Summary

The 2026 State of Retail Media Report shows DSP, CTV, and social commerce accelerating beyond on-site retail ads, with some of the highest net budget increases across channels. As commerce data reshapes programmatic, streaming TV, and social platforms, brands are shifting spend toward retail media-powered DSPs and shoppable experiences that connect media exposure to verified purchase behavior. The report makes clear that scaling these channels requires dedicated programs, governance, and measurement—not just adding new budget lines to existing retail media plans.

Download the 2026 State of Retail Media Report

Retail media’s next chapter isn’t about better ads on retailer sites. It’s about retail media data and signals powering media everywhere else.

DSP, CTV, and social commerce have been part of the retail media conversation for years. But the 2026 State of Retail Media data, drawn from a survey of 166 retail media advertisers conducted by Skai and Stratably, shows these channels are accelerating in a meaningful way. Budgets are shifting. Capabilities are expanding. And the brands that continue to treat DSP, CTV, and social commerce as add-ons to their retail media strategy risk missing the growth that is already happening beyond the shelf.

Note: The Net column shows the delta between Increase Budget and Decrease Budget, which indicates the net acceleration of budgets across media types. Social commerce ads (Net 50%), CTV/Streaming ads (Net 47%), and DSP (Net 40%) rate either at or near the top.

Here is what the State of Retail Media data reveals about each channel, and why the smartest brands are building dedicated programs around them.

While part of retail media, these formats should have their own programs

The biggest barrier to getting more from DSP, CTV, and social commerce isn’t technology or budget. It’s how brands think about them. When these channels are treated as components of a retail media plan, they get managed as extensions of on-site activity: funded with leftover budget, staffed by teams already stretched across sponsored ads. The result is shallow execution that never builds the expertise or institutional knowledge needed to drive real results.

The shift that matters is treating each of these channels as a program in its own right, with dedicated strategy, dedicated expertise, and dedicated investment.

But this shift may not be easy. Laura Briggs, former Head of E-Commerce Excellence at Philips, speaks to the organizational requirement: “Cross functional/channel processes and governance to drive clear and consistent media objectives, investment planning and optimisation whilst maintaining agility will be key.”

This isn’t about creating silos. It’s about giving these channels the strategic attention they demand so that expertise compounds over time rather than starting from scratch with every campaign.

DSP: where the real budget shift is happening

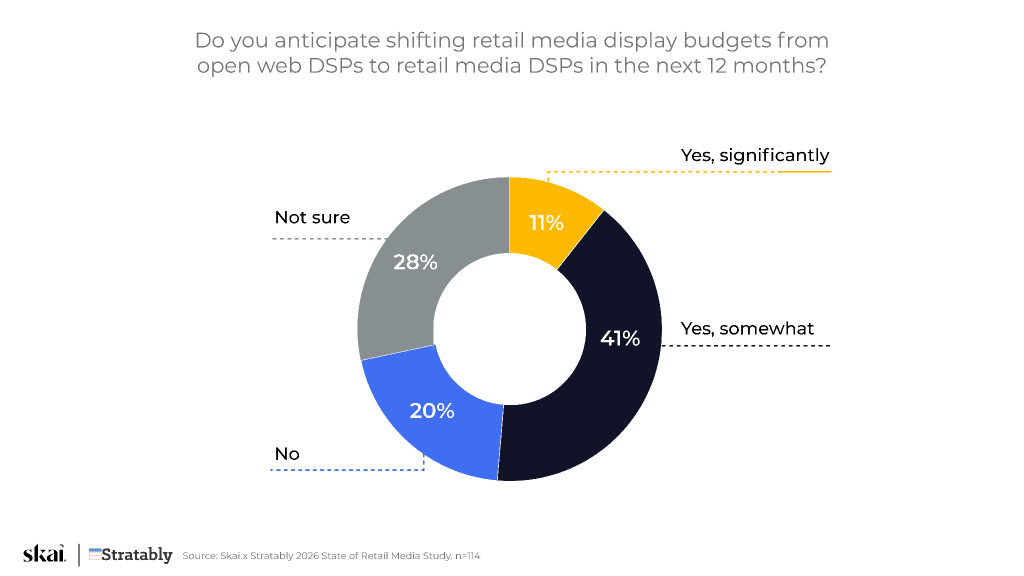

The move from open web DSPs to retail media DSPs is one of the most significant budget movements in the State of Retail Media data. Brands aren’t simply adding programmatic to their retail media mix. They are actively redirecting display investment toward platforms powered by commerce data.

This translates to more than half (52%) of marketers anticipating shifting investments away from open web DSPs and into retail media DSPs.

While there are many different reasons marketers say that retail media DSPs are superior to open web ones, the core reason is trust. As signal loss continues to erode traditional programmatic targeting and measurement, retail media DSPs offer something the open web increasingly can’t: deterministic purchase data, verified audiences, and closed-loop attribution.

Megan Conahan, EVP of eCommerce at Direct Agents, explains the appeal: “Retail media DSPs are winning not because they’re cheaper, but because they replace proxy signals with verified purchase behavior and attribution marketers can actually defend.”

This represents a fundamental change in where brands place their trust and their display dollars. The commerce data that powers retail media DSPs is becoming the infrastructure that informs targeting, optimization, and measurement across the entire programmatic ecosystem.

CTV: retail media data meets TV’s biggest stage

Connected TV represents perhaps the most significant opportunity for retail media to extend its influence. As streaming continues to replace linear TV as the primary video consumption environment, CTV offers what linear never could: the ability to connect premium video exposure to actual shopping behavior.

Conahan sees CTV reaching a critical turning point: “CTV has crossed a strategic threshold: when powered by platforms like Amazon, it’s no longer just trackable, it’s directly connected to shopping behavior, allowing brands to link premium video exposure to real downstream commerce outcomes.”

