Summary

Navigating the complexities of retail media budget planning through Joint Business Plans (JBPs) is crucial for advertisers aiming for strategic growth. The first step is figuring out your optimal budget to understand what leverage you may have at the negotiating table. In this post, learn how to align investments and negotiate effectively to achieve mutual success.

Retail media budget planning presents a unique and complex challenge for advertisers. While every other channel’s budget is solely decided internally by the advertiser teams, retail media budgets require the extra step of negotiating spend levels with their retailer partners as part of an annual Joint Business Plan (JBP).

Joint Business Plans (aka ABPs, ASPs, ACPs) have been around for decades to help brands (CPGs, suppliers, vendors, etc.) and retailers work closer together to boost their mutual growth and efficiency. The overarching objective of JBPs is for brands and retailers to align on annual targets and formalize the success of the joint partnership of driving sales and enhancing the customer experience. Even though there’s no one-size-fits-all JBP, the goal is to build a win-win partnership with a nod to how these efforts pay off in the big picture.

JBPs may contain:

- Sales targets to set specific partnership revenue and market share goals.

- Marketing strategies to define in-store and online advertising plans, trade, and co-op

- Product placement agreements on the positioning of products within the store.

- Promotional activities to develop sales promotions and discounts.

- Collaborative investments that cover joint funding for marketing and innovation efforts

“In the last few years, what once was a tiny retail media test budget has become one of the most significant line items to negotiate in the annual JBP,” says Kevin Weiss, VP of Retail Media for Skai. “With higher stakes comes higher scrutiny throughout the organization, and executives are now tasked with justifying retail media terms that serve their brands’ interests and align with the strategic goals outlined in the JBP.”

If you negotiate well, you can use your retail media budget as leverage to ask for more from your retailer partner, including increased purchase order volume, maintaining steady accruals, and providing enhanced or complimentary access to programs, unique data, assistance, or advantages. This might even open the door to securing greater in-store visibility for your products.

How can executives master the complexities of retail media negotiations within the JBP framework to ensure their strategies align with immediate and long-term business objectives?

More importantly, how do you avoid over-committing or under-committing your retail media investment in the JBP?

As retail media grows, the JBP budget allocation becomes an increasingly important and strategic business task that executives must get right.

Preparation is critical for retail media JBP negotiations

“Success in JBP — especially for retail media use cases — requires crystal clarity and alignment on the end objective,” explains Joe Davis, Managing Director & Chief Strategist of Tree Line Strategy Group. “If your team is all working towards different ends, the harmony sought after in the exercise will sound more like cacophony and, in fact, be more trouble than it was worth. So spend the time ensuring all teams (marketing, sales, operations, etc.) can ‘hold hands’ and negotiate as a single entity.”

While not every brand includes retail media in its JBP process, it’s a big miss if it doesn’t. Any amount a brand spends with a retailer should be considered part of the holistic investment strategy. If you’re not pulling in all investments into the JBP, you’re not getting credit for them and won’t be able to use their buying power as part of the negotiation.

As with any negotiation, good information is the critical factor between success and failure. The right data identifies your optimal retail media budget and empowers you to negotiate other aspects of the JBP in your favor.

Knowing your optimal budget and total investments across omnichannel paid media that are contributing to retail sell-through are must-haves before reaching the JBP table. But so is the agility offered by up-to-the-minute insights, which are more reflective of your true performance than only looking at previous campaigns. Real-time data points illuminate trends as they happen, allowing you to pivot your strategies with the market’s ebb and flow, ensuring your negotiation stance is as dynamic as the retail landscape itself

How do you pinpoint your optimal budget?

A well-prepared approach to retail media JBP negotiations involves a balanced look at past performance and future aspirations, ensuring your budgeting is realistic and strategically aligned with your broader business objectives.

Analyze historical data. Start by examining past retail media investments and their outcomes. Compare organic sales with those driven by advertising to measure the real impact of marketing activities. It’s also essential to evaluate how efficiently advertising spending translates into sales, distinguishing it from organic growth.

Review your plans and goals. Reflect on your company’s objectives for the year ahead, considering the expected returns from retail media investments and the support needed to drive demand. Consider planned strategic market initiatives — such as a big new product launch expected in the middle of the year — and how they align with your business vision. It’s also vital to consider how these ambitions fit within the broader market context and your company’s long-term strategy, ensuring every move is a step towards your overarching goals.

Consider the relationship. Cultivating a solid partnership with the retailer is paramount. This involves understanding their objectives and aligning your strategies to meet mutual goals. For example, dropping your spending by 50% versus the previous year may be right for your company, but it may also damage your retailer relationship. Additionally, investing in strategic initiatives led by the media arm of the retailer (e.g., Amazon Ads, Walmart Connect, etc.) can lead to indirect contribution to sell-in and sell-through if not overall vendor contribution and Net PPM.

