Summary

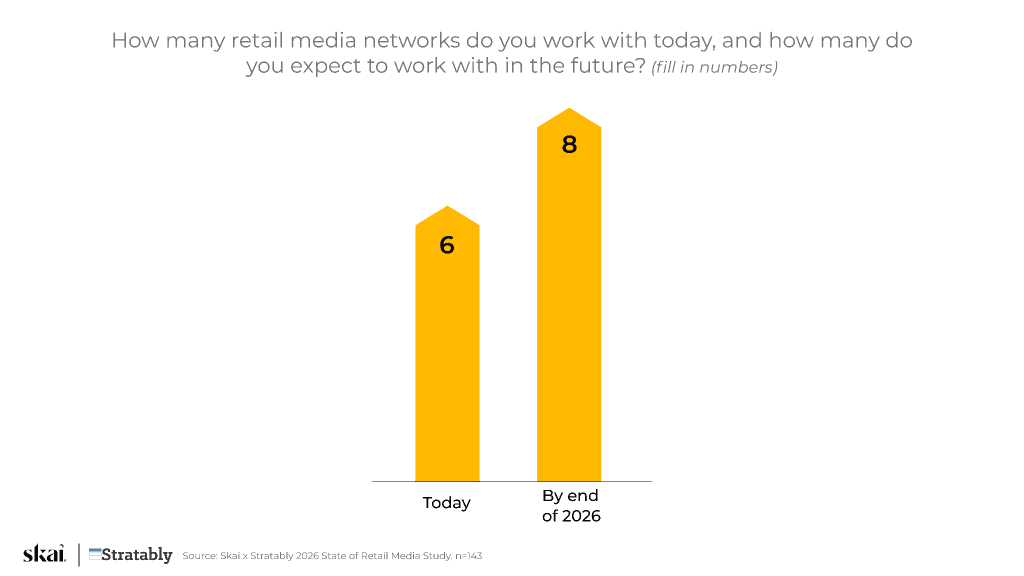

The 2026 State of Retail Media Report reveals that retail media fragmentation is no longer a temporary growing pain but a structural reality brands must manage to scale. With advertisers working across an average of six networks—projected to reach 11 by the end of 2026—operational silos, inconsistent measurement, talent gaps, and budget allocation challenges are limiting growth. The report outlines seven critical barriers and shows how consolidation, standardized metrics, and automation can help brands turn retail media fragmentation into a competitive advantage.

Download the 2026 State of Retail Media Report

No other digital channel looks like this.

Paid search has Google. Social advertising has Meta, TikTok, and a handful of others. But retail media has dozens to hundreds of networks globally, each with its own data, metrics, reporting, and ways of working. That structural fragmentation is not a phase the industry is passing through. It is the nature of the channel itself, because every retailer is, by definition, its own walled garden.

For the 2026 State of Retail Media, Skai partnered with Stratably to survey 166 retail media advertisers. The findings show that brands are engaged with an average of six retail media networks today and expect that number to grow to 11 by the end of 2026. Yet the operational, measurement, and organizational challenges created by fragmentation are not keeping pace with that expansion. The result is that fragmentation is capping the channel’s growth potential.

Here are seven ways retail media fragmentation is holding brands back, and why solving these challenges is the key to unlocking what comes next.

Your global teams are operating blind to each other

Enrico Babucci, Chief Strategy Officer at OmniShopper, describes the compounding effect: “Running six networks today and aiming for eight plus next year means more contracts, more formats, more reporting, and more internal confusion. In Europe, this is amplified by retailer-by-retailer differences and uneven data quality.”

Every retail media network comes with its own interface, its own workflows, and its own way of doing things. For global organizations, this means teams in different regions are running different networks with different processes, and none of them can easily share what they’ve learned. Best practices stay siloed. Institutional knowledge doesn’t travel.

Megan Conahan, EVP of eCommerce at Direct Agents, captures the tension: “Brands are adding more networks, but their tolerance for operational complexity is shrinking.”

Your measurement might be right, but you still can’t trust it

Fragmentation doesn’t just create operational headaches. It undermines confidence in the data itself. When every network measures performance differently, with different attribution windows, different definitions, and different methodologies, brands end up debating numbers instead of making decisions. Even when the data might be accurate, the lack of consistency across networks makes it difficult to act on.

