Summary

The 2026 State of Retail Media reveals a widening gap between what marketers know they should be measuring and what they can actually act on. While incrementality is widely recognized as the north star, fragmentation across platforms, teams, and metrics continues to erode confidence and stall decisions. This analysis shows why the real barrier isn’t data or methodology, but capability, ownership, and the lack of a shared measurement language that turns insight into action.

Only 15% of marketers say their organization is very or extremely effective at measuring retail media performance overall. The surprising part? The barrier is not methodology or data access.

In an omnichannel world, everyone asks the same question but gets different answers: Is our spend driving incremental impact or just reallocating demand? That uncertainty stalls budget conversations, fuels internal debates, and keeps teams stuck in reactive mode.

Fragmentation, not missing data, is what slows teams down. And, more so, the lack of confidence in our measurement approaches that it creates. Amazon reports at SKU level. Meta reports by audience and creative. Google Search reports by keyword and query. Each platform comes with its own metrics, attribution windows, and definitions. Inside organizations, this fragmentation multiplies as media, ecommerce, analytics, finance, and brand teams all view “performance” through different lenses.

For our 2026 State of Retail Media report, Skai partnered with Stratably to survey 166 retail media advertisers spanning CPGs, non-CPGs, agencies, and brands of all sizes. The goal was to understand what is really happening with measurement. The findings reveal a market that recognizes the problem, knows the solution, but remains stuck in a capability gap that prevents action.

Here is what we believe about commerce measurement, and what the data shows.

The three truths of commerce measurement

The main challenge in commerce measurement isn’t tools or data, but the lack of a shared language. Platforms measure differently, internal teams interpret performance through competing lenses, and without standardization, brands end up debating numbers instead of making decisions.

Three truths define effective measurement today.

Fragmentation is the enemy and erodes confidence

Amazon measures at SKU, Meta by audience, Google by keyword. Each comes with different attribution windows and definitions. Internal teams compound this by viewing performance through their own lenses: media wants reach, finance wants ROI, ecommerce wants conversion. When organizations aren’t speaking the same language, then conflicting insights arise, decisions slow, and trust in results erodes.

Incrementality is the north star, but cross-channel visibility is required to get there

Brands need to know what media caused, not just what it touched. That requires performance comparable across retail media, search, and social rather than trapped in platform silos. Brands that lack unified visibility remain stuck proving value campaign by campaign instead of creating systematic performance frameworks.

The gap is around capability and alignment to drive action

Brands know what to measure but cannot staff or operationalize it. Measurement just produces reports unless operational frameworks are in place to turn insights into action. When no team owns incrementality end-to-end, it becomes everyone’s priority and no one’s responsibility.

These are not abstract principles. Our 2026 State of Retail Media research validates each one and reveals just how wide the gap between recognition and action has become.

What the 2026 State of Retail Media reveals about measurement

The survey findings tell a consistent story. Brands recognize measurement matters, they know incrementality is the answer, but they are stuck in a capability gap that prevents meaningful action.

Most brands say they are succeeding, but their confidence tells a different story

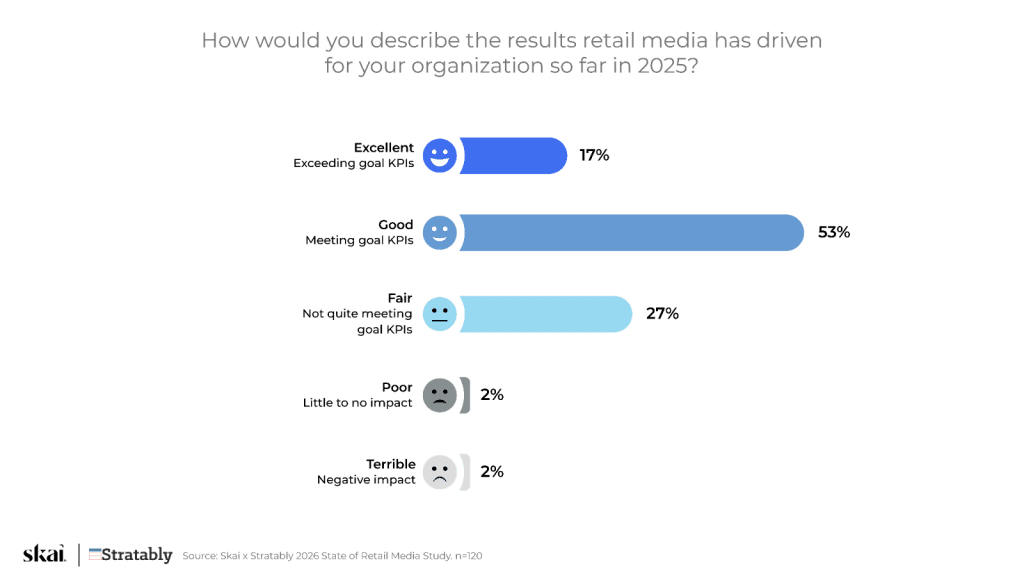

Seven in ten brands report meeting or exceeding their retail media goals in 2025. On the surface, that sounds like progress. Dig deeper and the picture shifts.