Keep an omnichannel view. Remember, while your negotiation might center on one channel, it’s crucial to consider the broader picture. Evaluate the significance of each retailer and how they fit into your overall strategy. If you dramatically increase or decrease your other channel budgets — such as your paid search or social advertising — what will be the impact on your retail media performance? Is there an opportunity to include your investments in other paid media channels that drive traffic to that retailer as part of your negotiations?

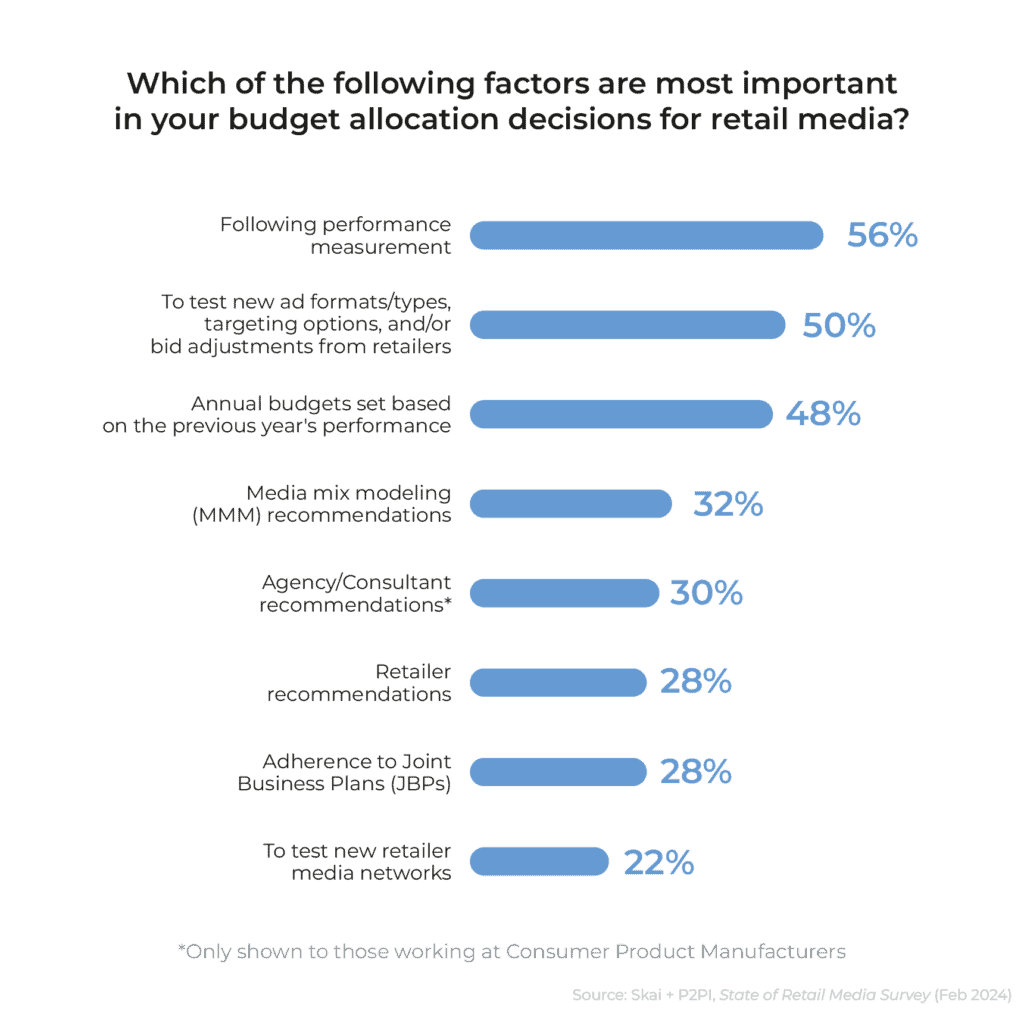

Retail media is a moving target! With new ad formats being released, new data opportunities, in-store, offsite, and non-endemic media, your retail media plan will look a lot different than it did last year. Analyze your media mix using your available tools and partners (e.g., solution provider, retailer, MMM, etc.), and ask for detailed success stories to inform your media plan and allocation strategy.

In the last few years, what once was a tiny retail media test budget has become one of the most significant line items to negotiate in the annual JBP.

Kevin Weiss, VP of Retail Media @ Skai

The power of forecasting in the JBP retail media budget negotiation

Once you have gathered and analyzed all of your data and information—and before you get to the negotiation table—you need one more thing: reliable investment forecasts infused with real-time data insights. This will not only give you a leg up in the JBP process but also give you confidence in any decision you make.

The first step is to find your optimal budget. There are many inputs to the budget planning process, and typically, they’re coming from the retailer, partner(s) supporting the retailer, and in-house team members. But all too often, the inputs coming from your own team are built more on human intuition than data science. Or, the data science-backed inputs aren’t granular enough to inform optimal allocation across tactics or campaign types, meaning best guesses are still used to find your optimal budget.

