Summary

Download the Skai Q2 2024 Quarterly Trends Report to see the full highlights of key shifts in digital advertising, offering marketers valuable benchmarks to compare their own results. Notable trends include the growing adoption of Performance Max in paid search and Meta’s Advantage Shopping Campaigns+ in paid social, both driven by the evolution of commerce media. Despite rising CPCs and CPMs, marketers remain confident, focusing on quality over quantity and leveraging advanced targeting to optimize ad spend.

Digital advertising is being reshaped as rising costs, new ad formats, and the increasing prominence of retail media redefine how advertisers approach spending and strategy. Skai’s latest Quarterly Trends Report offers a detailed look at this evolution, focusing on changes in ad spending, pricing, and performance metrics.

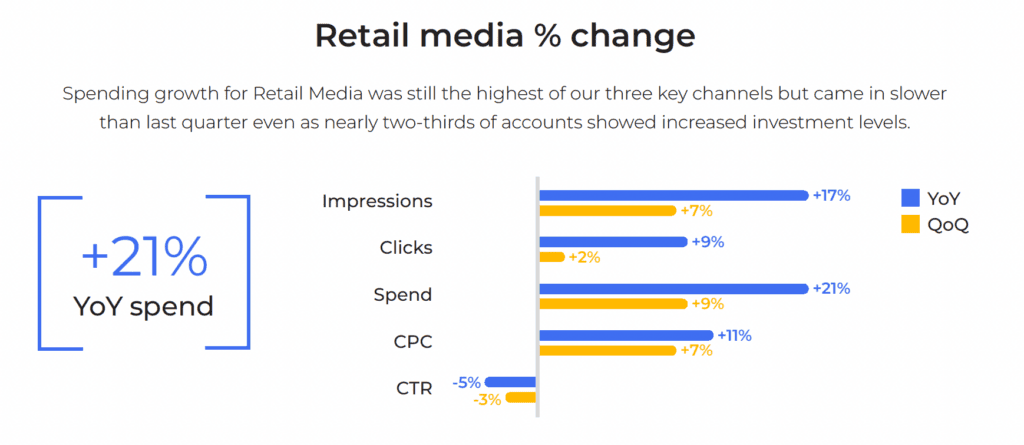

The report shows that even though ad prices rose in Q2, marketers continued to invest with confidence. Retail media, in particular, experienced significant growth, with a 21% increase in spending driven by higher costs per click and improved conversion rates. This is notably faster than the overall digital advertising market, projected to grow at a slower rate of 12.5%.

Meanwhile, paid search saw a shift towards newer ad formats like Performance Max, which have been widely adopted by advertisers, enhancing campaign efficiency and effectiveness. In paid social, Meta’s ongoing refinement of its ad objectives has led to a more streamlined approach, even as rising CPMs pose challenges for advertisers.

Note – This report’s insights are derived from a comprehensive analysis of advertiser campaign data managed through the Skai platform. The study encompasses over $8.6 billion in ad spending across various channels, including retail media, paid search, and social media. The analysis draws from a robust sample of over 1 trillion impressions and 14 billion clicks, ensuring a wide representation across multiple countries and industry categories. By examining trends in ad performance and pricing, this report offers valuable benchmarks for marketers.

Rising budgets reflect market confidence despite cost pressure

Even with rising costs, Q2 2024 saw increased investment in retail media, paid search, and paid social. Spending rose both year over year (YoY) and quarter over quarter (QoQ), highlighting these channels’ continued value to marketers.

The data shows that while CPC and CPM are increasing, marketers continue to invest in these channels. For instance, retail media spending grew by 21% YoY, with a notable increase in impressions by 17% and clicks by 9%. This indicates a strategic focus on maximizing ad spend effectiveness, even as costs rise. Marketers are concentrating on high-intent audiences and using advanced targeting techniques to ensure their ads reach the most relevant consumers. Additionally, some advertisers are noticing how inventory expansions and new ad formats on platforms like Amazon may lead to higher costs without necessarily increasing engagement, urging a more nuanced strategy.

