Summary

The retail media landscape is evolving, with a wide range of Retail Media Networks (RMNs) offering diverse opportunities. Marketers must understand and strategically use these platforms to target specific audiences effectively. This post highlights five RMNs, each with unique advantages, underscoring the need for brands to expand their retail media portfolios.

Over the past five years, retail media has quickly become one of the fastest ways for brands to impact and influence online and offline purchases. In a very short time, virtually every product company has seen the power of retail media firsthand. According to recent forecasts, retail media is projected to be the fastest-growing ad spending channel, with a minimum yearly growth rate of 21% through 2027.

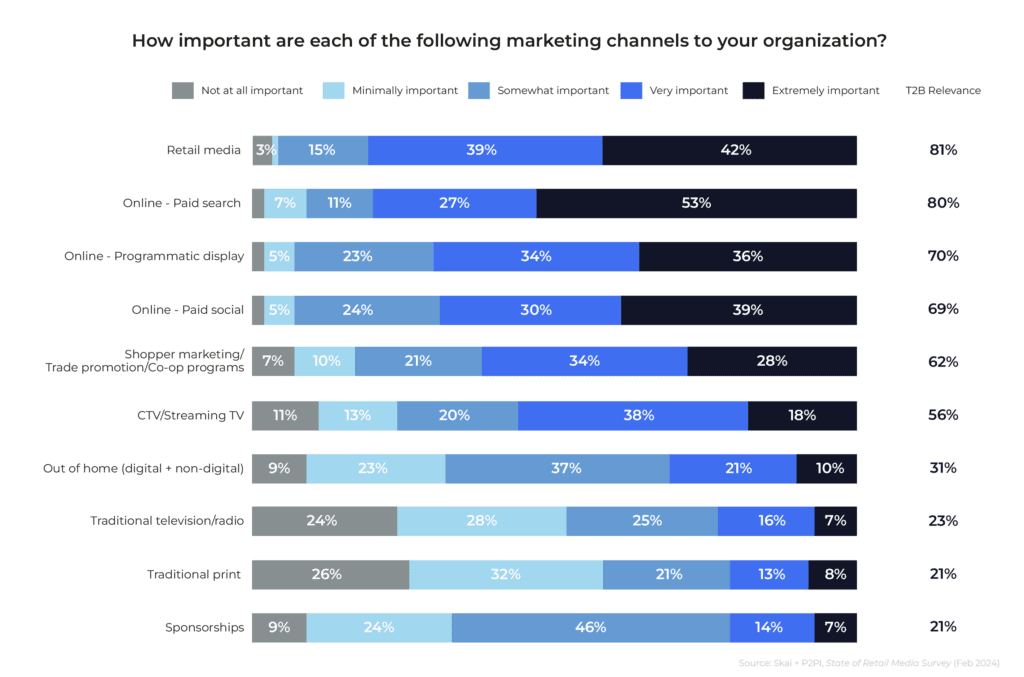

In Skai’s 2024 State of Retail Media Report, 81% of marketers reported that retail media is extremely important to their strategic business objectives.

This rise in importance also presents a growing challenge of rising costs and aggressive competition, especially on the biggest, most prominent retail media networks (RMNs), such as Amazon and Walmart.

We saw this happen at the same point in the growing phases of paid search and social advertising. As the auctions saturate, bid prices increase, and ROI flattens. Maintaining efficient performance on the biggest RMNs is becoming increasingly challenging.

What can advertisers do to stay competitive within the retail media landscape?

One of the significant differences between retail media and other digital channels is that there are just a handful of players in the other channels. For example, in paid search, if your Google costs spike, there’s no other game in town. But, with retail media, there are currently more than 100 retail media networks, and that number continues to grow every year.

Of course, most brands don’t have the budget, bandwidth, or expertise to manage campaigns on every retail media network. So, sifting through the clutter and finding the best RMNs for your retail media portfolio is the key to a successful strategy. Newer and more niche retail media networks might not have the giant audiences of Amazon, Walmart, and Target., but they can still be incredibly valuable in your media mix if they have the right audience for your brand.

Diversify your retail media portfolio: Five RMNs to consider

If you’re looking to expand your strategy and reach without breaking your budget, here are a few retail media networks to consider:

As one of the largest grocery chains in America, Albertsons is an incredibly appealing retail media network for advertisers looking for name recognition. In fact, more than half of American shoppers recognize the name Albertsons, and the brand has other big-name grocery chains under its umbrella, including Vons, Safeway, and ACME. The company’s retail media arm, Albertsons Media Collective, promises to help advertisers reach shoppers more easily with targeted ads based on preferences and online and offline purchase behavior.

Albertsons has recently launched its self-service demand-side platform to simplify the ad-buying process and provide greater transparency to advertisers. Adopting this platform means that advertisers can now access the company’s huge stores of first-party data, in-store sales data, and a wide range of shopper signals. Backed by all this data, advertisers will be much better able to connect with Albertsons shoppers across the brand’s owned properties.

Marketer Tip: Leverage the Albertsons Media Collective to analyze consumer grocery shopping habits with loyalty card data. This RMN not only enables precise audience targeting but also offers the chance to engage with consumers who have shown a consistent preference for sustainable or organic products, tapping into growing trends.

According to the brand’s research, 70% of the U.S. population lives within ten miles of a Best Buy store. That’s probably why they’re the number one tech retailer in the U.S., boasting two billion online, in-store, and in-home interactions every year. And if that isn’t enough reason for advertisers to be interested in the brand’s retail media network, Best Buy Ads‘ unique audience segmentation offerings should be.

Best Buy Ads enables advertisers to target audiences by highly specific types. For example, if an advertiser wants to target DIY enthusiasts preparing to equip their homes with an all-new smart kitchen, Best Buy likely has the first-party data to help brands connect across owned properties and even through an influencer network.