The opportunity is clear, but so are the gaps.

CJ Pendleton, Chief Strategy Officer at Matrixx, flags the current limitation: “Many RMNs are still offering limited audience and measurement data for channels like CTV and In-store, which will need to be improved so that they can truly illustrate their effectiveness.”

For brands, the implication is twofold. First, CTV powered by retail media data is a channel worth investing in seriously, particularly through platforms that have already built the signal infrastructure. Second, the measurement standards that brands demand from on-site retail media need to extend to CTV for the channel to reach its full potential.

Social commerce: where discovery becomes conversion

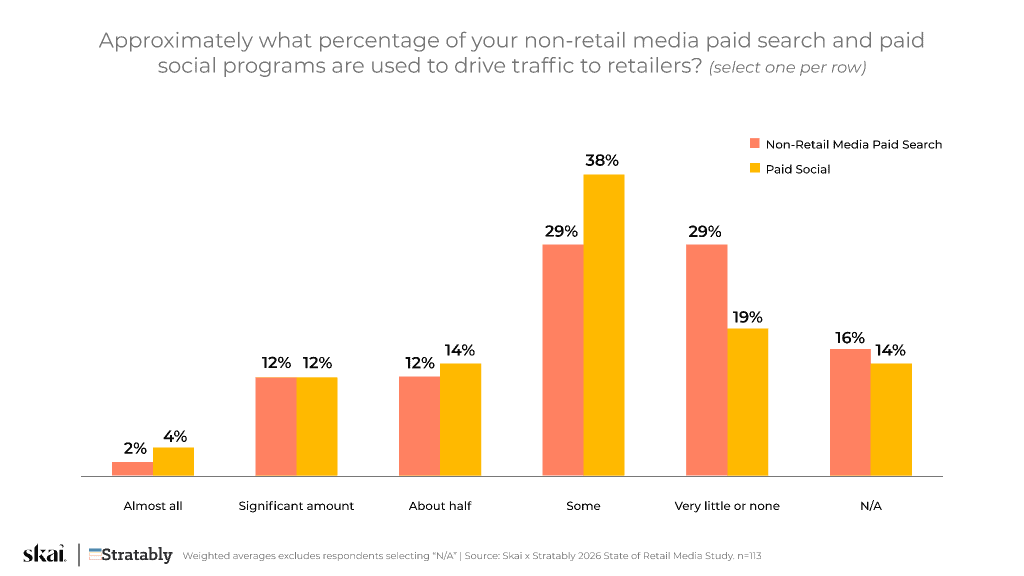

Along with paid search, social commerce occupies a unique position in the retail media ecosystem. It’s where discovery happens, where trust gets built through creators and content, and where the path from awareness to purchase is compressed into a single experience. The State of Retail Media data shows growing adoption and investment in social advertising that drives traffic to retailers.

When asked why they use paid social (and paid search) to drive traffic to retailers, there are a handful of reasons, but the common denominator is that they know that as long as they can get shoppers to these ecommerce sites, retail media programs are strong enough to close the deal.

But simply generating social commerce traffic alone doesn’t maximize the channel’s potential.

Pendleton sees a specific unlock on the horizon: “The big 2026 unlock is ‘creator-to-retailer’ systemization. The real opportunity is building systems that link creators directly to shoppable retailer moments like recipe bundles, store events, loyalty offers, so social becomes a reliable feeder or part of a brand’s retail media strategy. Social Commerce won’t scale until brands stop treating it as a separate channel run by independent teams with differing objectives and start building systems that connect creators and content directly to shoppable retail programs.”

The path forward for social commerce isn’t about choosing a single platform or tactic. It’s about building the systems that connect social discovery to retail conversion in a repeatable, scalable way.

Conclusion: Build the programs, not the budget lines

The State of Retail Media data makes one thing clear. DSP, CTV, and social commerce are accelerating channels with real budget momentum, growing capabilities, and distinct strategic requirements. The brands treating them as extensions of on-site sponsored ads are leaving growth on the table.

The brands that pull ahead won’t be the ones that add DSP, CTV, and social commerce to their retail media plan as budget lines. They’ll be the ones that build dedicated programs with dedicated expertise around each, creating the organizational muscle and institutional knowledge that compounds over time. As Alex Juday, SVP of Commerce and Revenue at Incremental, puts it: “As we crack that code as an industry, we will unlock tremendous growth and the corresponding justification for the continued investment being made by Brands in these networks.”

Skai’s Retail Media solutions enable marketers to plan, activate, and measure campaigns across 200+ retailers, including Amazon, Walmart, Target, and Instacart, as part of a broader commerce media strategy that spans on-site, DSP, and emerging channels. AI-powered pacing, product intelligence, and keyword tools help teams meet shoppers across the journey and tie spend to sales with confidence.

Ready to build dedicated programs around DSP, CTV, and social commerce? Schedule a quick demo to see how leading brands are expanding their retail media strategies beyond on-site.

Download the 2026 State of Retail Media Report

Frequently Asked Questions

The 2026 State of Retail Media Report shows strong budget growth for retail media DSP. Over half of marketers plan to shift spend from open web DSPs to retail media DSPs. Commerce data and closed-loop attribution are driving that change.

CTV connects premium video exposure to real shopping behavior. Retail media data allows brands to measure downstream commerce impact. The 2026 State of Retail Media Report highlights CTV as one of the fastest-growing investment areas.

Social commerce drives discovery and feeds shoppers directly to retailer sites. The 2026 State of Retail Media Report shows growing investment in social ads tied to retail outcomes. Brands that connect creators to shoppable retail moments unlock scalable growth.