That 27% in “fair” territory matters more than it may seem. These are brands stuck between justifying current spend and unlocking more budget, likely underinvesting in the capabilities needed to move from mediocre to strong performance. CPGs, larger brands, and heavy retail media investors skew more positive. Scale and sophistication correlate with results.

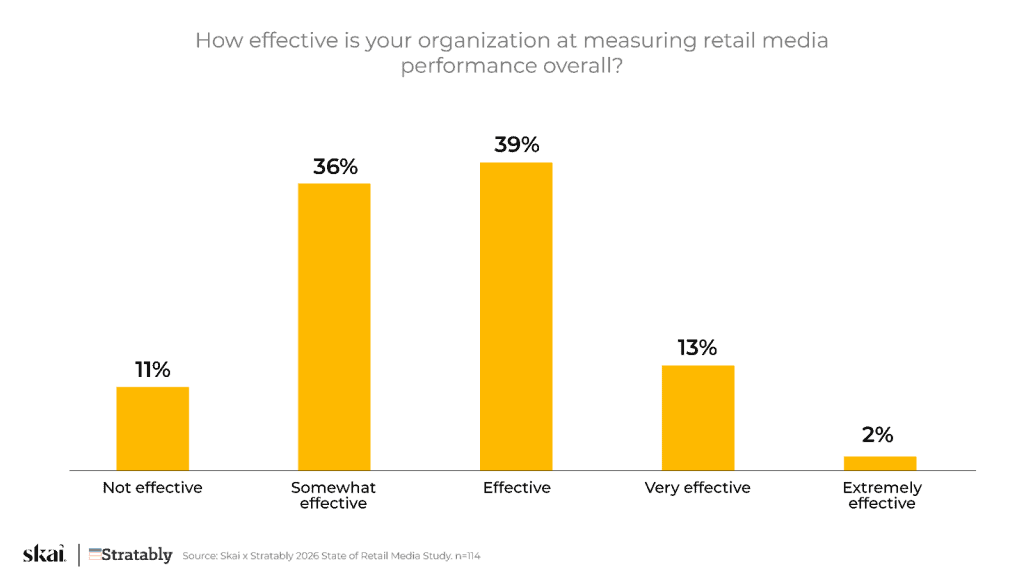

When asked directly about measurement effectiveness, the confidence gap becomes stark.

Only 15% report strong measurement confidence (very or extremely effective), while nearly half admit they are struggling. You cannot optimize what you cannot measure reliably. Most brands are still flying blind on cross-retailer performance and true incrementality.

This is why budget conversations stay difficult. Efficiency remains the top priority but keeps feeling out of reach.

Everyone agrees incrementality is the answer, but few are acting on it

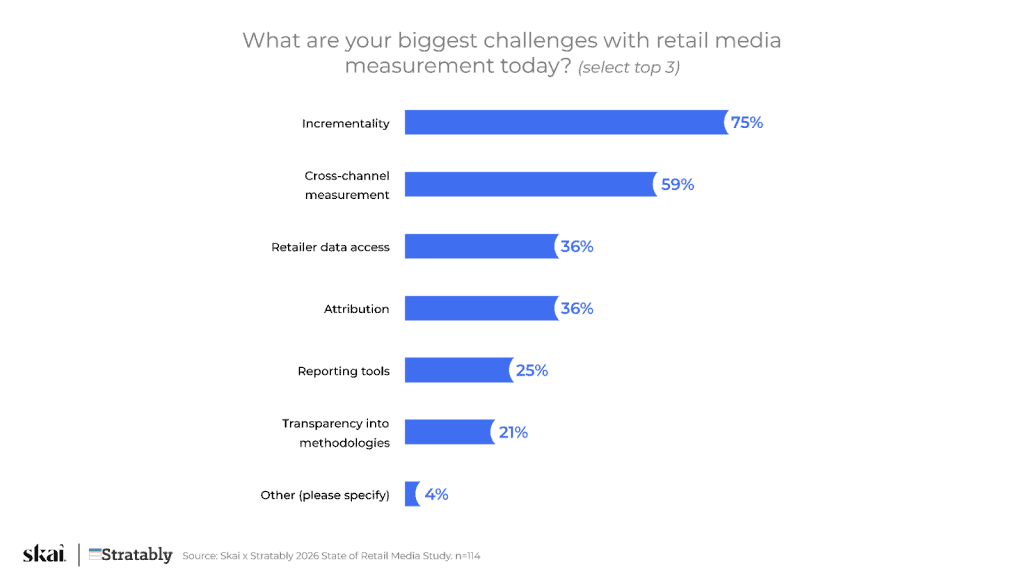

When we asked advertisers to identify their biggest measurement challenges, the results were unambiguous.