Only 15% of respondents report strong confidence in their measurements. That’s not a data problem. It’s a trust problem that stalls budget conversations, slows optimization, and keeps teams stuck in reactive mode.

Salim Bachatene, SVP of Global Sales for eCommerce at NIQ, frames it directly: “What this survey really shows is that most retail media challenges are not media problems: they are measurement and integration problems. Performance, incrementality, and ROI remain the core concerns, pointing to a clear market demand for more accurate, cross-referenced data across media, digital shelf, and shopper signals.”

Expertise that works on one network doesn’t carry over

The expertise required to run effective campaigns on Amazon is different from what’s needed on Walmart Connect, which is different from Instacart, which is different from any number of regional or category-specific networks. Each platform has its own tools, its own audience capabilities, and its own optimization levers. Talent built on one network doesn’t automatically translate to another, and the teams responsible for retail media are already stretched thin.

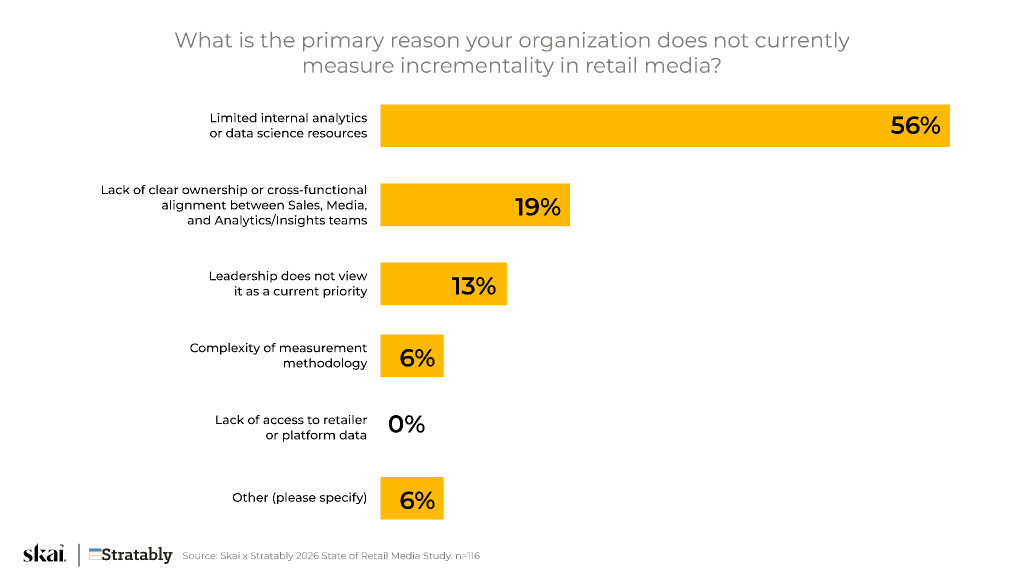

Across multiple State of Retail Media questions, the same barrier keeps surfacing: limited internal resources. Whether the topic is incrementality measurement or AI adoption, 56% of respondents cite a lack of technical expertise as the primary obstacle. In a fragmented landscape, that resource gap multiplies with every network added.

Retail readiness multiplies with every network you add

Media performance on any retail media network depends on more than media strategy. PDP quality, product availability, content, and pricing all have to be aligned before advertising can drive results. That’s true on every single network, and the coordination required spans multiple internal teams.

CJ Pendleton, Chief Strategy Officer at Matrixx, explains the challenge: “Brands that don’t align PDP quality, availability, and content with their media strategy are not going to see the performance outcomes they are looking for, and this requires coordination across many different parts of an organization to operate effectively.”

Multiply that coordination across six, eight, or eleven networks, and the operational burden becomes significant. Retailer readiness isn’t a one-time project. It’s an ongoing requirement for every network in the portfolio.

