The country continues to open up in various phases for different regions. What has been the impact on advertising by key industries? Here’s what happened last week.

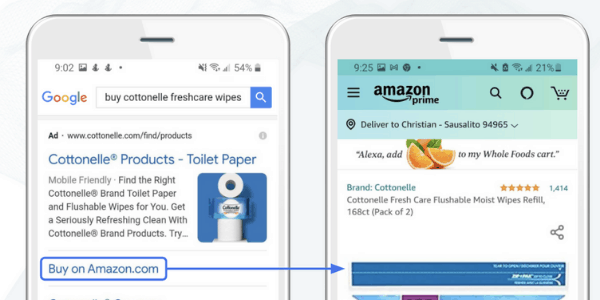

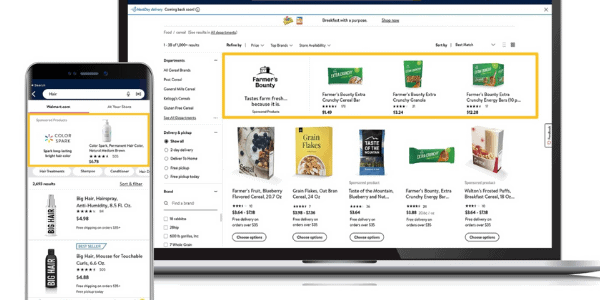

The data to follow comes from weekly vertical snapshots of our robust dataset in the Skai COVID-19 Marketing Resource Center. Visit the page to find weekly updated data, as well as marketing tips, response toolkits (deeper analysis and recommendations by channel), and replays of webinars and our Ask the Experts Live series.

The Skai COVID-19 Marketing Resource Center

Advertising Patterns and Insights by Industry: Week ending June 13th, 2020

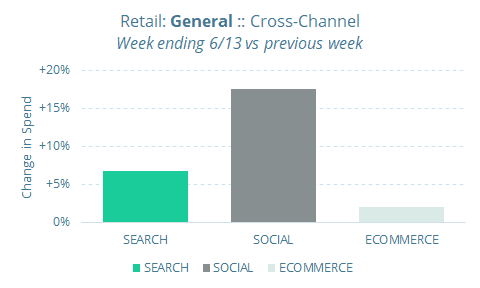

Retail: General

After two historically consecutive low months due to consumers pulling back spending, Retail bounced back in May with a record 17.7% month-over-month increase. This was a nice surprise as it was more than double what many economists had predicted. Based on how May panned out, some experts predict that consumer spending with Retail may be back to pre-COVID levels in a few months.

Marketers are beginning to see the daylight and increasing budgets as Retail ad spending was up across channels for the week ending 6/13, with Social showing the biggest gains after a down week.

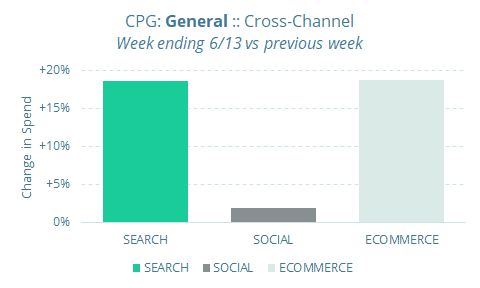

CPG: General

With the surge in online grocery driving sales during the pandemic, some aspects of CPG have been somewhat resistant to the downturn, while others have felt the crunch. CPG marketers have been somewhat cautious but are moving quickly to get in front of consumers as regions open up.

Ad spending for consumer packaged goods increased by nearly 20% over the previous week in the Search and Ecommerce channels and gained across social advertisers as well.

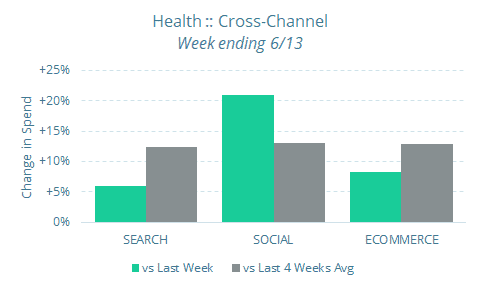

Health

Not all health-related purchases fall into the essential category so this vertical has been impacted by the pandemic. However, we’ve seen Health marketers continue to open up their wallets over the last month.

Across a wide range of health-related accounts including pharmacies and pharmaceuticals, spending is up compared to last week as well as the average for the last four weeks.

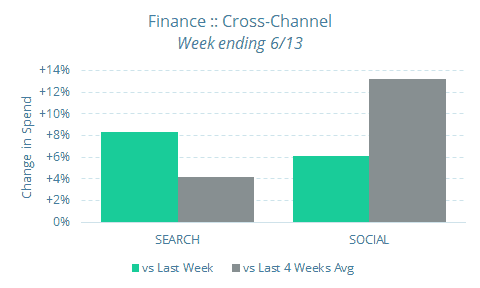

Finance

Recent turmoil has many rethinking their life goals, and that includes their financial security. In a recent study of 2000 Americans, 71% said the pandemic has caused them to seriously reconsider how they should be financially planning for their futures.

As we get closer to the extended income tax deadline in the United States, we see ad spending in the Finance category at elevated levels in both the short- and medium-term across the Search and Social channels.

Travel

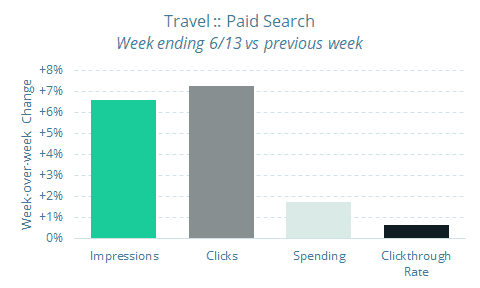

As we reported last week, an “Explore America” $4000 tax credit is being considered in Washington as part of the next wave of stimulus relief. That would be very beneficial to a category that has been one of the hardest hit by the economic downturn.

Travel marketers are making sure to stay in front of consumers knowing that many Americans are itching to get out of their shelter-in-home spaces. From an advertising perspective, Travel had yet another strong week in paid search across impressions, clicks, and spending, with clickthrough rate bumping up slightly as well.

Education

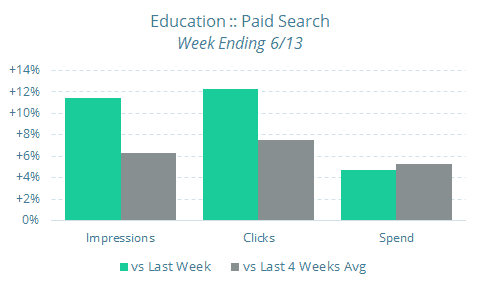

Colleges and universities are part of the Phase 4 opening schedule in some states which would be a welcomed economic lift for this category. While the summer months coincide with most students’ long breaks, Edu marketers are hard at work.

Paid search volume in the Education vertical, which spans categories like online and traditional universities as well as job training, was up last week compared to both the previous week and the four-week average for the industry.

Check back every week for updated data

For more COVID-19 tools and resources, check out the Skai COVID-19 Marketing Resource Center and visit the Skai.com/blog/ regularly for articles like these.