Incrementality dominates at 75%, followed by cross-channel measurement at 59%. Retailer data access and attribution both come in at 36%, with reporting tools at 25%. The message is clear: brands are not struggling to get data. They are struggling to make sense of it in a way that proves true impact.

Industry leaders see this as an inflection point. “The overreliance on ROAS as the benchmark of value is over,” says Jason Wescott, Global Head of Commerce Solutions for WPP Media. “Independent, transparent measurement is the baseline.”

Enrico Babucci, Chief Strategy Officer for OmniShopper, is even more direct: “Incrementality is now the price of performance. If you cannot measure incrementality with discipline, you are not running performance media. You are buying exposure.”

But recognition does not equal proficiency. Half of brands measure incrementality at only a basic level, and just 20% are good at both measuring and applying those insights to decisions.

This gap between knowing incrementality matters and actually operationalizing it is the defining challenge. Agencies, CPGs, and heavy retail media investors lead in proficiency. Incrementality fluency requires both scale and sophistication.

Skye Frontier, Executive Vice President at Incremental, sees this gap as a competitive differentiator: “There is a massive opportunity for first movers and early adopters, who are leveraging the intelligence advantage of incrementality to outmaneuver their competition.”

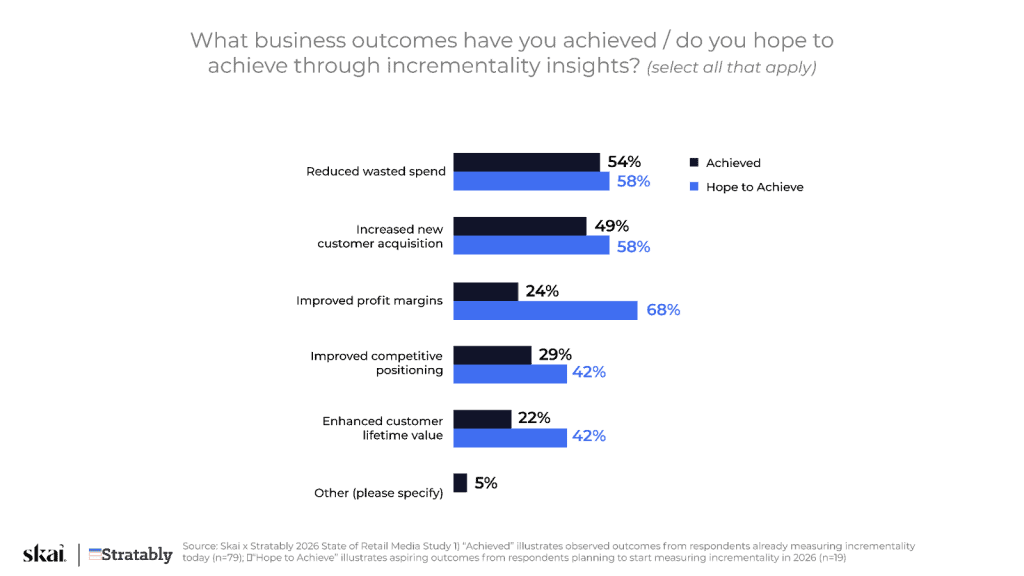

The aspirations-versus-reality gap makes this even clearer. When we asked what outcomes brands have achieved through incrementality insights versus what they hope to achieve, the gaps were striking.

The biggest gaps appear in profit margins (24% achieved vs. 68% hoped) and customer lifetime value (22% achieved vs. 42% hoped). Brands expect incrementality measurement to unlock strategic wins, but most are still using it as a tactical efficiency lever for reducing wasted spend and acquiring new customers. The strategic outcomes remain out of reach.

Perhaps most telling: 15% of brands measuring incrementality admit they have not seen meaningful business outcomes yet. Measurement without operational integration delivers reports, not results.