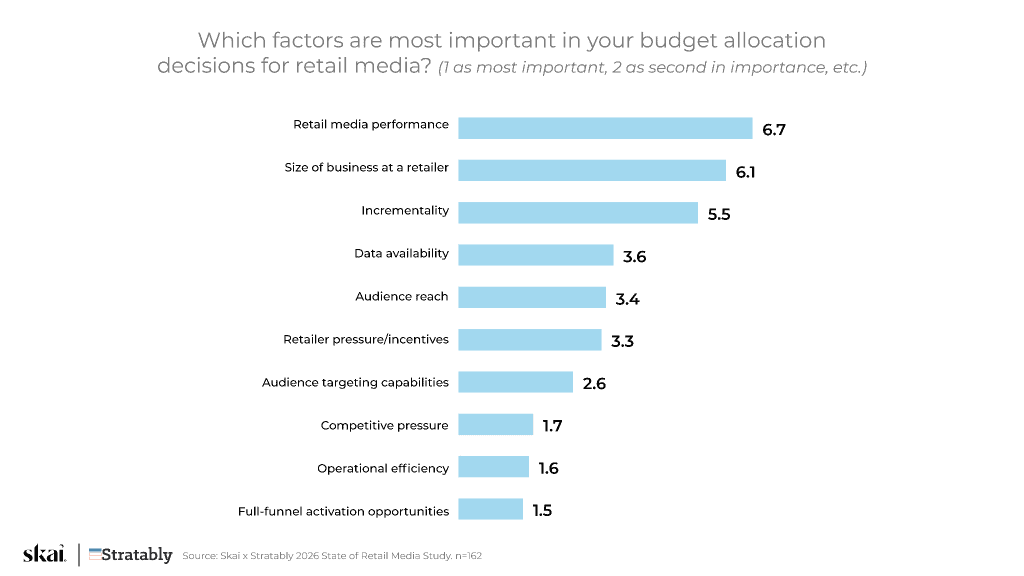

You can’t allocate what you can’t compare

When performance data isn’t comparable across networks, budget allocation decisions lose their foundation. Brands can’t confidently shift spend to where it will have the most impact if they can’t reliably compare results across retailers.

The State of Retail Media data shows that performance and ROI are the top factors in budget allocation decisions. But when each network defines and reports on those metrics differently, the exercise becomes more art than science.

Laura Briggs, former Head of E-Commerce Excellence at Philips, highlights the governance challenge: “With the ever-increasing number of retail media networks and the complexities this brings, brands still need to consider how best to control their overall media presence, manage budgets, and avoid media wastage. Cross-functional/channel processes and governance to drive clear and consistent media objectives, investment planning, and optimisation whilst maintaining agility will be key.”

What you can target on one network barely exists on another

Targeting sophistication, audience segment depth, and measurement granularity vary dramatically from one RMN to the next. Strategies that work on one platform often can’t be replicated elsewhere, forcing teams to rebuild approaches from scratch.

Pendleton points to a specific fragmentation gap: “Many RMNs are still offering limited audience and measurement data for channels like CTV and In-store that will need to be improved so that they can truly illustrate their effectiveness.”

The administrative overhead keeps compounding

More networks means more vendor relationships, more contracts, more invoicing, more reporting formats, and more points of coordination. The administrative overhead of managing a fragmented RMN portfolio is a real cost that rarely shows up in media budgets but absolutely affects team capacity and speed of execution.

Babucci argues for a more disciplined approach: “The winners will treat RMNs like an investment portfolio: clear entry criteria, clear exit rules, and faster decisions than the competition.”

You can’t eliminate fragmentation, but technology can ease the burden

Retail media fragmentation is structural. Brands will always work across multiple networks with different data, different tools, and different ways of operating. That reality isn’t changing. But the operational weight of managing it can.

