Two companies faced a similar challenge: How to capture a younger demographic purchasing beauty products online. One approached Sephora with a moisturizing cream hoping the online retailer would feature and promote the product, and was rejected due to their belief that the product claims and messaging would not resonate with Sephora’s customer base.

Another brand, leveraging insights extracted from the Skai beauty analytics platform, also approached Sephora with a moisturizer, but this one focused its marketing message on hyaluronic acid, an ingredient associated with glowing and uplifting skin, claiming on its product label as having three times more hyaluronic acid than the competition. This product was not only sold by Sephora, but it was also featured on their homepage for weeks, driving significant online sales volume.

How did the second company have the foresight to properly position the product?

Their secret weapon was advanced analytics, and according to McKinsey, companies that use it outperform their peers by 85 percent in sales growth and 25 percent in gross margin and experience gains in operating profit in the six percent range. And given the drastic shifts occurring in the Beauty and Personal Care market because of COVID-19, the rise of ecommerce, and the trend towards Direct to Consumer (DTC), we will see more and more companies looking to advanced analytics to navigate their way through.

To answer this market demand, Skai today announced a new offering for Beauty and Personal Care manufacturers, extending the capability of its advanced analytics platform to support this $78 billion market.

What is beauty analytics?

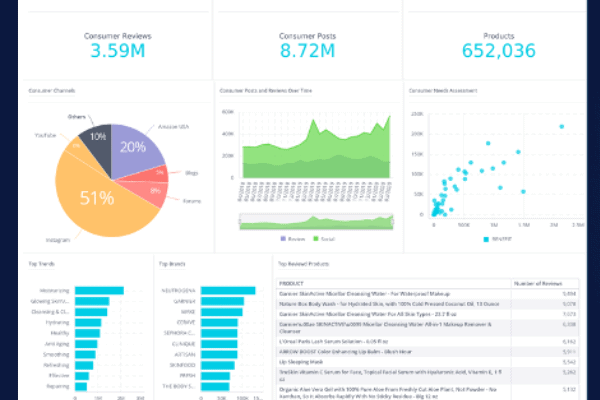

Beauty analytics is a cross-category analysis that helps business leaders understand what is driving innovation and consumer demand across the beauty and personal care industry, down to the attribute level.

In addition to the Skai Market Overview, Category Deep-Dives for Fragrance, Skin Care, Hair Care, Body Care, Body Hygiene and Cosmetics are available, honing in on granular analyses of the brand, patent and consumer landscape, as well as analytic models that surface white space opportunities, and scorecards that assess competitive trends, purchase drivers and more.

Underpinning these models is a strong data foundation, that can ingest any internal or external data source at any scale, and patented NLP and artificial intelligence that extracts context and predictive insights with very high accuracy. Businesses are able to configure the deployment to suit their business needs; the API and data mart seamlessly integrates the connected, enriched and contextualized data sets into a native data science or analytics environment.

Brands wield powerful insights with advanced analytics

Looking at and connecting these data sets yields insights that are relevant across the beauty and personal care market. Specifically as it relates to COVID-19, there has been an uptick in consumer discussion around acne control (up 24% over the last 6 months within the skin care ecosystem) and skincare products that enhance eyelashes (consumer discussions around “eyelash enhancing” as a product attribute is up 81% over the last 6 months). This supports an industry hypothesis that consumers are more focused on their eyes as a result of wearing masks, while acne control may be a result of wearing masks, and anxiety induced by the pandemic.

Surprisingly, the concept “DIY,” which had a massive jump in consumer discussion at the start of the pandemic, is trending significantly downward. On the other hand, ingredients commonly associated with DIY such as cucumber and green tea continue to grow (up 36.9% and 19.1% in 6 months respectively).

This suggests that while consumers may not be as interested in DIY as a feature within skin care anymore, they are still interested in buying products that resemble their at home, DIY routines. As a long term effect of COVID-19, when marketing products online, manufacturers may consider emphasizing product features or ingredients that they became familiar with or relied on during the height of the pandemic.

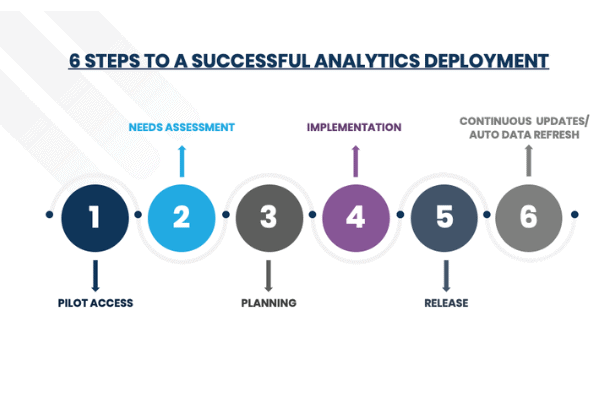

Configure advanced analytics to meet the brands’ needs

The Skai market intelligence platform allows beauty and personal care brands to configure data sets, taxonomies, visualizations and data science to suit their needs. The platform easily integrates different external and internal data sources, including Nielsen, IRI, Profitero, Brandwatch and more, to enhance analytic outcomes and provide the greatest accuracy in running prediction models, forecasting trends, optimizing messaging and campaign strategy and more. With so many changes on the horizon for this sector, given COVID-19, the rise of e-commerce, the shift to DTC and increased competition from upstart brands, it is imperative to have a holistic view of the market to plan the next move.

Contact us today and learn how to configure the platform and get a demo of the Category Deep-Dive that is relevant to your business.

————————————–

*This blog post originally appeared on Signals-Analytics.com. Kenshoo acquired Signals-Analytics in December 2020.