Marketer Tip: Utilize Best Buy Ads to engage with tech-savvy consumers through data-driven insights on the latest consumer electronics trends. This specialty RMN is a gateway to understanding and targeting the evolving needs of technology enthusiasts, particularly those interested in smart home devices.

While the idea of a “members only” retail media network might sound slightly limiting initially, it’s pretty brilliant. After all, members aren’t just going to Costco for the hot dogs. They’re going repeatedly, looking for great deals and new favorites. Membership RMNs can offer marketers “the holy grail” of online/offline targeting and membership.

Enter the Costco Retail Media Network, which serves ads to its network of loyal shoppers based on their purchase behavior. Because Costco keeps track of what each member buys, it has deep insights into behaviors, demographics, recent purchases, and basket sizes for each of its shoppers. They can also understand the impact of online ads on offline sales — and vice versa.

This data is incredibly valuable to retailers who sell products at Costco, but the possibilities extend much further. Costco’s granular understanding of each of its shoppers and the trust those shoppers have in Costco provides plenty of opportunities for travel companies, telecom, and other service providers to reach new audiences through Costco’s trove of first-party data, not to mention the fact that the sheer size of the average Costco gives ample space for in-store demos and opportunities for representatives to speak directly with consumers.

Marketer Tip: The Costco Retail Media Network’s ability to blend online and offline shopping data offers a unique advantage. Marketers can create highly personalized campaigns that resonate with Costco’s value-driven consumers by analyzing membership purchase behaviors.

Most Americans know that CVS is more than a pharmacy—it is a one-stop shop for everything from seasonal candies to cosmetics and medicine. According to Business Insider, the average CVS shopper pops into CVS about once a week to pick up about four items for an average total purchase of around $20. CVS Media Exchange (CMX) can help advertisers make the most of all those little interactions.

With a deep understanding of CVS Extra Care members’ shopping habits, CMX can use shoppers’ in-store and CVS app behavior to help advertisers reach customers at every stage of their journeys. CMX offers display, sponsored search, video, social, in-store, and audio ads to keep brands top-of-mind before, during, and after those quick trips to stock up on a few items at their local CVS. Using CMX, Dove Chocolate was able to entice a whole new crop of buyers with its holiday promotions. The brand used a multi-touch strategy through the CMX network and found that 30% of the customers who purchased their product were new to the brand.

Marketer Tip: Capitalize on the high frequency of visits to CVS stores by using the CVS Media Exchange to implement rapid testing cycles for your marketing messages, enabling quick adaptation and optimization. This convenience store-based RMN is ideal for reaching consumers with urgent needs or those making impulse purchases.

Ulta Beauty launched UB Media, tapping into the Ultamate Rewards program for targeted advertising. This approach allows brands to directly engage Ulta’s engaged beauty audience, using detailed customer insights for tailored advertising. By focusing on Ulta Beauty’s vast dataset from its 43 Million Ulta Beauty Rewards Members, the platform aims to streamline how brands connect with potential customers, ensuring ads are both relevant and effective.

UB Media broadens the scope of advertising possibilities through a mix of offsite displays, videos, social media engagements, and onsite sponsored products. This assortment provides brands with multiple avenues to convey their messages, ensuring high visibility across Ulta’s digital platforms. It’s a strategic move designed to not only enhance brand presence but also to integrate seamlessly with the customer’s shopping experience, fostering both discovery and conversion.

Marketer’s Tip: Leveraging UB Media goes beyond just selling products; it’s about building brand awareness within a dedicated beauty community. Unlike big box stores where customers typically go for purchases, specialty retail media networks like UB Media offer an invaluable platform for educating and engaging beauty enthusiasts. Here, the opportunity lies in introducing your brand and products to consumers who are actively seeking beauty knowledge and new discoveries.

Effectively managing a portfolio of RMNs

Expanding your strategy beyond the most prominent players is a significant first step toward maximizing your retail media budget. You’ll find unique, highly engaged audiences and lower prices. But there’s still a lot of complexity involved in this retail media strategy. You’ll need a solid tech foundation to save time, reduce errors, and drive performance without bogging down your team.

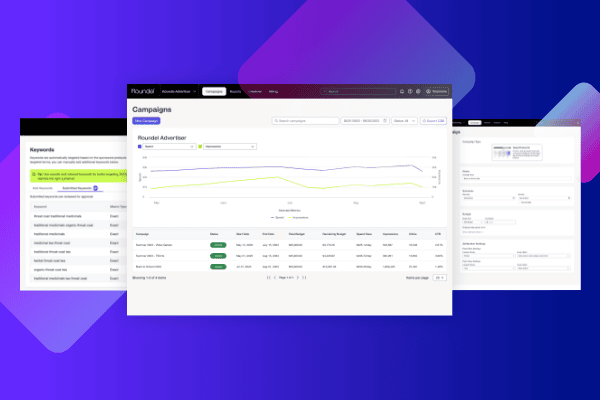

Skai’s Retail Media solution empowers marketers to plan, execute, and measure digital campaigns that meet consumers when and where they shop. As part of our omnichannel platform, connect the walled gardens and, through our API partnerships manage campaigns on 100+ retailers including Amazon, Walmart, Target, Instacart, and Criteo alongside major publishers across paid search, paid social, and apps

Client results include:

- 461% increase in Amazon Ads ROAS and 57% increase in page traffic for Bondi Sands

- 92% increase in share of voice on Amazon for a Fortune 500 CPG brand

- 72% increase in revenue for VTech

- 1,390% year-over-year sales growth for Kamado Joe

Please schedule a quick demo for more information or to see our cutting-edge innovation firsthand.