Summary

Discover key insights from the Skai Q1 2024 Trends Report, a vital resource for marketers aiming to understand shifts in digital marketing strategies amid evolving global conditions. Drawing from nearly $9B in annualized marketer spend, this report offers a deep dive into spending patterns, performance data, and strategic adjustments across various advertising channels.

The first quarter of the year always presents a bit of a reset for digital marketing. New annual media plans are put into action, which generally include the tried & true channels and tactics but also a few gambles to be tested. Marketers are closely monitoring the results of these new strategies, making adjustments as needed based on early feedback and performance data. This period is crucial for setting the tone and direction for the year’s campaigns, as it allows teams to identify which innovative approaches are resonating with audiences and which might need rethinking.

Being informed is part of the job for marketers, and Skai’s Quarterly Trends Report, a trusted resource for over a decade, helps you stay ahead. It doesn’t just track spending and performance; it interprets how shifts in technology and global economics are shaping marketing strategies.

The insights from the Q1 2024 report are essential for any marketer looking to navigate these changes effectively. In it, we can see clear indications of how digital advertising strategies are adapting to the evolving market conditions.

This edition of the Skai Quarterly Trends Report for Q1 2024 offers insights drawn from nearly $9B in annualized marketer spend, comprising over 3,000 advertiser and agency accounts across 40 vertical industries and 150+ countries running on the Skai platform. As one of the most well-respected datasets by those who follow advertising performance, it includes unique insights about what’s happening in the digital advertising industry on a macro level.

Key Takeaways from the Skai Q1 2024 QTR

“As we head into 2024, most of the fundamental growth trends across digital channels from 2023 remain intact,” said Chris Costello, Senior Director of Marketing Research at Skai. “At Skai, we are still seeing broad-based growth across retail media, with similar contributions from all across the spectrum. Paid search spending has picked up slightly as the transition to Performance Max transforms the search shopping experience and the ad inventory that goes along with that. And finally, Meta ad inventory looks like it has stabilized after a long stretch of declining CPM and big increases in impression volume.”

Download and read the full report for the in-depth details and charts.

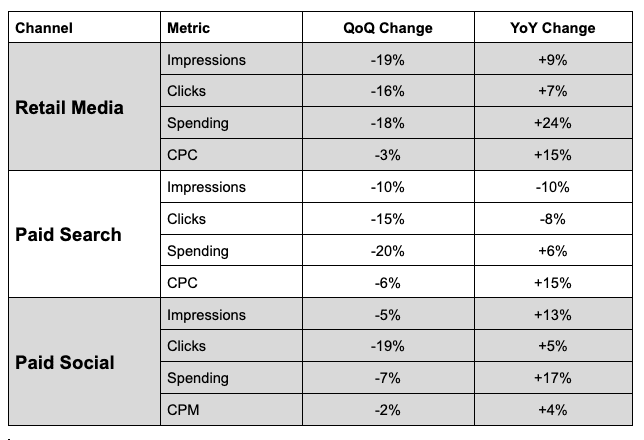

Spending is up over last year and down from last quarter

Walled gardens in retail media, paid search, and paid social continued to be attractive propositions to advertisers, as reflected by their investment patterns. On a same-account basis, spending increased year-over-year (YoY) in all channels even as quarterly spending dropped sequentially with the end of holiday seasonality.

Over 50% of accounts increased spending by at least 5% in each channel over Q1 of last year, with two-thirds of retail media advertisers seeing such an increase.

Retail media scales up smoothly

With ad prices rising 15% YoY in retail media, there could be concern about diminishing returns in the channel. However, the resulting 24% increase in spending was matched by a 24% increase in attributed sales revenue from advertisers, yielding no change in overall return on ad spend (ROAS).

Whether the catalyst for this CPC increase was a growing economy, an increase in the stickiness of ecommerce for consumers, or advertisers focusing their efforts on the channel, it has been part of a “virtuous cycle” of higher conversion rates that can absorb those higher prices and subsequently deliver more ad volume.

Performance Max maxes out adoption despite spending continuing to grow

The share of Skai accounts running paid search Performance Max (PMax) campaigns has remained fairly flat over the last three quarters, even as the YoY spending on these ads has nearly tripled. The increase in spend helped propel total search spending up 6% over Q1 of last year, a growth rate two percentage points higher than last quarter.

While PMax has been a boon for search spending, the transition from legacy shopping campaigns continued to drive fewer impressions and clicks but at a higher cost-per-click (CPC).

Paid social CPMs increased YoY for the first time since 2022

According to Skai’s data, year-over-year CPM grew for the first time since Q1 2022, while impression growth was the lowest since that same quarter, yielding spending growth of 17% overall and 8% for Meta.

This may mark the end of the rapid CPM decline and impression growth over the last 18 months that have accompanied the transition to Outcome-Driven Ad Experiences (or ODAX) on the Meta platform, which has transformed ad inventory patterns and now comprises more than 80% of spending across Facebook and Instagram.

Q1 2024 by the numbers

How to access Skai’s quarterly trends report, charts, and analysis

- Download the report to learn more about what happened in Q1 and the implications for marketers.

- Visit the Quarterly Trends Research Hub for even more in-depth analysis and access to previous reports.

- Check out the QTR interactive infographic, where you can explore the numbers yourself for more granular insights.

Go deeper into the QTR data with our interactive infographic

![[Infographic] How consumers plan to spend Amazon Prime Day 2024](https://skai.io/wp-content/uploads/2024/05/Amazon-Prime-Day-2024_Infographic_1200X628.png)