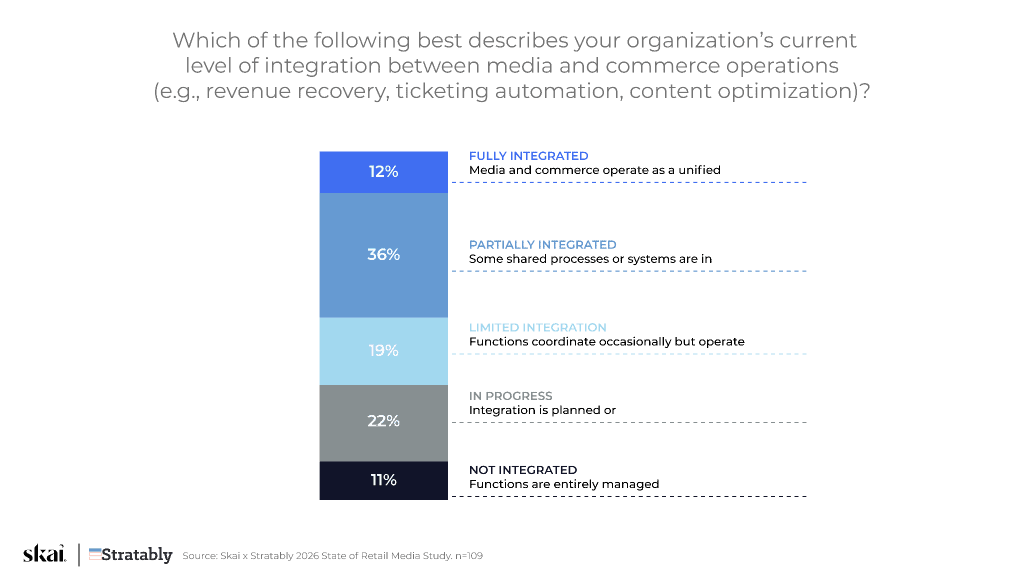

The first lever is consolidation. When campaign planning, activation, and measurement live in a single platform across retailers, teams stop toggling between interfaces and start operating from a shared view. Standardized metrics replace network-by-network translation exercises. Reporting becomes something you act on, not something you reconcile.

The second lever is automation. Every hour a team spends on manual bid adjustments, pacing corrections, or keyword harvesting is an hour not spent on the strategic work that fragmentation demands: sharing learnings across markets, building retailer-specific expertise, aligning retail readiness across networks. AI-powered tools that handle the repetitive execution work give teams the bandwidth to focus on the challenges that actually require human judgment.

This is how Skai approaches the problem. A unified platform across 200+ retailers reduces the fragmentation tax directly. And built-in AI for pacing, bidding, and product intelligence reduces the operational complexity around it, so teams have the capacity to tackle the seven challenges above instead of drowning in them.

Conclusion: Don’t let perfect be the enemy of progress

The fragmentation challenge in retail media is structural, and it isn’t going away. Every retailer will continue to operate as its own ecosystem with its own data, tools, and requirements. The brands that scale successfully won’t be the ones waiting for the industry to standardize. They’ll be the ones building internal capabilities to operate across fragmented environments while pushing for consistency where they can.

These seven challenges won’t all be solved at once. Start with the gaps that are costing the most, whether that’s measurement confidence, operational silos, or budget governance. Build toward standardization incrementally. Don’t let the complexity of fragmentation become an excuse to stand still, because the brands that figure out how to operate effectively across a fragmented landscape will be the ones that capture the channel’s full growth potential.

Skai’s Retail Media solutions enable marketers to plan, activate, and measure campaigns across 200+ retailers, including Amazon, Walmart, Target, and Instacart, as part of a broader commerce media strategy. AI-powered pacing, product intelligence, and keyword tools help teams meet shoppers across the journey and tie spend to sales with confidence.

Ready to turn retail media fragmentation from a barrier into a competitive advantage? Schedule a quick demo to see how leading brands are building the operational infrastructure to scale.

Download the 2026 State of Retail Media Report

Frequently Asked Questions

Retail media fragmentation refers to brands managing multiple retail media networks with different tools and data. The 2026 State of Retail Media Report shows advertisers average six networks today. Each network operates as its own ecosystem, creating operational and measurement complexity.

Retail media fragmentation limits growth because performance data isn’t comparable across networks. Inconsistent metrics reduce confidence in ROI and slow budget decisions. The 2026 State of Retail Media Report shows only 15% of advertisers strongly trust their measurement.

Brands can manage retail media fragmentation through consolidation and automation. A unified platform standardizes reporting and reduces manual work. The 2026 State of Retail Media Report highlights how shared metrics and AI-driven tools improve scalability across networks.