As Megan Conahan observes: “Incrementality works best when it changes future behavior, not when it’s used as validation.” Skye Frontier adds that the goal should be to “shorten the value chain from insights to activation”—a transformation most brands have yet to achieve.

The real barrier is not technology, but who is doing the work

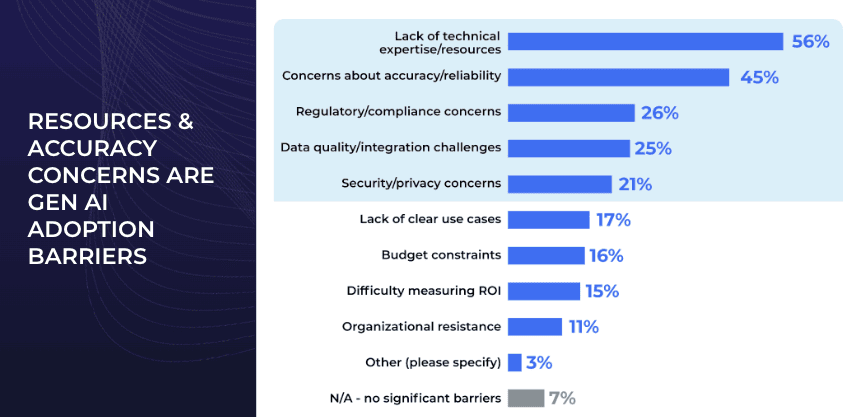

For brands not currently measuring incrementality, we asked why. The answers reveal a fundamental misalignment in how organizations are investing.

Limited internal analytics or data science resources tops the list at 56%. Lack of clear ownership or cross-functional alignment between Sales, Media, and Analytics teams comes in at 19%. Leadership not viewing it as a priority accounts for 13%.

But here is what is remarkable: complexity of measurement methodology barely registers at 6%. Lack of access to retailer or platform data comes in at 0%.

Brands know what to do. The methodology exists. The data is accessible. What is missing is the people, processes, and organizational alignment to execute.

Megan Conahan, EVP of eCommerce for Direct Agents, puts it bluntly: “Lack of analytics access is the excuse; lack of ownership is the problem.” Enrico Babucci echoes this: “The real blocker is capability, not tooling. The next step for brands is not another dashboard. It is a repeatable, incremental operating model.”

We see a troubling cycle: organizations are pouring budget into retail media while starving the analytics infrastructure needed to optimize it. Spend grows, but performance insight does not. The pattern is consistent: fragmentation creates distrust, distrust limits investment in capabilities, and limited capabilities perpetuate the cycle.

Conclusion: From fragmentation to a shared measurement language

The 2026 State of Retail Media paints a clear picture. Brands understand that the answer is not more data or better tools since methodology complexity and data access barely register as barriers. The gap is capability and alignment: the analytics resources, cross-functional ownership, and operational frameworks needed to turn measurement from a reporting exercise into a growth lever.

“The next wave of retail media growth will be driven by incrementality, not ROAS or the launch of new RMNs,” says CJ Pendleton, Chief Strategy Officer at Matrixx CPG. “The platforms that solve for that will earn the lion’s share of CPG investment while those that don’t will likely die on the vine.”

For marketers navigating this reality, the path forward is not another dashboard or one-off incrementality test. It is building a repeatable measurement operating model with clear ownership, standardized definitions across channels and retailers, and a decision cadence that turns insights into action. As Jason Wescott, Global Head of Commerce Solutions for WPP Media, notes: “Credible incrementality requires independent measurement. Periodic, diligent modeling can deliver a robust view without building a full internal lab.” The brands that solve this will stop debating numbers and start making bets.

Skai’s Retail Media solution enables marketers to plan, activate, and measure campaigns across 200+ retailers, including Amazon, Walmart, Target, and Instacart, as part of a broader commerce media strategy. With standardized metrics, always-on incrementality modeling, and cross-channel visibility built in, Skai creates the shared measurement language that media, analytics, finance, and leadership can all trust.

Ready to move from measurement confusion to measurement confidence? Schedule a quick demo to see how leading brands are building the infrastructure that unlocks sustained retail media growth.

Frequently Asked Questions

Retail media measurement is difficult because platforms measure performance differently. Amazon reports by SKU, Meta by audience, and Google by keyword. This fragmentation creates conflicting views internally and erodes confidence in results.

The biggest barrier to incrementality is not data access or methodology. It is a lack of analytics capability, clear ownership, and cross-functional alignment. Without these, insights fail to drive decisions.

Incrementality shows what media actually caused, not just what it touched. ROAS alone cannot prove true business impact. Incrementality enables marketers to justify spend, optimize budgets, and drive long-term growth.