Using both historical results and more recent data–as close to the time of the JBP as possible–will help refine predictions. Every dollar invested past the point of diminishing returns should probably be spent somewhere else unless there’s a strategic benefit to spend beyond that point because of your JBP objectives.

Now that you know your optimal budget, you need to run multiple what if? forecasts based on various retail media spend levels — both under and over your optimal spend. You might try under/over degrees of 10%, 25%, and 50% to see a variety of ROI calculations. You will want to be able to quickly reference these forecasts to help you navigate the negotiation process. You don’t want to stall the JBP conversation because you aren’t prepared to model different scenarios.

The JBP for retail media has the opportunity to unify your organization. It can bring together disparate teams to work towards a common goal of realizing volume goals and heightened consumer awareness and engagement. It is the penultimate team sport requiring solid processes, transparency, and acumen.

Joe Davis, Managing Director & Chief Strategist

Ideally, in addition to the forecasted plans, you’ll also want to have real-time data of all of your retail media programs at your fingertips, as the negotiation may last longer than your data stays fresh.

In any scenario, you have to do your due diligence around what you are willing and able to spend and what you expect to get in return at the bare minimum. Strong negotiating skills and discipline in following the process will ensure your team successfully navigates the often frenetic business of retail media while also avoiding the pitfalls of the ‘ready, fire, aim’ approach, which can create damaging precedents with retailers.

At the JBP negotiation table: 3 possible scenarios

Based on all the other aspects being negotiated in the JBP, the retailer will have a number in mind that they want you to commit to for your retail media budget.

The retailer likes your proposed optimal retail media budget.

Fantastic! You and your partner are on the same page. It rarely happens, but you’ve likely forecasted perfectly if it does. Time for drinks!

They want you to spend more.

This is the most common scenario. It’s not that retailers want you to spend more than you are comfortable spending. Still, it’s likely that their forecasts of your success with their retail media network (RMN) are most likely estimated in ideal conditions.

Having those what it? forecasts will help you here. Imagine at a glance being able to understand the ramifications of the retailer’s desired commitment. Instead of going back to your team to figure this out, you can be confident in your decision to either accept their recommendation or assert your stance with your forecasts on hand.

Their recommendation is less than your plan — now you have leverage.

An opportunity! On the odd chance that the retailer’s proposal is less than your optimal spend, you might be able to leverage your buying power to enhance the other aspects of your JBP. For example, by agreeing to spend more on retail media, the retailer may commit to more PO volume, keep accruals flat, and offer better (or free) access to programs, exclusive data, support, or benefits. You may be able to negotiate more in-store display, or perhaps simply spending more is a sign of goodwill and an investment in a relationship that will pay off down the road.

Whatever the final retail media commitment is in the JBP, you will likely need to justify your position to the rest of the organization — or your client if you are an agency. Being able to point to the forecasts that support your data-driven decision-making is critical for today’s media executives.

Extending your leadership beyond the JBP and throughout the year

The JBP is just one area that is enhanced when executives can access accurate media forecasts and real-time campaign data. While practitioner teams virtually live in their individual channel data, leaders at the top need a broader view—a view that only real-time data can provide. Real-time data arms executives with the knowledge to shift gears swiftly, addressing underperforming areas and reallocating resources where they’re most needed. In the fast-paced world of retail, the ability to react quickly to market trends, align cross-functional efforts, and optimize performance in real time is not just advantageous—it’s essential.

Equipping marketing executives with the real-time performance of every campaign can enhance critical “big picture” areas that only a leader at the top can influence, such as:

- Strategic planning for accountability setting to ensure strategies remain aligned with business objectives.

- Budget direction about where and how to invest with the ability to justify each strategic financial decision.

- Risk management scenario planning to help teams anticipate and prepare for significant market changes

- Performance tracking so that executives can identify and address underperforming areas by shifting resources to areas of need

- Cross-functional alignment to intelligently coordinate with sales, product development, and other business areas, ensuring that marketing supports overall business goals.

With real-time campaign data and access to data-driven forecasting, media leaders can become masters at negotiating JBPs while overseeing and improving marketing activity across their teams. Keeping the bottom line in sight requires a view from the top.

Do you have a tech foundation in place to deliver these critical insights?

Check out Skai Decision Pro, a first-of-its-kind solution built for media leaders by the media experts at Skai to help you connect and contextualize all your media, enhance and accelerate your decision-making, and maximize their outcomes in one place.

With Skai Decision Pro, media executives get the connectivity, visibility, and flexibility needed to:

- Control budget, oversee performance, and avoid overspending and underspending

- Maximize outcomes and speed up decision-making

- Uncover new opportunities and avoid wasteful spending

Beyond forecasting and monitoring, among the most important benefits of using Skai Decision Pro are that it makes you more agile and speeds up time-to-insight (TTI). By the time one of your rivals realizes they need to make a change, your team is already on to the next opportunity.