The country continues to open up in various phases for different regions. What has been the impact on advertising by key industries? Here’s what happened last week.

The data to follow comes from weekly vertical snapshots of our robust dataset in the Skai COVID-19 Marketing Resource Center. Visit the page to find weekly updated data, as well as marketing tips, response toolkits (deeper analysis and recommendations by channel), and replays of webinars and our Ask the Experts Live series.

The Skai COVID-19 Marketing Resource Center

Advertising Patterns and Insights by Industry: Week ending June 20th, 2020

Travel

It’s been widely publicized just how hard the Travel industry has been hit during the pandemic. That’s why it’s we’re glad to see some signs of recovery. According to research from a GlobalWebIndex.com survey of consumers, “Almost a quarter say that vacations will be their top post-outbreak purchase priority, rising to almost a third among the most affluent group.”

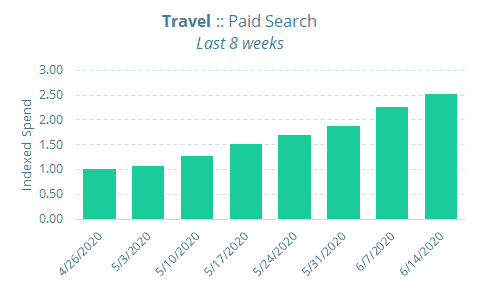

The shape of the graph says it all. Weekly spending on paid search in the travel category has increased 2.5X over the last 8 weeks and has shown no signs of slowing down. The fact that this channel is increasing in spending is an important indicator because paid search ads are triggered by consumer searches on keywords relevant to the Travel industry. Thus, more spend can be correlated to more consumer interest in traveling.

Retail: General

As we reported last week, Retail bounced back in May with a record 17.7% month-over-month increase. The numbers fluctuate mainly by region as areas of the country and the world opens back up in phases at different timetables.

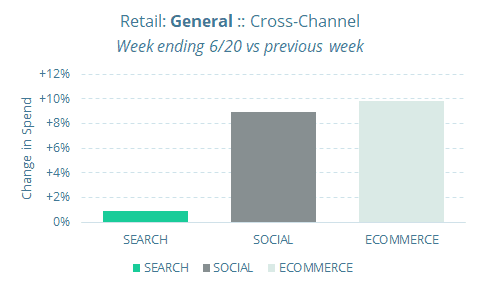

Last week, across all Retail, spending was up in each of the search, social, and ecommerce channels, with search growth just barely in positive territory. The fact that social advertising was up is a good sign because the channel is generally seen as an upper and mid-funnel tactic which means companies in this vertical are beginning to focus on filling their pipeline and not just transactional, bottom-funnel advertising strategies.

CPG: General

The CPG space is a mixed bag across essential and non-essential items. Essentials, of course, have been where consumers have continued to spend during the pandemic. Non-essentials took a bit of a hit at the beginning of the crisis but are starting to come back as consumers open up their wallets and pocketbooks to spend beyond just the necessities.

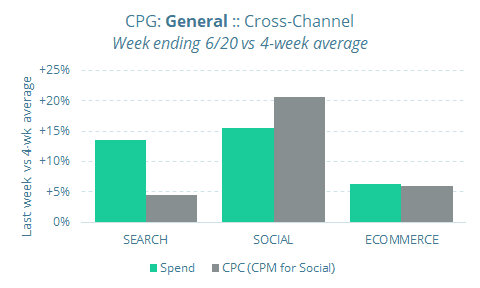

In CPG—across the search, social and ecommerce channels—spending increases in the medium-term view have been driven in part by pricing increases over that same period.

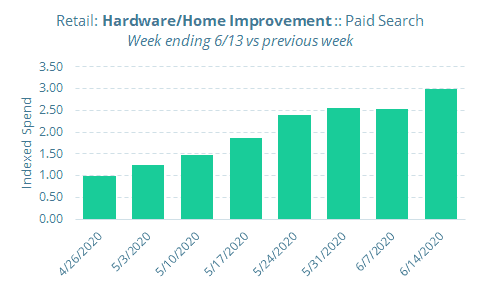

Retail: Hardware & Home Improvement

In the paid search channel, Hardware & Home Improvement has shown consistent spending increases over the past eight weeks, implying that consumers are taking on more home projects as they spend more time at those homes. A recent survey by LightStream, a consumer lending company, found that 77% of homeowners plan to renovate their homes in 2020.

Finance

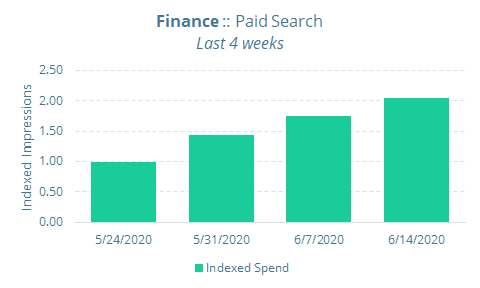

The global research firm, McKinsey & Company, recently reported that “while most financial decision-makers in the US view the current economy as weak, those that expect worsening in the next three months are decreasing.”

Health

The way consumers view healthcare has changed during the pandemic. Of course, many people are choosing not to visit doctors’ offices in person unless there’s something serious at play. However, telehealth and health apps are starting to play a bigger role in our lives.

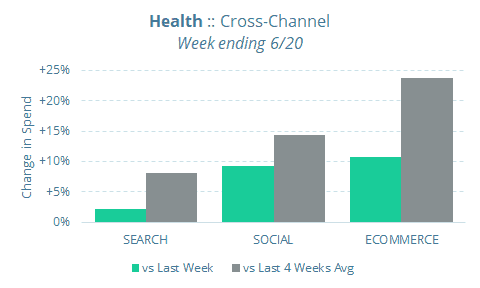

The wide-ranging health category continues to show increased spending over the short- and medium-terms in all channels.

Politics & Government

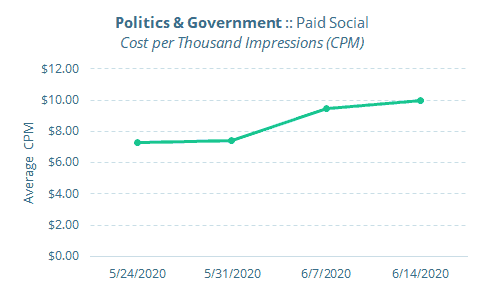

Historically, every four years during the U.S. presidential election drives a major spike in advertising spending. This also creates more scarcity in the market which drives up pricing and that’s what we’re seeing in Social advertising. The price of social ads across politics and government has increased over the last four weeks, coming in just shy of $10 in the week ending 6/20.

Check back every week for updated data

For more COVID-19 tools and resources, check out the Skai COVID-19 Marketing Resource Center and visit the Skai.com/blog/ regularly for articles like these.