Key actions for marketers

- Diversify ad channels. Expand your advertising efforts across multiple platforms to mitigate risk and maximize reach, ensuring a balanced investment strategy that can adapt to changing market conditions.

- Implement dayparting and budget capping. Schedule ads during peak engagement times and set strict budget limits to manage rising costs while maintaining reach.

These strategies are essential in a market where balancing cost and performance is becoming more challenging. Optimizing ad placements and budget management will be crucial for staying competitive as competition increases.

Balancing costs with campaign impact: quality over quantity

For the fourth consecutive quarter, retail media and paid search saw increases in cost-per-click (CPC), while paid social experienced a rise in cost-per-thousand impressions (CPM) for the second consecutive quarter. This trend suggests that volume growth may plateau as higher prices could lead advertisers to buy fewer impressions and clicks.

In Q2 2024, CPCs for retail media rose by 11% YoY, while CPMs for paid social increased by 8%. This price increase occurred alongside a 2% decline in paid search impressions and stable click growth, suggesting that higher costs do not necessarily lead to more engagement.

This pattern indicates that marketers must focus on efficiency and effectiveness in their campaigns. With fewer clicks and impressions available at higher costs, the emphasis must shift toward quality over quantity. Potentially, marketer adoption of Google Performance Max campaigns might be contributing to these cost hikes by prioritizing broad match keywords, leading to less control over budget allocation.

Key actions for marketers

- Enhance audience insights. Invest in tools and techniques that provide a deeper understanding of audience behavior. This will allow for more precise targeting and personalized ad experiences that improve campaign efficiency.

- Leverage automation tools. Automation tools can streamline campaign management and optimize bidding strategies, ensuring efficient budget and resource allocation.

Advanced targeting and optimization techniques are necessary to navigate this landscape. For example, AI-driven features can help identify the most profitable ad placements and audience segments, improving overall campaign effectiveness.

Retail media continues its strong momentum

Retail media continued to show strong performance metrics, with conversion rates increasing by 12% YoY. This growth and a rise in CPC resulted in an 18% increase in total conversion volume. The data suggests that higher purchase intent, requiring fewer clicks to convert, may drive this trend without compromising Return on Ad Spend (ROAS).

Retail media’s strength in Q2 can be attributed to factors such as the maturity of Amazon’s ad platform and the expansion of ad inventory across other retailers. Amazon’s dominance, supported by its diverse asset portfolio and advanced analytics capabilities, continues to set the standard. Additionally, nearly two-thirds of accounts reported increased investment levels, highlighting the channel’s effectiveness in driving conversions. However, there is growing concern about how long Amazon’s growth can be sustained, especially as the platform becomes more saturated and competitive.

Key actions for marketers

- Experiment with ad formats. Test and implement various retail media ad formats, such as video ads and interactive content, to capture attention and drive conversions in a competitive landscape.

- Optimize campaigns. Focus on campaigns with high conversion potential, using advanced analytics for better targeting and performance measurement.

The move towards more sophisticated ad formats has been critical to retail media’s success. These formats enhance user engagement and offer higher conversion rates. As the retail media space becomes more competitive, innovation and optimization will be crucial for maintaining an edge.

