Last week we co-hosted a webinar with renowned author and analytics expert, Tom Davenport, focusing on Competing on Analytics and External Data, following the title of his business classic book. In the book, Tom walks the reader through establishing deep analytical capabilities to drive sustainable competitive differentiation. The webinar delved into this topic in greater detail, covering how market leaders differ from laggards in their use of analytics, and how they manage to successfully leverage data within their businesses.

To become analytical competitors, business leaders must align the data and analytic needs with the overall strategy and objectives of the business, leveraging all data types, including external data. Given it is unconnected and unstructured, this is one of the first places where businesses fall short. However, with new developments in NLP and AI, it is now possible to unify all the elements of a data fabric into a configurable data platform, making the efficient use of external data to drive business decisions within reach.

Competing on Analytics: Unanswered Questions

The session went on past the allotted time, and we promised to collect the unanswered questions and provide answers to the important questions that were put forward, which are provided below.

QUESTION: What Consumer Packaged Goods/Fast Moving Consumer Goods Companies are state of the art in terms of using data analytics as a competitive weapon and pulling consumer insights, innovation and analytics into one group?

TOM: I believe Procter & Gamble is one of the best CPG firms at using data as a competitive weapon. They have consistent data across the organization, good tools for analysis, and a group of smart analysts that work closely with business leaders. They do have two organizations to support analytics and consumer insights – IT and Consumer and Market Knowledge – but they work together pretty closely.

QUESTION: In the world of sports analytics, what would you say about the relative importance of external data that is not already readily available? What would be some examples of those types of external data?

TOM: It depends on what you mean by external. Most professional sports teams now use data from video cameras, or from sensors in uniforms that provide data on player movements. They are generally run by the league, not by the team. The Boston Red Sox were famous for consulting NCAA player data to try to predict what attributes of college players were likely to predict a career in Major League Baseball.

QUESTION: What is the least invasive way to get an organization to buy into the value of analytics as a whole (besides ROI, etc)?

TOM: The least invasive way is to find something that a senior executive cares about – a particular objective that he or she emphasizes – and tie analytics to it. Another is to partner with a particular executive who already believes in analytics to try to persuade the rest of the management team that they are important.

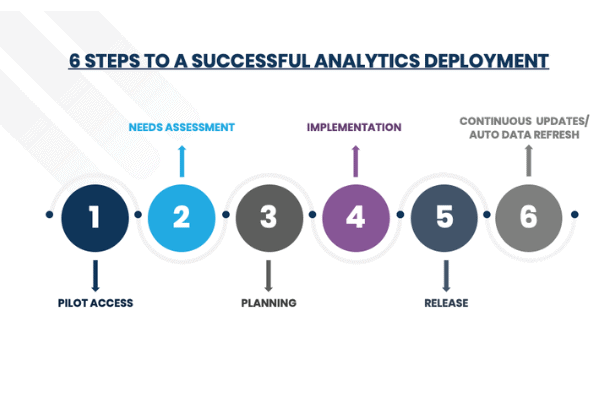

GIL: The least invasive way is to focus on a particular use case or problem you are trying to address so the value proposition becomes practical and demonstrable. This can come from speeding time to insight, reducing the amount of data integration that has to be managed internally, leveraging existing taxonomies instead of building and recreating your own. One successful implementation leads to greater recognition across the organization on the value and power of data. That is one benefit of a configurable data platform; you get all the benefits of custom analytics without the significant investment and resource commitment that would otherwise be required.

QUESTION: What are the most advanced models of streaming analytics that you expect in the next 5 years?

TOM: Not sure what you mean by “most advanced models,” but companies are increasingly doing analytics on streaming data from IoT sensors. One of the primary issues is where to do the analysis – in the cloud or at the edge. In the cloud they incur telecom costs; at the edge there is often not enough processing power.

QUESTION: What are some practical applications of Big Data in the Finance/Accounting field?

TOM: AI applications in Finance thus far have been relatively pedestrian. However, the future of intelligent financial applications is likely to be much more dramatic. Most transactions will be automated, replacing outsourcing as a way to achieve productivity. Finance functions will be staffed by substantially fewer people, all of whom understand AI and how to add value to it.

Budgets, forecasts, financial analysis, and approaches to improving financial performance will be based on machine learning models trained by internal and external data. This will be particularly important in the COVID-19 economy; some vendors, for example, have already developed approaches to using AI to minimize accounts payable cash outflows. Some companies are basing rapidly changing demand predictions on external data such as surveys, mobile phone data on consumer movement away from home, and even sensor data from consumer thermometers.

QUESTION: What are the main use cases for the Skai platform?

GIL: Skai is mainly used by business leaders, consumer and market insights teams and data and analytics organizations to drive product and growth decisions within their enterprises. By connecting voice of the consumer, product claims and updates, business announcements and other signals of innovation, key answers around where to invest, where to divest, how to build a winning product portfolio, how to effectively message and position a product or a brand, what ingredients to put into a product and more are answered in a meaningful and actionable way.

————————————–

*This blog post originally appeared on Signals-Analytics.com. Kenshoo acquired Signals-Analytics in December 2020. Read the press release.