted it broadly alongside (traditional) long-run offset printing,” says one industry expert. “I believe the same thing will happen in the fashion industry. And I believe the pressures from COVID-19 will accelerate this shift.”

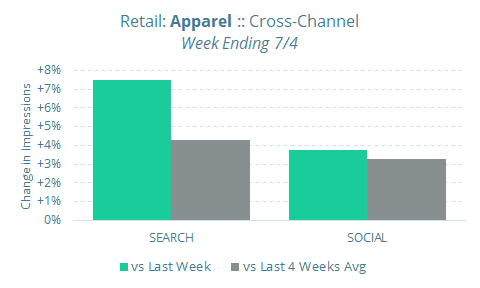

Impressions were up in the short- and medium-term for Apparel ads in both the Search and Social channels. We cannot confirm or deny if this was all related to increased interest in “Zoom shirts.”

Retail: Housewares & Home Furnishings

With consumers spending more time at home, it makes sense that they would be more inclined to spend on upgrading their living spaces.

Case-in-point, Wayfair reported that online sales were up 90% year over year in the first half of Q2. “Starting in mid-March, we saw a pickup in both traffic and conversion, with increasingly strong repeat behavior coupled with an acceleration in new customer orders,” said CEO Niraj Shah.

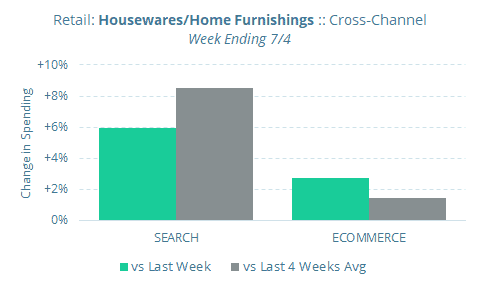

Spending on search ads for Housewares & Home Furnishings was up in the short- and medium-term, and spending was also elevated in the Ecommerce channel in a week when many categories were down because of the holiday.

Health

At the beginning of the pandemic, when most thought it last just a couple of months, consumers opted to postpone many appointments rather than venture out for non-essential health needs. However, as the pandemic lingers on, people have been more apt to continue with their normal lives as best that they can—and that includes returning to standard doctor, dentist, and other health visits.

This return to standard healthcare is also an important economic driver. According to the Department of Commerce, the American economy shrank by nearly 5% in Q1. Nearly half of this change—the biggest single-quarter drop since the Great Recession—had to do with reductions in health care.

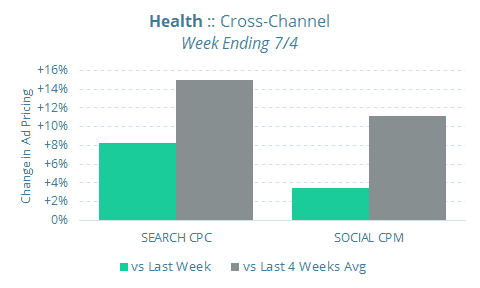

Ad prices for the entire Health category were up in the Search and Social channels compared to both the previous week and the average for the last four weeks. Clickthrough Rate (CTR) was up as well, and spending levels were also mostly higher.

Health: Pharmaceuticals

One of the big pandemic headlines for this industry that it has been able to somewhat turn around consumer sentiment for its industry.

Pre-COVID-19, pharma companies were dealing with strong, negative public opinion. According to a Harris Poll, just 32% of Americans had a positive view of the pharma industry at the time, ranking it near the bottom of the list. That sentiment has dramatically changed. 40% now say that they have a more positive view of the industry since the pandemic began.

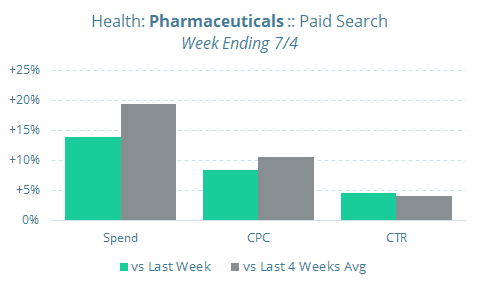

Increases in CPC and CTR can sometimes mean advertisers are actually pulling back less relevant or less effective ads, but for Pharmaceuticals in paid search, spending also increased.

Increases in CPC and CTR can sometimes mean advertisers are actually pulling back less relevant or less effective ads, but for Pharmaceuticals in paid search, spending also increased.

Travel

Because Travel is certainly one of the industries that have been hardest hit by the pandemic, it’s a key category to watch for signs of advertising recovery.

In the Forbes.com article, How The Travel Industry’s Lessons Learned From Covid-19 Will Apply For Years To Come, an industry expert lays out the ways that the travel industry is becoming more sophisticated in the wake of the global crisis and how—although the effects of the pandemic have been devastating in the short-term—the long-term impact means that the industry will be stronger and more insulated from crises than before.

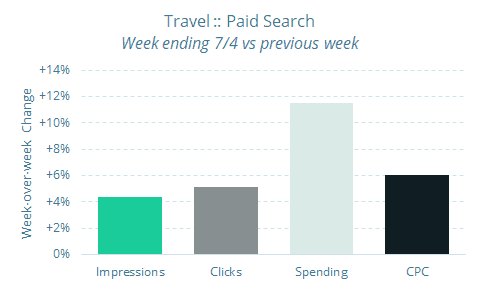

Total weekly spending on Travel ads in the Search channel was up for the twelfth straight week, with impressions, clicks, and CPC also elevated over the previous week.

Check back every week for updated data

For more COVID-19 tools and resources, check out the Skai COVID-19 Marketing Resource Center and visit the Skai.com/blog/ regularly for articles like these.