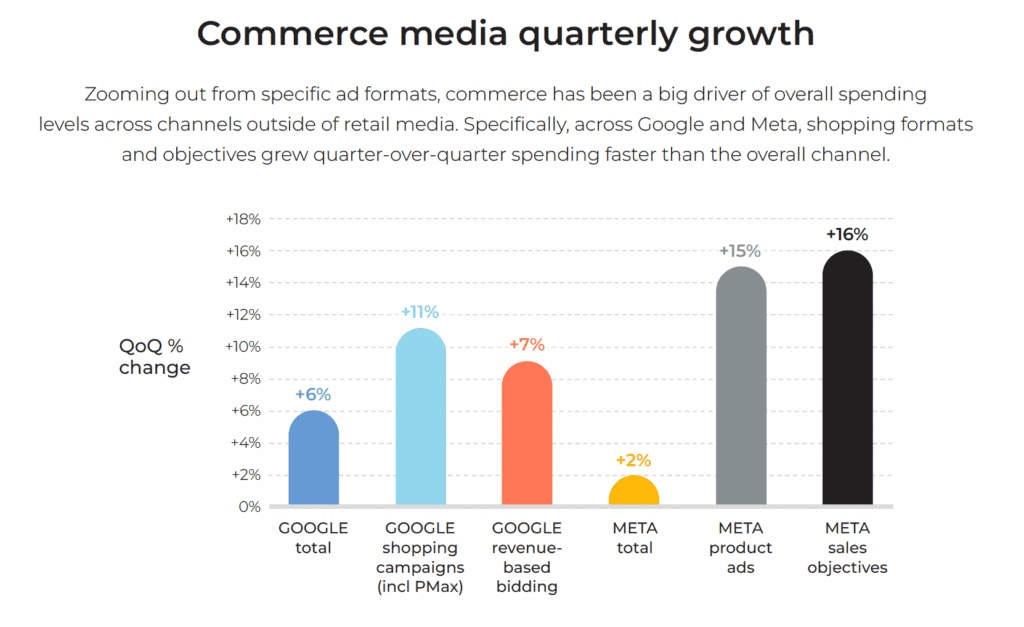

Growth opportunities driven by commerce media

[definition] commerce media – The evolving intersection of advertising and ecommerce, where media strategies and buying are directly linked to commerce data to drive transactions. This approach leverages detailed insights from consumer behavior and purchasing patterns to deliver targeted, personalized ad experiences, ultimately facilitating and enhancing the online shopping process.

Both paid search and paid social channels saw notable growth driven by commerce media. New formats like Performance Max in search and Advantage Shopping Campaigns+ in social media gained significant traction. By the end of Q2, half of Skai’s search accounts used Performance Max, while one-third used Advantage Shopping Campaigns+.

The rise of commerce media reflects the growing importance of integrating shopping experiences across digital platforms. Performance Max campaigns, for example, have more than doubled YoY, representing a significant share of paid search spending. This trend is further supported by the lower CPCs of shopping ads compared to traditional keyword campaigns, making them a cost-effective choice for advertisers. However, there is a noted caution within the community about relying too heavily on automated solutions like Performance Max, which might not always align with an advertiser’s strategic priorities.

Key actions for marketers

- Integrate shopping experiences. Utilize platforms that seamlessly integrate shopping experiences, offering a smooth path from discovery to purchase.

- Grow expertise in newer, innovative formats. Build expert approaches with new formats like Performance Max and Advantage Shopping Campaigns+ to enhance engagement and drive sales.

Meta’s Advantage Shopping Campaigns+ in paid social have shown impressive results, with spending on these ads increasing nearly sixfold YoY. Despite accounting for only 5% of Meta spending, the adoption rate among Skai accounts is expected to grow as advertisers prepare for the upcoming holiday season. The evolution of commerce media formats presents valuable opportunities for marketers to engage consumers more effectively, using data-driven insights to optimize ad performance and drive sales.

The big picture: what Q2 2024 tells us about the future

The ongoing rise in CPC and CPM across platforms indicates advertisers are becoming more selective with their investments. This shift underscores the importance of advanced targeting and optimization techniques as marketers aim to maximize their return on ad spend. Retail media, in particular, has shown strong performance, bolstered by sophisticated ad formats and robust infrastructure from key players like Amazon.

Looking ahead to the latter half of the year, commerce media’s role is expected to grow, with new ad formats offering promising engagement and conversion opportunities. The adoption of Performance Max and Advantage Shopping Campaigns+ highlights a broader trend of integrating shopping experiences across digital platforms. For marketers, staying agile and responsive to these evolving trends will be crucial for maintaining a competitive edge and achieving successful outcomes in a dynamic digital marketplace.

Staying ahead in the dynamic digital advertising landscape will require agility and responsiveness to emerging trends. Skai offers an omnichannel platform to help marketers navigate these changes, optimize their campaigns, and achieve better results. By leveraging Skai’s advanced analytics and automation capabilities, advertisers can confidently manage their ad spend and maximize returns in an increasingly competitive environment.

Set up a brief demo with our team at your convenience to explore how Skai can enhance your digital advertising strategies and keep you at the forefront of industry developments.